Navigating the World of Bitcoin ETFs: Opportunities and Challenges

In our previous article, we have already covered crypto ETFs. This article will explore Bitcoin ETFs and their development. So, what is a Bitcoin ETF? A Bitcoin exchange-traded fund (ETF) is a financial product that allows investors to gain exposure to the price movements of Bitcoin without actually holding the asset itself. Shares of a Bitcoin ETF are traded on traditional stock exchanges, making it easier for investors to participate in the cryptocurrency market.

Some ETFs directly hold physical BTC coins, Ethereum or other cryptocurrencies. Others will replicate the asset synthetically via derivatives. Different structures will give different results in terms of replication and moves in the price of the coin will not always be exactly reflected in the price of the ETF. Bitcoin ETFs tend to be priced on the higher end of the scale. Nonetheless, there’s a significant difference in the fees charged by different issuers, which ultimately will eat into the returns the investor receives. Bitcoin ETFs are exchange-traded funds that track the value of Bitcoin and trade on traditional market exchanges rather than cryptocurrency exchanges, while general crypto ETFs track other cryptocurrencies.

Article contents

The Significance of Bitcoin in the ETF Space: Historical Overview

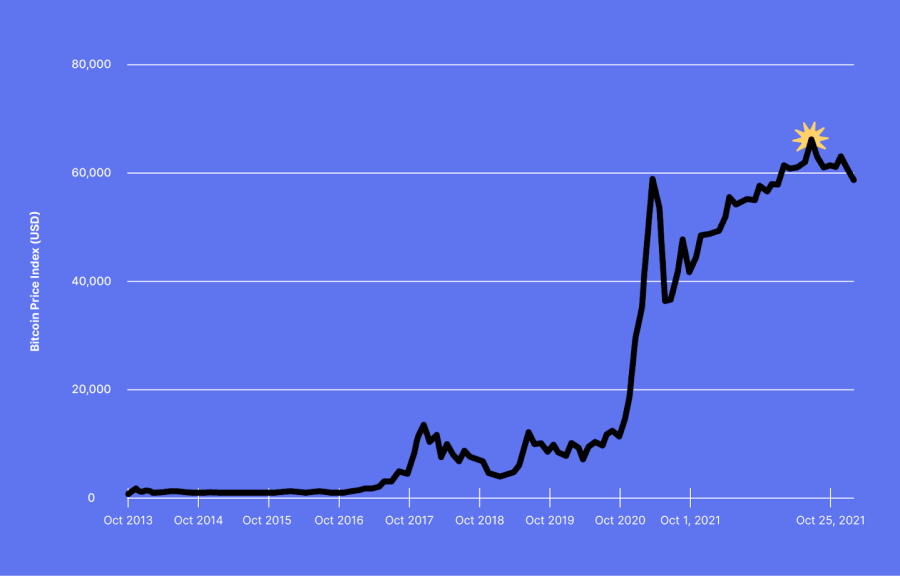

The road to unleashing the Bitcoin ETF potential has been a long and arduous one. The first attempt at a Bitcoin ETF occurred in 2013 with the Winklevoss Bitcoin Trust (COIN). Founded by Cameron and Tyler Winklevoss, the trust offered shares of the ETF that were equivalent to 0.2 BTC. Each share was worth $20.09 since Bitcoin’s price hovered around $100 at the time, according to CoinMarketCap. In the United States, the SEC has approved Bitcoin futures ETFs as well as spot Bitcoin ETFs, only on October 19, 2021. Other BTC futures-linked ETFs have been launched by VanEck, Valkyrie, Simplify Asset Management and GlobalX. Shortly after the very first Bitcoin-related ETF was launched, Bitcoin’s value cracked a new record-high of over $64,000.

Bitcoin Price After ETF Approval in 2021, source: Statista.com

The SEC approved spot Bitcoin ETFs on January 10, 2024, following a noticeably disorganized and perplexing approval procedure in the days preceding. The first 11 approved spot Bitcoin ETFs came from Bitwise, Grayscale, Hashdex, BlackRock, Valkyrie, BZX, Invesco, VanEck, WisdomTree, Fidelity and Franklin. Trading for spot Bitcoin ETFs first began on January 11, 2024. On the first day of trading, they attained a volume of $4.6 billion, with BlackRock’s product reaching $1 billion in value alone. $20 billion worth of trading volume was seen in the products after the first seven days of trade. Nonetheless, the initial adoption of the Bitcoin ETF did not meet expectations and failed to bring the predicted bull run. On the contrary, the markets saw a short-term decline in Bitcoin’s price. The dip was primarily due to position switching by holders of Grayscale and sales by some equity holders. This led to some disappointments from investors and crypto enthusiasts, including James Lavish.

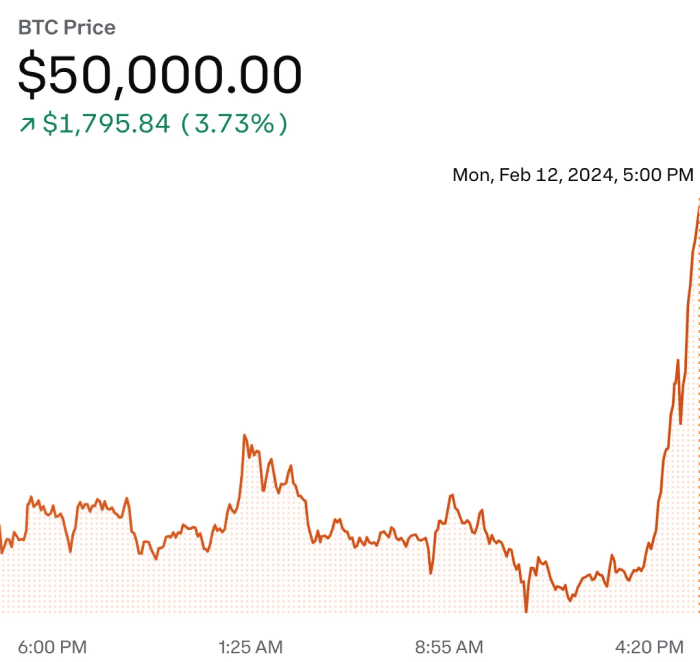

Despite these events, it seems that ETFs are starting to gain traction. This Monday, for the first time since 2021, the price of Bitcoin exceeded $50,000, highlighting the dramatic shift in interest in the token since the debut of mainstream Bitcoin investment funds earlier this year. Since the beginning of the year, the leading cryptocurrency in the market has increased by nearly 15%. This increase has been primarily attributed to the US Securities and Exchange Commission’s decision to reverse a ten-year policy and approve multiple exchange-traded funds (ETFs) that provide investors with regulated products that allow them to track the price of Bitcoin.

Bitcoin Hits $50,000 in February 2024, source: Coinbase

Now, with ETFs finally approved, they represent an important step for the investment space and the crypto industry. The bridge to mainstream adoption is the first benefit. ETFs can help bridge this gap between traditional finance and the crypto market, making it more accessible to mainstream investors who don’t have a formal way of investing in crypto. Moreover, with mainstream adoption comes market stability, the approval of Bitcoin ETFs, such as the anticipated BlackRock Bitcoin ETF, can lead to market stability around Bitcoin. Institutional adoption and regulatory approval provide confidence to investors, contributing to a more mature and stable market.

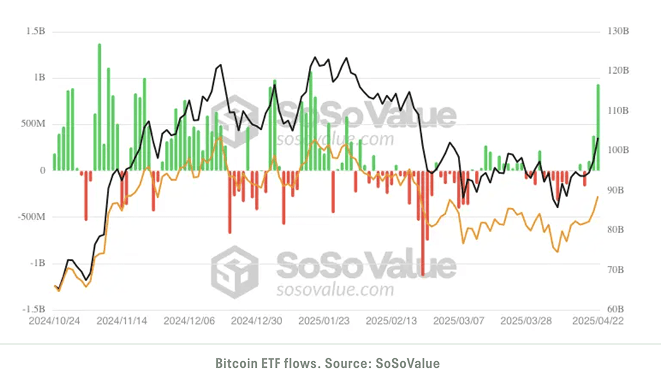

Following the trading session on April 22, 2025, US spot Bitcoin exchange-traded funds (ETFs) recorded an inflow of investor funds of almost $1 billion. This is the highest daily figure since Donald Trump took office as US President.

Advantages of Investing in Bitcoin ETFs

So why are institutional organizations and individuals interested in investing in Bitcoin ETFs? First of all, Bitcoin ETFs provide tax efficiency, diversification, liquidity, regulatory monitoring, and simplicity of access. They give investors an easy method to include Bitcoin in their holdings without having to deal with digital wallets or private keys. The familiarity and accessibility of this offer substantial benefits to conventional investors. Investors can also opt for Bitcoin ETFs because of its ease of use and compatibility with pre-existing investing methods. In addition, those unfamiliar with the technical aspects of Bitcoin trading will find Bitcoin ETFs very appealing.

Here are some of the key reasons why people are interested in Bitcoin ETFs:

- Ease of access. ETFs are traded on traditional stock exchanges, making it easier for mainstream investors to buy, hold and trade the Bitcoin-related asset through their existing brokerage accounts. This accessibility is particularly appealing to investors who are not familiar with cryptocurrency exchanges or are hesitant to use them.

- Regulatory oversight. A Bitcoin ETF would be subject to regulatory oversight, providing investors with a level of protection and transparency. This regulatory oversight can help reduce concerns about fraud and market manipulation, which can be more prevalent in unregulated cryptocurrency markets.

- Portfolio diversification. Investors view Bitcoin as a potential diversification tool. By offering exposure to Bitcoin through an ETF, they can incorporate the cryptocurrency into their investment portfolios without the need to directly hold and manage digital assets.

- Mainstream acceptance. The introduction of a Bitcoin ETF can be seen as a sign of mainstream acceptance and integration of cryptocurrencies into traditional financial systems.

How Bitcoin ETFs Operate

As mentioned earlier, an ETF is an investment fund that tracks the price of an underlying asset or index. ETFs are now offered for a variety of assets and sectors, including currencies and commodities. The operation of a Bitcoin ETF would be similar in that the value of one share of the exchange-traded fund would follow changes in the value of Bitcoin. The ETF’s value rises in tandem with Bitcoin’s, and vice versa. However, the ETF would trade on a market exchange such as the NYSE or TSX rather than a cryptocurrency exchange. There are two main types of Bitcoin ETFs: spot and futures.

Spot Bitcoin ETFs

A Bitcoin spot ETF is a type of exchange-traded fund that aims to provide investors with direct exposure to the current market price of Bitcoin. In this context, ‘spot’ refers to the immediate or current price of the underlying asset, which is Bitcoin itself. A Bitcoin spot ETF typically holds actual Bitcoin as its underlying asset and attempts to track the real-time price of Bitcoin as closely as possible.

Futures Bitcoin ETFs

Futures ETFs do not hold actual Bitcoin. Instead, they use Bitcoin futures contracts to gain exposure to the cryptocurrency. A Bitcoin futures contract allows investors to speculate and bet on the future price of the asset. Futures Bitcoin ETFs can behave differently from spot Bitcoin ETFs, and there may be costs associated with rolling over or settling futures contracts. Some futures Bitcoin ETFs are designed to provide leveraged or inverse exposure to BTC’s price, allowing investors to amplify both gains and losses.

Bitcoin ETFs: Risks and Challenges

Bitcoin ETFs have advantages, but they also have drawbacks. Exposure to market volatility, the possibility of manipulating the market, increased fee structures, indirect ownership, and tracking errors – these are just to name a few. The latter speaks of a possible discrepancy between the ETFs’ performance and the real performance of Bitcoin on the market.

Included in the category of ETF risks is market risk, which is the risk associated with typical price fluctuations in a market, such the stock market. Every stock, bond, and exchange-traded fund (ETF) is subject to overall market fluctuations. To add to this, regulatory hurdles and compliance issues may heavily impact the advantages of ETF investments. Bitcoin ETFs enhance liquidity in traditional portfolios but trade only during market hours, potentially missing significant price movements. Regulatory scrutiny provides a sense of security but often accompanies higher fees, impacting returns.

Moreover, Bitcoin serves as a hedge against central banks, fiat currencies, and equities. By being independent of central banks, Bitcoin provides a way to mitigate risks associated with the financial system. Bitcoin also protects users and investors by providing privacy through the Bitcoin blockchain. A Bitcoin ETF would be regulated by the government, eliminating these benefits.

The choice between a Bitcoin ETF, trust, or proxy depends on an investor’s preferences, risk tolerance, and goals. These options offer diverse avenues for traditional investors to enter Bitcoin, each presenting a distinct blend of exposure, risk, and potential reward, supporting broader market adoption and integration.

Market Overview and Trends

Until recently, access has been the biggest obstacle to the widespread use of Bitcoin. According to a recently published advisor survey and Bitcoin adoption study called The Bitwise/VettaFi 2024 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets, in spite of the fact that nearly 90% of advisors received inquiries regarding cryptocurrency allocations, 81% of advisors were unable to purchase cryptocurrency in client accounts. 88% of advisers surveyed in the report said they were waiting for a spot Bitcoin ETF before making an investment in the asset class since it was difficult, if not impossible, to provide an effective method of exposure to Bitcoin without a compliant investment solution like a Bitcoin ETF.

In addition, for many financial advisors, fiduciaries and others, Bitcoin is not an approved wealth management strategy until spot and futures ETFs have been finally approved by the SEC. This opened up an array of opportunities for eager investors, making Bitcoin ETFs an attractive investment option.

Today, the question of whether or not to include BTC in your portfolio has changed as spot ETFs have made it easier for many people to enter the market. Bitcoin has proven to have a significant positive impact on the traditional portfolio and may play a pivotal role, according to an analysis of historical market data for both BTC values and traditional market prices. For an array of investors seeking to add a unique edge to their portfolio, the Bitcoin benefit can be a strong potential. Due to its minimal correlations with traditional assets and previous strong returns, Bitcoin is a great option for portfolio diversification.

Many experts predict a bright future for Bitcoin ETFs, with global ETF assets poised to reach US$14 trillion by the end of 2024. All in all, surveys have found out that managers see model portfolios as a major source of demand for ETFs across all geographies, with the US leading the way with over 82% of respondents anticipating strong demand. These portfolios provide investors with the advantages of personalisation and diversification based on their risk tolerance and predetermined objectives. Nonetheless, businesses must stay up to date with the rapidly changing regulatory landscape.

Investment Strategies with Bitcoin ETFs

The emergence of Bitcoin ETFs has the potential to have a profound effect on the current financial system by endorsing cryptocurrencies as a legitimate asset class. It is unclear how that will affect the typical household’s portfolio, but research indicates that a cautious allocation could have a significant impact. Given that Bitcoin is notorious for its cycles of dramatic declines and captivating increases, investors must decide how much to invest. This must be an amount large enough to contribute to their portfolios but small enough to allow their portfolios to weather the volatility.

Although evidence indicates that a conservative allocation to Bitcoin may have been advantageous in the past and the launch of spot Bitcoin ETFs may boost investor trust, it’s possible that as BTC develops as an asset class, its well-known qualities may shift. And while the Bitcoin ETF hype is a landmark event, it’s important to consider your goals and risk tolerance before purchasing, experts say. It is true that Bitcoin carries risk, so if you want to add exposure, experts say the new Bitcoin ETFs could be worth considering compared to owning BTC directly or Bitcoin futures ETFs. When starting to build a position, you can buy at 1% allocation at a time and max it out at 3%. This may be considered a careful approach to the newly emerged asset class.

While there are undoubtedly some investors who will actively trade their ETFs, or who will use them as part of sophisticated portfolio hedging strategies, they are designed primarily for only one purpose: to get passive exposure to the long-run price potential of Bitcoin. This ability to capture the long-term price performance of Bitcoin is very attractive, because just about everyone agrees that the price of Bitcoin has the potential to skyrocket higher.

Best Bitcoin ETFs: Overview

Here is a list of the top-3 most well-known spot Bitcoin ETFs:

GrayScale Bitcoin ETF (GBTC)

Launched in 2013, GBTC is one of the first securities to invest in BTC solely. According to Forbes, in January it topped trading volume. It started as a private and open-ended trust for accredited investors before going public on over-the-counter markets in 2015. Since then, Grayscale has been lobbying hard for SEC approval to convert into a spot ETF. GBTC is the world’s largest Bitcoin spot ETF with a total AUM of $26.9 billion. The fund holds 617k Bitcoin, nearly 3% of the total supply. Although GBTC has reduced its expense ratio from 2.00% to 1.50% after becoming a spot ETF, that price is still too high considering other options.

Valkyrie Bitcoin Fund (BRRR)

Initially owned by Tennessee-based Valkyrie Investments, the BRRR fund was acquired by CoinShares after the SEC approval on January 12, 2024. According to MSN, Valkyrie expects at least $20 billion inflows for spot Bitcoin ETFs in the first year. The move adds assets worth $112 million to the $4.5 billion already managed by the EU-based crypto asset manager. Along with BRRR, Coinshares also acquired Valkyrie’s other crypto ETFs. Like most other Bitcoin ETFs in January 2024, BRRR offers steep fee discounts to attract buyers. The fund is promising a 3-month waiver in sponsor fees. After that, the fee will be 0.25%. Coinbase is the designated bitcoin custodian of BRRR.

Invesco Galaxy Bitcoin ETF (BTCO)

BTCO is the result of a partnership between Invesco, a leader in traditional ETFs, and Galaxy Asset Management, a significant investment manager of digital assets. Invesco is a trusted name in ETFs, with over $1,49 trillion in assets managed on behalf of clients as of 2023. The management fees are competitively priced at 0.39%, although cheaper options are available. The fund also offers a 6-month 100% fee waiver for the first $5 billion of assets.

Conclusion

The introduction of Bitcoin spot ETFs to the US market offers investors new, high-yield options to balance their portfolios, therefore this is a positive development. Even if there are currently Bitcoin spot ETFs in the EU and Canada, their introduction to the US might be the catalyst for institutional money worth billions of dollars to rush into the cryptocurrency space, and we already see this happening.

With the SEC decision in 2024, the long-awaited goal of getting hands for financial institutions on spot Bitcoin ETFs as a possible investment option has finally been realized. Other cryptocurrency spot ETFs may soon become popular; Ethereum seems as a likely candidate. This is undoubtedly a significant milestone in the lengthy process of cryptocurrencies becoming legitimate.

Regardless of whether you are new to crypto or have been there for a while, it’s essential to stay informed and protected while buying and holding digital assets. To keep updated on the latest news and invest in crypto with no risks, use StealthEX, a platform with over 1500 coins available for secure exchange. Just go to StealthEX, choose the amount of the cryptocurrency you want to swap, for example, ETH to BTC, and click Start Exchange.

Make sure to follow StealthEX on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin Bitcoin ETF crypto ETF crypto world ETFRecent Articles on Cryptocurrency

JASMY Coin Price Prediction: Will JASMY Coin Hit $1?

JASMY Coin Price Prediction: Will JASMY Coin Hit $1?  Best Monero Wallets: How to Safely Store XMR?

Best Monero Wallets: How to Safely Store XMR?