Bitcoin Price Prediction: Can BTC Coin Reach $1,000,000?

Bitcoin (BTC) is a decentralized digital currency that operates without the need for a central authority, such as a bank or government. Bitcoin is often hailed as a revolutionary innovation for its potential to democratize finance, combat inflation, and provide a borderless payment system. Despite its volatility, Bitcoin has become a widely recognized asset and a cornerstone of the cryptocurrency ecosystem. Just recently, Bitcoin has reached its new all-time high. What are we to expect from the first cryptocurrency? Discover the long-term Bitcoin price prediction in StealthEX’s latest article.

| Current BTC Price | BTC Price Prediction 2025 | BTC Price Prediction 2030 |

| $93,500 | $145,000 | $655,000 |

Article contents

- 1 Bitcoin (BTC) Overview

- 2 Bitcoin (BTC) Price History Highlights

- 3 Bitcoin (BTC) Price Chart

- 4 Bitcoin Price Prediction: 2025, 2026, 2030, 2035, 2040

- 5 Bitcoin Price Prediction: What Do Experts Say?

- 6 BTC USDT Price Technical Analysis

- 7 What Does the Bitcoin Price Depend On?

- 8 Is Bitcoin a Good Investment?

- 9 Will BTC Rise Agin?

- 10 How High Will Bitcoin Go Realistically?

- 10.1 How Much Will Bitcoin Be Worth in 2025?

- 10.2 How Much Will 1 Bitcoin Be Worth in 5 Years?

- 10.3 What Is the Realistic Bitcoin Price in 2030?

- 10.4 What Will the Price of Bitcoin Be in 2035?

- 10.5 How Much Will 1 Bitcoin Be Worth in 2040?

- 10.6 What Will 1 Bitcoin Be Worth in 2050?

- 10.7 Who Owns the Most Bitcoin?

- 10.8 How Long Does It Take to Mine 1 Bitcoin?

- 11 Conclusion

- 12 Where to Buy Bitcoin Crypto?

- 13 How to Buy BTC Coin: Quick-Step Guide

Bitcoin (BTC) Overview

Bitcoin is a groundbreaking form of digital currency that operates on a decentralized network, free from control by governments or financial institutions. It is powered by blockchain technology, a secure and transparent ledger that records all transactions across its network. Unlike traditional currencies, Bitcoin is not tied to a central bank or physical commodity, which allows for direct, peer-to-peer transactions globally. This makes Bitcoin an attractive option for people seeking financial sovereignty, lower transaction fees, and a payment system that is immune to censorship or restrictions.

At its core, Bitcoin relies on cryptographic principles to maintain its security and integrity. Transactions are verified by network participants, known as miners, who solve complex mathematical problems to validate blocks of data. This process not only secures the network but also creates new bitcoins in a controlled and predictable manner, ensuring a fixed supply cap. Bitcoin has grown beyond its origins as a niche innovation to become a widely recognized asset, serving as both a medium of exchange and a store of value in an increasingly digital world.

| Current Price | $93,500 |

| Market Cap | $1,856,229,664,082 |

| Volume (24h) | $51,393,259,667 |

| Market Rank | #1 |

| Circulating Supply | 19,855,212 BTC |

| Total Supply | 119,855,212 BTC |

| 1 Month High / Low | $94,535.73 / $74,436.68 |

| All-Time High | $109,114.88 Jan 20, 2025 |

Very little is known about the creator of Bitcoin, Satoshi Nakamoto, who created the Bitcoin network in 2009. It is thought to be a pseudonym, and some people even think there could be more than one person behind its creation. Nakamoto originally designed Bitcoin as an alternative to traditional money, with the goal for it to eventually become a globally accepted legal tender so people could use it to purchase goods and services. However, the volatility of Bitcoin’s price has hindered its usefulness for payments in various ways. On the other hand, it has also led to various speculations and wild swings in Bitcoin’s price helped many investors earn money.

Bitcoin Features

Bitcoin offers several features within the crypto space. As Bitcoin is the first cryptocurrency and a pioneer in the field, it has certain features that helped define the whole crypto space. These are:

- Hard Cap of 21 Million: The fixed supply dynamic of Bitcoin has become one of the key value propositions for the market demand and incentive to continue validating the network.

- Decentralization acts as a checks and balances system before blocks are added to the chain. The decentralized BTC network is a core feature that makes Bitcoin unique.

- Network Effects: Estimates suggest there are over 100 million active BTC users across the world. The popularity and ubiquity of Bitcoin make it more valuable. The fact that Bitcoin is considered a legitimate store of value and used by so many people gives it more liquidity and acceptability than most other traditional assets.

- Immutability: Every transaction on the Bitcoin network is stored on a block that is linked to a previous block of transactions. This blockchain technology is immutable, which means no entity can erase or alter any information on the network.

- A High Degree of Censorship Resistance implies freedom to transact, freedom from confiscation, and immutability of transactions.

Bitcoin (BTC) Price History Highlights

- 2009-2011: Bitcoin had a price of zero when it was first introduced to the world. On October 26, 2010, its price surged from its sustained level of $0.10 to $0.20. It had reached $0.30 before the year ended. When the cryptocurrency markets saw a severe downturn in 2011, Bitcoin’s price plummeted, ending the year at roughly $5. The price of the cryptocurrency began to rise over $1 in 2011 and peaked on June 8, 2011, at $29.60.

- 2012-2013: BTC did rise in price during 2012, but generally the year turned out to be quiet. 2013 saw significant increases in the price of the first cryptocurrency. With a starting price of $13, Bitcoin reached $100 by April and $200 by October. For the rest of the year, Bitcoin saw record highs. November saw it surpass $1,000, and at the end of the year, it was $732.

- 2014: After hitting $1,000 in early January, Bitcoin bottomed at $111.60.

- 2015: The year 2015 started with Bitcoin declining, but most of the year was a slow uptrend, unusual for Bitcoin, and it ended the year at $430.

- 2016: The first half of 2016 saw a continuation of this pattern of comparatively low volatility and stable prices. By year’s end, Bitcoin was just shy of $1,000, a mark it had achieved in early 2017, a landmark year for the cryptocurrency in terms of public awareness.

- 2017: 2017 had a range of $1,000 to $2,000 for Bitcoin before it broke $2,000 in mid-May and surged to close at $19,188 on December 16.

- 2018-2019: The price of Bitcoin fluctuated a little between 2018 and 2019, with sideways movements. For instance, in June 2019, there was a price and trade volume rebound, with the price rising beyond $10,000. But by mid-December, it had dropped to a closing price of $6,612.

- 2020: The COVID-19 pandemic shut down the economy in 2020. The price of Bitcoin surged once more. The first cryptocurrency started the year at $7,161. The government’s actions after the pandemic shutdown fuelled investors’ concerns about the state of the world economy and hastened the ascent of Bitcoin. As of November 23, the price of Bitcoin was $18,383. On December 31, 2020, the price of BTC closed at $28,993, up 416% from the beginning of the year.

- 2021: By January 7, 2021, Bitcoin had surpassed $40,000, shattering its 2020 price record in less than a month. Bitcoin values hit fresh all-time highs of more than $60,000 by mid-April, according to Coinbase. Prices dropped by fifty percent by the summer of 2021, closing on July 19 at $30,829. Another bull run occurred in September when prices nearly reached $52,956. However, a significant decline caused it to close at $40,597 around two weeks later.

- 2022: The price of Bitcoin fell steadily between January and May 2022, closing at only $47,459 by the end of March before plunging even lower to $29,000 on May 11. For the first time since July 2021, the closing price of Bitcoin fell below $30,000. Cryptocurrency prices fell on June 13. For the first time since December 2020, the price of BTC fell below $23,000.

- 2023: In 2023, Bitcoin’s fortunes drastically turned around as its price skyrocketed. In 2023, the opening price of Bitcoin was $16,530. It increased steadily in 2023, reaching $42,258 at the year’s end.

- 2024: The first half of 2024 brought some changes for BTC. With the upcoming halving, the price started going up. Moreover, it was fuelled by the long-awaited spot exchange-traded funds (ETFs). As a result, in March the oldest digital asset in the world hit $73,750. On December 17, Bitcoin reached a maximum price of $108K.

- 2025: At the beginning of 2025, the price of BTC fluctuates between $90K and $109K. On January 20, Bitcoin reached its new all-time high of $109,114.88. By the beginning of April, the price of Bitcoin fell to $75K, and by the end of the month, it had risen and returned to values of around $95K.

Bitcoin (BTC) Price Chart

CoinMarketCap, April 23, 2025

Bitcoin Price Prediction: 2025, 2026, 2030, 2035, 2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $83,800 | $205,342 | $145,000 | +55% |

| 2026 | $175,506 | $272,026 | $225,000 | +140% |

| 2030 | $444,022 | $865,200 | $655,000 | +600% |

| 2040 | $1,904,543 | $5,576,515 | $3,750,000 | +4,000% |

BTC Price Prediction 2025

DigitalCoinPrice experts believe that in 2025 Bitcoin’s price can drop to a minimum of $83,800 (-10%), while at its high it can reach a peak of $205,342 (+120%).

PricePrediction crypto analysts expect that in 2025 BTC is going to hit $121,364 (+30%) at its lowest point or reach $137,353 (+45%) as its new all-time high.

Telegaon crypto experts think that the lowest price BTC can hit in 2025 is $107,078 (+15%) vs its maximum price of $185,360 (+100%).

Bitcoin Price Prediction 2026

According to DigitalCoinPrice, in 2026 BTC can go as high as $242,353 (+160%) at its peak. Its lowest price might drop to $200,836 (+115%).

PricePrediction forecasts promise that in 2026 Bitcoin’s price will go beyond $200,000: a minimum of $175,506 (+85%) at its lowest point vs $209,884 (+125%) at its peak.

Analysts at Telegaon expect that in 2026, BTC will rise in price even higher: it can reach a maximum price of $272,026 (+190%), while at its lowest point it can drop to a minimum of $185,402 (+100%).

Bitcoin Price Prediction 2030

According to DigitalCoinPrice, by 2030 Bitcoin’s price can surpass $500,000 at its highest point and hit $509,312 (+445%), while even at its minimum it won’t go lower than $444,022 (+375%).

According to PricePrediction forecast, by 2030 BTC will shoot way over its current price levels: its lowest price is projected to be $715,820 (+665%), and at the peak, almost a million dollars is expected – $865,200 (+825%).

Telegaon price predictions are more moderate: their experts estimate that in 2030, Bitcoin is going to reach $618,330 (+560%) at its minimum and might trade at a maximum of $714,504 (+665%).

Bitcoin Price Prediction 2035

Telegaon analysts believe that by 2035, BTC coin will rise to a maximum level of $1,593,123 (+1,600%), while its minimum price will drop to $1,121,424 (+1,100%).

According to AMBCrypto, by 2035 Bitcoin will see the lowest price of $345,736 (+270%), while at its peak it might reach $518,604 (+455%).

Bitcoin Price Prediction 2040

According to PricePrediction forecasts, in 2040 BTC will reach staggering price levels: its minimum price is expected to be a whopping $5,075,630 (+5,330%), while its maximum price is going to hit $5,576,515 (+5,865%).

Telegaon analysts expect that in 2040, Bitcoin is going to hit $1,904,543 (+1,940%) at its lowest point and $2,518,512 (+2,595%) at its highest point.

Bitcoin Price Prediction: What Do Experts Say?

Expert predictions for Bitcoin’s price in 2025 range widely, reflecting the cryptocurrency’s volatility and the impact of external economic and regulatory factors. Many optimistic analysts anticipate significant growth due to increased institutional adoption, scarcity from halving events, and a global focus on inflation hedges. Predictions include $170,000 from Anthony Scaramucci of SkyBridge Capital, $114,000 by Pantera Capital based on halving effects, and $250,000 from venture capitalist Tim Draper, who emphasizes Bitcoin’s technological value.

At the same time, even though the price of Bitcoin has reached the $100,000 mark, financial advisor Robert Kiyosaki forecasts BTC crash to $60,000 again. However, Robert believes Bitcoin will soar to $250,000 in 2025.

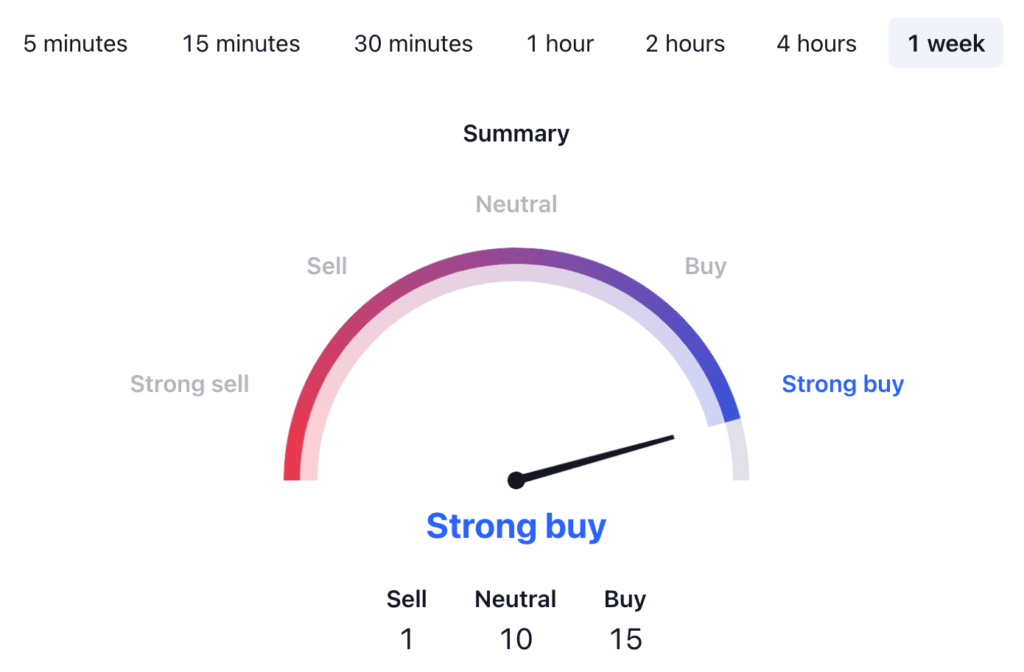

BTC USDT Price Technical Analysis

Tradingview, April 23, 2025

Now that we’ve seen possible price predictions for BTC, let’s find out a bit more about the factors that can influence its price.

What Does the Bitcoin Price Depend On?

The price of Bitcoin is influenced by several factors, including supply and demand, rivalry from other cryptocurrencies, news, manufacturing costs, and legal restrictions. Overall, Bitcoin’s price is shaped by a mix of predictable events, like halvings, and unpredictable influences, such as regulatory changes or macroeconomic shifts, making its market both dynamic and volatile.

Recent developments have had a significant impact on Bitcoin’s price. One of the most influential factors in 2023 was the approval of spot Bitcoin Exchange-Traded Funds (ETFs) by U.S. regulators. This move is expected to simplify Bitcoin investments for institutional and retail investors, contributing to growing demand and driving Bitcoin’s price to new highs, including reaching close to $90,000 in November 2023.

Presidential elections shape fiscal and monetary policies that affect inflation, interest rates, and investor behavior — all key drivers for Bitcoin. For example, expansive monetary policies might increase Bitcoin’s appeal as an inflation hedge, while tighter policies could temper demand. Analysts have observed that uncertainty around elections can lead to increased market volatility. For Bitcoin, this could translate into speculative trading, with price swings influenced by expectations of future economic stability or instability depending on the election outcome. This time, the presidential elections in the US also stirred the demand for cryptocurrencies.

When assessing Bitcoin as an investment, keep the following considerations in mind:

- Supply and demand;

- Halving events;

- Hype and news;

- Market sentiment;

- State of the economy;

- Regulatory developments.

Risks and Opportunities

Bitcoin operates without central authority, making it resistant to censorship and offering financial sovereignty to users worldwide. Often referred to as ‘digital gold,’ Bitcoin is seen as a hedge against inflation, with its limited supply of 21 million coins providing scarcity. Historically, Bitcoin has delivered significant returns over the long term, driven by increased adoption and demand.

Despite the pitfalls, Bitcoin has become popular and appears to be going mainstream. It’s been going from strength to strength, and many institutional investors continue flooding into the field. Increasing acceptance by corporations, funds, and even governments enhances its legitimacy and drives broader integration.

Is Bitcoin a Good Investment?

Based on factors like increased adoption and macroeconomic trends, some analysts forecast Bitcoin prices exceeding $150,000 or more in the coming years. Others warn about its speculative nature and advise only allocating a small percentage of an investment portfolio to Bitcoin, treating it as a high-risk asset. Overall, Bitcoin can be a good investment for those who understand its risks, believe in its long-term potential, and have the financial capacity to withstand volatility. However, as with any investment, due diligence and careful consideration of personal financial circumstances are crucial.

How Much Is $100 Worth of Bitcoin Right Now?

At this very moment, $100 would purchase about 0.001 BTC.

How Much Will I Get if I Invest $100 in Bitcoin Today?

As $100 would purchase about 0.001 BTC, if Tim Draper’s most optimistic price prediction is correct, then this would get you $250 in case Bitcoin ends up costing $250,000 in 2025.

What if I Invested $1,000 in Bitcoin in 2009?

If you invested $1,000 in Bitcoin in 2009, your investment would be worth an extraordinary amount today. In 2009, Bitcoin’s price was extremely low, often valued at less than $0.01 per Bitcoin when it first started circulating. For simplicity, let’s use a figure of $0.001 per BTC as a rough average price during that period. If you had invested $1,000 in Bitcoin in 2009, your investment would now be worth over $100 billion, reflecting Bitcoin’s massive price growth over the last decade and a half. This illustrates why Bitcoin has often been compared to ‘digital gold’ and why early investments have yielded life-changing returns.

Is It Safe to Invest in BTC Coin Today?

Bitcoin has a history of delivering high returns over the long term, particularly when purchased during market downturns and held through volatility. Some analysts believe that the ongoing adoption by institutions and the reduction of new supply due to halving events could support future price growth. Investing in Bitcoin is not risk-free, and it is considered a high-risk, high-reward investment. Experts generally recommend that if you decide to invest, only allocate a portion of your portfolio to Bitcoin, in line with your risk tolerance.

Will BTC Rise Agin?

Bitcoin has recently experienced significant growth. Experts remain optimistic about its long-term potential, with some forecasting substantial increases in the next years.

However, as with any investment, Bitcoin’s price is subject to market volatility and external influences, so it’s essential to approach it with caution and conduct thorough research.

Bitcoin Reaches $100K, What’s Next?

Bitcoin’s recent surge past $100,000 marks a significant milestone, driven by increased institutional adoption and favorable regulatory developments. Analysts predict continued growth, with some estimates reaching up to $130,000 by year-end. However, the market remains volatile, and while the long-term outlook is positive, investors should be prepared for potential short-term fluctuations.

Can BTC Reach $250,000?

Bitcoin has the potential to reach $250,000, with experts offering optimistic forecasts for its future growth. Predictions for 2025 include projections from analysts at Standard Chartered, who believe Bitcoin could break through $250,000, bolstered by rising institutional investments and potential effects from the 2024 halving event.

Can Bitcoin Reach $1,000,000?

Reaching $1,000,000 per Bitcoin is an ambitious and highly speculative prediction, but it’s not entirely outside the realm of possibility. While the idea of Bitcoin reaching $1,000,000 per coin may sound far-fetched today, it’s not entirely out of the question over the next decade or more, especially if it gains more widespread adoption, institutional support, and integration into financial systems.

Can Bitcoin Reach 1 Billion?

Bitcoin may have the potential to increase in value significantly and reach levels of $150,000 or even $250,000 per coin, however, the idea of it reaching $1 billion is highly unlikely under current and foreseeable conditions.

How High Will Bitcoin Go Realistically?

A realistic outlook suggests that its price might range between $100,000 to $500,000 over the next decade, depending on various factors such as adoption, market conditions, and regulatory developments.

How Much Will Bitcoin Be Worth in 2025?

According to DigitalCoinPrice, in 2025 Bitcoin will hit a maximum of $205,000.

How Much Will 1 Bitcoin Be Worth in 5 Years?

DigitalCoinPrice experts think that in 5 years Bitcoin will go as high as $700,000.

What Is the Realistic Bitcoin Price in 2030?

Cathie Wood of Ark Invest has proposed an optimistic estimate of $1.5 million by 2030, driven by increased institutional investment and Bitcoin’s continued adoption as a digital asset akin to gold. PricePrediction experts believe that in 2030 Bitcoin can reach a maximum of $865,200. Other analysts project more conservative outcomes, citing potential prices between $509,000 and $715,000.

What Will the Price of Bitcoin Be in 2035?

Telegaon analysts think that in 2035 Bitcoin will reach $1,593,000 at its peak.

How Much Will 1 Bitcoin Be Worth in 2040?

Telegaon analysts think that in 2040 1 Bitcoin will hit a maximum of $2,500,000.

What Will 1 Bitcoin Be Worth in 2050?

According to PricePrediction experts, in 2050 Bitcoin can go as high as $6,578,000.

Who Owns the Most Bitcoin?

The pseudonymous creator of Bitcoin is believed to own approximately 1 million BTC.

How Long Does It Take to Mine 1 Bitcoin?

The time it takes to mine one Bitcoin depends on several factors, including mining hardware, the network difficulty, and whether miners are part of a mining pool. Currently, Bitcoin mining is most effectively carried out using specialized hardware called ASIC miners, which have high computational power. For example, using a single powerful miner like the Whatsminer M30S++, it could take over 3,000 days (approximately 8.3 years) to mine a full Bitcoin as part of a mining pool.

Conclusion

Bitcoin has emerged as a revolutionary financial asset, sparking interest from individual investors, institutional players, and even governments around the world. As a decentralized digital currency, it offers a unique blend of security, transparency, and the potential for significant financial gains. Over the years, Bitcoin’s journey has been marked by impressive growth, moments of extreme volatility, and an evolving regulatory landscape. Cryptocurrency has been embraced as a store of value, akin to digital gold, and has shown resilience even during times of economic uncertainty. Whether Bitcoin’s future holds continued growth or faces new challenges, it remains a compelling asset with the power to transform financial systems and redefine the global economy.

Where to Buy Bitcoin Crypto?

StealthEX is here to help you buy BTC crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Bitcoin privately and without the need to sign up for the service. StealthEX crypto collection has more than 1,500 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy BTC Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to BTC.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your BTC coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin Bitcoin price prediction BTC crypto price prediction price analysisRecent Articles on Cryptocurrency

Crypto News: Trump Media Approved, Cardano's Bitcoin Bridge, XRP's Ethereum Plans

Crypto News: Trump Media Approved, Cardano's Bitcoin Bridge, XRP's Ethereum Plans  Arbitrum Price Prediction: Is ARB Crypto a Good Investment?

Arbitrum Price Prediction: Is ARB Crypto a Good Investment?