Review of the Crypto Market: May 5, 2023

The crypto market was rather quiet this week. Although we saw quite a large red candle on the Bitcoin chart, at the end of the day, the BTC price is almost the same as the week before. We invite you to our next recap of the week, where we’ll analyze the BTC and ETH prices in USD and look at the latest news from the crypto world. So, let’s get started!

Article contents

- 1 What Happened to Crypto This Week?

- 2 Crypto News of the Week

- 2.1 Elon Musk Introduces Twitter Monetization System for Content Creators

- 2.2 Nearly Half of Millenials Own Crypto

- 2.3 JPMorgan Acquires First Republic Bank

- 2.4 White House Wants to Introduce Tax on Mining

- 2.5 BRC-20 Tokens Have Chased Away Bitcoin in Terms of Transaction Volume

- 2.6 The Fed Raised Interest Rates. Possibly for the Last Time

- 2.7 SEC Receives Deadline to Respond to Coinbase’s Petition

- 2.8 AMA Dash x StealthEX

What Happened to Crypto This Week?

Before we get to the overview of the most important news, as we do every week, let’s first look at the basic data on the two largest cryptocurrencies in terms of market cap – BTC and ETH. Let’s look at their charts, how their dominance is shaping up, and investor sentiment.

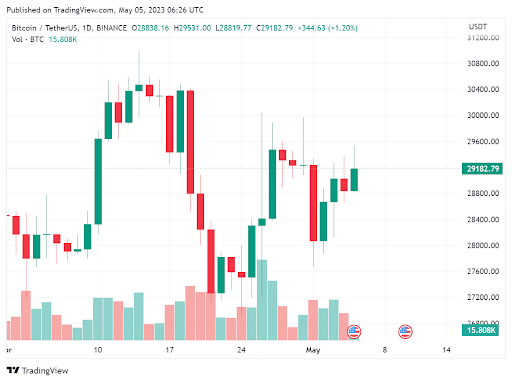

Bitcoin Price in USD This Week

Bitcoin did quite well this week. Admittedly, its price did not rise, but despite the sizable red candle recorded on May 1, BTC has rebounded and is at the same level as a week ago. So, what is the price of Bitcoin today? Currently, the price of BTC is located at the level of $29,182.

The 7d high of BTC formed at nearly $30,000, while the 7d low was around $27,600. The dominance of the largest cryptocurrency rose slightly to 45.4%.

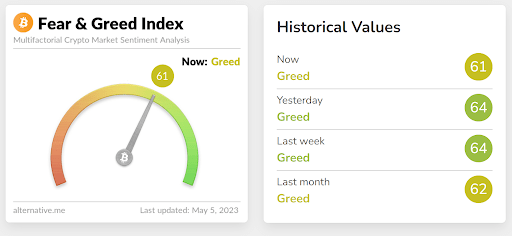

Investor sentiment is the same as the week before. Greed still prevails in the market, with Bitcoin’s Fear and Greed Index indicating a level of 61.

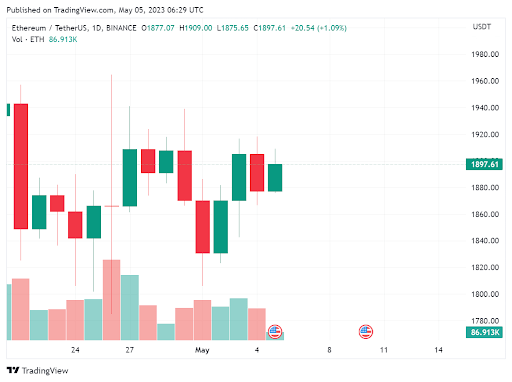

Ethereum Price in USD This Week

The chart of Ethereum looks similar to that of Bitcoin. ETH started and ended the week at the same level, even though a sizable red candle appeared on the chart. In the case of ETH, the 7d high was $1938, and the 7d low was almost $1800. The current price of Ether is nearly $1900.

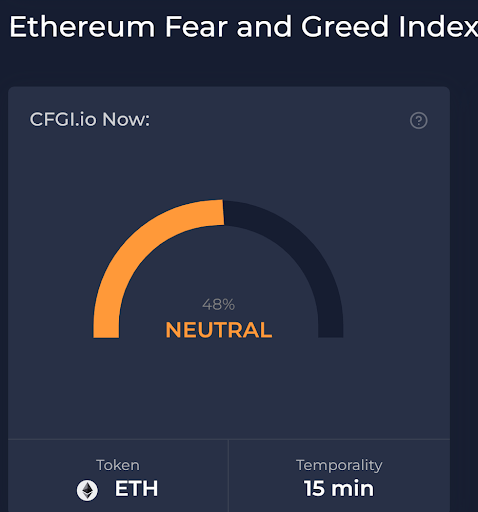

The dominance of the second-largest cryptocurrency in terms of market cap increased to 18.3%. Investor sentiment for Ethereum, however, is worse than for Bitcoin. It ranks at 48, or neutral.

Biggest Crypto Gainers This Week

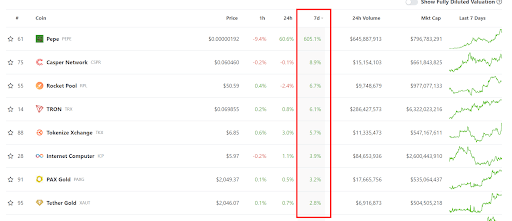

Bitcoin and Ethereum did quite well this week – they did not see too much decline. However, quite a few altcoins provided investors with much higher returns on their investments – some even several hundred percent. So, which coins have done best? Which projects are the biggest crypto gainers this week? Below is the list:

- Pepe (PEPE) – This token has seen incredible growth due to the meme coin fever. In the last seven days alone, its price rose 610%.

- Casper Network (CSPR) – In this case, the growth is not so impressive – it is “only” 8%.

- Rocket Pool (RPL) – 6.2%.

- Tron (TRX) – 6%

- Tokenize Xchange (TKX) – 5.4%

- Internet Computer (ICP) – 3.7%

Among other tokens that achieved higher gains than Bitcoin were stablecoins linked to the price of gold – Pax Gold (PAXG) and Tether Gold (XAUT). All thanks to the XAU/USD pair reaching another ATH.

Crypto News of the Week

Now that we have analyzed the charts of the major cryptocurrencies, it is time to move on to the next important part of this recap: the list of the most important news of the week.

Elon Musk Introduces Twitter Monetization System for Content Creators

Since Elon Musk took over Twitter in October, the billionaire has been steadily making some changes to the platform to make it, as he puts it, an app for everything. One of the key elements is the implementation of a monetization system for published content. Musk is convinced that this will benefit the users and make them even more active. It will also help Twitter itself, of course.

He has now unveiled a plan under which content creators can make money by sharing their content with other users. As he stated – he hopes this will translate into greater promotion of citizen journalism.

The announced “Subscriptions” feature offers Twitter users to generate additional profits by charging monthly fees to their followers. Upon payment of the corresponding fee, subscribers will receive access to exclusive content by a given creator, which will not be available to everyone.

As Musk conveyed, content creators can keep 97% of the revenue up to a limit of $50,000. Once this limit is exceeded, revenue will be split – only 80% will remain in the creators’ pockets. To do this, Twitter has partnered with Stripe, a payment processor.

Nearly Half of Millenials Own Crypto

Analysts from Bitget conducted a survey in 26 countries. They collected responses from 255,000 people in four different age groups: millennials, Generation X and Z, and baby boomers. Some countries included in the survey were the United States, Nigeria, China, Indonesia, and Japan. The study analyzed activity in the cryptocurrency market from July 2022 to January 2023.

As many as 19% of respondents were from the baby boomer generation. Representatives of Generation X accounted for 23% of the surveyed population, while Generation Z and millennials – 31% and 17%, respectively. The results were published on April 28.

What did they find out? 46% of millennial respondents own some virtual assets. Around 25% of Generation X and 21% of Generation Z respondents have crypto. The figure for “boomers” is only 8%.

Millennials invest in digital currencies because they have extensive knowledge of the Internet and other digital technologies. Moreover, this demographic group considers crypto a promising investment option – mainly because of the significant potential returns this asset class can generate.

On the other hand, Generation Z respondents are interested in modern technologies such as blockchain and digital assets. It is worth mentioning that this is a group of people who were born after 2008 and have not experienced the negative effects of the previous financial crisis in the past.

JPMorgan Acquires First Republic Bank

The California Department of Financial Protection and Innovation on May 1 officially closed First Republic Bank. It also reached an agreement with the Federal Deposit Insurance Corporation (FDIC) – it will act as a trustee for the bank.

In addition, the FDIC has agreed for JPMorgan to take over the collapsed institution. One of the largest banks in the United States is to take over the FRB’s assets. On top of that, there are also deposits that do not have adequate collateral. As of this moment, First Republic Bank manages assets worth $229.1 billion. The deposits it holds were estimated at $103.9 billion.

After JPMorgan takes command of the funds above, all 83 points belonging to FRB, located in eight US states, will reopen under the bank’s branding. All customers using the bankrupt institution’s services will continue to have access to them at the current branches as long as they don’t get a notice of the changes from JPMorgan.

A special loss-sharing agreement has also been reached between the Federal Deposit Insurance Corporation and JPMorgan. It addresses the issue of residential and commercial loans that the FRB previously acquired.

White House Wants to Introduce Tax on Mining

The White House sees the mining market as harmful to the environment and with limited economic benefits. So it is trying to convince Congress to pass a 30 percent tax on climate change. This one would apply to cryptocurrency miners.

The tax would encourage companies in the mining market to consider so-called “social damages” in their operations. The U.S. President’s Council of Economic Advisors also justifies the potential tax that it should be paid because of the need to “combat climate change.”

This tax would be phased in over three years. Starting at 10% in the first year, it would rise to 20% and 30%. It is estimated to generate revenues of $3.5 billion over ten years.

The Council’s economist, who spoke to Yahoo, added that the economic benefits of cryptocurrency mining remain “unclear,” while there are still concerns about the industry’s financial stability and environmental risks.

The White House’s new idea is part of a broader policy. In April 2022, a group of activists from the Democratic Party signed a letter addressed to the Environmental Protection Agency. It demanded an investigation into whether crypto mining companies were violating environmental regulations.

Bitcoin fans responded with their letter to the agency. In the document, they defended the idea of mining and pointed out that it is less harmful than many believe.

BRC-20 Tokens Have Chased Away Bitcoin in Terms of Transaction Volume

The BRC-20 token standard has been enjoying its 5 minutes recently. It is currently a very popular trend in the Bitcoin ecosystem community. This coincides with another memecoin boom, especially with the PEPE token craze. Indeed, the latter has scored a crazy price rally over the past two weeks. 8,500 tokens were minted on the blockchain of the oldest cryptocurrency using BRC-20. Most of them are classified as memecoins.

BRC-20 is the standard for minting tokens on the Bitcoin network, modeled on ERC-20 from Ethereum. Developers can create and transfer such tokens using the Ordinals protocol launched on the BTC blockchain earlier this year. They differ from Ethereum tokens because BRC-20 does not use smart contracts. The standard of these tokens also needs a BTC wallet to carry out their mint and trading.

Interestingly, the popularity of BRC-20 tokens has resulted in transactions surpassing those involving Bitcoin on its network. Between April 29 and May 2, there was a 50% increase in BRC-20 token transfers. The highest volume was observed on May 1 – it amounted to 366,000 transactions. Meanwhile, their total since the inception of this standard is 2.36 million.

The Fed Raised Interest Rates. Possibly for the Last Time

The Federal Reserve raised interest rates by 25 basis points this week. Authorities’ announcement suggests it may have been the last increase in the most aggressive monetary tightening cycle since the 1980s.

U.S. interest rates today are in a range of 5 to 5.25 percent. That’s the most since 2007. Let the fact that rates were at zero at the beginning of last year indicate the scale of the cycle. The key question, however, is this the end of interest rate increases? Federal Open Market Committee does not answer it directly.

The public was told only that “the Committee will closely monitor incoming information and assess the implications for monetary policy.” Noteworthy, however, in previous announcements, there was wording stating that the Fed “anticipates that additional policy tightening may be appropriate.” It also hinted at “future increases.” These words are not in the new statement. According to experts, this is an announcement of a change in U.S. monetary policy and a move to quantitative easing.

We also found out that the Committee’s vote was unanimous. Jerome Powell, who leads the Fed, said during a press conference that the economic situation in the U.S. is stable. He pointed to, among other things, the banking sector, however, contrasting sharply with, for example, the recent collapse of First Republic Bank. He added that a scenario in which the United States may experience a mild recession is becoming possible. Jerome Powell said that “the case for avoiding a recession is (…) more likely than a recession.”

Powell also pointed to a decline in job vacancies not accompanied by increased unemployment. He didn’t hide that the authorities will continue their efforts to bring inflation down to 2%. In March, that figure was as high as 5%.

To all of the above, Bitcoin reacted positively. Indeed, it once again managed to break through the $29,000 level.

SEC Receives Deadline to Respond to Coinbase’s Petition

On April 25, attorneys of the crypto exchange Coinbase filed a formal complaint against the U.S. Securities and Exchange Commission (SEC). The company was fed up with waiting indefinitely for a response from the agency to a petition it sent last year.

On Thursday, May 4, the exchange’s chief lawyer, Paul Grewal, broke the news that the U.S. Court of Appeals for the Third Circuit had responded to the lawsuit. It set a deadline for the SEC to respond to the questions it received. The judicial body’s decision is an important step in seeking clarity on cryptocurrency market regulations in the U.S.

As Grewal reported, the court asked the Gary Gensler-led body to act on the petition. The court instructed the commission to respond to Coinbase’s petition within ten days. The so-called “mandamus order” is an administrative measure used by the courts to direct a lower-level state entity to fulfill its official duties.

Coinbase’s lawyer added that the court also granted the company the right to respond to the SEC’s response within seven days. Determining the position on the clarity of the commission’s regulation of cryptocurrency entities is key to operating freely in the digital asset market.

AMA Dash x StealthEX

In addition to traditional news, there is a lot going on with our partners. One example is the Dash. The team has published a summary of its recently introduced new developments.

There are so many new things that we decided to conduct an AMA with Dash team. It will be held on Twitter Spaces on May 11 at 3 PM UTC. To ensure you attend the event, we invite you to follow our Twitter.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto crypto world cryptocurrency EthereumRecent Articles on Cryptocurrency

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight  Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?

Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?