Crypto Market Week in Review: February 10, 2023

The last week in the crypto world was rather successful. Although we did not experience massive gains, the price of BTC maintained a fairly stable range. Admittedly, the Bitcoin price in USD is lower than a week ago, but the drop is not an extreme one to panic about. Nevertheless, there was a lot of interesting news last week, which we will briefly discuss in today’s crypto recap. So, what happened to crypto this week?

What Happened to Cryptocurrency This Week?

But before we get to the news, let’s analyze the Bitcoin and ethereum prices and see which projects were the biggest crypto gainers this week.

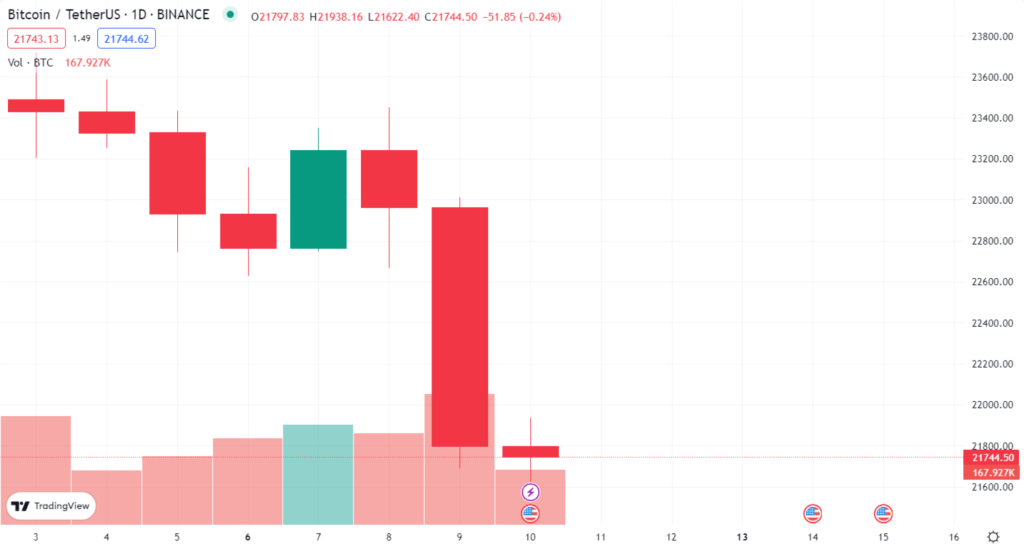

Bitcoin Price This Week

Bitcoin price this week behaved in a relatively calm manner. The 7d high of BTC was $23,678.10, while the 7d low stood at $21,754.13. Meanwhile, we could see a solid green candle triggered by The Bureau of Labor Statistics’ release of labor market data.

Source: Tradingview, Data was taken on February 10, 2023

Today, Bitcoin (BTC) price is $21,780.51, and the market cap stands at $420,007,235,627. The dominance of the crypto king in the overall market remains stable at 39.68%.

Concerning investor sentiment, it is still positive. The Fear and Greed Index points to 48, indicating that traders still show signs of greed.

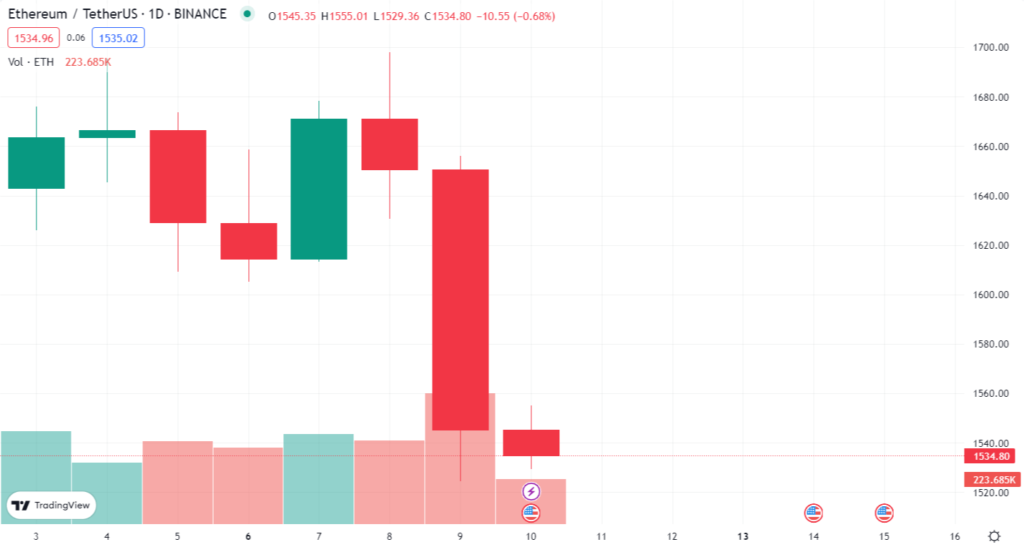

Ethereum Price USD This Week

The Ethereum price also stagnated this week. ETH’s 7d high reached $1,643.64, while the 7d low was $1,536.59. As with Bitcoin, macroeconomic data resulted in a significant green candle on February 7.

Source: Tradingview, Data was taken on February 10, 2023

So, what is the current price of Ethereum? ETH price today is 1,536.59, and the market cap remains above $188,147,975,604 trillion. ETH’s dominance of the overall market is 17.57%.

Biggest Crypto Gainers This Week

Although Bitcoin and Ethereum stagnated slightly, with their prices oscillating in a very narrow range, some altcoins did much better. Among the top crypto gainers of the week from the top 100 were mainly AI-focused cryptocurrencies, which have been gaining heavily recently on the heels of the ChatGPT success.

Over the past seven days, the highest price increases were seen in the case of the following projects:

- SingularityNET (AGIX) – 101.29%.

- The Graph (GRT) – 57.09%

- Baby Doge Coin (BABYDOGE) – 55.32%

- Klever (KLV) – 49.24%

- Fetch.ai (FET) – 46.32%

Altcoins that have gained more than 20% in value over the past week include Frax Share (FXS) and Lido DAO (LIDO). The latter project saw gains probably due to the successfully deployed testnets preparing Ethereum for the Shanghai update.

Crypto News of the Week

As we have already analyzed the situation in the crypto market this week, let’s now look at the most important news.

US Labor Market Data Positive, but Worries Fed

Everyone in the financial markets was waiting for the US labor market data and the new Fed announcement. The former turned out to be overly good. However, they do not soften the Federal Reserve’s stance. In January, US employment rose by 517,000. This is great news. At the same time, the unemployment rate fell from 3.5 percent to 3.4 percent, the lowest since 1969.

What may please ordinary people worries the Fed. The central bank hoped that the labor market situation would deteriorate enough to cool the markets and thus reduce inflation. As a sign of the economy’s strength, there are two jobs for every unemployed person at this point. New data thus cemented the monetary authorities’ strategy- of raising interest rates. In response to the Fed’s recent announcement, the dollar strengthened again.

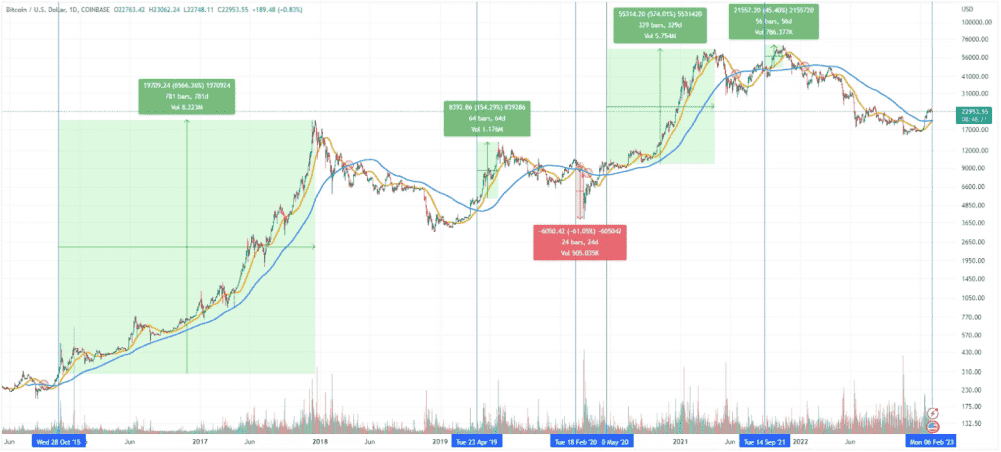

A Golden Cross Appeared on the Bitcoin Chart

On the bitcoin chart, a bullish signal – golden cross – appeared for the first time in 510 days, or almost 1.5 years. Historically, such a situation has indicated the start of a bull market.

For example, two months after this signal was generated during the last boom, bitcoin’s price began to rise and finally reached ATH at more than $69,000.

Throughout bitcoin’s history, the golden cross has already appeared five times: on October 28, 2015, April 23, 2019, February 18, 2020, May 20, 2020, and September 14, 2021. The chart below perfectly illustrates how BTC’s price behaved after the golden cross’s formation.

Source: Tradingview, Data was taken on February 7, 2023

First Withdrawals of ETH from Staking Contract Succesfull

The ability to withdraw Ethereum (ETH) from the ETH 2.0 staking contract is getting closer. Last week developers deployed a new testnet called Zhejiang. This week team implemented the Shanghai-Capella (Shapella) upgrade. According to the project, the first ETH withdrawals have already been completed.

Deploying test networks allows developers to prepare to implement the Shanghai upgrade. The second major update after The Merge changed the Ethereum consensus algorithm from Proof-of-Work to Proof-of-Stake.

Institutions Are Backing Away from Cryptocurrencies

CoinDesk’s analysis indicated that despite Bitcoin and altcoin’s powerful rebound in January, cryptocurrency startups raised only $548 million compared to more than $6 billion in January 2022. The situation was likely influenced mainly by three factors:

- The impact of the FTX failure on the industry’s fundraising has been huge – it has caused funding procedures to tighten, and anyone giving away money in a bull market without proper ‘due diligence’ is ten times more cautious.

- Cryptocurrencies’ rebound is still uncertain. Venture capital funding usually peaks not in a bear market ‘when it’s cheap’ but when a rebound in risky assets is already widely considered very likely.

- High interest rates have made raising external financing a) more difficult b) more expensive, due to higher interest rates, that make venture capitalists who are leveraging their business either unwilling to accept high rates or wait until rates fall, making it cheaper to go into debt, fueling demand for risk (it is uncertain when this will happen). Plenty of VC funds are now in financial trouble because of funding unprofitable startups – others want to avoid repeating that mistake.

Binance Is Halting Transfers in USD: What’s Going On?

Binance, the world’s largest cryptocurrency exchange, has announced halting all bank transfers in U.S. dollars for its non-U.S. customers starting February 8. However, Binance.US, the U.S. branch of the exchange, assured that the halt does not affect local customers.

The mysterious announcement has caused a lot of FUD. Many people suspect the exchange of liquidity problems similar to the whales that have already collapsed, and of hiding the true picture of the situation from the community. However, it may be just speculation.

There was no official reason for the transfer suspension, but the company says it is working hard to restart the service. The exchange’s CEO, Changpeng Zhao, explained in an interview that the problem affects only 0.01% of monthly active users, and the company understands it’s a poor user experience.

It appears that the company is having problems with the banking system in the United States after their SWIFT transfer partner, Signature Bank, announced that as of February 1 it will only process transactions linked to the U.S. banking sector and above $10,000. The exchange is currently looking for a new SWIFT provider.

Summary

This week has been rather quiet for the crypto market. Admittedly, there was a lot of good and worse news, but Bitcoin managed to stay above support. However, we must remember that this market is extremely unpredictable and volatile. Cryptocurrency prices can fluctuate in either direction, and the trend can change from hour to hour. This is brilliantly illustrated by AI-focused cryptocurrencies, which became the biggest gainers of the week on the ChatGPT heels. What will the next week bring? We’ll have to wait and see.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto market crypto world cryptocurrency EthereumRecent Articles on Cryptocurrency

SEI Price Prediction: Is Sei Crypto a Good Investment?

SEI Price Prediction: Is Sei Crypto a Good Investment?  Bitcoin Cash Price Prediction: Will BCH Reach $1000?

Bitcoin Cash Price Prediction: Will BCH Reach $1000?