How to Buy Bitcoin with Credit Card: A Step-by-Step Guide

Bitcoin is a digital money that runs independently of any central authority or government monitoring. It is instead based on peer-to-peer software and cryptography. It’s considered to be the number one cryptocurrency in the world that gave birth to a vast number of altcoins. Let’s take a closer look at this oldest cryptocurrency and how to buy Bitcoin with credit card.

Where to Buy BTC with a Credit Card?

There are many exchanges where one can buy Bitcoin (BTC), and StealthEX is one of the safest options. This platform offers users to swap Bitcoin with no extra fees and with the best floating and fixed rates. The oldest cryptocurrency is always freely available for purchase via StealthEX.

How to Buy Bitcoin with a Credit Card?

Fiat/crypto swaps via StealthEX are done in a straightforward, simple, and hassle-free process. This exciting feature became available thanks to our partnership with a well-known fintech company – Mercuryo. Thanks to the StealthEX-Mercuryo partnership, StealthEX users can now not only exchange crypto, but also initiate fiat-crypto swaps.

So how do you buy Bitcoin with a credit card? To initiate the purchase just go to StealthEX and follow the instructions below.

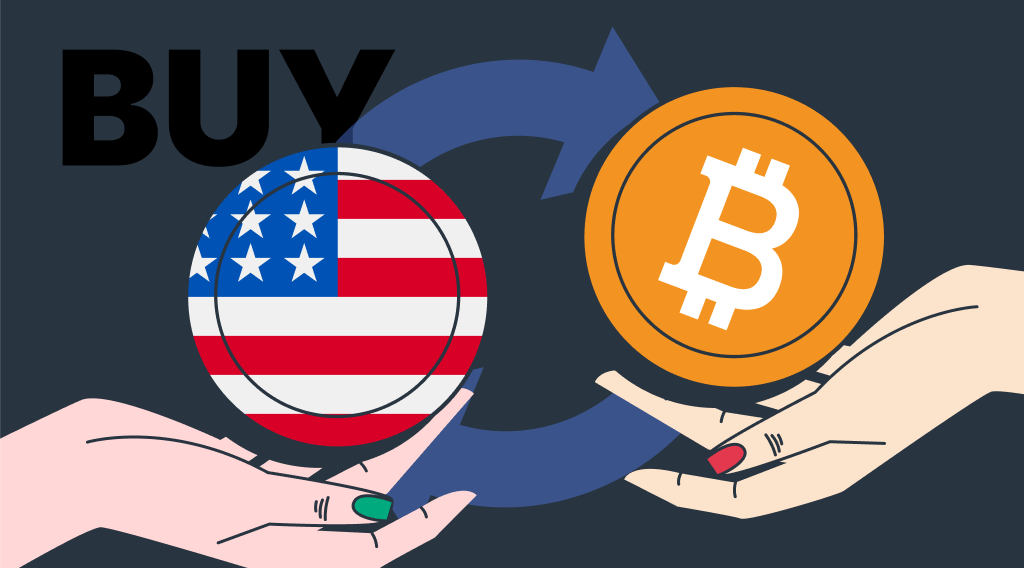

Step Number 1

- Switch from Exchange to the Buy Crypto section.

- Select a fiat currency, for instance, USD, from the left drop-down list and BTC cryptocurrency from the right list of coins.

- Enter the amount of fiat money you’d like to exchange. Then, the estimated amount of BTC will be shown depending on the current rates.

- Press the Start Exchange button.

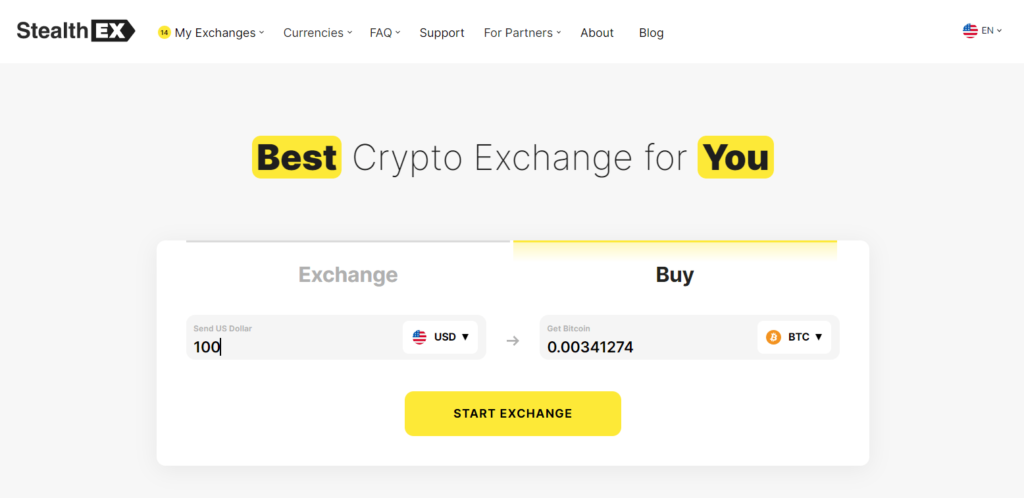

Step Number 2

Next, you need to provide the Bitcoin recipient address. The recipient address must match the cryptocurrency you are going to receive. Remember to double-check the information you enter prior to the exchange as the transaction you make cannot be canceled.

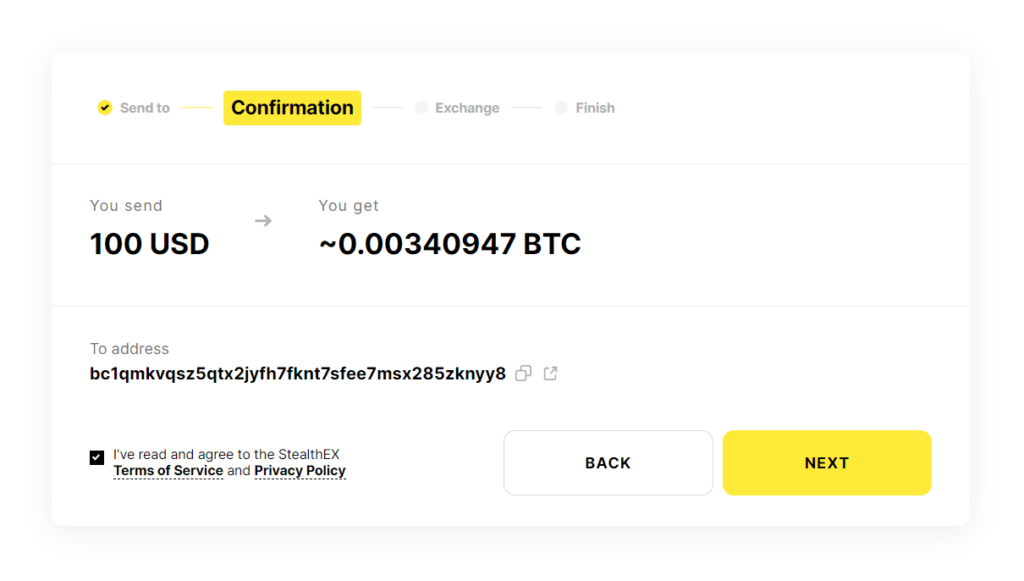

As soon as you have carefully checked all the details, you can press the Next button and you will be redirected to the Confirmation page with the information about the exchange.

Here you can revise the address provided and the amount of BTC cryptocurrency you will receive.

Pressing the Next button you will be redirected to the Exchange page.

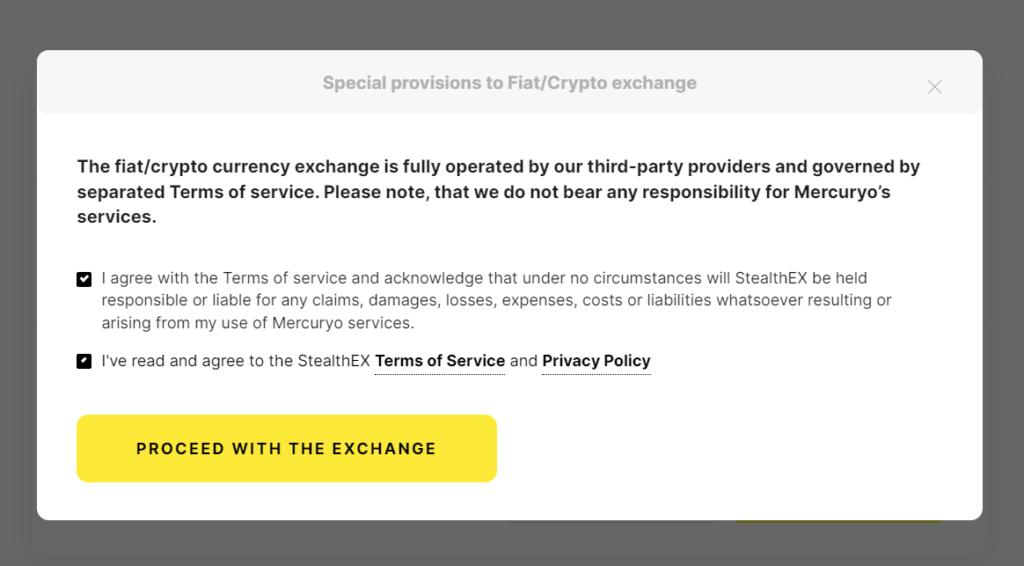

Before purchasing crypto, read the Terms of Service of StealthEX and agree with them. By doing this, you confirm that you understand that our platform is not responsible for any claims, damages, or costs arising from your use of Mercuryo services.

Step Number 3

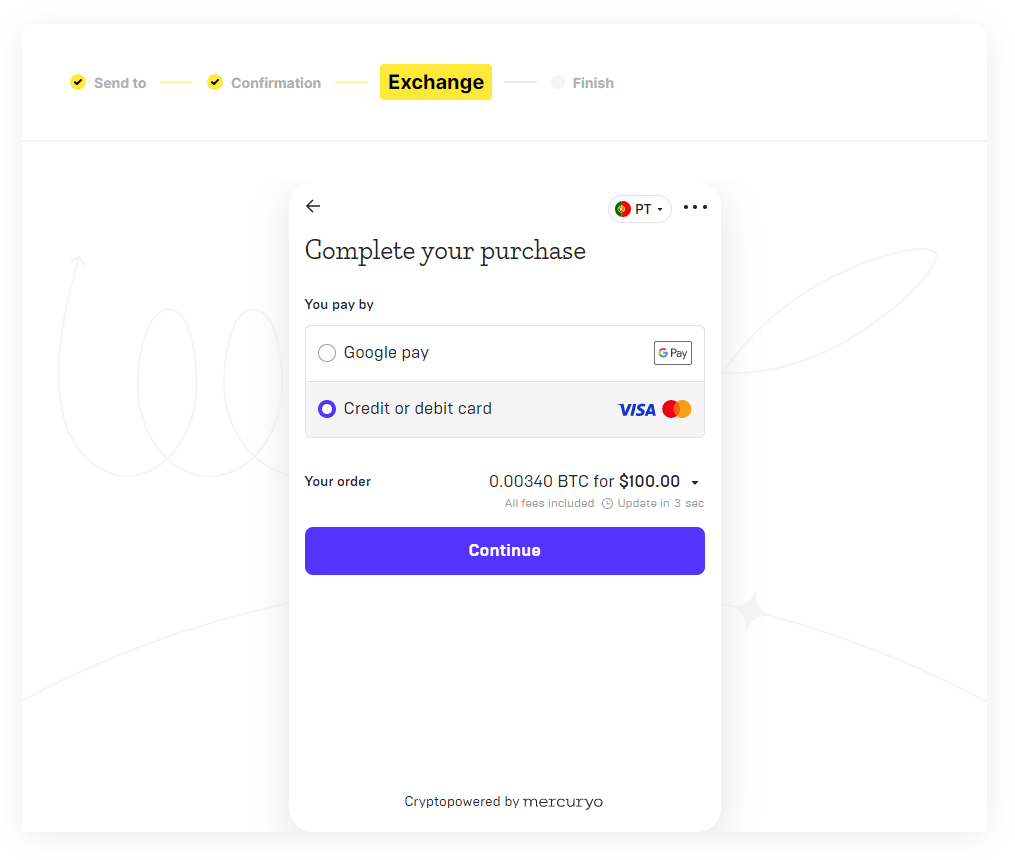

After pressing the Proceed with the Exchange button, the Mercury service will be opened inside the StealtEX interface.

First of all, agree to the Terms of Service provided by Mercuryo and click Buy.

If you purchase crypto via Mercuryo for the first time, you have to verify your identity. You aren’t required to go through this procedure again if you’ve already used these services.

To verify your identity, you need to provide your phone number, email, and enter confirmation codes that you’ve got to your phone and email. Then insert your personal info, including your first name, last name, and date of birth.

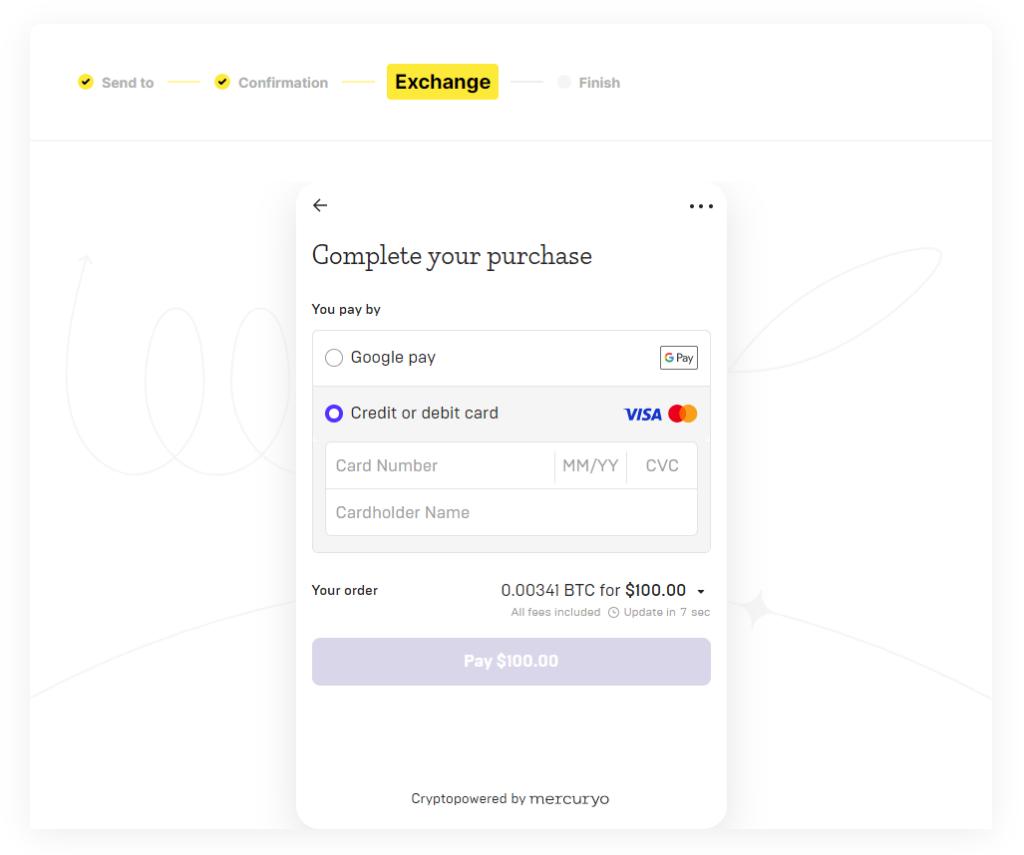

After that, provide your card details, such as your card number, expiry date, cardholder name with capital letters, and click Buy.

Mercuryo accepts only Visa and MasterCard: virtual, debit/credit cards and holds and immediately withdraws 1 USD to check if your bank card is valid.

Step Number 4: Buy BTC Without KYC

If you swap fiat money to crypto for the first time, you should also pass the KYC procedure. As soon as you complete it, your cryptocurrency will be sent to the blockchain address you have indicated earlier.

No KYC for buying crypto: if the total amount of your purchases does not exceed $700 for the first time, you don’t have to verify your identity. You can make one big purchase or several small $20, $50, or $100 transactions. By offering an opportunity of buying cryptocurrency up to $700 without KYC StealthEX aims to simplify the process of entering the world of crypto.

After buying crypto, you’ll also receive a letter from our partner Mercuryo to your email with all data about this transaction, including the amount of fiat debited, the amount of crypto sent, Mercuryo ID of the transaction, top-up address.

And that’s it! Your exchange will start. Our live chat with the Support Team will help you should you have any questions.

As you can see, buying crypto with your credit card is a seamless process that does not require any thorough research. Usually, the process is quite rapid so you won’t need to wait long: cryptocurrency swaps are processed in a matter of minutes. Now that we’ve sorted out how you can buy Bitcoin (BTC) via StealthEX without KYC, let’s take a closer look at the oldest cryptocurrency.

Bitcoin: Principles of Work

Bitcoin is the world’s first successful decentralized cryptocurrency and payment system, founded in 2009 by Satoshi Nakamoto, a mysterious developer who only goes by the name Satoshi. The term ‘cryptocurrency’ refers to a class of digital assets in which transactions are secured and validated through the use of cryptography, a scientific method of encoding and decoding data. These transactions are frequently stored on computers scattered around the world using blockchain, a distributed ledger technology.

Bitcoin can be broken into smaller units called ‘satoshis’ (up to 8 decimal places) and used for payments, but it is also regarded as a store of value, similar to gold. This is due to the fact that the price of a single bitcoin has risen dramatically since its beginnings, from less than a cent to tens of thousands of dollars. When discussing Bitcoin as a trading asset, the ticker symbol BTC is used.

Proof-of-Work (PoW) Mechanism

Proof-of-Work (PoW) is a mechanism used by computers in the Bitcoin network to validate transactions and safeguard the network. While Proof-of-Work was the first and is now the most prevalent type of consensus mechanism for blockchain-based cryptocurrencies, there are others, most notably Proof-of-Stake (PoS), which consumes less overall computer power (and thus less energy).

Proof-of-Work elevates certain network contributors to the role of ‘validators’ – more commonly known as miners – only after they have demonstrated their commitment to the network by devoting an enormous amount of computing power to discovering new blocks.

When a new block is discovered during the mining process, the successful miner who discovered it gets to fill it with 1 megabyte of validated transactions. This new block is subsequently added to the chain, and everyone’s ledger copy is updated to reflect the new data. In exchange for their work, the miner gets to keep any fees associated with the transactions they contribute, as well as a certain number of newly created Bitcoin. The fresh Bitcoin created and distributed to successful miners is known as a ‘block reward.’

Bitcoin’s Fundamental Characteristics

The main features of Bitcoin are:

- Decentralized: The Bitcoin network is not controlled or owned by anyone, and there is no CEO. Instead, the network is made up of consenting members who agree to follow the rules of a protocol (in the form of an open-source software client).

- Distributed: Every Bitcoin transaction is recorded on a public ledger known as the ‘blockchain.’ People who willingly store copies of the ledger and run the Bitcoin protocol software power the network. These nodes aid in the correct propagation of transactions over the network by adhering to the protocol rules as established by the software client.

- Transparent: According to the protocol’s principles, the addition of new transactions to the blockchain record and the state of the Bitcoin network at any given time (in other words, the ‘truth’ of who owns how much bitcoin) is reached by consensus and in a transparent manner.

- Peer-to-peer: Although nodes maintain and propagate network state, payments are sent directly from one individual or business to another. This means that no ‘trusted third party’ is required to act as an intermediary.

- There are no gatekeepers and no need to register a Bitcoin account. The network will confirm any and all transactions that adhere to the protocol’s requirements using the established consensus procedures.

- Pseudo-anonymous. Identity data is not automatically linked to Bitcoin transactions. Instead, transactions are linked to addresses that are made up of random alphanumeric characters.

- Censorship-resistant: Because all Bitcoin transactions that follow the protocol’s rules are valid, transactions are pseudo-anonymous, and users hold private keys to their Bitcoin holdings, it is difficult for authorities to prohibit individuals from using it or seize their assets. This has significant consequences for economic freedom and may potentially operate as a global counter-force to dictatorship.

- All Bitcoin transactions are recorded and publicly accessible to anyone. While this essentially eliminates the potential of fraudulent transactions, it also allows individual identities to be linked to specific Bitcoin addresses in some situations.

Bitcoin: Still Number One 14 Years Later

How come Bitcoin has not given up even some part of its power and sustainability? Well, some analysts believe that Bitcoin is the solution to the corruption of money. For instance, Dylan LeClair, Head of Market Research at BTC Inc., a well-known Bitcoin maximalist and crypto influencer, believes that traditional fiat currencies and asset classes such as gold are intrinsically subject to manipulation and corruption.

During the Bitcoin 2023 event in Miami, Obi Nwosu, the CEO and co-founder of Fedi, a Bitcoin community custody protocol, emphasized that it is becoming ‘increasingly hard to deny that Bitcoin has the fastest, cheapest, easiest, most decentralized and secure’ ecosystem. Nwosu said whether the goal is to develop functionality, establish a decentralized social media network or empower local communities, it is becoming increasingly obvious that Bitcoin is the most efficient and secure solution. He also claims that he’s more bullish on Bitcoin than ever.

During the same Miami event, Robert F. Kennedy Jr., a presidential candidate, outlined his vision for supporting Bitcoin. Kennedy told the crowd that he was first inspired by Bitcoin as a critical freedom technology.

So why do many believe the Bitcoin age is not over yet? Well, Bitcoin is not a predefined protocol. It can and has incorporated modifications during the course of its existence, and it will continue to evolve. While there are several formalized mechanisms for updating Bitcoin, the protocol’s governance is ultimately reliant on discourse, persuasion, and volition. In other words, the public determines what Bitcoin is, and this is undoubtedly one of its main strengths.

Make sure to follow StealthEX on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin BTC buy Bitcoin how to buy how to buy cryptoRecent Articles on Cryptocurrency

JASMY Coin Price Prediction: Will JASMY Coin Hit $1?

JASMY Coin Price Prediction: Will JASMY Coin Hit $1?  Best Monero Wallets: How to Safely Store XMR?

Best Monero Wallets: How to Safely Store XMR?