Understanding Crypto ETFs: A Game-Changer in Investment Landscape

A blockchain exchange-traded fund is a fund that invests exclusively in a basket of blockchain-based companies. Cryptocurrency exchange-traded funds (ETFs) track the price performance of one or more cryptocurrencies by investing in futures contracts for digital currency, or by investing in digital currencies directly. This eliminates the need to deal with the fees and complications associated with directly owning digital assets and allows the investor to participate in cryptocurrency price movements without having to transact on a crypto exchange. Discover more about crypto ETFs in StealthEX’s latest article.

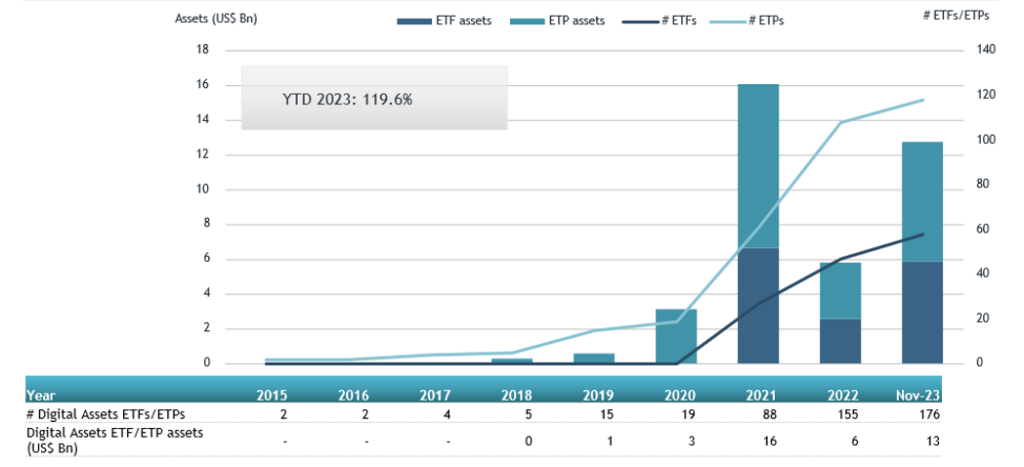

ETFs were first introduced in the early 1990s. These products have evolved over the years, covering digital assets like Bitcoin in addition to more conventional asset classes like equities and commodities. As investor appetites changed over time, ETFs grew to encompass a wider range of assets, including precious metals like gold and silver. The approval of the first spot Bitcoin ETF in the US is a significant development for the financial industry as it offers investors direct exposure to Bitcoin within traditional finance. According to ETFGI, there are 176 crypto ETFs and ETPs (exchanged traded products) listed globally, with 482 listings. In the first 11 months of 2023, assets allocated to Crypto ETFs and ETPs worldwide surged by 119.6%, soaring from $5.79 billion at the close of 2022 to $12.73 billion. November alone witnessed net inflows of $1.31 billion. Furthermore, the year-to-date net inflows for 2023 stand at $1.60 billion, marking the second-highest on record, following the $9.02 billion recorded in 2021.

Source: etfgi.com

Article contents

How Crypto ETFs Work?

As mentioned earlier, a crypto ETF tracks the performance of cryptocurrencies, such as Bitcoin or Ethereum, and mirrors the assets’ price movements. While the majority of exchange-traded funds (ETFs) mimic indexes by holding a basket of the underlying assets, a cryptocurrency ETF provides two methods for following the performance of a virtual currency. Spot ETFs hold cryptocurrencies directly and create a portfolio that essentially mimics the performance of the digital assets they hold. Invested in futures contracts, which are contracts to buy or sell cryptocurrency at a fixed date and price, are other cryptocurrency exchange-traded funds. Like other derivatives, synthetic cryptocurrency ETFs have an additional risk because their operations are not always transparent. There are two types of EFTs: Sport Bitcoin ETFs and Bitcoin futures ETFs.

Spot Bitcoin ETF

A spot Bitcoin ETF is backed by physical Bitcoins that underpin the value of the ETF. If the value of the digital coins backing the ETF rises, the value of your investment can generally be expected to increase. In simple terms, if the price of Bitcoin increases, the investment should too.

A physically-backed Bitcoin ETF is the most direct way of investing in Bitcoin without buying Bitcoin on a crypto exchange and holding the coins. In this case, the fund holds them.

Bitcoin Futures ETF

A Bitcoin futures ETF does not hold any Bitcoin as the underlying assets; instead, the fund holds futures contracts over Bitcoin instead of the actual coin. A futures contract potentially allows investors to profit from rising prices through an agreement that sets a fixed price and a future date for delivery of an asset, or the cash equivalent value. As a futures-based Bitcoin ETF does not hold Bitcoin, it is not directly exposed to the risks associated with storing the cryptocurrency.

| Advantages | Disadvantages | |

| Spot Bitcoin ETF | 1. Investors can gain direct exposure to Bitcoin without having to sign up to a crypto exchange or create a wallet. 2. Portfolio diversification. 3. Investor protection regulation. | 1. Unlike cryptocurrency exchanges that are open 24/7, traditional exchanges have set hours for trading. 2. ETF management fees. |

| Futures Bitcoin ETF | 1. May have lower management fees due to ease of setting-up and lack of fees on custody and other requirements for spot ETFs. | 1. Can be prone to decay, which results in losses attributed to the underlying asset such as futures roll which may not be apparent in an underlying spot exposure. 2. Can be prone to divergence, when the price of an asset is moving contrary to the underlying asset. 3. The ETF does not hold physically backed Bitcoin. 4. Unlike cryptocurrency exchanges that are always open, traditional exchanges have set hours for trading. |

Benefits of Investing in Crypto ETFs

There are many benefits of investing in cryptocurrency EFTs, namely:

- Diversification. With a new asset class, Bitcoin ETFs provide a way to diversify investment portfolios. Including a Bitcoin ETF in a portfolio can aid in risk distribution because BTC frequently has a low correlation with conventional assets like stocks and bonds. For instance, the price of Bitcoin may fluctuate on its own when traditional markets are underperforming, possibly providing a hedge against market declines.

- Accessibility. Bitcoin ETFs streamline the investing process by enabling investors to purchase shares using conventional brokerage accounts. This is especially helpful for people unaware of the subtleties of crypto exchanges. For instance, a stock trader with experience can add a Bitcoin ETF to their portfolio using brokerage platforms without comprehending the intricacies of private keys and digital wallets.

- Regulatory aspects. The fact that Bitcoin ETFs function within regulated financial systems improves investor protection. Moreover, it creates a secure investment environment by ensuring openness and adherence to financial regulations. One significant development was the SEC’s 2021 approval of the first U.S. Bitcoin futures ETF, which provided investors with a regulated opportunity to participate in Bitcoin. In addition, in January 2024, the SEC approved spot Bitcoin ETFs, a significant milestone in integrating cryptocurrencies into mainstream financial markets.

- Liquidity. When it comes to cryptocurrency investments, ETFs typically offer more liquidity than direct investments. This implies that during market hours, investors can easily purchase and sell shares of a Bitcoin ETF at market rates. This liquidity is essential because it enables a quicker reaction to market fluctuations, particularly in volatile markets.

Crypto ETFs: Risks and Considerations

Traders looking for general exposure in the crypto markets without the complications of opening another account are ideal for crypto ETFs. Moreover, stock traders can feel more comfortable with an ETF as opposed to trading the actual crypto and dealing with the spreads, commissions, and slippage. To put it simply, equities traders may trade crypto ETFs when they want exposure to crypto markets without the hassle of setting up a digital wallet or a new account at a crypto exchange.

However, there are some of the disadvantages of investing in crypto EFTs. These may include:

- Market volatility. Exposure to the extreme price volatility in cryptocurrency markets is one of the significant disadvantages of Bitcoin ETFs. Bitcoin and its ETFs can experience sharp price fluctuations in a short amount of time.

- Regulatory risks. Cryptocurrency regulations vary by country and can change over time and can restrict the use of these ETFs or depress the price of the underlying digital currency.

- Tracking error. The performance of a crypto ETF may not precisely match the performance of the underlying cryptocurrencies it aims to track because of factors like expenses, rebalancing, and tracking errors.

- Indirect ownership. Investors who purchase Bitcoin ETFs do not directly possess any Bitcoin. Instead, they are investors in a fund that holds Bitcoin. As a result, individuals miss some of the advantages of having direct ownership of Bitcoin, such as the capacity to transact with it or keep it in their possession as an asset without needing an intermediary.

- Higher fees. Compared to conventional ETFs, the fees of Bitcoin ETFs may be higher. The expenses incurred in maintaining and safeguarding the underlying cryptocurrency holdings are the justifications for these fees.

- Diversification limitations. While some crypto ETFs offer diversification, they may still be subject to overall market trends and conditions affecting the cryptocurrency market as a whole.

Existing Cryptocurrency ETFs in the Market

There are ETFs available that are made up of the stock of multiple companies that own cryptocurrency or have some business in the world of cryptocurrency. Although these ETFs are connected to the cryptocurrency space, they do not hold any cryptocurrency. Rather, they own stock in businesses that have made cryptocurrency investments or whose operations include mining, trading, or other activities related to cryptocurrencies. There is a number of ETFs, such as Amplify Transformational Data Sharing ETF (BLOK), First Trust Indxx Innovative Transaction & Process ETF (LEGR), or Siren NASDAQ Economy ETF (BLCN) that focus on investing in companies that have committed to research, development and usage of blockchain technology or tracking the investment performance of the Indxx Blockchain index.

The acceptance of spot ETFs is expected to increase investor comfort levels for institutional and retail investors alike, which could lead to a larger pool of potential investors. Spot ETFs have the potential to change the way people view BTC, turning it from a risky investment into a reliable financial instrument.

Additionally, there might be a rise in the whole addressable market for goods linked to Bitcoin, which will boost sales and user base. ETFs are indeed creating a market for themselves even now: optimism surrounding a potential wave of spot Bitcoin ETF approvals sent Bitcoin surging to new 52-week highs above $44,700 in December. However, investors have several other key themes and catalysts to monitor in the coming year. These include Bitcoin halving, crypto regulations, CBDCs (central bank digital currencies), interest rates and inflation, and more. On top of that, the growing acceptance of cryptocurrencies by traditional financial institutions, along with regulatory clarity in many jurisdictions, is likely to contribute to their mainstream adoption. This can also pave the road for cryptocurrency ETFs.

How to Invest in Cryptocurrency ETFs?

The majority of internet brokers that sell conventional products like stocks and bonds also offer Bitcoin ETFs. While some of these brokers only let you trade Bitcoin futures, others can also give you the option to invest in Bitcoin directly.

ETFs are traded on conventional markets like the Nasdaq and the New York Stock Exchange. You’ll need an account with a cryptocurrency exchange, like Binance or Kraken, if you want to invest directly in digital coins and want the largest selection available. Here are some tips for investing in crypto ETFs: – Open an account with brokers like Fidelity Investments, Robinhood, etc., by completing their onboarding process.

- Decide what percentage of your total investment budget you want to invest in ETFs.

- Fund your brokerage account and look for ETFs you want to invest in. For instance, if you’re going to invest in ProShares Bitcoin Strategy ETF, type BITO (ticker symbol) into the search bar.

- Place a market order for cryptocurrency ETFs you want to buy. Enter the maximum number of shares you may purchase with your current budget.

- If you’d like to continuously extend your investment portfolio, set up an automatic investment plan with your broker.

Best Crypto ETFs

There is a large market of cryptocurrency ETFs available. Here are some of the most prominent ones:

- Amplify Transformational Data Sharing ETF. With more than $400 million in assets, the Amplify ETFs is one of the largest funds focused on the cryptocurrency and digital asset economy. It was featured in an article by Seeking Alpha, which is a service that publishes news on financial markets.

- Bitwise 10 Crypto Index Fund endorsed by CCN. The Bitwise 10 Crypto Index Fund invests in the top 10 cryptocurrencies and is rebalanced monthly to account for changes in crypto prices. Bitcoin and Ethereum are far and away the largest cryptocurrencies by size, so they make up over 90% of the underlying portfolio.

- Siren Nasdaq NexGen Economy ETF (BLCN) mentioned by Nasdaq. The Siren Nasdaq NexGen Economy ETF is another fund that focuses on companies developing and using blockchain technology. The ETF is composed of more than 60 stocks. It includes some general technology businesses with a crypto or blockchain segment, such as IBM.

- Global X Blockchain ETF (BKCH) featured in ETF Trends. The Global X Blockchain ETF believes blockchain technology has uses far beyond cryptocurrency alone. It invests accordingly into more than 20 tech and Bitcoin mining stocks that are leading the charge in the world of crypto and the underlying blockchain technology.

- Invesco Elwood Global Blockchain ETF is mentioned in the Proactive Investors article. It’s a fund that provides a combination of exposure to traditional businesses that are thought to be utilizing blockchain technology, as well as businesses directly engaged in Bitcoin and cryptocurrency mining and trading.

Conclusion

The recent approval of spot ETFs makes the overall acceptance of crypto ETFs look promising, with a possible significant growth in the future. The introduction of spot Bitcoin ETFs marks a crucial development, which gives investors direct exposure to BTC prices and brings them closer to the market performance of the cryptocurrency.

A wider spectrum of investors, including those who are interested in the cryptocurrency market but would rather use regulated financial instruments, are expected to be drawn in by this move. In addition, the increased competition among ETF providers has led to lower fees, making these investment vehicles more approachable and appealing. All things considered, the field of crypto ETFs is likely to develop and become more integrated into traditional financial portfolios. However, as with all volatile assets, it’s best to do your own research, rely on portfolio diversification, and stay updated about the latest news and developments within the industry.

Regardless of whether you are new to crypto or have been there for a while, it’s essential to stay informed and protected while buying and holding digital assets. To keep updated on the latest news and invest in crypto with no risks, use StealthEX, a platform with over 1400 coins available for secure exchange. Just go to StealthEX, choose the amount of the cryptocurrency you want to swap, for example, ETH to BTC, and click Start Exchange.

Make sure to follow StealthEX on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin Bitcoin ETF crypto ETF crypto world ETFRecent Articles on Cryptocurrency

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight  Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?

Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?