Uniswap Price Prediction: Will UNI Coin Reach $100?

Uniswap (UNI) is a decentralized cryptocurrency exchange (DEX) that enables users to trade Ethereum-based tokens directly from their wallets, eliminating the need for a middleman. Instead of traditional order books, Uniswap uses smart contracts and liquidity pools to set prices and facilitate trades automatically. Uniswap is one of the most popular crypto exchanges and a strong player in the market. In the last month, the price of its native token UNI increased to $7.63 (+60%) from a price level of $4.76 that it had dropped to at the beginning of April. In this article, we’ll discover what awaits this major crypto platform, provide the latest Uniswap price prediction, and dissect the key factors that can impact the future of this powerhouse.

| Current UNI Price | UNI Price Prediction 2025 | UNI Price Prediction 2030 |

| $6.3 | $15 | $66 |

Article contents

- 1 Uniswap (UNI) Overview

- 2 Uniswap Price History Highlights

- 3 UNI Price Chart

- 4 Uniswap Price Prediction: 2025, 2026, 2030-2040

- 5 Uniswap Price Prediction: What Do Experts Say?

- 6 UNI USDT Price Technical Analysis

- 7 What Does the Uniswap Price Depend On?

- 8 Is Uniswap a Good Long-Term Investment?

- 9 Does Uniswap Have a Future?

- 10 What Was Uniswap’s Highest Price?

- 11 Can Uniswap Reach $20?

- 12 Will Uniswap Skyrocket?

- 13 Conclusion

- 14 Where to Buy UNI Crypto?

- 15 How to Buy Uniswap Coin? Quick-Step Guide

Uniswap (UNI) Overview

Uniswap is a leading crypto asset exchange within the EVM ecosystem, offering a fully decentralized and disintermediated alternative to traditional trading platforms. Unlike conventional exchanges, Uniswap operates without a central authority, and no single entity controls or manages the network. It introduced a groundbreaking trading model known as an automated liquidity protocol, which replaces traditional order books and removes the need for trusted intermediaries, placing decentralization and security at the forefront.

As a DEX, Uniswap enables users to swap a wide range of ERC-20 tokens through a simple, intuitive web interface that removes many of the common hurdles found on traditional and centralized platforms. Instead of relying on order books, Uniswap uses an Automated Market Maker (AMM) model with liquidity pools to set asset prices, facilitate transactions, and execute trades. AMM technology is one of the most significant innovations in the DeFi space, offering users key advantages; most notably, the ability to instantly swap tokens without needing to match with a specific buyer or seller on the other side of the trade.

Uniswap doesn’t use an order book like traditional exchanges to set token prices. Instead, it uses a mathematical formula based on the amount of tokens available in its pools to calculate prices. This method is important because storing large order book data directly on the blockchain would be too expensive and slow.

| Current Price | $6.3 |

| Market Cap | $3,944,398,187 |

| Volume (24h) | $375,645,257 |

| Market Rank | #30 |

| Circulating Supply | 628,688,837 UNI |

| Total Supply | 1,000,000,000 UNI |

| 1 Month High / Low | $7.63 / $4.76 |

| All-Time High | $44.97 May 03, 2021 |

Uniswap was first released in 2018 by founder Hayden Adams. In 2020, Uniswap v2 launched, enabling direct swaps between essentially any ERC-20 token on Ethereum. Uniswap’s September 2020 UNI token launch included an airdrop of 400 UNI tokens to any ETH address that had completed a transaction on the network before the beginning of September.

UNI Features

The popular Uniswap platform offers several features within the crypto space. These are:

- Governance: UNI token holders are empowered to govern the Uniswap platform, with voting power distributed in proportion to users’ UNI balances.

- Efficiency: Smart contracts on the platform enable asset trading that may be cheaper and more efficient.

- AMM: Prices are set algorithmically using liquidity pools instead of order books.

- Cross-chain support: Uniswap is deployed across multiple blockchains, including Ethereum, Arbitrum, Optimism, Polygon, Base, and BNB Chain, enabling faster transactions, lower fees, and broader access to DeFi markets. Users can trade and provide liquidity on the chain that best suits their needs, while developers can integrate Uniswap functionality across ecosystems via standardized APIs and bridges.

- Concentrated liquidity: Concentrated liquidity allows liquidity providers to determine what price range their capital is allocated to. These will be aggregated into a single pool and form a combined curve for traders to trade against. From that, the multiple fee tiers compensate liquidity providers under the risk they take.

Uniswap Price History Highlights

- 2020: UNI started trading on the open market in 2020. After its launch, the token quickly increased in value to over $7. The coin’s all-time low was recorded on September 17, 2020, at $0.419.

- 2021: In 2021, UNI’s value soared to an unprecedented peak, surpassing $44.97. Throughout the remainder of the year, UNI’s price continuously decreased.

- 2022: At the beginning of 2022, UNI took another hit, correcting even further. In June 2022, its price continuously fell to almost $4. By mid-October 2022, UNI was trading around $6.

- 2023: During December 2023, Uniswap’s price increased by 20%, starting at $5.96 and closing the month at $7.23.

- 2024: In March 2024, during the short bull run, UNI hit $15.39. Later in June it also rose to a high of $11.98.

- 2025: At the beginning of 2025, when the market started stirring again, UNI hit $15.28. However, it later slowly dropped to $4.76 at the beginning of April. At the moment, the token’s price hovers between $6 and $7.

UNI Price Chart

CoinMarketCap, June 5, 2025

Uniswap Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $5.76 | $23.83 | $15 | +140% |

| 2026 | $13.77 | $37.2 | $25 | +300% |

| 2030 | $24.44 | $109.21 | $65 | +930% |

| 2040 | $6.12 | $376.71 | $190 | +2,900% |

UNI Coin Price Prediction 2025

Analysts from various sources offer varying outlooks on UNI’s potential, reflecting differing assumptions about market conditions and adoption. DigitalCoinPrice crypto pros think that in 2025 UNI coin’s price can hit $14 (+120%) at its peak, while at its minimum it can cost no less than $5.76 (-10%).

Telegaon experts are certain that Uniswap is going to get stronger this year: they believe that in 2026 Uniswap crypto will cost a minimum of $14.16 (+120%), or it can hit $23.83 (+270%).

Uniswap Crypto Price Prediction 2026

Looking further to 2026, estimates vary significantly: DigitalCoinPrice crypto specialists think that in 2026, the UNI token will cost as much as $16.65 (+160%) per coin at its highest point. According to them, it will also cost no less than $13.77 (+115%).

CoinLore analysts believe that in 2026 UNI crypto will cost $28.05 (+340%) at its minimum, while at its peak UNI will rise to $37.2 (+480%).

Experts at Telegaon are even more optimistic on the future of the platform: they think that in 2026 Uniswap crypto will cost a minimum of $24.59 (+285%), or it can hit $32.94 (+415%).

UNI Crypto Price Prediction 2030

DigitalCoinPrice analysts believe that by 2030, the UNI token will rise to a maximum level of $34.87 (+445%), while it will also cost no less than $30.36 (+375%).

By 2030, forecasts at CoinLore become even more speculative, with ranges from $24.44 (+280%) as a minimum price for UNI coin to a high of $109.21 (+1,600%) at its peak.

Telegaon predictions estimate that in 2030 $UNI coin can hit $85.06 (+1,230%) at its peak. At its lowest point, it will cost no more than $71.06 (+1,000%) per coin.

Uniswap Coin Price Prediction 2040

As time horizons extend, market forecasts become increasingly speculative. CoinLore predicts that in 2040 Uniswap coin could trade at $6.12 (-5%) at its low or skyrocket to a whopping $376.71 (+5,800%) at its peak.

According to Telegaon, in 2040 UNI coin’s price will cost no less than $178.12 (+2,700%) or it can go to $201.33 (+3,000%).

Uniswap Price Prediction: What Do Experts Say?

Uniswap is undoubtedly a credible DEX among crypto investors, and they prefer UNI coins to invest in because of its market performance and solid reputation. Additionally, Uniswap continues to develop as a platform. There’s also speculation that the launch of Uniswap V4 could also signal a new chapter in the evolution of decentralized trading.

Far from being a routine upgrade, V4 represents a fundamental shift in how on-chain trading operates. At its core, it introduces a more advanced liquidity management system that gives liquidity providers finer control over how and where their capital is allocated. If the rumours are true, this leap in precision is expected to greatly improve capital efficiency, resulting in better pricing and reduced slippage for traders. Uniswap V4 will also unlock a new level of customization, empowering developers to build more sophisticated trading strategies and financial products. This added flexibility could spark the next wave of DeFi innovation, paving the way for entirely new types of decentralized applications.

Moreover, Uniswap is developing a Layer-2 solution called Unichain, aiming to improve the efficiency and scalability of Ethereum. In a recent tweet, Uniswap unveiled a new feature: the native yield on USDC, the U.S. dollar-pegged stablecoin issued by Circle. This comes alongside the launch of Spark Finance on Unichain, Uniswap’s Layer-2 network built using Optimism’s OP Stack, and has already led to an increase in the price of UNI coin.

This, along with more developments in the project, could signal the beginning of a new, more prosperous era for the platform. Because of its popularity, many experts generally view Uniswap as a promising long-term asset within the DeFi space: for instance, experts at MEXC believe that in 2040 $UNI will hit $13 per coin as its all-time high.

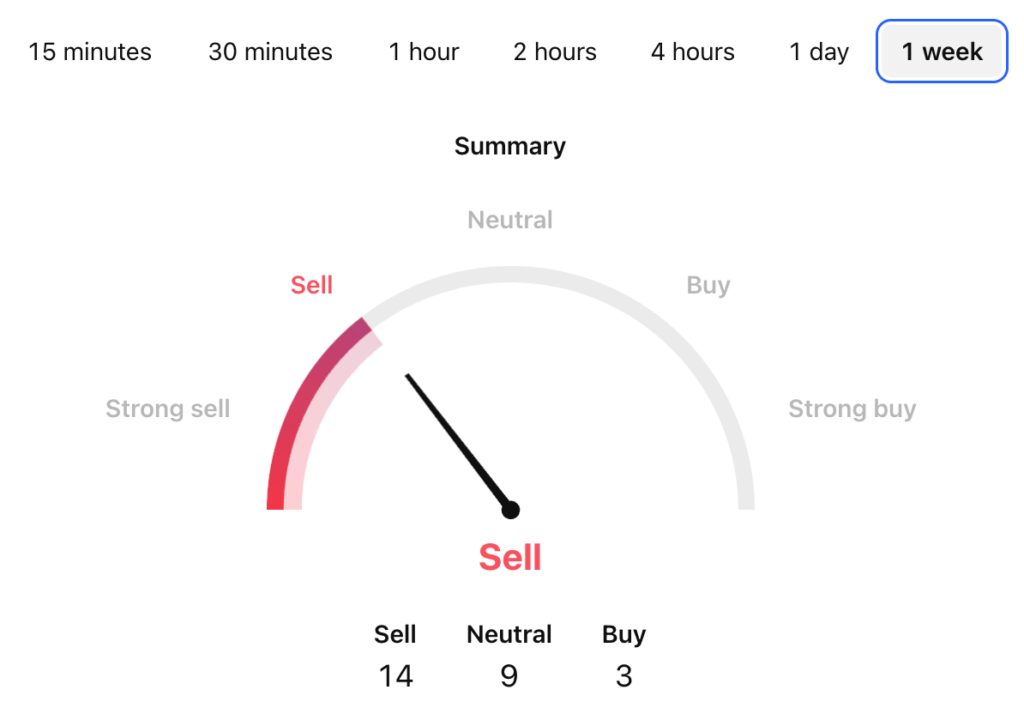

UNI USDT Price Technical Analysis

Tradingview, June 5, 2025

Now that we’ve covered a variety of forecasts for $UNI, let’s find out a bit more about the factors that can influence the price of this digital asset.

What Does the Uniswap Price Depend On?

Factors known to affect the price of Uniswap include market sentiment, project development, and upgrades, its demand and supply, as well as potential crackdowns on DeFi protocols. The price of Uniswap tokens can be greatly influenced by their movement into and out of exchanges since strong inflows could be an indication of selling pressure. Outflows, on the other hand, can indicate accumulation and future price hikes.

Moreover, the price can be influenced by introducing changes to the Uniswap protocol, advancements in technology, or adjustments to governance. In a similar vein, basic elements like market adoption, liquidity, and network usage are important. As a governance token, UNI gives holders the power to vote on key decisions, which adds to its value, especially as Uniswap continues to expand through upgrades like V4 and integrations with Layer-2 networks like Optimism and Arbitrum. Increased usage of the platform often leads to higher demand for UNI, contributing to price growth.

Risks and Opportunities

Uniswap presents a range of compelling opportunities for both traders and liquidity providers. As a decentralized exchange, it allows users to swap Ethereum-based tokens directly from their wallets, giving them full control of their assets. It also provides early access to newly launched tokens, often before they are listed on the centralized platforms.

Uniswap’s liquidity pools provide a unique chance for users to earn passive income by supplying token pairs and collecting a portion of trading fees. With the introduction of concentrated liquidity in Uniswap V3, providers can now earn even more efficiently by targeting specific price ranges. For those willing to provide liquidity, Uniswap offers the chance to earn a share of trading fees, potentially generating passive income. Its presence across multiple chains like Arbitrum, Optimism, and Polygon also gives users the flexibility to trade with lower fees and faster transactions.

Despite these advantages, there are notable risks to consider. Liquidity providers face the possibility of impermanent loss if token prices shift significantly. The open nature of Uniswap means anyone can list a token, which increases exposure to scams or low-quality projects. And while Uniswap remains one of the most popular DEXes on the market, it has also faced regulatory headwinds.

In April 2024, the US Securities and Exchange Commission sent Uniswap a Wells Notice, an initial notification. A Wells notice is a draft notification sent by the SEC outlining its initial determination to suggest that the commission take enforcement action against individuals who violate securities laws. No formal enforcement action has been taken publicly as of now. Nonetheless, when investing in UNI coin, it’s important to remember that in the future, Uniswap can be a target for regulatory bodies.

Is Uniswap a Good Long-Term Investment?

Uniswap can be considered a promising long-term investment due to its strong position as a leading DEX in the rapidly growing DeFi ecosystem. Its innovative automated market maker model, expanding presence across multiple blockchains, and ongoing protocol upgrades like V4 show a clear commitment to improving user experience and capital efficiency. Additionally, as DeFi adoption continues to rise, Uniswap’s role as a foundational platform could increase demand for its native token, UNI. However, like all crypto investments, Uniswap carries risks such as market volatility, regulatory uncertainties, and competition from other DEXs and centralized crypto exchanges. It’s important to do thorough research, consider your risk tolerance, and possibly consult a financial advisor before investing.

All in all, UNI may be a good long-term investment if you believe that Uniswap will become one of the most used decentralized exchanges on the market. As one of the pioneering decentralized exchanges in the DeFi sector, Uniswap has demonstrated consistent growth and innovation.

Does Uniswap Have a Future?

Uniswap seems to have a strong future ahead. As one of the first and most popular decentralized exchanges, it has established itself as a key player in the DeFi ecosystem. With continuous innovation and its expansion across multiple Layer-2 networks, Uniswap is well-positioned to meet the growing demand for fast, low-cost, and secure decentralized trading. Moreover, the broader shift toward DeFi and increased user interest in trustless, permissionless platforms bodes well for Uniswap’s continued relevance and growth. While challenges like competition and regulatory changes exist, Uniswap’s active community, strong developer support, and proven track record suggest it will remain a strong player in the field. However, $UNI can be a suitable investment for investors with high risk tolerance as investing in such speculative assets can lead to financial losses.

What Is Uniswap Used For?

Uniswap is a DEX that allows users to trade cryptocurrencies directly from their wallets without intermediaries, using automated liquidity pools instead of traditional order books. It enables permissionless token swaps, liquidity provision, and decentralized trading with self-custody, making it a cornerstone of DeFi. Additionally, Uniswap supports new token listings without approval, fostering innovation in the crypto space while maintaining transparency through smart contracts on Ethereum and Layer-2 networks.

Is Uni a Good Crypto?

Uniswap’s role as one of the largest and most trusted decentralized exchanges gives UNI solid real-world utility and long-term relevance. That said, like all cryptocurrencies, UNI comes with risks, including market volatility, competition, and regulatory uncertainty. If you believe in the future of DeFi and decentralized trading, UNI can be considered a good crypto to hold or explore.

What Was Uniswap’s Highest Price?

Uniswap hit its all-time high of $44.97 on May 03, 2021.

What Is the Current Price of UNI?

At the moment, its price hovers around $6.5.

How Many UNI Coins Are There?

UNI has a total supply cap of 1 billion tokens.

Can Uniswap Reach $20?

Uniswap reaching $20 is definitely within the realm of possibility, especially considering its strong position in the DeFi space and ongoing innovations.

Will UNI Coin Reach $50?

UNI coin could reach $50 in a strong bull market, especially if Bitcoin surges past $100K, Uniswap implements fee-sharing for stakers, and DeFi adoption grows. All these factors previously drove its all-time high near $45.

Can Uniswap Hit $100?

Uniswap’s UNI token reaching $100 is ambitious but not impossible. Hitting such a price level would require a massive surge from current levels, likely needing a massive bull market, major protocol upgrades (like fee-sharing or UNI staking rewards), and explosive DeFi growth surpassing previous cycles.

Will Uniswap Reach $1,000?

Reaching $1,000 per UNI token is extremely unlikely in the foreseeable future. Such a price would imply a market capitalization rivaling or surpassing some of the largest companies or even entire national economies, which is a huge leap given the current size and scope of the DeFi market.

Will Uniswap Skyrocket?

Uniswap has skyrocketing potential if key catalysts align. These may include a major crypto bull run, the activation of fee-sharing for UNI stakers, and dominance in Layer-2 trading volume, and more. Many experts, such as CoinLore, believe that by 2040 Uniswap can hit $377 at its peak.

What Will Uniswap Be Worth in 2025?

DigitalCoinPrice experts think that in 2025 Uniswap will go as high as $14.

Where Will Uniswap Be in 5 Years?

DigitalCoinPrice analysts believe that in 2030 Uniswap will peak at $35.

What Is the Price Prediction for Uniswap in 2040?

Telegaon experts think that in 2040 Uniswap will reach a maximum of $201.

What Is the Uniswap Price Prediction for 2050?

According to Telegaon, in 2050 Uniswap will cost a whopping $413 at its all-time high.

Conclusion

As one of the pioneering forces in decentralized finance, Uniswap continues to push the boundaries of what’s possible in the crypto space. With ongoing innovations like Uniswap V4 and expansion into Layer-2 networks, the platform is poised to deliver faster, cheaper, and more efficient trading experiences. Its strong community, growing adoption, and commitment to decentralization make Uniswap not just a leader today, but a key driver of DeFi’s future. For anyone looking to explore the potential of decentralized trading, Uniswap offers an exciting gateway to a more open and accessible financial world.

Where to Buy UNI Crypto?

StealthEX is here to help you buy Uniswap (UNI) if you’re looking for a way to invest in this cryptocurrency. You can buy UNI privately and without the need to sign up for the service. StealthEX crypto collection has more than 2000 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy Uniswap Coin? Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to UNI.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

crypto price prediction price analysis price prediction UNI UniswapRecent Articles on Cryptocurrency

No KYC for Buying Cryptocurrency on StealthEX

No KYC for Buying Cryptocurrency on StealthEX  XDC Price Prediction: Will XDC Crypto Reach $10?

XDC Price Prediction: Will XDC Crypto Reach $10?