How to Invest in Web3: Unlocking the Benefits of the Decentralized World

Are you curious about investing in web3 and looking for some guidance on what to consider before taking the plunge? You may be asking yourself: What is web3 and why should I invest in it? What should I do first? No worries! We’ll break down the ins and outs of how to invest in web3 to remove the uncertainty from your shoulders and equip you to make a well-informed decision.

Disclaimer: This article does not constitute investment advice, nor are any assets mentioned recommended investments. It is important to be aware of the risks associated with crypto assets before investing.

Article contents

- 1 What Is Web3?

- 2 What Are Some Examples of Web3 Technology?

- 3 How to Invest in Web3 Step-By-Step

- 3.1 Step 1: Decide on Your Investment Strategy – Passive or Active

- 3.2 Step 2: Choose Your Assets – Decide Which Investments You’re Going to Make

- 3.3 Step 3: Identify Risk Factors – Choose the Assets that Fit Your Risk Tolerance

- 3.4 Step 4: Review and Adjust – Keep an Eye on Your Portfolio and Make Needed Adjustments

- 4 A Summary on How to Invest in Web3

What Is Web3?

Perhaps you’re here because your friends told you about web3 and said it’s cool. You may have also read articles online that say it’s something exciting, with a lot of companies investing in it. But do you know exactly what web3 is?

Certainly, a smart investor keeps up with the market waves, but even more important is to dig deeper into the industry to find out if an investment is worthwhile. In the end, your money is too hard-earned to put it at risk in something you don’t know. Do your own research and make sure you understand the technology before investing. Take into account what others say, but don’t rely solely on it.

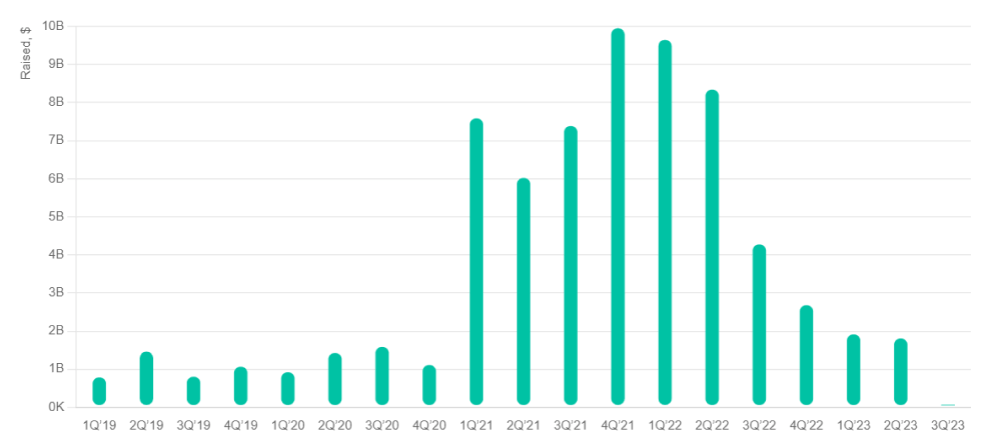

Indeed, web3 still looks attractive to investors, even with artificial intelligence taking the spotlight and regulatory pressure mounting. Web3 startups raised $1.9 billion in Q2 2023, according to Crunchbase’s data.

Source: crunchbase.com

So what does web3 mean? Essentially, it’s the new world wide web based on blockchain technology. Today’s internet, or web2, is primarily focused on user-generated content, social networks, and cloud computing, whereas web3, also known as Web3.0., focuses on decentralization, transparency, and accessibility, as well as censorship-resistance.

Web3’s main focus is on shifting control from big companies to users, creating a more open and equitable web, where everyone has a voice.

What Are Some Examples of Web3 Technology?

Web3 in itself is not a technology, but blockchain technology at its core presents the concept of a decentralized internet, bringing new innovations to the table.

NFTs

NFTs, or non-fungible tokens, are a good example. NFTs enable individuals to claim ownership of digital art and other assets. A digital piece of art or music can be turned into an NFT and sold through NFT marketplaces, for instance. The artist can then take a share of the sales proceeds in the form of cryptocurrency.

The NFT market is huge – just last month, Blur topped the DappRadar list in terms of 30-day trading volume ($536.69 million!), followed by OpenSea ($164.54 million) and Magic Eden ($30.1 million). The average cost of an NFT on these marketplaces is $2,500, $70.85, and $480.22, respectively.

| Market | Average Price | Traders | Volume |

Blur Blur | $2.5K | 44,699 | $536.69M |

OpenSea OpenSea | $70.85 | 320,963 | $164.54M |

Magic Eden Magic Eden | $480.22 | 31,592 | $30.1M |

UniSat UniSat | $390.07 | 13,597 | $24.43M |

Immutable X Marketplace Immutable X Marketplace | $67.12 | 26,302 | $23.89M |

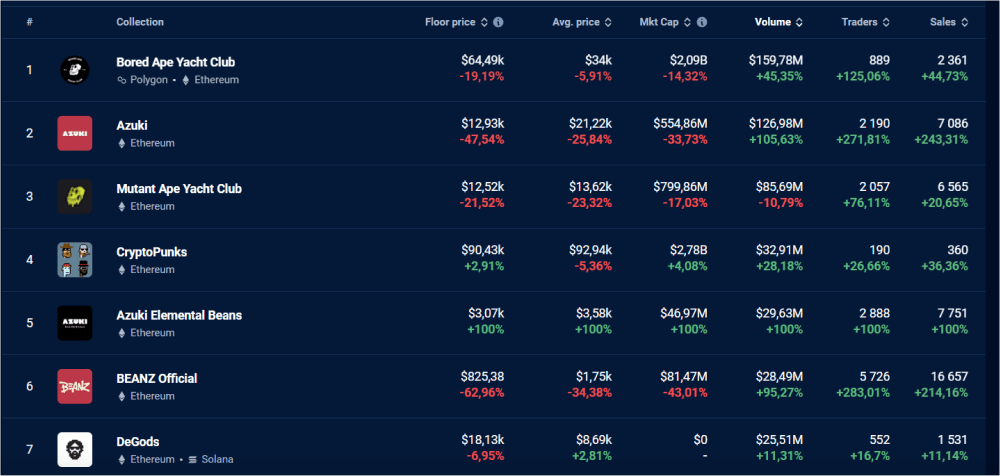

If you’re looking for the most popular NFT collections of the month, Azuki, Beanz Official, and Azuki Elemental Beans are three of the hottest. Their sales skyrocketed over the past 30 days, increasing by 243.31%, 100%, and 214.16%, respectively.

Source: DappRadar

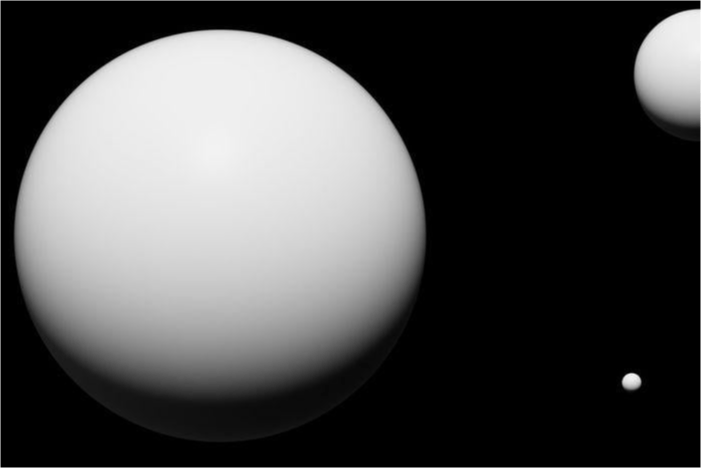

Have you ever wondered what’s the most expensive non-fungible token (NFT) collection ever sold? Known as Merge, it is Murat Pak’s dynamic non-fungible token (NFT) collection designed to commemorate Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus. Launched in December 2021, the Merge NFT raised an astonishing $91.8 million within 48 hours, making it the highest priced non-fungible token (NFT) artwork ever sold as well as the most expensive work ever sold on the open market by a living artist.

Merge by Pak. Source: niftygateway.com

It is clear from these figures that NFTs have become enormously popular in recent years, offering direct exposure to the crypto world and allowing investors to tap into the growing market of digital assets.

Smart Contracts

Smart contracts are a central component of web3, which are self-executing digital contracts built on blockchain, which power tasks ranging from processing financial transactions to managing decentralized autonomous organizations (DAOs). As the agreement terms are directly incorporated into the code and exist in a decentralized blockchain network, the transaction environment is transparent, tamper-proof, and secure.

How to Invest in Web3 Step-By-Step

As you now have a better grasp of what web3 and blockchain technology are, let’s explore web3 investing in more detail.

- Step 1: Decide on your investment strategy – Passive or active

- Step 2: Choose your assets – Decide which investments you will make

- Step 3: Identify risk factors – Choose the assets that fit your risk tolerance

- Step 4: Review and adjust – Monitor your portfolio regularly and adjust it if necessary

First, decide if you’ll be a passive or active investor. Next, choose the assets that fit your risk tolerance, and monitor your portfolio consistently, making any necessary adjustments. As we move through this section, we will examine each step in greater detail.

Choose StealthEX for Exchange and Buy Crypto

- User-Friendly — Simple and minimalistic interface for everyone.

- Fast and Private — Instant non-custodial cryptocurrency exchanges.

- Buy crypto with Credit Card.

- 1200+ coins and tokens are available for limitless, quick and easy exchanges.

- NO-KYC crypto exchanges — Buy cryptocurrency up to €700 without KYC!

- StealthEX crypto exchange app — Process crypto swaps at the best rates wherever you are.

- 24/7 Customer Support.

Earn from Each Exchange by Joining StealthEX Affiliate Program.

Become a partner right now and use affiliate tools:

- Public API — Earn from your wallet, aggregator, or exchange terminal.

- Referral Links — Recommend StealthEX to your audience.

- Exchange Widget — Built crypto exchange widget on any page of your website.

- Button — A perfect choice for traffic monetization.

- Banner — Track conversion and stats right in the personal cabinet.

Step 1: Decide on Your Investment Strategy – Passive or Active

Now that you’ve got the basics down, let’s quickly review the terminology and the different strategies available.

What Is Active Investing?

If you’re an active investor, you’ll seek out investments with rapid growth potential or those that can yield attractive dividends over a medium term. In order to decide when to buy and sell, you’ll likely use market indicators, technical analysis, fundamental analysis, or even artificial intelligence.

What Is Passive Investing?

A passive investor typically engages in a buy-and-hold strategy to generate passive income. This involves making less frequent investments and usually investing in the same assets over time. If you have specific investment goals, you can also take advantage of dollar-cost averaging, which means investing the same amount of money consistently regardless of price fluctuations.

Is It Possible to Mix Active Investing with Passive Investing?

Absolutely. You can use a hybrid strategy, which combines active investing with targeted passive investing, giving you the best of both worlds.

Step 2: Choose Your Assets – Decide Which Investments You’re Going to Make

There are many different types of web3 assets. We’ve listed a few of the most popular ones below.

Cryptocurrencies

Cryptocurrencies are digital assets that can be used as a means of exchange or a store of value on the crypto market.

It is possible to hedge against inflation and earn passive income through digital assets with ahigh market cap such as Bitcoin, Ethereum, Solana, Litecoin, and others.

These digital currencies are highly liquid, which means they can be exchanged into cash quickly and easily. Their decentralized nature makes them a good investment choice for a diversified portfolio, in part because they are not controlled by governments or central banks. These digital assets function as a viable alternative to traditional banking systems, letting you send, receive, and store money without having to go to the bank.

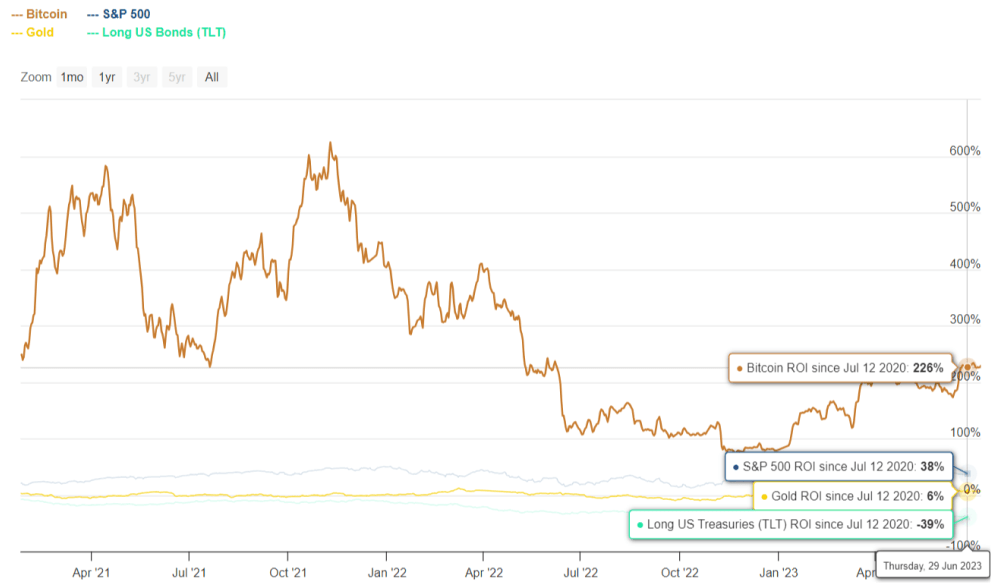

Bitcoin & Traditional Assets ROI (vs USD)

Investing in Bitcoin has been an extremely successful venture over the past few years, with returns significantly exceeding the S&P 500 and Gold. For example, over the past 8 year period, the returns for Bitcoin have been an incredible +10,521%, compared to the S&P 500’s +112% and Gold’s +70%. A traditional bank savings account won’t offer you that much!

| Bitcoin | Gold | S&P 500 | |

| 1 year: | +54% | +13% | +17% |

| 2 year: | -7% | +8% | +2% |

| 3 year: | +228% | +2% | +41% |

| 4 year: | +182% | +39% | +48% |

| 5 year: | +388% | +58% | +60% |

| 6 year: | +1,236% | +61% | +82% |

| 7 year: | +4,539% | +46% | +108% |

| 8 year: | +10,521% | +70% | +112% |

| 9 year: | +4,794% | +48% | +126% |

| 10 year: | +33,028% | +52% | +166% |

The following graph shows that Bitcoin has significantly outperformed the S&P 500, Gold, and US Treasuries during the past three years, providing evidence of how it can generate significant returns in a relatively short time frame.

Source:Casebitcoin.com

Tokens

Do you know the difference between a cryptocurrency and a token? The two are not the same, regardless of how similar they may seem. A crypto coin is a form of currency, whereas a crypto token represents an ownership interest in an asset and facilitates blockchain transactions.

What Types of Tokens Are There?

| Token type | Purpose |

| Equity tokens | The tokens represent equity in an underlying asset, which is recorded on the blockchain. It is usually a stock or equity in a company or property. The main difference from traditional stock ownership is the registration on a blockchain versus a database or paper certificate. |

| Utility tokens | Utility tokens are digital assets that are designed to be used within a specific ecosystem. They are typically used to purchase goods or services within the network, but can also be used to access certain features or functions. They are often issued by startups to raise capital for their projects. |

| Asset-backed tokens | Tokens backed by assets function similarly to IOUs in the digital world. In this case, the tokens are backed by something physical, like gold, paper money, art, or gemstones. Using the token, users can claim an underlying asset from a specific issuer. |

| Governance tokens | Decentralized protocols are rapidly evolving, forcing their decision-making processes to adapt as well. The purpose of governance tokens in blockchain-based voting systems is to signal support for and to vote on proposed changes. |

| Non-fungible tokens (NFT) | NFTs are unique digital assets that can represent a range of things, such as music, digital art, in-game items, and virtual properties. They can either be a digital asset or a tokenized version of an asset in the real world. “Non-fungible” denotes the irreplaceability of an item. There is no direct exchange of a non-fungible item for another item of the same value since their characteristics are different. |

Crypto Lending Platforms

On these platforms, you can lend your tokens to borrowers in exchange for interest payments. Lending crypto is possible on centralized and decentralized platforms. After some major centralized lending platforms collapsed, many crypto holders began to feel uneasy about using them, choosing instead decentralized finance (DeFi) platforms. In decentralized finance, users can participate in financial services in a secure and transparent way without being dependent on centralized systems.

Amid current crypto lending conditions, lenders can earn APYs ranging from 1% to nearly 15%, with some of the strongest returns offered by DeFi platforms.

Airdrops

An airdrop is a way of distributing tokens to a large audience for free. Airdrops are typically used to increase exposure and create awareness for the project. They also help to build excitement and encourage people to engage with the project further.

Crypto Mining

Technically, mining isn’t an investment, but it can still be rewarding. The blockchain mining process rewards you for verifying transactions. As web3 continues to evolve, mining is becoming more and more profitable. If you want to get the most out of your investment, be sure to look into the details as mining requires a considerable investment in hardware.

Play-to-Earn (P2E)

As an added bonus for those looking to have a bit of fun, there are play-to-earn and play-and-earn models for blockchain games where you can earn digital assets as you play. Once you earn them, you can exchange them for fiat currency or use them to purchase items from in-game stores.

Step 3: Identify Risk Factors – Choose the Assets that Fit Your Risk Tolerance

When investing in crypto assets, identifying risk factors is essential to ensure you are comfortable with the amount of risk you are taking. Making an informed investment decision requires you to consider the volatility, the liquidity, and the security of the asset.

Volatility refers to the fluctuation of an asset’s value, which makes it important to determine how risky an investment is.

When an asset is liquid, it can be bought and sold easily on the market. Liquid assets usually have more buyers and sellers, making entering and exiting the market easier and faster.

Step 4: Review and Adjust – Keep an Eye on Your Portfolio and Make Needed Adjustments

It can be extremely rewarding and enjoyable investing in web3 – just make sure you don’t throw all your eggs into one basket. Spreading out your risk can be achieved by investing in a variety of asset classes and by continuously tweaking your investment strategy. By doing so, you can avoid taking on too much risk, while still raising your chances of success.

A Summary on How to Invest in Web3

Web3 offers a wide range of investment opportunities that come with potential rewards as well as risks. Nevertheless, with the right research and understanding, web3 investments can be a great way to build wealth and take your financial journey to the next level!

decentralized finance invest in crypto investing web 3 web3Recent Articles on Cryptocurrency

Crypto News: Trump Media Approved, Cardano's Bitcoin Bridge, XRP's Ethereum Plans

Crypto News: Trump Media Approved, Cardano's Bitcoin Bridge, XRP's Ethereum Plans  Arbitrum Price Prediction: Is ARB Crypto a Good Investment?

Arbitrum Price Prediction: Is ARB Crypto a Good Investment?