Review of the Crypto Market: May 12, 2023

A week ago, the situation in the crypto market looked stable. Although BTC and ETH saw initial drops, they managed to recover losses. This week, however, was much different. The two largest cryptocurrencies have recorded seven daily red candles in a row. What is the reason? Why is the crypto market falling?

Article contents

- 1 What Happened to Crypto This Week?

- 2 Biggest Crypto Gainers This Week

- 3 Crypto News of the Week

- 3.1 The European Central Bank and the Fed Raised Interest Rates. Inflation in the US is Falling

- 3.2 Bittrex Exchange Goes Bankrupt

- 3.3 QuadrigaCX Will Begin Distributing Funds to its Clients

- 3.4 PayPal Has Revealed How Much it Holds in Crypto

- 3.5 US Government Again Dump Bitcoin. The Massive Sale Has Shaken Up The Market

- 3.6 AMA Volt Inu x StealthEX

What Happened to Crypto This Week?

In today’s recap, we will answer the questions posed in the intro. However, before we move on to the news that may be influencing such a situation, let us briefly analyze the price charts of Bitcoin and Ethereum.

Bitcoin Price in USD This Week

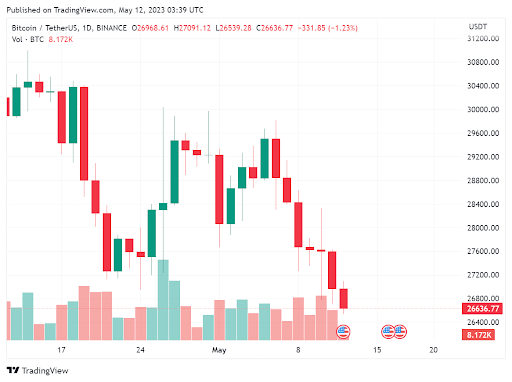

Bitcoin started the week with a rebound after last week’s decline. Unfortunately, the recovery did not last long. The next day, a big red candle appeared on the chart. However, it did not stop there. BTC recorded as many as seven red candles in a row, and its price fell by more than $3,000. So, what is the price of Bitcoin today? Currently, the BTC price sits at around $26 600. The last time we saw such a level was almost two months ago – on March 17.

The amplitude of the BTC price was quite large this week. The 7d high of BTC formed at nearly $30,000. Nevertheless, Bitcoin recorded consistent declines from that point, bringing the 7d low to almost $26,500. As the price has fallen, the dominance of the king of crypto has also declined gently – currently standing at 44.9%.

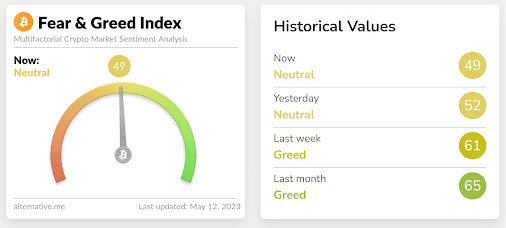

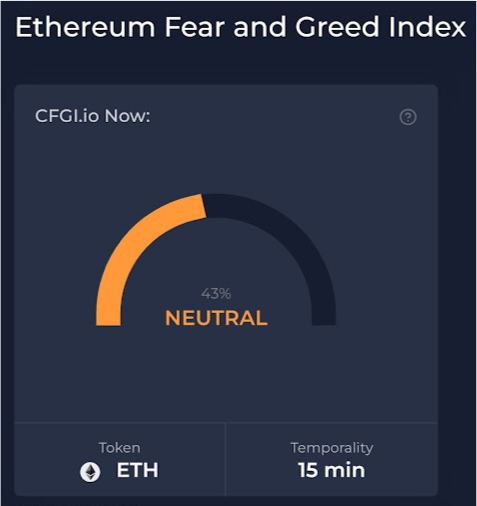

Sentiment among investors has also become slightly more negative. Just last week, they were greedy, with the Fear and Greed Index indicating a level of 61. It is at 49 today, meaning the investor stance is ‘neutral.’

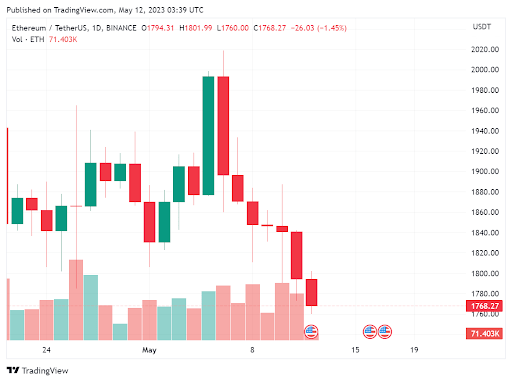

Ethereum Price in USD This Week

Ethereum’s chart looks similar to that of Bitcoin. The king of smart contracts also consistently draws red candles on the chart. In the case of ETH, the 7d high was above $2,000. However, ETH’s price fell by more than $250 and today recorded a 7d low near $1,750.

Interestingly, ETH’s dominance has not declined like in the case of BTC. It has managed to hold on and even gently increase by 0.2%. Ethereum now represents 18.5% of the total crypto market cap.

Investors’ sentiment for Ethereum also gently slipped, from 48% to 43%. Both figures indicate a neutral approach from traders.

Biggest Crypto Gainers This Week

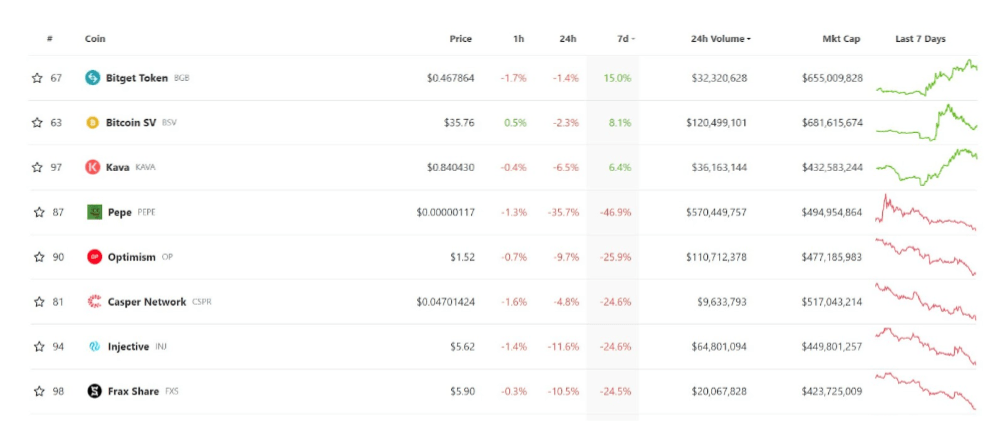

Admittedly, BTC and ETH fell 9% and 7% respectively this week and dragged down the rest of the market. Nevertheless, there are still exceptions. Some tokens in the TOP 100 have seen growth – although these tokens are only three in total.

So, which projects are the biggest crypto gainers this week? Here is the list:

- Bitget Token (BGB) – 15%

- Bitcoin SV (BSV) – 8.1%

- Kava (KAVA) – 6.4%.

The biggest losers, however, were Pepe Coin (47%), Optimism (26%), Casper Network (25%), Injective (25%), and Frax Share (25%).

Crypto News of the Week

Now that we have looked at the charts and the crypto market situation, it is time to move on to the next part of our weekly recap, a review of the latest news.

The European Central Bank and the Fed Raised Interest Rates. Inflation in the US is Falling

Last Thursday, the Governing Council of the European Central Bank (ECB) decided to raise base interest rates by 25 basis points (bps). The monetary authorities indicated that future increases are still possible, however. It added in the communiqué that the main task remains the fight against inflation.

ECB interest rates were raised to a range of 3.25-4.00%. The 25 basis point increase is the smallest since the start of the increase cycle in July 2022.

At the same time, the ECB stressed that the Council’s future decisions would ensure a “timely return of inflation to the 2% target”. It also said that “sufficiently restrictive” levels would be maintained “for as long as necessary.”

The slowdown in rate rises in the eurozone may follow a decision by the US Federal Reserve. The Fed decided last Wednesday to raise the benchmark interest rate by only 25 basis points. Analysts interpret the stipulations in the Reserve’s announcement as indicating that this may have been the last in a series of increases.

This week also saw the release of the latest US inflation figures. In April, inflation stood at 4.9 percent. This means it was marginally lower than in March, at 5.0 percent. It is worth noting, however, that this is the tenth consecutive month of falling inflation in the US.

March saw a much bigger drop, from 6.0 to 5.0 percent, resulting from falling fuel and electricity prices.

So is there anything to be happy about? The problem is, first and foremost, quite high core inflation. This is an indicator that does not take into account food, fuel, and energy prices.

In a broader context, however, it may be pleasing to note that a second consecutive month of falling food prices is behind us (-0.2% against -0.3% in March). Nevertheless, the latter is still as much as 7.1% more expensive than a year ago.

On a monthly basis, we will also pay 3% more for petrol, which at the same time a year ago was as much as 12.2% more expensive. Diesel in the USA was 20.2% cheaper in April than in April 2022 and 4.5% cheaper than in March. The price of electricity also fell (by 0.7% month-on-month and 8.4% year-on-year). Gas was, on average, 2.1% cheaper than a year ago and 4.9% cheaper than in March.

Bittrex Exchange Goes Bankrupt

Crypto exchange Bittrex has declared bankruptcy in the US state of Delaware. This happened on Monday, a few months after informing its customers that it would cease operations in the country. It also came just weeks after the exchange was sued by the Securities and Exchange Commission (SEC).

The exchange said it has more than 100,000 creditors, with estimated liabilities and assets ranging from $500 million to $1 billion. This is evident from court filings.

It is worth mentioning that the US branch of Bittrex has had a tough year due to the bear market. On top of this, it laid off as many as 80 people in February 2023. In March, it announced that it would close all its US operations by the end of April.

However, the above does not affect Bittrex Global, a cryptocurrency exchange outside the US.

Despite Bittrex’s impending exit from the US, the SEC sued the exchange in mid-April. Indeed, the company behind the business was accused of operating a platform for trading securities, acting as a broker and clearing agency.

The SEC also sued the former CEO of Bittrex, Bill Shihara, and Bittrex Global. Bittrex Global CEO Oliver Linch said last month that the exchange intends to fight the SEC in court but that bankruptcy proceedings could make that difficult.

QuadrigaCX Will Begin Distributing Funds to its Clients

According to a May 8 post by law firm Miller Thomson, which represents users of the non-existent cryptocurrency exchange QuadrigaCX, the distribution of funds related to the bankruptcy proceedings will be scheduled “in the coming weeks.”

The insolvency trustee Ernst & Young announced the above in consultation with the practitioners. The trustee will publish a notice to users shortly regarding the manner and procedure for distributing funds.

According to Miller Thomson, only a few users will receive a notice rejecting the claim. This means that the creditor’s claim has been amended or dismissed through the insolvency process.

QuadrigaCX was once the largest cryptocurrency exchange in Canada. However, it became insolvent in February 2019, shortly after its co-founder, Gerald Cotten, died in India. To make matters worse, he took with him to his grave the private keys to the addresses where his exchange’s cryptocurrency holdings were stored.

According to the Ontario Securities Commission (OSC), QuadrigaCX owes its customers around US$160 million. Leaving aside the loss of cold wallet keys, the OSC noted that Cotten generated as much as US$86 million in losses with his mismanagement. He traded cryptocurrencies on other platforms and covered the losses with … user funds.

The insolvency practitioner Ernst & Young has since recovered assets worth USD 34.3 million.

PayPal Has Revealed How Much it Holds in Crypto

PayPal, the world-renowned financial technology company, recently revealed how much it holds in cryptocurrencies. The data was included in a new quarterly report filed with the US Securities and Exchange Commission.

As of March 31, 2023, PayPal’s cryptocurrency assets were worth US$943 million. This indicates a 56 percent increase from the previous quarter when US$604 million was reported.

The company added that it allows its “customers in certain markets to buy, store, sell, receive and send certain cryptocurrencies, as well as use the proceeds from cryptocurrency sales to pay for purchases.” Paypal indicated that when the company wrote ‘cryptocurrencies,’ they meant Bitcoin, Ether, Bitcoin Cash, and Litecoin.

The Q1 2023 statement of cryptocurrency assets for PayPal includes 499 million USD in BTC (up from USD 291 million seen in December 2022) and 362 million in ETH (up from USD 250 million). On top of this, the company accumulated 82 million in BCH and LTC (a jump from USD 63 million).

PayPal’s profitability also increased in the first quarter of this year. On a generally accepted accounting principles (GAAP) basis, the company disclosed earnings per share of $0.70. This compares to USD 0.43 in the first quarter of 2022. On a non-GAAP basis, PayPal’s earnings per share were US$1.17, compared to US$0.88 in the first quarter of 2022.

US Government Again Dump Bitcoin. The Massive Sale Has Shaken Up The Market

All signs point to the US government dumping more confiscated Bitcoin. This time it is one of the largest transactions to date, amounting to 9,800 BTC – the equivalent of around $227 million.

The information was reported by WhaleWire – one of the world’s best-informed portals watching cryptocurrencies from behind the scenes.

The sudden release of this amount of BTC has caused the BTC price to plummet.

Meanwhile, the US government still has more than 200,000 BTC in total. If they are still going to get rid of them, this could push the price of the most popular crypto down. These types of transactions usually cause mixed feelings among Bitcoin holders—especially those who hold a significant amount of BTC.

This is the second time the government has sold the same amount of BTC. Three weeks ago, they also got rid of the equivalent of 9800 BTC.

Bitcoin sales by the government are nothing new. All of these BTC have been seized as part of anti-crime efforts. In November 2022, 50,000 BTC was confiscated from crypto-criminal James Zhong (who stole them from Silk Road). In 2014, the 30,000 BTC secured from the same source was sold.

AMA Volt Inu x StealthEX

A lot has been going on recently, not only in the Bitcoin market but also with our partners. For example, Volt Inu has migrated from V2 to V3, making it a tax-free token. Therefore, we have decided to hold an AMA with Volt Inu’s community chef Pablo, which will take place on May 17 at 5 PM (UTC) on the Twitter Spaces platform. We invite you to follow our Twitter to ensure you attend the event.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto world Ethereum exchange cryptocurrency Volt InuRecent Articles on Cryptocurrency

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?  FUNToken Price Prediction: Can FUN Coin Reach $1?

FUNToken Price Prediction: Can FUN Coin Reach $1?