Is Solana a Good Investment? Discover Its Future Potential and Market Insights

Is Solana a good investment? In 2023, Solana (SOL) emerged as a formidable competitor in the crypto market, with its price skyrocketing by tenfold in the aftermath of the FTX collapse. Currently processing over 50,000 transactions per second (TPS) and maintaining transaction costs below $0.001, Solana’s performance has caught significant attention.

According to Visa’s recent deep dive, “It(Solana) holds promise for payments due to its speed, scalability and low transaction costs, helping to make it a good candidate for efficient blockchain settlement rails using stablecoins like USDC. The Solana blockchain network incorporates a number of key features and novel innovations that are worth unpacking for anyone interested in payment technologies”.

Let’s delve into the factors contributing to Solana’s meteoric rise and assess its investment potential.

Article contents

Solana (SOL): Overview

Solana was founded to provide every individual with financial independence, possibilities, and security. Indeed, the Solana ecosystem exemplifies decentralization to perfection. Let’s look at how its features can benefit consumers. Here are the main use cases for Solana:

- Staking. The primary use case of the Solana Network’s native token SOL is staking. Through staking, users actively support the integrity of the network itself. SOL can either be staked directly onto the Solana network or delegated to active validators that do this for them.

- Decentralized application development. The most obvious application of Solana blockchain is the construction of decentralized applications (dApps). Decentralized apps gained traction with the introduction of smart contract programmability on Ethereum. Solana also facilitates the construction of smart contracts, making it an ideal choice for dApp development.

- Non-fungible token development. Solana has emerged as a preferred choice among NFT designers. The popularity of top Solana blockchain use cases in NFTs is demonstrated by the platform’s ability to mint over 21 million NFTs. Solana currently plans to introduce executable NFTs. The new source wallet’s open beta version allows users to access executable NFTs.

- Play-to-Earn game development. The creators of Solana blockchain believes that the future of gaming will revolve around Play-and-Own games. The concept of Play-and-Own can pave the way for the evolution of Play-to-Earn games on the Solana blockchain. Solana might help design Web3 games that give users control over their data.

- Decentralized finance. Solana has become an important element of the DeFi environment, with a diverse range of DeFi apps within its ecosystem. The Solana ecosystem includes decentralized exchanges, digital wallets, and automated contract systems. Solana might also enable the freedom to create asset management software and open-order book exchanges.

- Decentralized Autonomous Organizations (DAOs). The benefits of Solana may also encourage the use of blockchain to create Decentralized Autonomous Organizations. Solana provides fast transaction throughput and low transaction fees, which are excellent for DAOs. As of today, the Solana ecosystem has 140 DAOs, with each member playing an active role.

As a blockchain, Solana has several features that offer unique advantages to the crypto space. Solana claims to support a minimum of 50,000 transactions per second (TPS), significantly surpassing the transaction capabilities of both Bitcoin and Ethereum. This phenomenal speed makes Solana one of the fastest blockchain networks available. Moreover, Solana offers some of the cheapest transaction fees in the cryptocurrency market, typically costing between $0.003 and $0.03. These are the main distinguishing features that differentiate Solana from other cryptocurrencies.

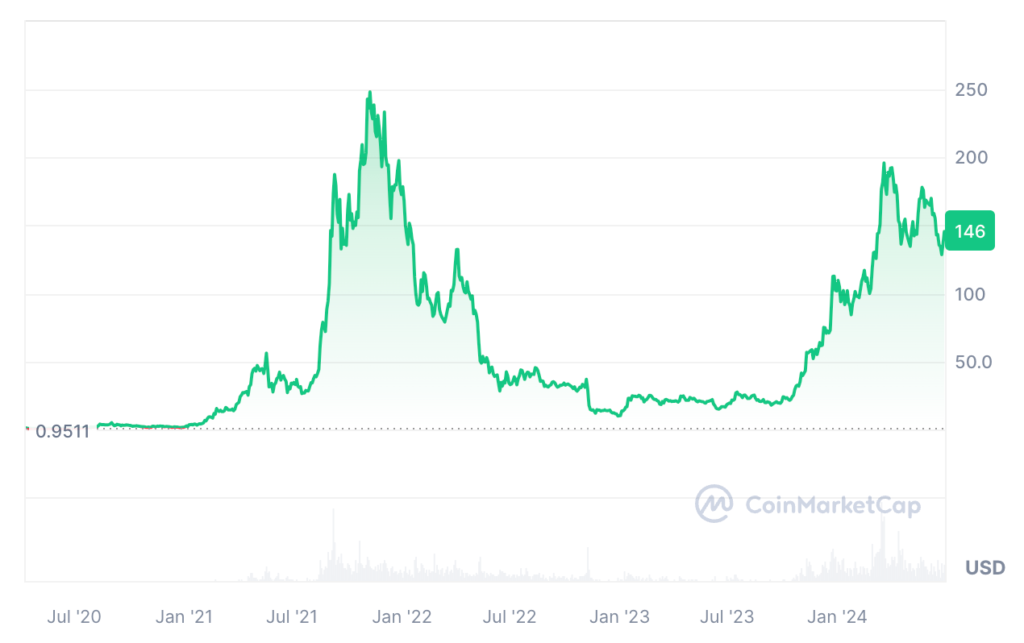

Solana’s Market Performance and Historical Data

- 2020: Solana started small: the token’s value in April 2020 was only $0.74, and in June 2020, the token’s value surged to the $0.85 range.

- 2021: Solana had a very optimistic start to 2021; the token started the year at $4.23 and made a huge move in February to reach $13.31. In November SOL reached an amazing all-time high of $260.06, before taking a significant tumble at year’s close to settle at roughly $172.51.

- 2022: 2022 began on a very negative note when the token fell to $93.4. In February, it fell even further, plunging to about $85.57. The SOL cryptocurrency recovered its bullish momentum in March, rising to a price range of $120. It likewise had slight increases on July 5, closing at $36.78; but on July 6 it dropped to $35.32. In November, SOL reached its all-time high of $260.06.

- 2023: SOL started the year 2023 with a price of around $20. By December, it reached $112.56.

- 2024: In March 2024, during a bullish market, Solana reached a new peak of $202.12. Over the past month, SOL price fluctuated between $125-$175. And according to various Solana price predictions, its price will reach $1,800 in 2030.

SOL Price Chart

CoinMarketCap, June 28, 2024

Solana’s Technological Advantages

Solana offers several technological advantages, including:

- Horizontal scaling. Solana features horizontal scaling mechanisms, which enable the network to maintain its excellent performance as it grows. Unlike other blockchains, which encounter congestion and slowdowns as more users and applications join the network, Solana can scale successfully, meeting growing demand without sacrificing speed or security.

- Stateless architecture. Solana’s stateless architecture improves scalability by lowering the amount of data that each validator must keep and process. This strategy reduces overhead and ensures that the network remains efficient as it scales.

- Cost-efficiency is critical for startups and small businesses. Solana’s low transaction fees mean that new initiatives can launch and operate sustainably, free of the financial strain associated with high petrol fees on competing platforms. This economic feasibility encourages other projects to use Solana, enhancing the ecosystem with different and innovative solutions.

- Solana’s security is enhanced by its advanced consensus mechanism, Tower BFT, which is based on the Practical Byzantine Fault Tolerance (PBFT) protocol. This ensures that the network can reach consensus swiftly and securely, preventing malicious attacks and ensuring transaction integrity.

- Decentralized system. Solana’s security is further boosted by its decentralized architecture. With a large number of validators spread across the globe, the network is immune to attacks and censorship. This decentralization implies that no single party has power or influence over the network, hence maintaining trust and transparency.

Solana’s Strategic Partnerships: Enhancing DeFi and Developer Ecosystem

Solana has partnered with many prominent companies, both within the DeFi field and outside of it. Solana’s partnership with Chainlink, a leading decentralized oracle network, is a testament to the platform’s commitment to the DeFi space. Another Solana’s partner, Serum, a decentralized exchange (DEX), represents an internal partnership within the Solana ecosystem. It leverages Solana’s speed and scalability to offer fast and cost-effective trading of digital assets.

Solana’s engagement with ChainSafe, a blockchain technology company, demonstrates the company’s commitment to enhance the developer experience on its platform. ChainSafe’s contributions to Solana’s developer tools and ecosystem have enabled more developers to create dApps on Solana, resulting in more creativity. Other Solana’s partners include Saber Labs, Bonfida, Raydium, Mercurial Finance, MatricaLabs and more.

Is Solana a Good Investment?

Perhaps the most appealing aspect of Solana is the cryptocurrency’s transaction speed. Solana may be the most promising ‘Ethereum killer’ among cryptocurrencies, owing to its quickness. Solana’s Proof-of-History (PoH) and Proof-of-Stake (PoS) mechanisms validate transactions using coin ownership. This simplicity of verification also allows Solana to have cheaper fees than Ethereum. It also reduces Solana’s energy consumption and environmental impact compared to Proof-of-Work (PoW) blockchains such as Bitcoin.

In addition to the high speed, Solana is also rapidly acquiring market share in the fast-growing non-fungible token (NFT) space. Solana NFT aficionados benefit from faster transaction speeds and reduced fees than those on the Ethereum network. Solana has a total of 260 dApps. The surge in demand for smart contracts and NFTs may pave the way for Ethereum and Solana to prosper over time.

When it comes to the environmental impact of Solana, Solana’s PoS and PoH verification processes require significantly less energy, potentially making the cryptocurrency a greener alternative to Bitcoin. Even the Ethereum community recognised the scalability concerns with a PoW architecture, converting the network to a PoS consensus mechanism by 2022. Solana’s energy consumption is supposedly 658 joules per transaction, which means that each Solana transaction uses less energy than a Google search.

Thanks to these advantages, Solana is seen as a prospective investment opportunity. With its revolutionary technology and vibrant ecosystem, Solana has piqued the interest of investors searching for the next big opportunity in blockchain. This anticipation of future product releases demonstrates a continuing attempt to develop and broaden Solana’s reach, which adds to its appeal as a potentially profitable investment.

Many experts predict that Solana is going to become an even more widely used cryptocurrency in the future. For instance, CoinEdition analysts released an article where they are debating that by 2030, Solana would cost $3,200. With the current market trends directed towards DeFi and NFTs this may be a valid forecast for market cap giants like Solana.

Investing in Solana: Risks and Challenges

Solana’s progress, like that of many other emerging blockchain platforms, is sometimes regarded in terms of comparison to Ethereum, which dominates the category of blockchain smart contract platforms. In addition, one of the primary reasons for Solana’s supremacy in the cryptocurrency field is its superior technology, which enables high-speed transactions at minimal transaction fees. When developers build their venture on Solana, they can leverage these advantages to create scalable and efficient solutions that meet the needs of their target audiences.

The future price of Solana will depend on a number of factors. First of all, the balance of supply and demand is a key component in determining the price of any cryptocurrency. The utility of the Solana network also plays a crucial role in determining the value of SOL, and the continuous development and improvement of the Solana protocol can significantly impact the price of the token. Other challenges include regulatory concerns, market volatility, and technological risks.

Whether Solana may be a profitable investment depends on a number of criteria, including one’s risk tolerance, investment horizon, and conviction in the platform’s technological and market potential. While Solana’s novel features and community passion make a compelling case, investors must also consider the problems it might face in establishing long-term dominance. As with any investment in the volatile cryptocurrency market, careful research is essential, and consulting with a financial expert before making a choice is always advisable.

Solana vs. Competitors: Analyzing Strengths and Market Positions in the Crypto Landscape

The competition is strong in the crypto field, and Solana’s popular competitors include Ethereum, Avalanche, Cardano, and Polygon. While Ethereum, Avalanche and Cardano are all independent projects, Polygon is a Layer-2 network that runs on top of Ethereum and it’s in a symbiotic relationship with Ethereum.

| Characteristic | Solana | Ethereum | Bitcoin | Cardano | Avalanche |

| Transaction Speed (TPS) in testnet | 65,000 | 20-30 | 5-10 | 1,000+ | 4,500+ |

| Transaction Fee | $0.003-$0.03 | $1-$6 | $1.7-$10 | $0.1-$0.2 | $0.01-$0.01 |

| Energy Usage, kWh/transaction | 0.00018 | →0 | 703 | 0.51 | 4.8 |

| Consensus Mechanism | PoH + PoS | PoS (PoW until 2022) | PoW | PoS | PoS |

| Maximum Supply | No limit | No limit | 21 million | 45 billion | 720 million |

Solana and Ethereum: Different Approaches to Blockchain

Solana and Ethereum are like two motors that use the same fuel, that is, cryptocurrency, but in different ways. Ethereum has transitioned from Proof-of-Work to Proof-of-Stake, hoping for a greener, more energy-efficient ride. The Ethereum 2.0 upgrade aims to reduce energy consumption and improve scalability. In PoS, validators use their ETH as collateral to validate transactions and maintain network security. Solana, on the other hand, was created with Proof-of-Stake from the ground up but incorporates Proof-of-History (PoH), resulting in a supercharged engine that executes transactions at lightning speed. Both networks can be seen as potentially profitable investments.

Comparing Solana and Avalanche

Solana and Avalanche present attractive features however, their market performances and technical indicators create a complex image. Even with solid fundamentals and a strong ecosystem, Solana is currently dealing with downward momentum, while Avalanche’s customizability and potential for interoperability offer significant upside, particularly if it can rebound from its current lows.

Solana vs. Cardano: Technical and Community Differences

As leading smart contract platforms, Cardano and Solana take markedly different approaches to scaling, consensus, governance, and other key mechanisms, appealing to distinct audiences and applications. This comparison highlights their major technical and community divergences. Solana currently facilitates high transaction speeds, and drastically higher throughput than Cardano’s estimated 1,000 TPS limit. However, real-world conditions introduce variability from these peak benchmarks based on factors like hardware capabilities.

In general, any investment choice will depend on a particular investor’s risk tolerance and the desired portfolio size. It’s also important to do your own research and research the assets you’re planning to buy.

Conclusion

Solana is a unique platform that has clearly established itself as a leader in the cryptocurrency market. Its outstanding technology, efficient infrastructure, and increasing community have made it the preferred choice for developers, investors, and users alike. Solana may prove to be a solid investment for crypto enthusiasts and financial experts as it continues to expand and develop. It’s also important to always do your own research before investing in Solana or any other cryptocurrency.

If you’re looking for a way to buy Solana, you will find detailed guidelines in the article on how to do it via StealthEX.

How to Buy SOL Crypto?

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to SOL.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

invest in crypto investment SOL SOL to ETH SolanaRecent Articles on Cryptocurrency

Toshi Price Prediction: Will TOSHI Coin Reach $1?

Toshi Price Prediction: Will TOSHI Coin Reach $1?  GoPlus Security Price Prediction: Will GPS Coin Reach $1?

GoPlus Security Price Prediction: Will GPS Coin Reach $1?