Stablecoin Dominance Drops to 18-Month Low: What’s the Reason?

Stablecoins have long been viewed by investors as a safe haven from wild fluctuations in crypto assets. However, their dominance in the crypto market has recently dropped to a 18-month low. What might be causing stablecoins to take a backseat? Is it a sign of a larger trend, or just a passing fad? Here’s a closer look at what we can uncover.

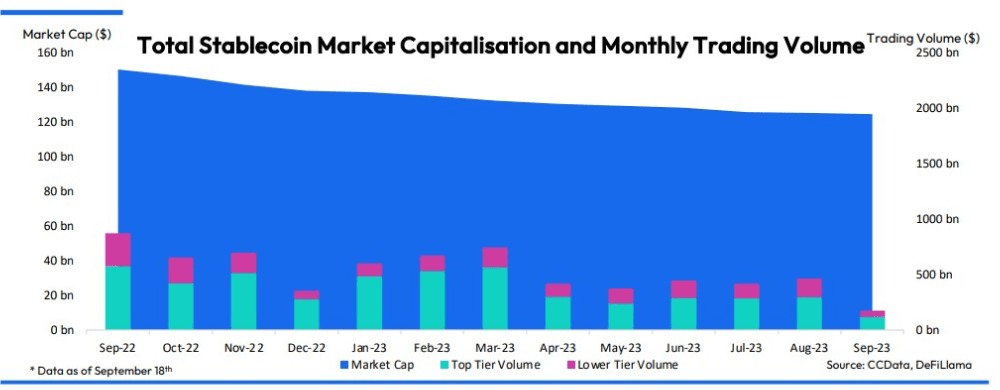

As reported by CCData, the total stablecoin market cap declined again in September, falling by 0.63% to $124 billion, falling for the 18th consecutive month, and down to its lowest level since August 2021.

Source: CCData’s Stablecoins Report

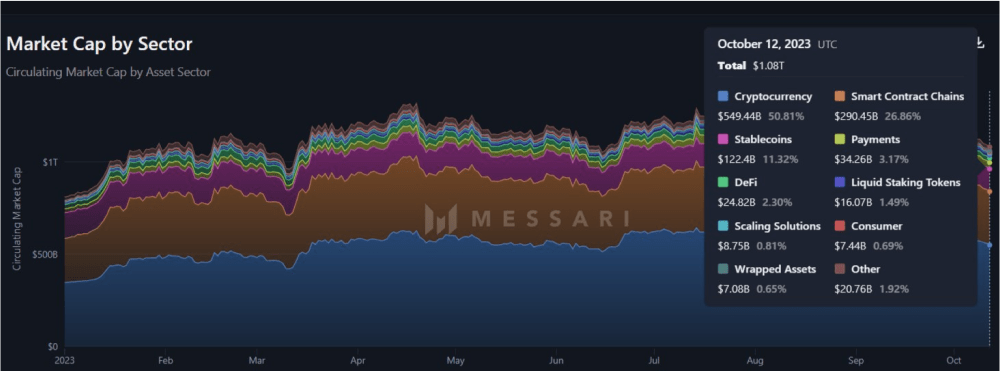

At the time of writing, stablecoins account for 11.32% of the total market cap, below their all-time high of 16.6% or 22.4 billion in December 2022.

Source: Messari.io

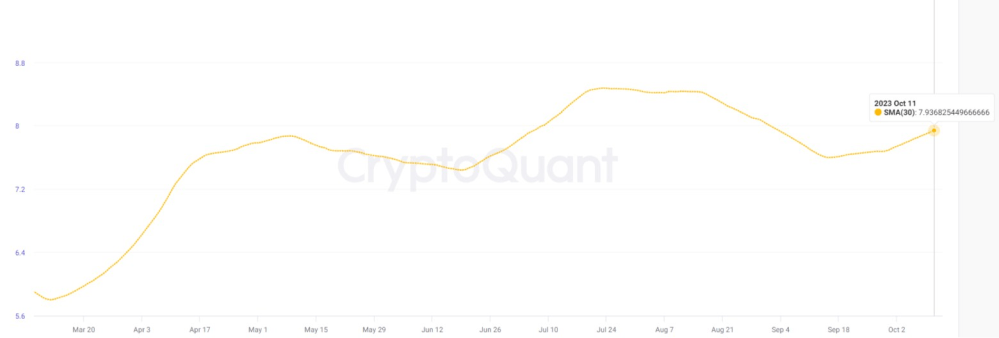

This trend is further confirmed by the 30-day SMA of the stablecoin-specific supply ratio (SSR), which can be seen as a seesaw relationship between Bitcoin and stablecoins and which provides insight into the current dominance of one or the other. Currently, the indicator is rising, suggesting that stablecoins are losing purchasing power.

Source: CryptoQuant

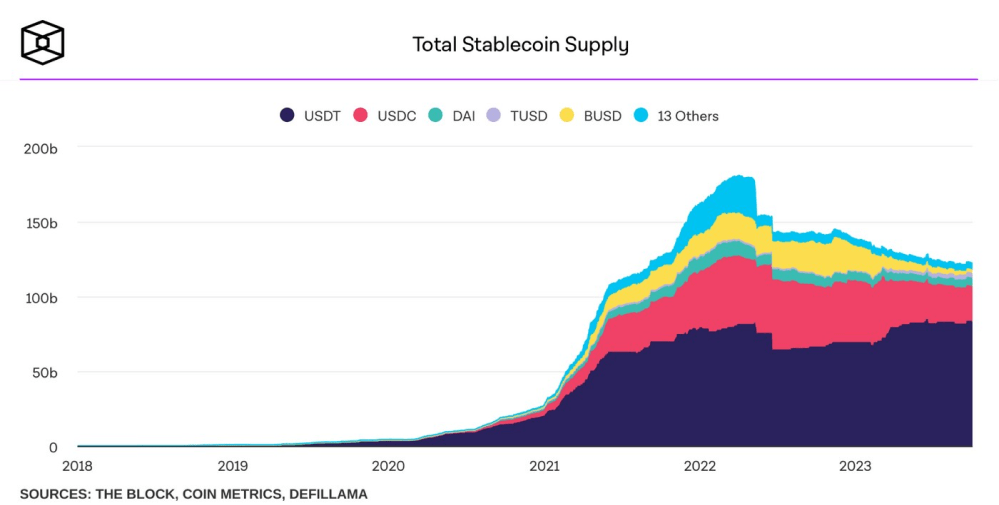

Based on the Block, Coin Metrics and DefiLlama data, the total supply of USD-pegged stablecoins stood at 121.63 billion as of October 3. TetherUSD (USDT) had the largest portion of the supply at 82.85 billion, followed by USDC at 23.34 billion, DAI at 5.54 billion, TUSD at 3.45 billion, and BUSD at 2.25 billion. The rest of the 13 stablecoins made up the remaining 4.2 billion.

Source: The Block, Coin Metrics, Defillama

Why Is the Dominance of Stablecoins Declining?

The crypto market has been tumultuous over the past year, and the stablecoin sector has not been immune to this instability. Last May, the ‘decentralized stablecoin’ Terra’s UST crashed to virtually zero, resulting in investors losing billions of dollars.

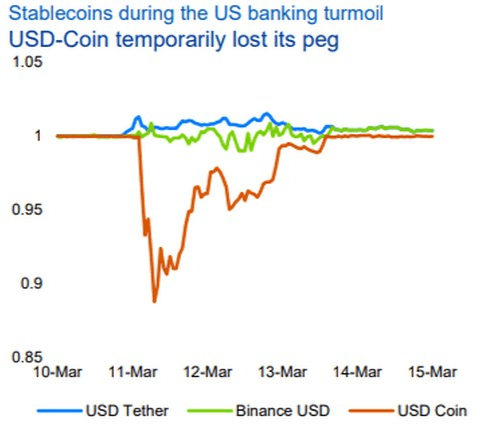

Other issues with major stablecoins have also occurred, including USDC being temporarily depegged from the dollar following Silicon Valley Bank’s shutdown in March.

Source: ESMA

Investors’ trust in stablecoins has been eroded, and there is a school of thought that there are now better investment opportunities.

Additionally, an assessment of the activity of crypto whales and other institutional players suggests they are accumulating Bitcoin, which may also explain why stablecoins are losing popularity.

Final Thoughts

The shift away from stablecoins may signify a changing crypto market landscape. Additionally, it could indicate that investors have lost their skepticism about the long-term viability of Bitcoin and other major cryptos. Moreover, more investment capital may flow in, which may increase cryptocurrency prices and boost adoption.

Make sure to follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

This article is not supposed to provide financial advice. Digital assets are risky. Be sure to do your own research and consult your financial advisor before investing.

Originally published at Bitcoin Insider.

DAI stablecoin Tether USD USDTRecent Articles on Cryptocurrency

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?