Ondo Price Prediction: Is ONDO Finance Crypto a Good Investment?

Ondo Finance (ONDO) is a DeFi platform focused on tokenizing real-world assets (RWAs) and bridging the gap between traditional finance and the blockchain world. Ondo has seen a significant price decline over the past month, falling by about 45% from a local high of $1.1 to a low of $0.625. Currently, the ONDO coin price has corrected and risen by 25% to trade at around $0.78. The sharp drop coincided with a period of macroeconomic uncertainty, including shifting expectations around U.S. Federal Reserve interest rate policy. In this article, we will analyze the key factors affecting the value of the ONDO coin and provide the latest Ondo price prediction.

| Current ONDO Price | ONDO Prediction 2025 | ONDO Price Prediction 2030 |

| $0.78 | $2.4 | $18 |

Article contents

- 1 Ondo (ONDO) Overview

- 2 ONDO Price Chart

- 3 Ondo Price History Highlights

- 4 Ondo Price Prediction: 2025, 2026, 2030-2040

- 5 Ondo Price Prediction: What Do Experts Say?

- 6 ONDO USDT Price Technical Analysis

- 7 What Does the ONDO Price Depend On?

- 8 Is Ondo a Good Investment?

- 9 What Is the Price of Ondo Finance Today?

- 10 Will Ondo Go Up?

- 11 How High Can Ondo Coin Go?

- 12 Conclusion

- 13 Can I Buy ONDO Coin?

- 14 How to Buy Ondo? Quick-Step Guide

Ondo (ONDO) Overview

Ondo Finance is a blockchain-based platform bridging traditional finance (TradFi) and DeFi by offering institutional-grade, yield-generating products. Focused on tokenized RWAs, Ondo provides access to U.S. Treasury bonds, money market funds, and other regulated financial instruments through its flagship products like OUSG (tokenized short-term U.S. Treasuries) and USDY (yield-bearing stablecoin). Backed by former BlackRock and Goldman Sachs executives, Ondo combines compliance-friendly structures with blockchain efficiency, catering to both institutional investors and DeFi users seeking stable yields.

The platform operates on multiple blockchains (Ethereum, Solana, Sui) and is powered by its native ONDO token, which governs the ecosystem and incentivizes participation. With over $500 million in assets under management (AUM) and partnerships with major institutions like Morgan Stanley and BlackRock, Ondo is positioning itself as a leader in the RWA sector. At its core, Ondo Finance is powered by the ONDO token, which governs the ecosystem, distributes protocol fees, and unlocks discounts on asset management services.

ONDO Price Statistics

| Current Price | $0.78 |

| Market Cap | $2,457,799,275 |

| Volume (24h) | $266,315,290 |

| Market Rank | #38 |

| Circulating Supply | 3,159,107,529 ONDO |

| Total Supply | 10,000,000,000 ONDO |

| 1 Month High / Low | $0.9723 / $0.6259 |

| All-Time High | $2.14 Dec 16, 2024 |

Ondo Finance was founded in 2021 by Nathan Allman and Pinku Suran to ‘accelerate DeFi adoption among mainstream investors by enabling the granular exchange of risk.’

Ondo Features

Ondo offers several features within the crypto space:

- Custodians and regular audits: This approach increases liquidity and accessibility for a wider range of investors.

- Isolated vaults: Ondo introduces a unique concept of Vaults that are tailored to isolate risks. This means that lenders have the opportunity to express specific preferences around acceptable collateral, usage of funds, and loan-to-value (LTV) thresholds without fearing unexpected changes. Each Vault caters to fixed yield and variable yield depositors, providing a stable yield or a chance to maximize returns through leverage, respectively.

- First subscription vaults: Ondo initiated its services with a selection of four Vaults, emphasizing USDC, USDT, DAI against ETH, and an ETH against ALCX pairing, demonstrating the platform’s versatility and commitment to providing diverse investment opportunities.

- Innovative subscription mechanism: The platform allows liquidity providers to participate in fixed yield or variable yield positions through a subscription mechanism. This approach balances the two positions at the inception of each Vault, ensuring that fixed yield positions are secured while offering leveraged exposure to variable yield depositors.

- Security and compliance: Although it cautions users to exercise caution owing to the experimental nature of the program, Ondo has completed comprehensive security audits by respectable businesses such as PeckShield, Certik, and Quantstamp, acknowledging the inherent risks of DeFi.

ONDO Price Chart

CoinGecko, June 24, 2025

Ondo Price History Highlights

- 2023: Ondo Finance launched its first tokenized product in 2023 on the Ethereum blockchain.

- 2024: ONDO first came onto the open market on January 18, 2024, when it was worth about $0.1. It rose steadily, breaking past $0.3 on January 22, 2024. The bullish trends on the market have also seen ONDO hit a high of $1.48 in June of 2024. In December, it went to its all-time high of $2.14.

- 2025: In May 2025, $ONDO reached a peak of $1.1. Since then its price has dropped and at the moment fluctuates within the $0.7 – $0.8 price range.

Ondo Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.69 | $4.14 | $2.4 | +210% |

| 2026 | $1.41 | $9.87 | $5.6 | +620% |

| 2030 | $3.67 | $31.76 | $18 | +2,200% |

| 2040 | $64.29 | $528 | $300 | +38,360% |

ONDO Price Prediction 2025

DigitalCoinPrice experts anticipate a potential trading range between $0.69 (-10%) at the lower bound and $1.7 (+120%) at peak valuation.

PricePrediction analysts project that in 2025, the Ondo token will reach a maximum price of $1.09 (+40%), with a potential low of $0.9561 (+25%).

Telegaon analysts forecast a more bullish 2025 outlook: they believe that ONDO will trade between $1.51 (+95%) at a minimum and $4.14 (+435%) at its peak valuation.

Ondo Crypto Price Prediction 2026

Experts at DigitalCoinPrice estimate ONDO crypto could reach between $1.66 (+115%) at its lowest point and $1.94 (+150%) at its peak valuation during 2026.

According to PricePrediction models, the coin may trade in a range of $1.41 (+80%) to $1.69 (+120%).

Telegaon analysts believe that in 2026 ONDO coin will cost no less than $4.18 (+440%), while at its highest point, it can rise to $9.87 (+1,175%).

Ondo Price Prediction 2030

DigitalCoinPrice forecasts ONDO may trade between $3.67 (+375%) at its low and $4.24 (+450%) at its peak valuation by 2030.

PricePrediction models suggest a potential range of $6.2 (+700%) to $7.65 (+890%) for the same period.

Telegaon experts are ultra-bullish on Ondo: if we are to believe their predictions, in 2030 ONDO has the potential to reach a maximum price of $31.76 (+4,000%) per coin, while at its bottom it can hit $27.35 (+3,430%).

Ondo Price Prediction 2040

Market analysts at PricePrediction project substantial long-term growth for Ondo crypto, forecasting a 2040 price range of $413.64 (+53,300%) at the lower bound to $528 (+68,100%) at peak valuation. These projections suggest that ONDO could emerge as a dominant player in the tokenized RWA sector.

A more conservative 2040 estimate from Telegaon anticipates ONDO reaching between $64.29 (+8,200%) and $69.34 (+8,850%). This wide dispersion in analyst projections reflects uncertainty around RWA adoption and regulatory clarity for tokenized securities.

Ondo Price Prediction: What Do Experts Say?

Ondo presents a high-variance investment, with expert price predictions varying widely based on adoption timelines for tokenized RWAs. Generally, price predictions stem from differing assumptions about Ondo’s ability to capture market share in the emerging trillion-dollar RWA sector, regulatory developments, and competition.

The consensus suggests that ONDO could deliver significant returns if it maintains its first-mover advantage in tokenized Treasuries and expands its institutional user base. However, investors should approach ultra-bullish scenarios with caution, as they require Ondo to achieve unprecedented dominance in financial markets. More realistic is steady growth tied to measurable milestones: quarterly AUM increases, Fed policy impacts on yield products, and concrete adoption by major financial institutions. Some of the experts, like CoinLore, believe that the coin will achieve considerable price levels as it develops: according to their forecast, in 2040 $ONDO will hit a maximum of $18.35 per coin.

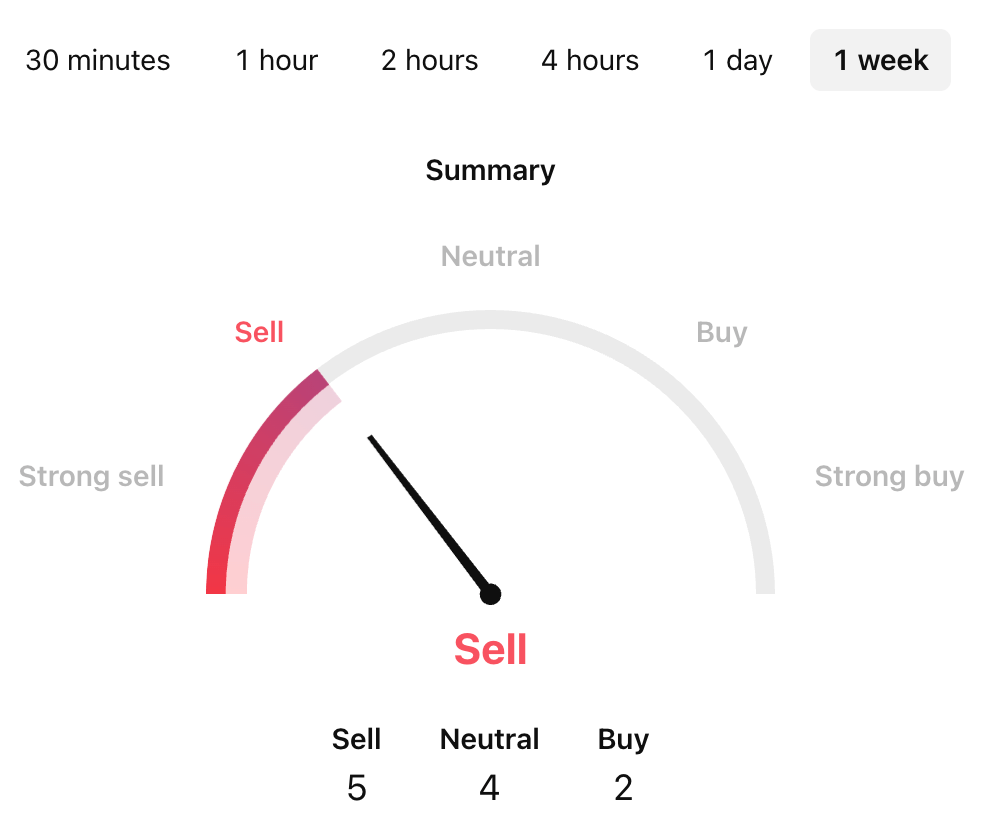

ONDO USDT Price Technical Analysis

Tradingview, June 24, 2025

Now that we’ve seen possible price predictions for Ondo crypto, let’s find out a bit more about the factors that can influence its price.

What Does the ONDO Price Depend On?

The price of the ONDO coin primarily depends on institutional adoption of its RWAs and broader market conditions. As a bridge between traditional finance and DeFi, Ondo’s value hinges on demand for its yield-generating products like tokenized Treasuries (OUSG) and its stablecoin (USDY). Key drivers include growth in AUM, regulatory clarity for tokenized securities, interest rate trends (which affect yield attractiveness), and competition from both TradFi giants like BlackRock and DeFi rivals like MakerDAO. Macro crypto market cycles also play a role, though ONDO may decouple if RWA adoption grows independently of general crypto sentiment.

Secondary factors include Ondo-specific developments and token mechanics. New product launches, strategic partnerships with financial institutions, exchange listings, and the token’s utility in governance and fee structures can all impact price.

Risks and Opportunities

Ondo presents compelling opportunities as a pioneer in the RWA sector, combining institutional-grade financial products with blockchain efficiency. Its tokenized U.S. Treasuries and yield-bearing stablecoin offer investors exposure to traditional yields with DeFi accessibility, positioning it well to capitalize on the projected multi-trillion dollar RWA market. As global interest in yield-generating assets grows, especially in volatile markets, Ondo could see exponential demand from both crypto-native users and TradFi investors seeking compliant on-chain exposure.

However, significant risks remain, including regulatory uncertainty, intense competition, and execution challenges. While Ondo’s institutional structure lends credibility, it faces competition from TradFi giants like BlackRock (BUIDL) and DeFi protocols. Regulatory crackdowns on tokenized securities or stablecoins could hinder adoption, and Ondo’s success depends on scaling its AUM significantly beyond current levels.

Is Ondo a Good Investment?

It is hard to say. Ondo could be a high-potential but high-risk investment, ideal for investors bullish on the growth of tokenized RWAs and willing to tolerate volatility. Its institutional-grade products position it as a leader in bridging TradFi and DeFi, with strong backing from ex-BlackRock and Goldman Sachs executives.

What Blockchain Is Ondo On?

Ondo crypto primarily operates on the Ethereum blockchain as an ERC-20 token; however, it’s leveraging Solana and Sui for high-efficiency retail transactions, and Polygon for DeFi integrations, with cross-chain interoperability enabled through LayerZero and Wormhole.

What Is the Price of Ondo Finance Today?

At the moment, the ONDO coin costs around $0.78.

Will Ondo Go Up?

It’s possible: Ondo has strong potential to rise in value if it continues gaining traction, particularly as institutional adoption of its yield-bearing products expands. Key catalysts include growing demand for stable yields in volatile markets, strategic partnerships with TradFi institutions, and regulatory clarity favoring tokenized securities.

Can Ondo Coin Reach $5?

This price level is achievable within the next 2 or 3 years but is contingent on several critical factors aligning. These are major institutional adoption, benefits from a crypto bull market, and favorable regulations.

Can Ondo Reach $10?

Ondo reaching $10 is theoretically possible but would require near-perfect execution and massive adoption of RWAs, making it a high-risk, low-probability scenario in the near-to-mid term.

Will ONDO Reach $20?

It is possible. Websites like Telegaon believe that ONDO coin can hit a maximum of $25.7 in 2029.

Can Ondo Reach $100?

A $100 price target for Ondo is likely not achievable under realistic market conditions, as it would require an enormous market cap (surpassing Ethereum’s current valuation) for a tokenized RWA platform.

How High Can Ondo Coin Go?

Ondo has a realistic upside potential of $5 – $15 in optimistic scenarios within the next 10 years.

What Will Ondo Finance Be Worth in 2025?

DigitalCoinPrice sets the maximum price level for ONDO coins in 2025 at $1.5.

What Is the Prediction for Ondo Coin in 2030?

According to PricePrediction crypto experts, in 2030 Ondo can go as high as $5.7.

Conclusion

Ondo Finance is pioneering the financial revolution, seamlessly merging the trillion-dollar realm of traditional assets with blockchain’s transformative power. While challenges remain, Ondo’s first-mover advantage, strategic multi-chain approach, and growing AUM suggest a future where its technology becomes the backbone of institutional DeFi. As regulatory clarity improves and TradFi adoption accelerates, ONDO could emerge as one of crypto’s most transformative success stories; not just as a token, but as the gateway to a new era of programmable, on-chain finance.

Can I Buy ONDO Coin?

Yes, you can do it via StealthEX if you’re looking for a way to invest in this cryptocurrency. You can buy ONDO privately and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy Ondo? Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to ONDO.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

crypto price prediction ONDO Ondo Finance price analysis price predictionRecent Articles on Cryptocurrency

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight  Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?

Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?