Quant Price Prediction: How High Can QNT Crypto Go?

Quant (QNT) is a ground-breaking project in the cryptocurrency space that aims to connect various blockchain networks and facilitate seamless interoperability. By addressing one of the most significant challenges in the blockchain ecosystem (communication between different chains), Quant Network provides a unique solution that enhances the functionality of dApps. Over the past month, Quant coin has demonstrated significant volatility, from its April low of $60 to a peak of $125 (+110%) before stabilizing around $90. This notable price movement reflects shifting market dynamics and renewed investor interest in the project. In this analysis, we examine the key drivers behind QNT’s recent performance and provide an updated Quant price prediction based on current trends and ecosystem developments.

| Current QNT Price | QNT Price Prediction 2025 | QNT Price Prediction 2030 |

| $90 | $150 | $640 |

Article contents

- 1 Quant (QNT) Overview

- 2 Quant Coin Price History Highlights

- 3 QNT Price Chart

- 4 Quant Price Prediction: 2025, 2026, 2030-2040

- 5 Quant (QNT) Price Prediction: What Do Experts Say?

- 6 QNT USDT Price Technical Analysis

- 7 What Does the Quant Price Depend On?

- 8 Is Quant a Good Long-Term Investment?

- 9 Does QNT Have a Future?

- 10 How High Can QNT Realistically Go?

- 11 What Is a Realistic Price Prediction for QNT?

- 12 Is QNT Worth Buying?

- 13 Conclusion

- 14 Where to Buy Quant Coin?

Quant (QNT) Overview

Quant Network is a groundbreaking software solution designed to bridge the gap between disparate blockchain networks, enabling seamless interoperability for organizations and governments. By providing robust infrastructure, Quant allows businesses to connect their systems across multiple blockchains (regardless of differences in coding languages or protocols) and transfer data efficiently. At the heart of this solution is Overledger which acts as a universal translator between blockchains. Unlike traditional blockchain platforms, Overledger serves as a secure and scalable connector, eliminating the friction of cross-chain communication.

The Quant ecosystem is powered by its native token, QNT, which serves as the fuel for accessing and utilizing the network’s services. Organizations must hold and spend QNT to leverage Overledger’s capabilities, creating inherent demand for the token. As blockchain adoption grows and the need for interoperability intensifies, Quant’s innovative approach positions it as a critical player in the future of enterprise blockchain integration. With its ability to unify fragmented networks, Quant is paving the way for a more connected and efficient decentralized world.

| Current Price | $90 |

| Market Cap | $1,093,292,593 |

| Volume (24h) | $29,767,795 |

| Market Rank | #60 |

| Circulating Supply | 12,072,738 QNT |

| Total Supply | 14,881,364 QNT |

| 1 Month High / Low | $125.21 / $85.74 |

| All-Time High | $428.38 Sep 11, 2021 |

Quant Network was initially founded by Gilbert Verdian in 2015. The protocol raised over $11 million during a successful Initial Coin Offering (ICO) in April 2018. Before launching Quant, Verdian, who later became the company’s CEO, worked at a number of large international corporations, including BP Oil and Ernst & Young. In 2015, Verdian founded the ISO Standard TC307, laying the foundation for the development of interoperability-focused distributed ledger technology.

Quant Features

QNT offers features that are embedded in its architecture, which consists of four layers:

- Transaction Layer: Transactions that have been verified using distributed ledger technology are stored at this layer. This implies that another ledger cannot confirm already validated transactions. By consolidating all related activities onto a single layer, Overledger simplifies the actions required to reach consensus across various blockchain domains.

- Messaging Layer: The Messaging Layer is a shared channel where transactions from all ledgers are recorded, in contrast to the transaction layer, which is divided into separate ledgers. This logical layer pulls all transaction-related information, including smart contract data and messaging digests, from each ledger in the Transaction layer.

- Application Layer: The Application Layer assumes control over all other layers by establishing the guidelines and methods for interacting with the blockchains. Each multichain application is segregated from the others in this layer.

- Filtering and Ordering Layer: The Messaging Layer’s messages that are referred to in the digest of out-of-chain messages are filtered and ordered by this layer. Additionally, this layer makes sure the message complies with the application’s needs and schema. For instance, a program can require that a specific quantity of coins be moved for a transaction to be acceptable, or it might only allow transactions from/to a particular address.

Quant Coin Price History Highlights

- 2018: Quant launched its token, QNT, in 2018. The token started trading at about 27 cents.

- 2019-2020: In July 2019, Quant’s price set a new high, surpassing the $10 mark.

- 2021: By the start of 2021, Quant token reached about $12. In September 2021, Quant reached its all-time high of $428.38.

- 2022: In February 2022, $QNT fell to $100 and dropped even lower.

- 2023: This year, the price of QNT fluctuated between $86 and $153.

- 2024: In the summer of 2024, QNT crypto went to a peak of $160.48, however, this price level was later corrected, and by the end of the year, the coin dropped to $111.

- 2025: In April of 2025, QNT coin’s price dropped to around $60. At the moment, its price fluctuates between $90 and $91.

QNT Price Chart

CoinGecko, June 23, 2025

Quant Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $81.53 | $218.35 | $150 | +65% |

| 2026 | $155.67 | $360.23 | $260 | +190% |

| 2030 | $431.11 | $849.55 | $640 | +610% |

| 2040 | $1,439.31 | $73,727 | $38,000 | +42,000% |

Quant Coin Price Prediction 2025

DigitalCoinPrice experts anticipate Quant (QNT) may trade between $81.53 (-10%) at its 2025 low and $199.58 (+120%) at peak valuation.

PricePrediction crypto analysts project stronger performance, with QNT expected to range from $112.13 (+25%) to $125.60 (+40%) during 2025.

Telegaon analysts suggest a 2025 price range of $112.59 (+25%) to $218.35 (+140%), reflecting potentially stronger market acceptance.

Quant Price Prediction 2026

DigitalCoinPrice experts project that in 2026, QNT may reach $234.9 (+160%) at peak valuation, while potentially declining to $195.07 (+115%) at its lowest point.

Based on the experts’ forecasts at PricePrediction, in 2026, QNT crypto can go as high as $193.81 (+115%) as its lowest price might drop to $155.67 (+70%).

Telegaon’s bullish outlook suggests QNT may trade between $224.51 (+145%) at minimum and $360.23 (+300%) at maximum during 2026. This hints at Quant’s development and market adoption.

Quant Price Prediction 2030

DigitalCoinPrice analysts think that by 2030, QNT coin will considerably rise in price: according to their calculations, its maximum price level is expected to be around $499.68 (+450%), while its minimum price will drop to $431.11 (+375%).

According to PricePrediction’s 2030 projections, QNT is anticipated to appreciate significantly, with a potential low of $750.24 (+725%) and a possible peak of $849.55 (+835%).

According to Telegaon’s 2030 forecast, QNT could achieve a maximum valuation of $645.09 (+610%), while maintaining a floor of $584.48 (+540%).

QNT Price Prediction 2040

PricePrediction projects that by 2040, QNT may reach between $60,629 (+66,600%) at its low and $73,727 (+81,000%) at its peak valuation.

Telegaon analysts forecast more conservative 2040 price targets, anticipating a range of $1,439.31 (+1,480%) to $1,573.09 (+1,630%).

Quant (QNT) Price Prediction: What Do Experts Say?

Quant has drawn bullish sentiment from analysts due to its unique position as an interoperability pioneer in the blockchain space. Experts highlight that QNT’s recent price surge aligns with growing institutional demand for blockchain interoperability solutions, particularly following major partnerships like Quant’s work with central banks on digital currency projects. Many predict sustained upward momentum as Overledger’s adoption expands, with some forecasts suggesting QNT could retest its all-time high of $428 if enterprise adoption accelerates. The token’s fixed supply of 14.8 million also creates favorable scarcity dynamics that could amplify price movements during market uptrends.

That said, expert opinions vary significantly due to the inherent volatility of cryptocurrency markets and the rapid evolution of scaling technologies. While long-term price speculation remains highly uncertain, some analysts, including researchers at Gate, suggest Quant’s native token could theoretically reach $605 by 2035 if the platform’s solution becomes more widely used.

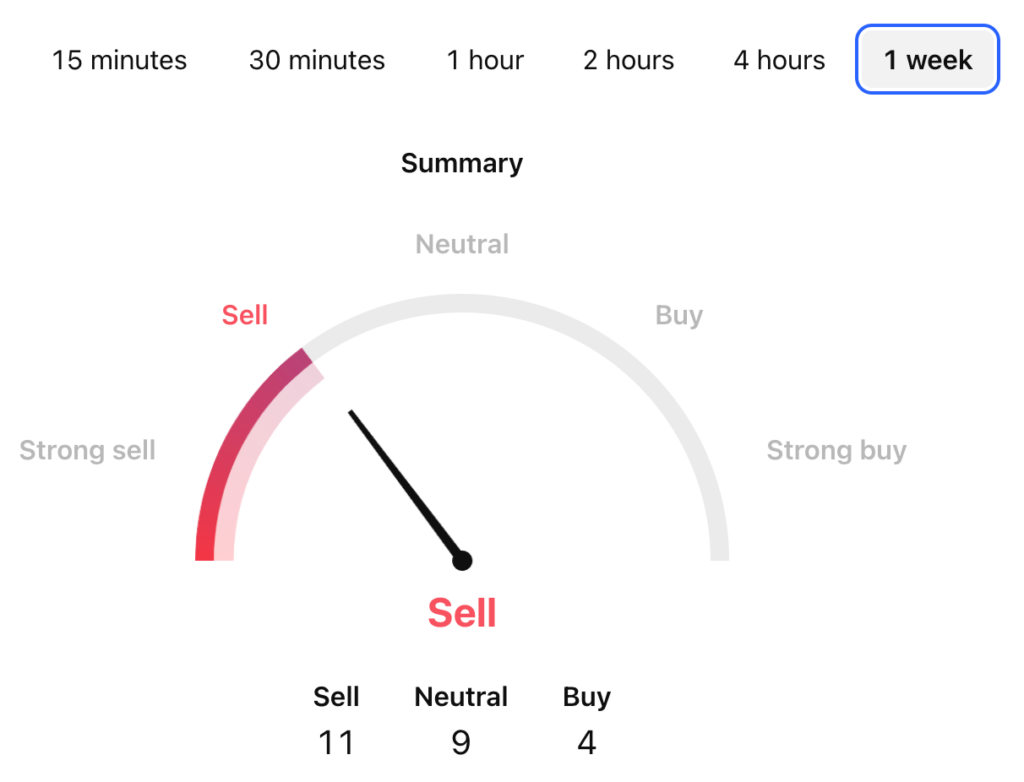

QNT USDT Price Technical Analysis

Tradingview, June 23, 2025

Now that we’ve taken a look at the possible future of the QNT coin, let’s find out a bit more about the factors that can lead to its further success.

What Does the Quant Price Depend On?

The price of Quant primarily depends on institutional adoption of its Overledger technology and broader market demand for blockchain interoperability solutions. As the native token required to access Overledger’s cross-chain functionality, QNT’s value is directly tied to enterprise usage, particularly in sectors like Central Bank Digital Currencies (CBDCs), healthcare data sharing, and financial services. Major partnerships with governments and Fortune 500 companies serve as key price catalysts, as seen when QNT surged 300% in 2021 following its inclusion in the Bank of England’s CBDC prototyping project. The token’s fixed supply of 14.6 million creates built-in scarcity that magnifies price movements during periods of increased network utilization.

Secondary factors include the competitive landscape of interoperability projects, broader crypto market trends, and Quant’s ability to maintain technological leadership. While QNT benefits from being an early mover in enterprise blockchain connectivity, the emergence of alternatives like Chainlink’s CCIP and Polkadot’s XCM presents competitive pressure. Like all crypto assets, QNT remains susceptible to macroeconomic conditions affecting investor risk appetite, though its enterprise focus provides somewhat more insulation than pure retail-driven tokens.

Risks and Opportunities

Quant presents compelling opportunities as one of the few blockchain projects with proven enterprise adoption, particularly in the high-growth interoperability sector. Its Overledger technology has already been implemented by major institutions, including central banks exploring CBDCs and global corporations seeking secure cross-chain communication. The platform’s agnostic approach (connecting any blockchain without requiring migration to a new network) gives it a unique advantage as organizations increasingly operate in multi-chain environments. With only 14.6 million QNT ever to exist, increased institutional demand could create significant upward price pressure, especially as real-world use cases expand into areas like healthcare data exchange and international payments.

However, Quant faces substantial risks, including intensifying competition and the challenges of maintaining a first-mover advantage in a rapidly evolving space. The project’s enterprise focus also creates a dependency on relatively slow-moving institutional sales cycles, potentially limiting short-term growth compared to retail-driven crypto projects. Additionally, as a permissioned interoperability solution, Quant must continually demonstrate superior security and compliance features to justify its premium positioning; any high-profile security incident or failure in a major implementation could significantly impact QNT’s valuation and market confidence.

Is Quant a Good Long-Term Investment?

Quant presents a compelling investment opportunity as a premier Ethereum Layer-2 scaling solution, delivering enhanced transaction speed and cost efficiency without compromising security. The protocol’s expanding integration across DeFi ecosystems, NFT platforms, and decentralized applications underscores its long-term viability, particularly amid Ethereum’s persistent challenges with network congestion and exorbitant gas fees. Nevertheless, investors should remain informed of inherent risks including cryptocurrency market volatility and intensifying competition within the L2 solutions space.

What Is Quant Crypto?

Quant is an enterprise-focused blockchain interoperability platform designed to connect multiple distributed ledger technologies (DLTs) through its proprietary Overledger operating system. Quant’s technology enables seamless communication between different networks without requiring direct integration, solving critical interoperability challenges for institutions. The QNT token serves as the network’s utility and governance asset, required to access Overledger’s features, pay for enterprise services, and participate in ecosystem decisions.

What Is Quant All-Time High?

Quant hit its all-time high of $428.38 on September 11, 2021.

What Is the Max Supply of QNT Crypto?

The max supply of Quant is 14,881,364 QNT.

Does QNT Have a Future?

Yes, Quant has strong long-term potential as one of the leading interoperability protocols. Its low fees, high throughput, and seamless integration with Ethereum make it a top choice for DeFi, gaming, and NFT projects. However, its success hinges on execution amid growing competition.

What Is Quant Used For?

Quant is primarily used to power Overledger which enables seamless interoperability between different distributed ledger technologies (DLTs), including both public and private blockchains. Enterprises and developers utilize QNT tokens to access Overledger’s services, pay for API calls, and deploy multi-chain applications (mApps) that can operate across multiple blockchain networks simultaneously.

How High Can QNT Realistically Go?

Quant could realistically reach between $500 to $2,000 in a bullish scenario, assuming accelerated adoption of its Overledger technology for enterprise blockchain interoperability and CBDC integration.

Can QNT Reach $500?

QNT reaching $500 is achievable in a multi-year bull market scenario, though it would require substantial enterprise adoption of Overledger technology and favorable crypto market conditions. According to DigitalCoinPrice, it will reach $499.68 by 2030.

Can Quant Hit $1,000?

It is possible, however, in the long-term perspective as this would require unprecedented enterprise adoption and a multi-year crypto bull market, placing it among the top 10 cryptocurrencies by market cap.

Can QNT Reach $2,000?

Quant reaching $2,000 would require a near-perfect alignment of technological dominance, institutional adoption, and macroeconomic conditions, making it a high-risk, low-probability scenario in the foreseeable future.

Can Quant Hit $10,000?

Quant reaching $10,000 per token is an extreme long-shot scenario that would require a complete transformation of global financial infrastructure, so while it is theoretically possible, this scenario would make Quant more valuable than today’s Goldman Sachs or BlackRock. Blockchain will most likely disrupt finance, however, this specific price target defies economic gravity.

Can Quant Reach $50,000?

A $50,000 QNT price represents a 500x surge that would require a huge market cap, exceeding Bitcoin’s current valuation. This is a highly unrealistic scenario.

Can Quant Hit 100k?

A $100,000 Quant price is mathematically, economically, and technologically impossible under any realistic global financial scenario.

What Is a Realistic Price Prediction for QNT?

Quant has the potential to reach up to $2,000 in the future.

What Will QNT Price Target Be in 2025?

According to DigitalCoinPrice, at its peak in 2025, QNT’s price will rise to $200.

What Will QNT Price Be in 2027?

DigitalCoinPrice experts believe that in 2027 $QNT will hit a maximum of $325 per coin.

How Much Will Quant Be Worth in 2030?

DigitalCoinPrice analysts estimate that in 2030 QNT’s price will go as high as $500.

What Is the Price Prediction for QNT 2035?

According to Telegaon, in 2035 QNT will cost $860 at its peak.

What Is the Quant Prediction for 2040?

Telegaon expects $QNT to cost $1,570 at its all-time high in 2040.

What Is the Price of QNT in 2050?

According to Telegaon, in 2050 QNT will go as high as $3,520.

Is QNT Worth Buying?

QNT could be worth buying as a high-risk, high-reward bet on enterprise blockchain adoption, but only as a small part of a diversified crypto portfolio. Its unique interoperability technology and central bank partnerships give it legitimate upside potential, especially if CBDCs gain mainstream traction. However, investors should be wary of its enterprise sales cycle delays and the overall crypto volatility.

Conclusion

Ultimately, Quant might be the blockchain’s next evolutionary leap as it provides seamless interoperability across enterprises, institutions, and global financial systems. With its proven Overledger technology already powering central bank experiments and Fortune 500 deployments, Quant is uniquely positioned to become the backbone of tomorrow’s connected blockchain economy. While challenges exist in any transformative technology, Quant’s first-mover advantage, enterprise-grade solutions, and fixed token economics may create a perfect storm for long-term value appreciation.

Where to Buy Quant Coin?

StealthEX is here to help you buy QNT coin if you’re looking for a way to invest in this cryptocurrency. You can buy Quant safely and without the need to sign up for the service. StealthEX crypto collection has more than 2,000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy QNT Coin? Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to QNT.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

crypto price prediction price analysis QNT Quant Quant NetworkRecent Articles on Cryptocurrency

No KYC for Buying Cryptocurrency on StealthEX

No KYC for Buying Cryptocurrency on StealthEX  XDC Price Prediction: Will XDC Crypto Reach $10?

XDC Price Prediction: Will XDC Crypto Reach $10?