Crypto Market Week in Review: March 16, 2023

A lot happened this week. Cryptocurrency banks such as Silicon Valley Bank, Signature Bank, and Silvergate began to collapse in a domino effect. As for Europe, there were signs of trouble at Credit Suisse. Nevertheless, the crypto market did remarkably well. So let’s check out what happened to crypto this week. As always, we will first look at the price charts of Bitcoin and Ethereum in USD and then analyze the most important news. So, let’s get started!

Article contents

- 1 What Happened to Crypto This Week?

- 2 Biggest Crypto Gainers This Week

- 3 Cryptocurrency News of the Week

- 3.1 Silvergate Announces Liquidation

- 3.2 Is ETH Security? That’s the Opinion of a New York Prosecutor

- 3.3 White House Wants to Patch US Budget Hole with Higher Taxes on Crypto

- 3.4 Silicon Valley Bank Collapsed: The Largest Bankruptcy in More Than a Decade!

- 3.5 USDC Loses Peg to Dollar After SVB Collapse and Gets It Back Days Later

- 3.6 U.S. Inflation Is Falling, But Still High: What Will the Fed Do?

- 4 News and Updates from StealthEX Partners

What Happened to Crypto This Week?

As we do every week, we’ll start our recap today with a quick analysis of the BTC and ETH price charts.

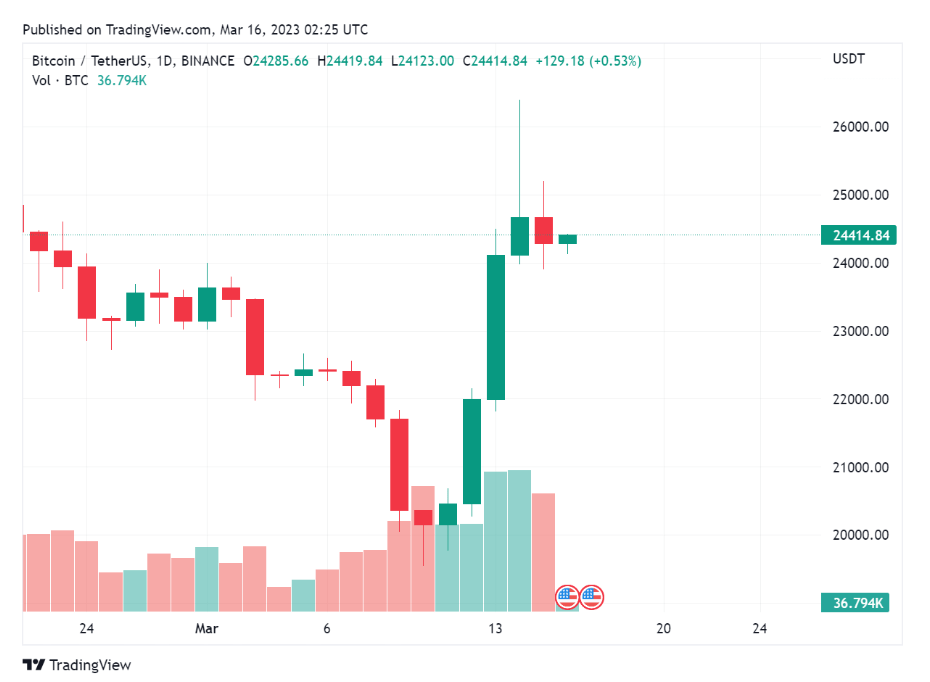

Bitcoin Price in USD This Week

The price of Bitcoin in USD has been doing extremely well this week. Just seven days ago, the BTC price settled below the psychological barrier of $20,000. Nevertheless, the banking crisis in the US caused a bank run, and investors began to place their funds in digital gold. This led to Bitcoin temporarily climbing to nearly $26,500 on March 14.

Since then, a slight pullback has taken place. So, what is the Bitcoin price today? Currently, the price of BTC is settling around $24,400, and its market cap is about 474 trillion dollars. The 7d high of BTC was almost $26,500, while the 7d low stood at $19,600, according to Coingecko. Digital gold’s dominance of the overall crypto market broke through the 42.5% level.

Investor sentiment has risen gently with the price of BTC. Currently, the Fear & Greed Index indicates a level of 52 points – which is neutral.

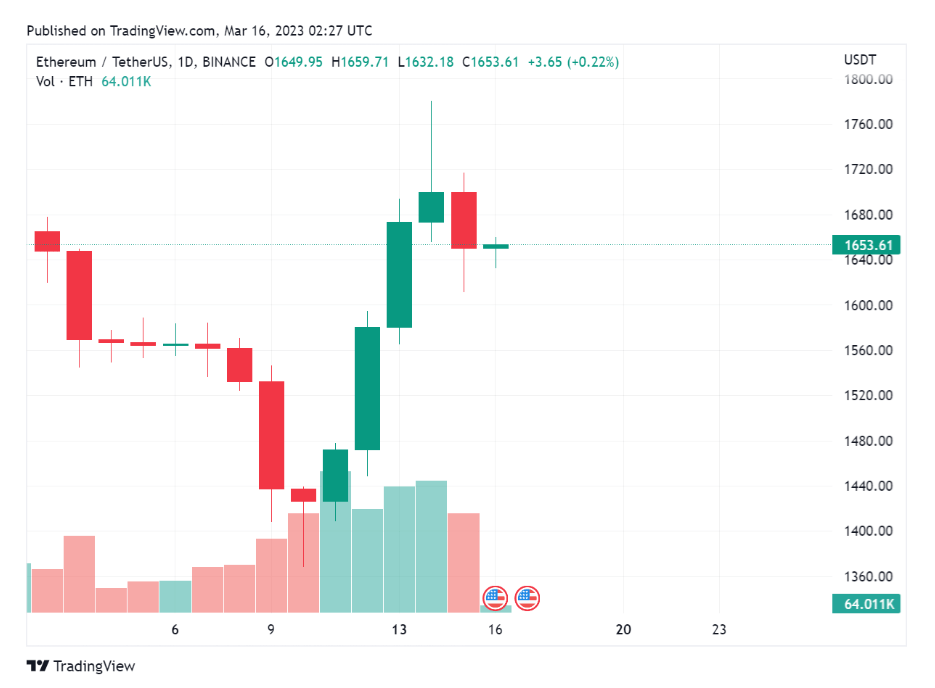

Ethereum Price USD This Week

The chart of Ethereum looks almost the same as Bitcoin’s. Initially, ETH recorded a sizable red candle falling below $1400. With the collapse of crypto-friendly banks, however, it quickly recovered and, at one point, even approached almost $1800.

Since then, a pullback has occurred, and ETH’s price has settled around $1650, with a market cap of $200 billion. ETH’s 7d high reached almost $1,800. The 7d low, on the other hand, was around $1370. The dominance of the smart contract, NFT, and DeFi king is exactly 18%.

Biggest Crypto Gainers This Week

Although Bitcoin and Ethereum did extremely well this week, some altcoins performed even better.

This week’s biggest crypto gainers among the TOP 100 projects are a mix of different projects. From HALO, which just completed an ICO, to Stacks, which is launching smart contracts for Bitcoin, to AI tokens, which rose on the wave of OpenAI’s release of its new AI model, GPT-4.

So, which projects did best this week?

- Halo Coin (HALO) – 92.7%.

- Stacks (STX) – 49.9%

- Conflux (CFX) – 49.8%

- Kava (KAVA) – 31.9%

- SingularityNET (AGIX) – 31.6%.

ImmutableX (IMX), Render (RNDR), and Fetch.ai (FET) were also among the projects that provided investors with more than 20% profit.

Cryptocurrency News of the Week

We have already analyzed the price of Bitcoin and Ethereum in USD, and we know which cryptocurrencies turned out to be the biggest crypto gainers this week. So, as we do every week, let’s move on to review the most important news from the crypto world, and there is a lot of them this week.

Silvergate Announces Liquidation

On March 8, the black scenario that had been rallied among the digital asset community in recent months came true. One of the two largest cryptocurrency banks, Silvergate, has officially ceased operations. The company failed to cope with the massive outflow of investors after the November collapse of the FTX exchange.

Since the beginning of 2023, all reports on the Silvergate bank were based only on negative news. Colossal losses for the last quarter of last year, numerous lawsuits from investors, an investigation by the U.S. Department of Justice, the loss of key partners, and the fall of shares on stock exchanges finally led to the inevitable.

Silvergate Capital announced its liquidation. Right after New York-based Signature Bank, the company was the second largest institution for cryptocurrency players. Until a certain point, Silvergate’s largest client was the FTX exchange, which unexpectedly collapsed last November. This event greatly damaged the industry’s reputation in the media and led to a loss of investor confidence in custodial institutions.

Is ETH Security? That’s the Opinion of a New York Prosecutor

SEC Chairman Gary Gensler said all cryptocurrencies except BTC are securities. Indeed, he pointed out that behind such assets are “groups of entrepreneurs” who have their “legal entities.” In his opinion, this is enough to consider cryptocurrencies and tokens as securities.

The above would have huge implications for the market, as it would mean that the blockchain industry is entirely subject to the SEC. On top of that, Gensler thinks that every token or cryptocurrency (except, we should add again, Bitcoin) has been issued illegally.

It turns out that New York General Attorney Letitia James reacted to his words. She sued the KuCoin exchange for selling unregistered securities. She specifically mentions ETH, but also Terra (LUNA) and TerraUSD (UST) as examples of the latter.

But where do these conclusions come from? James points out that cryptocurrencies “represent investments in joint ventures.” On top of that, their profits “come mainly from the efforts of others.” So it’s a direct reference to the famous Howey test, which for nearly 100 years has helped determine whether assets are securities.

James focused mainly on Ethereum. She believes the cryptocurrency is strongly associated with Vitalik Buterin and the Ethereum Foundation. The latter, to raise funds for the development of the network, organized an ICO in 2014. It collected BTC from investors and, in return, paid them ETH.

On top of that, the prosecutor claims that even on the Ethereum Foundation’s website, Ether was promoted as an investment. She added that today many Ethereum users see ETH “as a digital store of value.” What’s more, they are counting on the price increase resulting from the change in the ETH issuance algorithm.

In addition, “the move to proof-of-stake has affected the basic functionality and incentives for owning ETH,” allowing investors to stake ETH.

White House Wants to Patch US Budget Hole with Higher Taxes on Crypto

US monetary policy has been far from perfect for years. Likewise, the country’s economic situation could be better. Currently, the US has a $3 trillion budget hole.

The White House this week released an announcement on, among other things, changes to the tax system on cryptocurrency entities. According to the plan, the US government intends to raise about $24 billion from the sector.

One of the points involves withdrawing concession to the “tax loss harvesting” strategy. This is based on traders selling their cryptocurrencies at a loss to pay less tax and then buying them back. In the US, its use is prohibited for securities and bonds because of the “wash sale” rule. However, so far, it has not covered crypto.

Considering that most people who entered the market in 2021 are currently at a loss on their investments, this move benefits the government.

Moreover, Biden also proposed doubling the tax rate on capital gains from the sale of digital assets. It currently stands at 20%. After the changes the White House suggests, it would be 39.6%.

This is not the end of the bad news regarding the announcement. The government document also states that the operation of Bitcoin and other Proof-of-Work digital coin mining companies should be restricted.

As part of this, it is proposed to subject mining operators to a new tax. Ultimately, it would be expected to amount to as much as 30% of the cost of electricity. The new law will take effect in 2024. The tax would gradually increase year by year for the first three years. First, it would be 10%, the following year 20%, and in 2026 already 30%. In addition, miners would have to submit periodic reports on “the amount and type of electricity consumed, as well as the value of that electricity.”

Silicon Valley Bank Collapsed: The Largest Bankruptcy in More Than a Decade!

On March 10, the Federal Deposit Insurance Corporation officially announced that US financial regulators had closed Silicon Valley Bank (SVB). The bankruptcy of this institution is the largest in 15 years. SVB held a key position in technology (including blockchain) and venture capital entities. As a result, top companies are still determining what will happen to their assets.

As written in an official announcement issued by regulators, the California Department of Financial Protection and Innovation has shut down the SVB. Moreover, the Federal Deposit Insurance Corporation (FDIC) has been appointed receiver. The FDIC, in turn, launched the National Deposit Insurance Bank of Santa Clara – where the insured deposits of the failed bank are located.

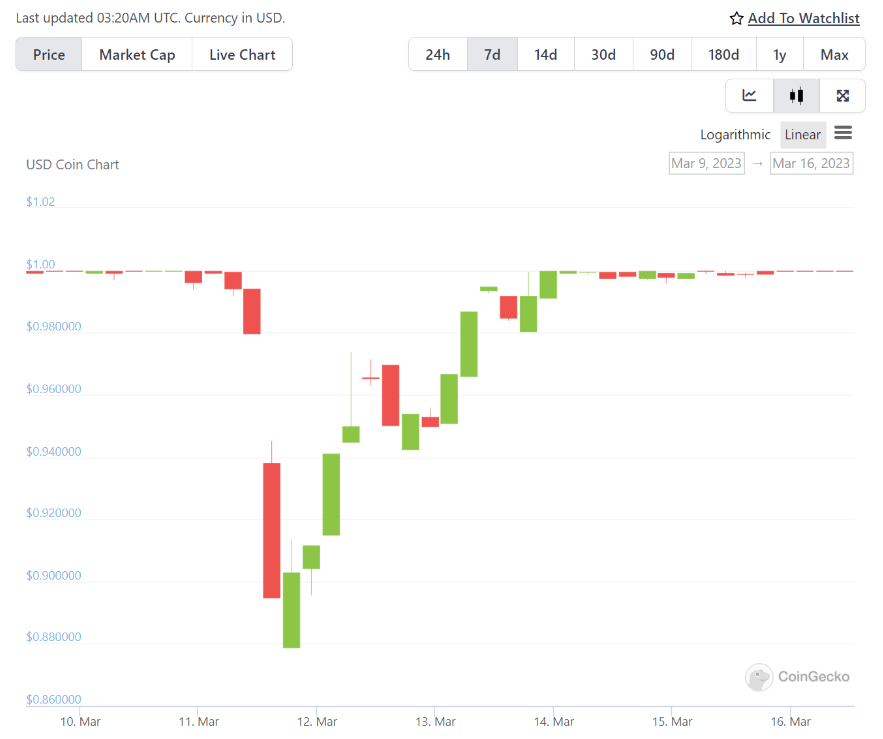

USDC Loses Peg to Dollar After SVB Collapse and Gets It Back Days Later

Last Wednesday, SVB announced that it planned to raise $2 billion in funding. The reason was to offset the loss it suffered from the sale of its assets. As a result, investors panicked and rushed to withdraw their deposits. One company that decided to pull its funds out of the bank was Circle.

On Friday, however, it was reported that the withdrawal order initiated on Thursday had yet to be fully processed. Ultimately, $3.3 billion worth of assets were stuck in the bank – part of USDC’s stablecoin reserves. Concerns also began to grow this week. This follows the release of a recent audit report, according to which – as of January 31 – as much as $8.6 billion, or about 20% of the stablecoin’s reserves, were deposited in several financial institutions. Two of these are the failed Silvergate and Silicon Valley Bank.

To make matters worse, the USDC stablecoin lost its peg to the US dollar. In a matter of hours, the price of this stablecoin lost 11% and, at one point, fell below 90%.

A day later, Circle released a special statement. To cover the deficit of their reserves, which were stuck in SVB accounts, the company decided to use its own “corporate resources.”

The Federal Reserve Board also announced a $25 billion fund to safeguard the reserves of banks and other companies in the sector. The additional funds would ensure financial institutions have sufficient liquidity in the face of potential problems.

These relief measures from Circle and the Fed rescued the USDC, which regained parity with the dollar after a few days.

U.S. Inflation Is Falling, But Still High: What Will the Fed Do?

US inflation in February was 0.4 percent month-on-month and 6 percent year-on-year, the Bureau of Labor Statistics (BLS) reported Tuesday.

In contrast, core inflation – that is, excluding energy and food prices – rose 0.1 p.p. It amounted to 0.5 percent month-on-month. This was because the cost of housing (rents) was rising. Energy and fuel, on the other hand, were getting cheaper.

Although the data is not a revelation, U.S. authorities are reassuring and indicate that things are moving in the right direction. US President Joe Biden commented on the new data as follows:

“Today’s report shows that annual inflation is down one-third from last summer, while the unemployment rate remains near its lowest level in 50 years. This is the slowest annual increase since September 2021.”

The news is also important for investors. This is because they mean that the risk of the Fed raising interest rates by as much as 50 bps is falling. There are many indications that the U.S. central bank will stick with increases of only 25 bps.

However, falling inflation is not the only factor that could make it difficult for the Fed to raise interest rates. The Federal Reserve’s monetary policy may also be disrupted by bank collapses. So far, bankruptcies have been declared by: Silvergate, Silicon Valley Bank and Signature Bank. However, it cannot be ruled out that this is not the end. It is possible that the authorities may even have to start stimulating the economy again with printing, which in turn will fuel increases in the financial markets, but may also cause inflation to spike again.

Another thing is that the Fed’s policies so far, which were intended to cool the economy and start reducing inflation, are not working. Inflation is falling, but slowly, while new labor market data surprises: more than 300,000 jobs were created in the US in February.

News and Updates from StealthEX Partners

In addition to news strictly from the crypto market, we have also prepared some of our partners’ latest news.

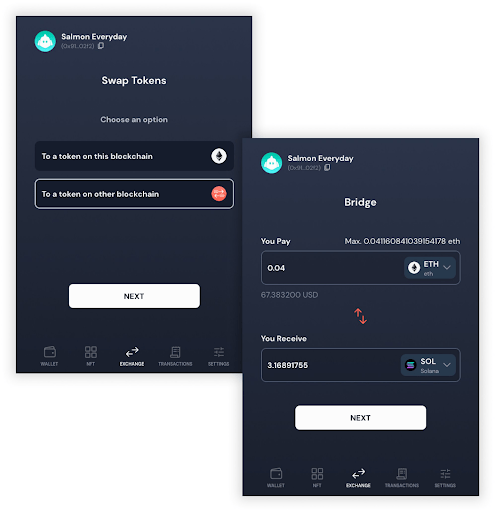

StealthEX Integrates with Salmon Wallet

StealthEx has established a partnership with Salmon Wallet. As a result, any user of this wallet can swap more than 700 cryptocurrencies without any effort and without KYC directly in the app. The process is simple and comes down to just a few mouse clicks. Everything looks like the image below:

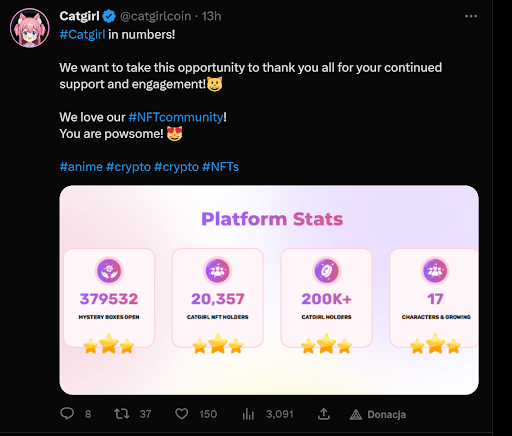

Catgirl presented on Twitter some statistics on its project. As it turns out, protocol users have already opened 379532 Mystery Boxes. The project’s NFTs already have over 20,000 hodlers; the coin is stored at over 200,000 addresses.

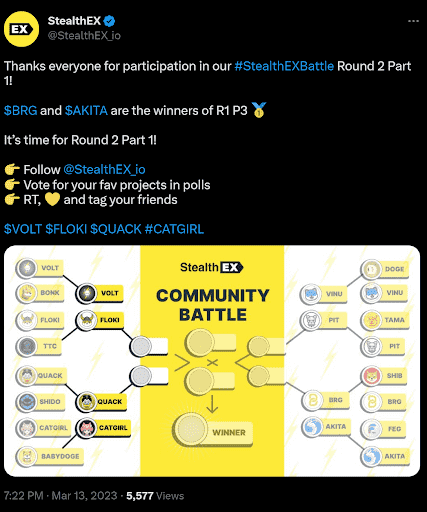

StealthEX Organizes Another Community Battle

StealthEx organized a crypto communities tournament some time ago. Another round is taking place, with VOLT vs. FLOKI and QUACK vs. CATGIRL facing each other. Go to our Twitter and take part in the battle. The winning community can get a giveaway from the winning project!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto news crypto world Ethereum StealthEX newsRecent Articles on Cryptocurrency

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?  Hyperliquid Price Prediction: Can HYPE Reach $100?

Hyperliquid Price Prediction: Can HYPE Reach $100?