Simple and Secure Cryptocurrency Trading Methods for Beginners

A long time ago, in a galaxy far, far away, in 2017, the entire world started talking about cryptocurrency. Some at that time had already earned a fortune on their investments; others were just beginning to understand the meaning of a blockchain. The cryptocurrency’s high volatility always has a risk exposure, but according to a wise saying ‘Nothing ventured, nothing gained.’ In this article, StealthEX will guide you on the basics of cryptocurrency trading methods and crypto price analysis.

It is the volatility that has brought popularity to crypto trading as price fluctuation in the right hands often turns into a profit. However, in order not to spend all savings on the crypto market on the first day, there is a need for theoretical and practical knowledge.

Successful trading of any assets has one main recipe for success: buy low, sell high. Cryptocurrencies are no exception. Unlike investing in crypto where profits are expected in the long term run when trading it you need to predict price changes over shorter periods of time.

Article contents [hide]

What Is Cryptocurrency Trading?

Crypto trading is the buying and selling of cryptocurrencies on a crypto exchange. It is also an act of monitoring the price movements of the cryptocurrency market to make a profit. To begin cryptocurrency trading, you will need a crypto wallet and a crypto exchange.

Methods for Predicting Cryptocurrencies Rates

There are various methods for forecasting cryptocurrencies prices, but the main methods are the following:

Fundamental Analysis

Fundamental analysis is a valuation tool used by stock analysts to determine whether an asset is over- or undervalued by the market. It considers the economic, market, industry, and sector conditions a company operates in and its financial performance. We have released a separate article dedicated to fundamental analysis vs technical analysis. Here is what fundamental analysis comes down to:

- Determining the internal value of crypto takes into account any factors that affect the value of this coin. So it is necessary to study carefully the crypto project, its mission, and originality, technical aspects, team and roadmap.

- General analysis of the crypto market. It’s worth remembering that the rates of the ‘biggest’ coins such as Bitcoin and Ethereum are correlated with the state of the entire market.

- News regarding state regulation of cryptocurrency. Prohibited activities significantly affect the cost of crypto.

Technical Analysis

This method consists of determining patterns and trends in the price through the construction of the mathematical models. The goal is to determine the most likely scenarios of price change. Technical analysis is based on three assumptions. They are:

- The market discounts itself. This assumption holds that everything in the market that could affect the price of crypto is reflected in its price. The price shows you everything you need to know about a crypto asset. You don’t have to consider the fundamental factors that affect a crypto asset to determine its price movements. For instance, you notice that a crypto asset’s price is decreasing. You can use the information in the chart, like the candlestick pattern, the extent of the price fall, and other technical information to know if it is best to invest in such a coin at such a time.

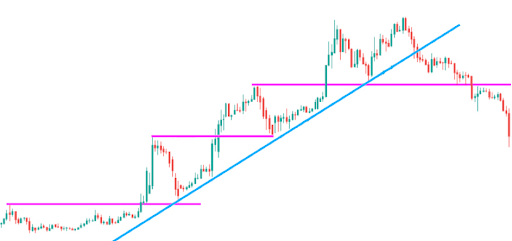

- Price moves in a trend. Price action always exhibits trends, even in random market movements, regardless of the timeframe you use. The green and red candlesticks show the trend pattern and direction of the price. A future price movement is more likely to follow an established trend. Below, you can see an example of a trend in crypto. In this real-world example you see the (blue) trendline that acts as a support in an uptrend:

- History repeats itself. The repetitive nature of the crypto market means that analyzing previous patterns can help you predict future market movements. Market participants usually exhibit consistent reactions to market happenings over time. Even though some chart patterns formed a long time ago, they are still considered important as they could happen again.

Fundamental Analysis vs Technical Analysis

Many traders rely on technical analysis to make trade decisions. In fact, some believe only in technical analysis. However, combining technical and fundamental analysis is considered a more rational approach to trading.

We can say that both methods — fundamental and technical — are important and necessary. If you are buying a new cryptocurrency, pay attention to the fundamental method. If the coin has been trading for a long time, make sure to take a closer look at technical analysis. It is also necessary to take into account the impact of extraordinary events on the market. One of these can be the recent coronavirus pandemic.

Cryptocurrency Trading Methods

• Day trading — profit from several short-term transactions during the day. In this method, the trader opens and closes all orders during a single daily session to avoid the risk of volatility between sessions. Some of the best crypto exchanges for day trading are Coinbase and Kraken.

• Scalping — hundreds of transactions during the day with a minimum drop in value to reduce risks. In this case, the trader places a lot of small orders instead of playing big. The profit for each transaction is minimal, but the total result can be significant.

• Swing trading — profit from price volatility in the longer term. Here investor buys cryptocurrency and waits for its price to rise, then fixes a profit.

Top Crypto Trading Mistakes

Venturing into crypto is risky, especially if you are new to the world of trading. In many ways, this is an uncharted territory. It also doesn’t help that the crypto industry is largely unregulated; many scammers are looking to take advantage of people who are just starting out. Due to their lack of knowledge, some inexperienced traders make avoidable mistakes that cost them money. Below are some of the grave mistakes a beginner can make.

Take a Greater Risk than You Can Afford.

Be sure not to invest all your savings in cryptocurrency or take out loans that, sooner or later, you will have to pay back. Trading like this leads to hasty decisions and inevitable losses. So only invest what you can lose.

Failing to Diversify Your Portfolio.

Many new investors make the mistake of putting all their eggs in one basket. They might invest all their money in a single cryptocurrency or only trade a few coins. This is risky because you could lose all your money if something happens to that asset. To mitigate this risk, you should diversify your portfolio by investing in various asset classes. This way, if one asset loses value, you have other assets to offset the loss. Investing in a mix of established and up-and-coming investment options is also a good idea. Not only does this diversify your risk, but it also allows you to invest early in promising projects that could yield significant returns down the line.

The Lack of Plan and Strategy.

You need to learn your strategy and to stick to it, even if other traders convulsively starting to sell falling coins. Ask any successful trader about the beginning of their career, and they will tell you that they repeatedly “drained” their savings before they realized how to trade correctly.

Investing Without Doing Any Research

One of the most important things you can do before investing in any asset is to educate yourself about it. This is especially true for something as complex and volatile as cryptocurrency. If you don’t understand what you’re investing in, you will likely make bad decisions and lose money. Take the time to learn about the project, the team behind it, the market opportunity it’s targeting, and the competition it faces. This is the right way to take an informed decision about whether to invest in a particular asset or not.

Give In to Emotions (Greed, Fear)

This phenomenon actually has a name. The Fear Of Missing Out is a powerful psychological force that drives people to make impulsive decisions. In the context of cryptocurrency trading, FOMO leads investors to buy assets when prices are skyrocketing in the hope of not missing out on further gains.

While it is true that the price of some crypto changes so fast that even experienced investors find it difficult to keep their emotions under control, remember that most of the trading mistakes are usually made under the influence of panic, fear, greed, etc.

As Adam Draper, the founder of Boost VC and a venture capitalist, said, ‘Fear is one hell of a drug.’ It is better to wait for the end of the price correction and enter the crypto market with the expectation of continuing the trend. Try to take a long-term view of your investment strategy and focus on building a portfolio of quality assets rather than chasing short-term gains. You should also be mindful of the risks associated with investing in new crypto projects.

Forget to Learn from Mistakes

Everyone makes mistakes. However, it’s best to remember this great quote:

‘Only who does nothing is not mistaken! Do not be afraid to make mistakes — be careful not to repeat mistakes!’

Theodore Roosevelt

If you are wondering how to buy cryptocurrency for trading, you can always use the user-friendly and non-custodial StealthEX crypto exchange platform. You can purchase crypto privately and without the need to sign up for the service. Our crypto collection has more than 700 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, BTC to ETH.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Make sure to follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto market Ethereum how to buy crypto invest in cryptoRecent Articles on Cryptocurrency

Prom Price Prediction: Is PROM Token a Good Investment?

Prom Price Prediction: Is PROM Token a Good Investment?  Bonk Price Prediction: Is BONK Coin a Good Investment?

Bonk Price Prediction: Is BONK Coin a Good Investment?