Recap of Exclusive AMA: Alchemix Crypto x StealthEX

On June 2, 2022, we had StealthEX & Alchemix crypto AMA session in our Telegram Community Chat, and here is a recap. Just take a little time to read through and learn everything you need about Alchemix coin.

Welcome everyone to our AMA session, thank you all for coming 🙌

Today we are delighted to be joined by @Ov3rkoalafied, a contributor to Alchemix. Huge thank you for taking the time to respond to the questions of our community 🤝

We will start off with a round of questions from Twitter, with the chat being turned off. Once it is finished, we will proceed to the round of live questions, where I will turn the chat back on for a few minutes to let you ask your questions.

Ov3rkoalafied: Hello! Happy to be here!

Ben Frost, StealthEX: It’s a pleasure to have you! First off, could you please tell us a couple of words about Alchemix for all the uninitiated members of our community? 🙂

Ov3rkoalafied: Yes! Alchemix is a self repaying loans platform. At its core, we allow you to deposit ETH or stablecoins. You can then take a loan in alETH (from ETH), or alUSD (from stablecoins), up to 50% of the value you deposit. You are then able to spend your loan however you want. In the meantime, your full deposit continues to earn yield, which is used to repay your loan.

Ultimately, this allows users to spend & save at the same time!

Ben Frost, StealthEX: This ultimately sounds like a dream come true!

Alright, without wasting any time, let’s jump right in the first question from Twitter, in no particular order:

Q1: In terms of learning more about the project usability, are there Youtube channels, and learning videos on social media pages where we can learn from?

Ov3rkoalafied: Yes! We have a how-to guide here. A youtube channel here with videos. We also have a newsletter that goes more in-depth into current events/developments.

Additionally, I encourage anyone who wants to learn more in-depth to join our discord community. It’s incredibly helpful – it’s rare someone asks a questions that goes unanswered for more than a few hours

Ben Frost, StealthEX: Yes, a Discord community is essential for understanding the ins and outs of a project, especially when there are members that are willing the help the “newbies”!

Q2: How do you make your platform safe for investors, and is it secure against hackers? And what happens if Alchemix is hacked, compromising its sensitive information of Alchemix? Is Alchemix up to the task?

Ov3rkoalafied: Great question! There are a few considerations here. First off, Alchemix v2 was audited by Runtime Verification, see here for more information.

Runtime verification was involved in the entire process, which gave them a very deep understanding of our system. They have audited some top-notch crypto and non-crypto projects, including working with Ethereum and NASA. Runtime Verification continues to audit many of the additional features we are adding to Alchemix. Additionally, we just ran an audit competition through Code4rena, and have a constantly running bug bounty competition running with ImmuneFi with a $500k bounty for any critical vulnerabilities that are reported. We take security very seriously as we are aiming to build over years to come. Sometimes this means sacrificing development speed – which can be discouraging when other protocols are shipping left and right during a bull market and generate a lot of hype by taking shortcuts. But with all the hacks and bugs in DeFi resulting in lost funds and failed protocols, we believe it’s necessary to ensure long term success.

As for the hack question – we have numerous levers and controls in place that we can use to limit the damage of a hack. For example, we can limit how much of a specific collateral type is allowed, how much total collateral users can deposit, we can also pause the system if something goes wrong. If Alchemix is hacked and loses funds, the community would need to vote to determine if and how to make users whole.

Users should note that DeFi is still new and has a lot of risks, and Alchemix is even newer (just over one year old). Additionally, Alchemix builds on other DeFi protocols, so it’s possible that a user loses funds due to those protocols failing, not just Alchemix. Users need to understand these risks when evaluating how they plan to use Alchemix and other DeFi protocols. DeFi is still very new!

Ben Frost, StealthEX: Wow, that is quite a substantial bounty for all the ethical hackers to consider! I believe you are taking the security aspect of the platform very seriously. Also having the predetermined measures to combat the potential issues is great!

Q3: Adoption is one of the most important factors that all sustainable blockchain projects should focus on to be more attractive in the investors’ Eyes. Can you tell me what #Alchemix has done & plan to do to achieve adoption in reality, real use cases & our real society?

Ov3rkoalafied: I believe Alchemix is well positioned to break into the real world due to the offering of loans that can’t be force liquidated (the reason you can’t be liquidated is because we offer loans in like-kind assets. Ie, when you deposit ETH you take a loan in alETH, so your debt doesn’t care about the price of ETH, just how much alETH you owe back). Many other lending protocols have liquidations, which requires users to monitor market prices. Not everyone wants to spend all their time thinking about crypto – some people just want to put their money somewhere useful and forget about it. Alchemix offers this option, by allowing users to spend and save at the same time without risk of liquidation. This is an improvement on the accessibility and functionality of similar products that were previously only available to high net worth individuals.

We have started to publish some use cases of alchemix. Our youtube channel does a great job at breaking down how you can use Alchemix in easy to digest videos.

We have advertised through bankless in the past (a podcast that often onboards a lot of new people to crypto).

We are starting to write more articles geared towards beginners.

We are working on a mobile-friendly version of the site. We are also discussing with other protocols that wish to integrate us, most recently (such as MoverDAO), which would give users multiple options on how they use Alchemix. Lastly, we have one of the most helpful discord communities out there – which is imperative in helping more users to understand and be comfortable with using Alchemix. Nothing beats personalized answers to questions!

Q4: What is the utility of your native token $ALCX? Also, what special features do you have or plan to implement that keep you ahead of your competitors?

Ov3rkoalafied: Currently, the token is only used for governance. ALCX emissions are used by the DAO (ie, the Alchemix community/team) in order to grow Alchemix. This does mean that currently, the ALCX token is the classic “valueless governance token”.

This will be changing with the tokenomics update. The vision was recently revealed.

The community feedback was positive, and therefore development work has begun. The primary features of the new tokenomics are:

- ALCX holders will be able to lock up ALCX for a period of time up to 4 years (locked ALCX is called veALCX, or vote-escrowed ALCX) in order to receive boosted yield on their loans. They can elect to receive the boosted yield in the form alETH or alUSD credits to an Alchemix account. This means if they have an outstanding loan, it will be paid off faster! If the user does not have an active loan or account, they will still receive alETH or alUSD credit that they can mint.

- Alchemix has a sizable treasury with some power over how rewards are distributed to various liquidity pools in DeFi. The new tokenomics will allow users to control these rewards, giving ALCX holders some power to direct rewards to themselves(if they are deposited into those liquidity pools) or others.

- The release of Alchemix v2 enables us to more efficiently add new features to Alchemix. This lets us quickly develop new features while having a very strong baseline of security. This should enable us to speed up development time, while not sacrificing the importance of security (as mentioned in a previous question). Since launching v2 in March, we’ve already added yield strategies for stETH and rETH!

The most successful defi protocols over multiple years are firstmost the ones that survive, and that’s why security is so important!

Ben Frost, StealthEX: The tokenomics update sounds like a massive step forward, looking forward to it! And yes, the security in crypto cannot be understated at this moment, so it is very reassuring to hear that it is being focused on so heavily.

Q5: What are your major goals to achieve in the next 2-5 years? Where can we see you in this period? What are your plans to expand and gain more adoption?

Ov3rkoalafied: The release of Alchemix v2 makes it significantly easier to add features to Alchemix – this was actually the primary purpose of v2. Some major goals include: multichain support (currently on fantom, targeting arbitrum, optimism, and zksync, potentially others), additional collateral types (currently USDT, USDC, DAI, and ETH), Additional yield strategies. As mentioned we already added rETH and stETH. We are looking at adding the strategies listed here.

In addition to expanding the functionality of Alchemix proper, we also want to expand our integrations! Other protocols were not able to build on Alchemix v1, but with Alchemix v2 this is now possible. This lets other protocols build on top of and tap into Alchemix (such as MoverDAO). We have numerous ideas for how Alchemix, as well as alETH and alUSD, could be integrated into other aspects of DeFi. A simple idea would be self-repaying ENS domains, or self repaying Gitcoin donations!

The primary obstacle in scaling Alchemix is alAsset liquidity (ie, the ability for users to sell their alETH or alUSD for ETH or stablecoins). We are always looking for ways to improve this, including our heavy participation in the curve wars, our large position in Tokemak, finding new use cases for alAssets (so that users don’t need to sell them to use them), etc. It’s an ongoing process and DeFi is exceptionally exciting in that every month there seems to be some new breakthrough that lets us scale more efficiently.

Ben Frost, StealthEX: The possibility of other protocols to build on Alchemix V2 might be one of the most important updates IMHO! After all, crypto is supposed to be a tightly-knit community 🙂 Also having other collateral types sounds great.

Q6: What is the technology which is used by Alchemix for fast and scalable transactions? What kind of measures will be implemented to secure the chain with sharding and its security liabilities?

Ov3rkoalafied: Alchemix is a protocol built on blockchains (ie, Alchemix itself is not a chain). Alchemix is currently on Ethereum and Fantom, so those would be the technologies that we use. Alchemix’s home is on ethereum due to its reputation for security and longevity, as well as having the strongest DeFi ecosystem for us to integrate in to. However, we recognize many users are priced out of Ethereum. We currently have a deployment of Alchemix on Fantom (for alUSD only), and are looking to expand to Arbitrum, Optimism, and ZK in the future to give users more options to use Alchemix with lower fees.

Note that Alchemix assets (gALCX, alUSD, and alETH) can be bridged infinitely between the various non-Ethereum chains. However, the amount of assets that are bridged to ethereum cannot exceed the assets that have been bridged away. This significantly limits the risks that launching on other chains poses to the primary Ethereum home of Alchemix.

Ben Frost, StealthEX: Ethereum is great, but diversifying the available chains is a very sound idea, glad to hear that you are considering it! I guess the next question has been semi-answered already, however here it is 🙂

Q7: Alchemix has many valuable features, but the passive income system is one of the issues that users care about. How will it be possible for #Alchemix users to earn passive income on the platform?

Ov3rkoalafied: No problem – it’s a good question and it gives me the chance to give one of my favorite examples that helps people understand the power of Alchemix!

Alchemix is built on top of passive income strategies that earn yield for users, such as Yearn Finance. The difference is Alchemix lets you take an advance on your future yield from these strategies. Ie, a user can choose to deposit to yearn, OR they can choose to deposit to yearn through depositing to Alchemix.

Here’s my favorite example comparing the options: Let’s say someone named Fred has $10,000 in a savings account. When the savings account hits $10,500, Fred wants to buy a puppy for $500 (they don’t want the account to go below $10,000). Fred decides to look into moving the account to DeFi. Let’s say Fred can earn 5% yield in yearn.finance. Fred also notices he can use Alchemix, which also gives him 5% yield, but lets him take a loan on his money. Let’s compare scenarios:

- If Fred deposits the $10,000 to yearn, then in one year he will have $10,500. Fred can withdraw $500 and buy a puppy. Now Fred has a puppy and $10,000!

- What if instead Fred deposited to Alchemix? Fred could deposit $10,000, then take a loan for $500. He can buy the puppy TODAY. Over the next year, Fred’s loan will repay – after 12 months he will still have his $10,000, and his originally $500 loan will be $0 (since it got self-repaid!). Just like in the first scenario, after 1 year Fred still has $10,000 and a puppy. The difference is that Fred got to his puppy a year early! Alchemix allowed him to spend AND save his money, leading to more puppy time for Fred.

- Even better, since Alchemix lets you take a loan at 50% LTV, what if fred instead takes a loan for $5000? He can use $500 to buy a puppy, and then he can use the other $4500 to put back in the bank to reduce his risk in crypto, or he could use it elsewhere in DeFi to earn more yield to buy the puppy even sooner!

There are some nuances that aren’t covered in this example, but I think it does a great job of explaining the benefits of Alchemix.

Ben Frost, StealthEX: The Fred example made it really easy to understand the beauty of Alchemix, great analogy! I’m sure our community will appreciate such an easy to understand the comparison

Q8: Do you allow suggestions and feedback from the community? Are we allowed in decision-making, do you put the community into consideration?

Ov3rkoalafied: 100% Yes!

Alchemix is a DAO which welcomes suggestions, comments, feedback, as well as governance proposals from the community. The community certainly has power within Alchemix. You can see a list of proposals voted on, and in some cases written by the community.

I actually became an official contributor to Alchemix by originally by writing educational content, governance proposals, and helping new users. Anyone can show up to discord and ask questions or contribute!

Q9: What are the benefits of holding your token as a long-term investment? Can you tell us about the motivation and benefits for investors to keep your token in the long run?

Ov3rkoalafied: Yeah – I think the new tokenomics cover it quite well, here’s the article in case anyone missed it.

I think the main benefit of the tokenomics is that now they will now align the success of Alchemix with the ALCX token.

To go along with the previous question – the tokenomics shown here are not 100% guaranteed to be the same when we release them. Part of being a DAO means we release information very early on in the process, that way we can get community feedback while it’s still early enough to implement changes. That also means the devs are still working, so thing may change as they get into the weeds. Joining the community is truly a way to get an insight and have an impact on how Alchemix functions.

Obviously it’s also up to the individual to conduct their own analysis on all the risks / rewards / possibilities associated with a token when assessing its expected value.

Q10: How do you plan to spread awareness of your project in different countries/regions where English can’t be used well? Do you have a community approach for them to better understand AlchemixFi?

Ov3rkoalafied: Great question – this is one we certainly hope to get better at in the future. We do have some community members that offer educational content on Alchemix in other languages here and there, but we do not have anything official at this time. We have begun efforts to provide multi-language

Ben Frost, StealthEX: support on the Alchemix website. If any community members wish to aid Alchemix in spreading awareness in languages other than English or translating the website, feel free to reach out in the community discord. Alternatively, you are welcome to make content and share it in the discord without asking us – we have been known to provide retroactive tips to helpful community members!

Ben Frost, StealthEX: It sounds like you have an amazing community built around the project, I will make sure to drop by your Discord 🙂

Q11: Revenue and adoption are the main points of all projects, can you tell us your Business model and How Alchemix generates revenue? And what makes Alchemix unique compared to other projects?

Ov3rkoalafied: Fantastic question. I’ll answer the second part first. I mentioned how our lack of liquidations makes it easier for us to jump into the mainstream. Additionally, there really aren’t that many other projects out there doing self-repaying loans, and many of the ones that are were inspired by or recieved some advice from us! We have continually been able to remain at the forefront of self-repaying loans due to our knowledge, community, team, and treasury. We also offer advice and help to projects that wish to fork us in return for a share of their project – this way we can continue to benefit from the growth of our idea and other projects can tap into our knowledge.

For revenue, we have a few sources:

- When a user deposits with us, we do NOT charge a withdrawal or deposit fee. However, we do take a 10% cut of all yield generated. Ie, if a user deposits $1,000, and earns 5% yield ($50), we would take $5 of that.

- This is a bit complex, but assets like alUSD and alETH are overcollateralized (ie, fully backed) by DAI/USDC/USDT and ETH. There are mechanisms in place for users to redeem alUSD and alETH for USD and ETH. However, when the protocol is healthy, users don’t need to redeem these alAssets as often. This creates a large buffer of ETH and DAI that is sitting their idle. We use this ETH and DAI to yield farm to generate revenue for the treasury

- We also have some other miscellaneous sources of revenue, but those are the primary ones! I’ll also plug alchemix-stats here, a great website by a community member with a lot of good info about Alchemix. It’s continually evolving and will have more information about revenue at some point.

Ben Frost, StealthEX: The fact that you are not gatekeeping the technology and expertise but rather share it with similar projects is honestly admirable! And the monetization sounds beyond reasonable, thanks for the clear answer 🙂

Alright, that was it for the Twitter part! Now I will turn the chat on to let the questions accumulate. Once there are enough questions, I will turn the chat back off. You just need to select a couple of questions you liked the most and take your time to reply to them 🙂

Live Questions

Q1: Every successful project has a few stories behind it, what is the story behind Alchemix success? What was that vision when it first appeared as an idea?

Ov3rkoalafied: Alchemix started as an idea from a group of friends that had an idea. They built it out together over the course of many months, then eventually launched it as Alchemix v1. Fun fact – it was originally a different product, called cheese.fi! But they realized the idea didn’t work, and had to go back to the drawing board. Now that same group was able to shift focus full time to alchemix after the launch of v1, and expand the team to work on the always-expanding road map.

Q2: What security features will be implemented in Alchemix to prevent hackers from entering due to smart contract failures. How often are Alchemix checked for security vulnerabilities?

Ov3rkoalafied: We get all major modifications audited and continue to engage our auditors, runtime verification, on changes that we make to Alchemix. They understand our system very deeply, so it gives us confidence that they know what to look for.

Q3: Tell us about your plans for 2022, what Alchemix is doing right now and plans to expand the list of major exchanges?

Ov3rkoalafied: We are already listed on many exchanges! FTX, Coinbase to name a couple

Q4: I see many risks associated with DeFi, do you agree with that opinion? how to make Alchemix secure with DeFi?

Ov3rkoalafied: Yes, there are many risks, especially given how new it all is! Our large quantity of audits is one way we prioritize security. We also aim to educate users and not try to hide behind the fact that DeFi is risky. Lots of rewards to be had, but plenty of risk too. As usual users should not put all their eggs in one basket, both in what they invest in and the protocols they use!

Q5: What do you think about the future of the Metaverse and do you think in the long term will you follow the metaverse model to some extent?

Ov3rkoalafied: Alchemix isn’t a metaverse protocol but there are some people who want to create an RPG-style game on top of our governance platform. TBD if it ever gets built haha. Overall I’m not super clued into the metaverse.

Q6: I think the Alchemix project is still quite unfamiliar to everyone. Can you share more information and pictures about the project with everyone?

Ov3rkoalafied: Definitely check out the how-to guides and videos that I shared, and please do join the discord and ask questions if anything is unclear. The #media channel on discord also has a ton of helpful resources!

Q7: Many established projects are facing difficulties in CAPITAL AND VALUE. Do you think about a situation where Alchemix would also face the same thing?

Ov3rkoalafied: Yes – Even if we make no profit for the next couple years we have runway to survive (ie, pay for costs), and as the market conditions become clearer we are taking more steps to grow that runway. We’ve also taken steps to ensure a baseline amount of profit, related to various recent governance proposals.

Q8: If a competitor emerges today offering the same services as Alchemix, what will Alchemix do to keep your project and stay relevant?

Ov3rkoalafied: Our treasury as well as partnerships with other protocols, and deep knowledge of DeFi enables us to provide and source deep liquidity so that users are able to take loans and sell them for USD/ETH when desired. Anyone who forks us would need the treasury, knowledge, as well as understanding of the fairly complex smart contracts, and the incredibly helpful community, to rival us. That being said, there are tons of liquidatable loan platforms, so there is probably room for more self-repaying loan platforms. As more pop up, I think it’s important that we don’t dismiss them and instead learn from them to determine if they are doing anything differently, and if what they do differently is working better than what we do.

Q9: I want to support Alchemix project,tell us more about the Ambassador Program and in what ways can we participate?

Ov3rkoalafied: Join the discord – easiest way to get involved is to start chatting, ask questions, make sure you understand Alchemix – and then eventually you can be the one answering the questions or creating educational material in any language! It’s not especially official right now, but our community is very good about rewarding users who are frequently doing helpful things.

Q10: Do you have any plans to attract non-crypto investors to join your project? Because the success of a project attracts more investors who haven’t yet entered the crypto world. What are the plans to raise awareness about your project in the non-crypto space.

Ov3rkoalafied: Currently we are more interested in targeting non-crypto users to USE alchemix. It would be a bit disingenuous to try to attract users to invest in us who may not even understand crypto yet! But if they use the protocol and understand it, then decide to invest, that is a healthier path.

Overall just FYI I’m skipping a lot of the investment questions – I can’t tell you whether you should or shouldn’t invest in Alchemix. But I can help direct you to all the resources and questions on how Alchemix works, so that you can form your own opinion!

Q11: Lots of investors hit and run during the sale and sell session after listing on the first exchange, WHAT DO Alchemix say about this? How does Alchemix stop early investors from selling tokens?

Ov3rkoalafied: We’ve already been listed and been live for over a year. Additionally there no ALCX tokens that are currently locked (ie, no future “unlocks”)

Q12: Hey. Thanks for the amazing AMA🥰😍 Due to the recent situation in the market and because of what happened to LUNA , that was one of the the best currencies in the market, investors are afraid to invest in any currency and can not trust the projects easily, because they are afraid that this will happen again for other currencies!

My question is, what do you say to investors to trust the project? What do you have to say to gain the trust of investors?

Ov3rkoalafied: I think LUNA proved the importance for investors to not blindly trust a newer project and to attempt to do what they can to understand how it works. I would highly encourage anyone to read our audit report, it’s somewhat technical but would be a great place to start to figure out what other things you may want to try to understand.

I would also encourage investors to try to understand why LUNA failed, perhaps look into other projects that failed too. You may start to see similarities between failed projects, and new projects you find. Then look at ones that have been around for longer, see if you can spot anything that makes them stand out as more trustworthy.

Additionally, we’ll be reviewed on DeFiSafety in the coming days. Lastly, the longer a protocol survives, the more likely it is it’s secure (though this is not fully guaranteed!)

I will say that Alchemix held up quite well in the market crash and continues to function just fine, so that was a great stress test for us to continue to prove that it works!

Q13: Hi, i have question. Alchemix community has grown significantly. Can you elaborate how important is the community to Alchemix and how much it affect Alchemix in present and future? Vice versa, what Alchemix do for the community?

Ov3rkoalafied: The community is INCREDIBLY important to us. You CAN’T fork a community. So many people have grown to contribute to Alchemix in various ways, from writing the newsletter, to running DAOs, writing educational content, helping users with issues, etc. We can’t thank our community enough. We try to give back by frequently offering ALCX tokens to community members that are consistently helping. That’s where I started out, and look where I am now! 😉

Q14: It seems confusing when I look at the Alchemix ecosystem. Can you briefly introduce your ecosystem structure? What is the most prominent use case that you want the world to remember?

Ov3rkoalafied: I want the world to remember that you can deposit your money, and take a loan up to 50% of what you deposit. Your loan will repay itself over time, allowing you to spend your loan while your original deposit continues to earn you yield! It’s a juiced up savings account. Spend AND Save with Alchemix 🙂

Q15: Most DeFi projects especially those ones offering yield farming are driven up by hype and scarcity, so when the hype dies the project dies. What’s the key to sustaining Your Project yield farming?

Ov3rkoalafied: Quite frankly a lot of the Hype in DeFi has died – look at token prices, yields, all of them are far lower than they were. Did you know yield on USD when Alchemix launched was 40% APR?? Crazy, right! The good news is even at the current low token prices and low yields, ALchemix is continuing to function and users are continuing to take loans and earn their yield. When the “hype” projects die due to over-reliance on bullish markets, the ones that survive are the ones that can make it long term!

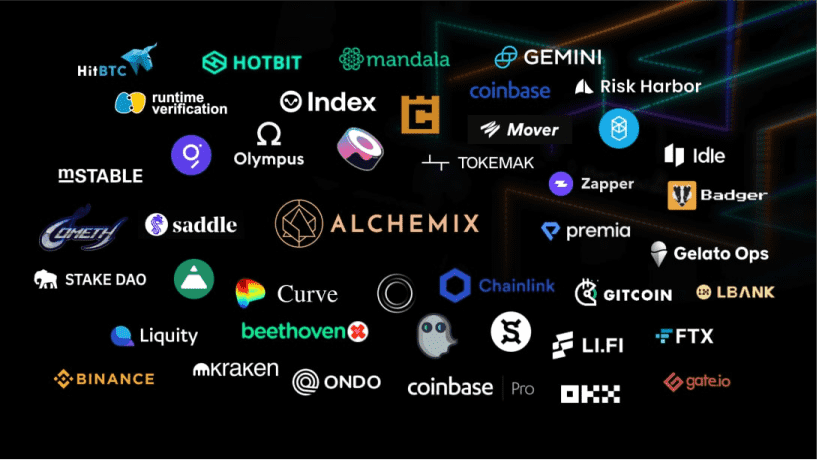

Q15: Partnership is always an important factor for every project. So who is your partner? What are the benefits you get from those relationships?

Ov3rkoalafied: Here’s a great graphic of some partners/exchanges/protocols we have worked with in varying capacities!

Q16: Does Alchemix have any: Telegram Group, YouTube channel, Tiktok Channel, Website? Please share with us the link.

Ov3rkoalafied: We DO NOT have a telegram. You can find our official links at the bottom of Alchemix under ‘social’

Q17: Did you consider community feedback/requests during the creation of your product in order to expand on fresh ideas for your project? Many projects fail because the target audience and clients are not understood. So I’d like to know who your ideal consumer is for your product?

Ov3rkoalafied: I believe the ideal consumer is someone who doesn’t want to deal with liquidations on their loans. This could be a newer DeFi user, or someone who wants a ‘safer’ place to park their money (smart contract risks nonwithstanding). Or it could be someone with a large amount of money that wants to borrow against it, but cannot accept any liquidation risk. This could be a high net worth individual, or even a project DAO

Q18: How do you overcome the threat of centralization in Alchemix? And what is the main difference between Alchemix and other platforms?

Ov3rkoalafied: Alchemix is a psuedo-DAO right now in that it runs through a multisig. Decentralization is also a risk if you do it too quickly (see things like beanstalk, etc). So it’s a balance of slowly decentralizing over time. We do have a long term goal of being fully on-chain decentralized.

Q19: DeFi is hot and currently using the crypto space, do Alchemix have any idea to develop DeFi in the platform?

Ov3rkoalafied: We are DeFi!

Ben Frost, StealthEX: And that was it!

Once again, a huge thank you to @Ov3rkoalafied for taking the time to respond to all these great questions! It was a thorough and informative deep dive into Alchemix crypto and I’ve personally learned a lot about the project 🙂

And don’t forget to check out the articles shared during the AMA 🙂

Thank you everyone for being here, and we hope that you enjoyed the AMA!

Also, just as recently mentioned, you can swap $ALCX on StealthEX exchange platform.

How to Buy Alchemix Crypto Coin?

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount for your exchange. For example, BTC to ALCX.

- Press the “Start exchange” button.

- Provide the recipient address to which the coins will be transferred.

- Move your cryptocurrency for the exchange.

- Receive your crypto coins!

If you have remaining questions about the StealthEX exchange service you can go to our FAQ section and find all the necessary information there.

Follow us on Medium, Twitter, Telegram, YouTube, and Reddit to get StealthEX.io updates and the latest news about the crypto world.

We are always ready to give you support if you have any issues with exchanging coins. Our team does our best to protect all members and answer their questions. For all requests message us via [email protected].

You are more than welcome to visit StealthEX exchange and see how fast and convenient it is.

Alchemix ALCX AMA crypto cryptocurrencyRecent Articles on Cryptocurrency

No KYC for Buying Cryptocurrency on StealthEX

No KYC for Buying Cryptocurrency on StealthEX  Aptos Price Prediction: Is APT Coin a Good Investment?

Aptos Price Prediction: Is APT Coin a Good Investment?