Review of the Crypto Market: June 16, 2023

Recent weeks have been rather quiet for the crypto market. However, everything changed when the SEC sued the Binance and Coinbase exchanges. Last week we could see a drop in the prices of BTC and ETH, but then there was a rebound. Now the situation looks much worse. The two largest cryptocurrencies record losses of 3.5 and 10%, respectively. What is affecting the case? Why is the cryptocurrency market falling? We invite you to join our weekly recap, where we analyze the prices of Bitcoin and Ethereum and the most important news from the crypto world!

Article contents

Bitcoin Price in USD This Week

Bitcoin has seen a nearly 4% decline over the past seven days. Back on June 9, it was oscillating around $27,000, but now the price of BTC is just above $25,500. Bitcoin even settled below the psychological barrier of $25,000 at one point

However, BTC’s situation is still okay. The king of cryptocurrencies is doing quite well if we compare it with other altcoins. This brought BTC’s dominance to 46%.

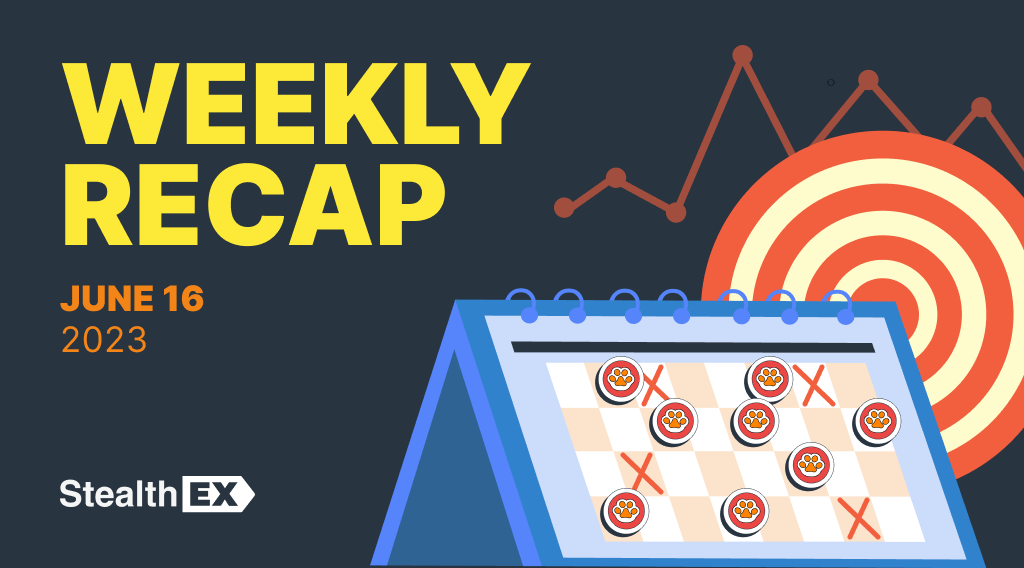

Like a week ago, the declines did not shake investor sentiment much. The Fear and Greed Index still indicates a neutral view. The index fell by only 3 points.

Ethereum Price in USD This Week

As for Ethereum, the project has lost its correlation with Bitcoin. Its chart looks completely different. Ethereum has lost almost 10% of its value over the past week, and today’s ETH price is $1669. Looking at the chart, we can see two massive red candles.

Nevertheless, quite a few other altcoins – those classified as securities in the SEC’s lawsuit against Binance and Coinbase – did worse than ETH. This brought Ethereum’s dominance of the overall market to 18.1%.

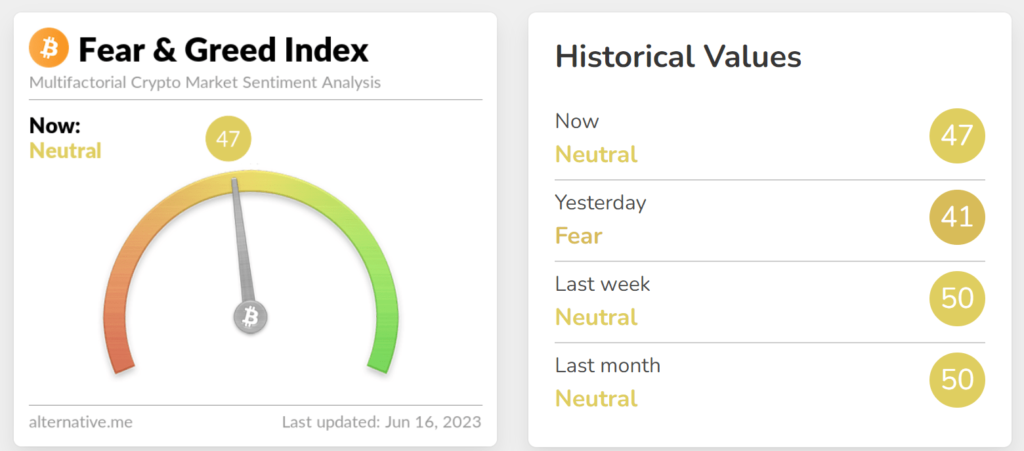

As for investor sentiment, it unexpectedly improved. Just a week ago, investors were showing signs of fear. Today, their attitude is neutral.

Biggest Crypto Gainers This Week

Bitcoin and Ethereum were not the only projects that saw losses last week. In fact, almost every crypto in the CoinMarketCap’s TOP100 saw a sizable drop. Projects that recorded gains can be counted on the fingers of a sapper and include only:

- Kaspa (KAS) – 35%

- Maker (MKR) – 3.3%

- KuCoin (KCS) – 3.3%

- Leo Token (LEO) – 0.8%

The rest of the projects that are not shining in the red are stablecoins linked to gold and the US dollar.

Crypto News of the Week

Now that we know the situation of the two largest cryptocurrencies on the market and which altcoins managed to end the week positively, it’s time to move on to the next section of this recap to analyze the most important news!

Hong Kong Invites Coinbase and Other Exchanges

The SEC recently sued two major cryptocurrency exchanges – Binance (Binance.US, to be precise) and Coinbase. The reason is that both companies allowed the trading of cryptocurrencies, which officials considered unregistered (read: illegal) securities.

Hong Kong is trying to take advantage of the situation. A member of the city-state’s Legislative Council, Johnny Ng, suggested on Twitter that he wants to support cryptocurrency exchanges such as Coinbase. In other words – he tweeted that such companies should move to Hong Kong.

His words are in line with what is happening in Hong Kong. Local authorities have announced that they are liberalizing their cryptocurrency policies. In January 2023, the city-state’s financial secretary, Paul Chan, told that the government wanted to lay the groundwork for a strong, healthy ecosystem of digital assets. On top of that, there have been legislative changes that, as of June 1 this year, allow exchanges to operate in this market. Hong Kong may become a cryptocurrency hub for China.

We Know the Results of Inflation and Interest Rates in the US

This week, we learned new data on inflation in the United States. In this field, we can see a clear decline.

The data for May showed a strong reduction in the dynamics of rising prices. Importantly, greater than economists had expected. Today, inflation in the US is already the lowest in two years.

The core consumer price index (CPI) fell to 4% year-on-year. The scale of the Fed’s success can be seen in the fact that a month earlier, the result was 4.9%. Inflation is thus falling for the 11th consecutive month and is the lowest since March 2021. The peak was registered in June 2022 at 9.1%, the highest reading in over 40 years.

Core inflation (excluding fuel and food prices) rose 0.4% month-on-month and 5.3% year-on-year.

Moreover, the Fed authorities left interest rates at current levels. Despite this, Bitcoin price responded to this good news with declines. Why? It is possible that the words of Jerome Powell, the Fed chairman, turned out to be crucial. During the press conference that followed the announcement of the decision, he said that the current freeze in the level of interest rates does not mean the end of the hike cycle.

The next meeting of the Fed authorities will take place in 41 days. Currently, most analysts assume that 25 bps will raise rates at it.

Ledger Tries to Fix Its PR and Discounts Wallets by 30%

In the second half of May, one of the most popular providers of crypto hardware wallets, the French company Ledger, suffered a serious branding mishap. It was about the new “Ledger Recover” option, which stirred up much controversy among users. Oil to the fire was added by a support employee, who suggested that the manufacturer could seize our private keys.

The violated PR has to be salvaged to maintain our leadership position in the sector (which, however, Ledger still enjoys), so the process of warming up the company’s image has begun. The CEO of the French manufacturer himself – Pascal Gauthier – has given a series of interviews in which he has tried to clarify all inaccuracies and answer controversial questions.

Recently, Ledger also announced a special promotion of -30% on Nano Color series devices. It applies to the NANO X and NANO S PLUS models.

Tether (USDT) Has Lost Its Peg to the Dollar!

Before noon (June 15), the price of the largest stablecoin was depegged from the US dollar. It fell to around $0.996, according to data from the CoinMarketCap platform. Now, USDT has recovered its lost value, rising to $0.998. What caused the situation?

The main reason for the USDT’s deviation from its peg (pegging the price to the USD) was an imbalance in the stablecoin pool 3pool Curve. It stores huge liquidity in three “stable” cryptos – USDT, USDC, and DAI. The increase in the “weight” of one of the mentioned stablecoins in this pool indicates intensive selling of this asset.

According to experts, the depeg from USD occurred after USDT’s weight in the 3pool Curve rose from 33.1% to over 70%. With a weight of around 73.8%, traders usually sell USDT for either DAI or USDC.

What was the reason for the imbalance? Well, a certain whale under the nickname CZSamSun is behind it. He borrowed USDT 31.5 million to then exchange it for USDC. This, in turn, led to a slight deviation in the value of stablecoin issued by Tether against the dollar. This user used 17,000 ETH and 14,000 stETH as collateral. He, in turn, converted the borrowed amount in USDT into USDC using the 1inch Network.

The borrower made payments to Aave v2 and v3 of $10 million and $21 million, respectively. He then borrowed USDT for $12 million from v3 and deposited it in v2.

Investors Withdraw BTC From Exchanges

BTC holders have intensively continued to withdraw their crypto assets from exchanges recently, according to data from analyst firm Santiment. The metric released by it measures the percentage of the total supply of Bitcoin held in the wallets of all centralized trading platforms.

When the value of the metric increases, it indicates that investors are sending Bitcoins to exchanges. In the opposite situation, there is a transfer of BTC outside such platforms.

The data presented shows uncertainty among holders of the leading cryptocurrency after the US Securities and Exchange Commission (SEC) attack on Binance and Coinbase. Faced with the lawsuits these exchanges have received, investors have begun to approach them distrustfully and withdraw their funds.

It should be noted that Bitcoins were leaving the centralized exchanges in large numbers before. This trend was evident in the wake of the collapse of FTX. BTC holders may have learned from the bankruptcy of this platform and bet on the “self-custody” of their cryptos.

StealthEX x PAWSWAP AMA

Last week a lot was going on in the crypto market but also with our partners, such as the PAWSWAP project. Therefore, we decided to hold an AMA session with the team. It will be held already on June 20 on the Twitter Spaces platform. If you have any questions about the project or its future, follow our social media so you can attend the event!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto crypto world Ethereum price analysisRecent Articles on Cryptocurrency

Top Monero Faucets to Earn Free XMR: A Comprehensive Guide

Top Monero Faucets to Earn Free XMR: A Comprehensive Guide  Crypto News Roundup: MonoSwap Hack, dYdX Attack, Ethereum ETFs

Crypto News Roundup: MonoSwap Hack, dYdX Attack, Ethereum ETFs