Top 10 Best Proof-of-Stake Coins: A Comprehensive Guide

Proof-of-Stake (PoS) is a consensus mechanism used on blockchains to verify and validate cryptocurrency transactions. Unlike Proof-of-Work, PoS uses less computational power and allows for faster transactions and processing than PoW, making it a more viable option as a consensus mechanism. You can read more about the differences in these two consensus mechanisms in our previous article.

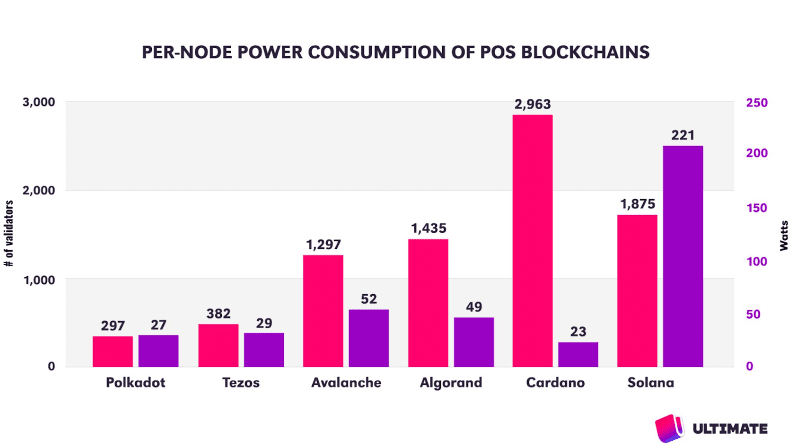

PoS projects have become more popular in the world of crypto. The gap in energy consumption between the Proof-of-Work and Proof-of-Stake consensus mechanisms is significant. For instance, it is projected that a Proof-of-Work network like Bitcoin uses over 99% more energy than a Proof-of-Stake network like Tezos, Polkadot, or Solana.

Source: Ultimate.app

Moreover, Proof-of-Stake coins are great when it comes to staking and earning rewards. In this article, we’ll discover the best Proof-of-Stake coins that can be considered a solid investment. The most relevant criteria for them will be their market capitalization, community support, technological innovation, potential for growth, and staking rewards.

Article contents

Top 10 Best Proof-of-Stake Coins

Here is a full list of the most prominent Proof-of-Stake coins on the market that includes a variety of projects with the most potential.

Ethereum (ETH)

Ethereum is a decentralized, open-source, and distributed computing platform that allows you to create smart contracts. This ‘next-generation web’ allows for dApps, DeFi, and DEXs. Ethereum is also the second largest cryptocurrency after Bitcoin, so it remains an attractive investment for many.

Its strong infrastructure, expanding usage, and planned improvements, such as Ethereum 2.0, which saw the transition from a Proof-of-Work to a Proof-of-Stake consensus algorithm, make it one of the leading PoS coins. Ethereum’s capacity to ease the development of a wide range of applications, as well as its thriving ecosystem, make it popular among developers. ETH has firmly established itself as a formidable presence within the cryptocurrency space, indicating its resilience.

Ethereum can be staked with a yearly yield (APY) of 5% in a variety of crypto wallets or on major crypto exchanges, including Coinbase. Some of the potential challenges you might face when investing in ETH include scaling issues, security threats, high gas fees, regulatory concerns, competition from other blockchains, and liquidity risk.

Solana (SOL)

Solana is a high-performance blockchain noted for its quick transaction times and scalability, it is a blockchain with striking similarities to Ethereum; in fact, it’s often referred to as an ‘Ethereum killer.’ The token’s real value is in conducting transactions on the Solana network, which has unique advantages. Powered by what’s referred to as delegated Proof-of-Stake algorithms, the main problem Solana is attempting to solve is Ethereum’s scalability issues.

Solana’s thriving ecosystem, developer-friendly architecture, and increasing usage make it a viable long-term investment alternative. Solana originated as a blockchain designed for decentralized banking, applications, and smart contracts. Its core architecture is based on a unique combination of hybrid Proof-of-Stake and Proof-of-History technologies that enable fast and secure transaction processing. Solana can be staked for rewards in many wallets and on many platforms, including Exodus, Atomic Wallet, and more. The regular APY is around 7%.

Solana stands out from other blockchains in terms of efficiency. However, investing in it carries some risks, including monolithic construction (leading to centralization) and problems with overall security.

Cardano (ADA)

Cardano has emerged as an early proponent of the Proof-of-Stake consensus method. Unlike Bitcoin, which uses competitive and energy-intensive problem-solving methodologies, Cardano’s Proof-of-Stake mechanism speeds up transaction processing.

Cardano is a major figure in the sector, functioning as a thought leader in establishing Proof-of-Stake consensus processes. ADA, Cardano’s native coin, provides a blockchain solution with lower fees and higher security than many of its competitors. The team behind Cardano revealed their future plans, and these include delivering solutions for legal contract tracing, voter fraud, and chain interoperability as well as an ecosystem of DeFi products.

ADA staking with 4% APY is available in a number of wallets as well as on crypto exchange platforms. Whenever investing in Cardano, make sure to keep in mind that it also carries some risks with it, including extreme wealth centralization, competition, and a too general purpose.

Polygon (MATIC)

Polygon with its native coin MATIC emerged as a Layer-2 scaling solution, or sidechain, to overcome this issue, resulting in speedier transactions and lower costs. It serves as a parallel blockchain to Ethereum, allowing users to connect their crypto assets and access a variety of popular crypto apps.

Polygon allows developers to build dApps, smart contracts, and other solutions. In essence, it’s a cheaper, faster, but Ethereum-aligned EVM-compatible chain. Low fees and near-instant transactions make the Polygon network an excellent way to gain some real-world experience trying out DeFi protocols.

MATIC rewards with 5% APY can be claimed, whenever you opt for staking in wallets, such as Atomic or Exodus, or on major crypto exchanges, such as Binance. When investing in MATIC, it’s best to be aware of the risks that come along with it, including a strong competition from other platforms and security tradeoffs.

Binance Coin (BNB)

The native token of the well-known Binance crypto exchange serves two purposes. First, as a means of exchange. Secondly, holding BNB gives a variety of benefits at Binance, like lower trading fees. The BNB currency is used as ‘gas,’ similar to Ethereum, to pay transaction costs.

BNB was initially launched as an ERC-20 compliant Ethereum token in mid-2017 through an initial coin offering (ICO). With the launch of Binance Chain, a decentralized exchange was constructed on top of the network, allowing consumers to retain custody of their assets. BNB staking can be done via Binance with up to 2% APY or in Atomic Wallet with 4.5% APY.

However, BNB does not come without its own risks. For instance, if the platform becomes less popular and traders move to platforms such as Kraken and Coinbase then BNB may be less in demand. Other potential challenges you might face when investing include hacks, centralization, and unsustainable scalability.

Hedera Hashgraph (HBAR)

Hedera Hashgraph is a ‘public-permissioned’ blockchain that aims to offer high throughput, fair ordering, and low-latency consensus in processing transactions. As a public permissioned ledger, anyone can deploy applications to the network, but only invited nodes can participate in the network’s consensus.

Hedera enables scale for dApps by delivering 10,000 tps, finality of transactions in under 5 seconds, fixed low costs of transactions (less than 1 US cent), and low energy consumption. The hashgraph consensus algorithm makes this possible as a leaderless consensus algorithm that prevents network downtime or outage.

HBAR staking can be done via Atomic Wallet with 0.5% APY. Like an investment in other crypto assets, an investment in Hedera Hashgraph includes volatility risk and liquidity risk, demand risk, forking risk, code defects, regulatory risk, electronic trading risk, and cyber security risk.

Algorand (ALGO)

Algorand is a Level-1 smart contract platform that uses an open-source, permissionless Pure-Proof-of-Stake (PPoS) blockchain system. ALGO was created with the goal of ensuring genuine decentralization, scalability, and security for industrial use cases.

The well-credentialed team and permissioned relay node architecture constitute an appealing mix for commercial and government use cases. Some time ago, the Marshall Islands revealed that they would use the Algorand blockchain to develop a national digital currency.

ALGO rewards with 4.7% APY can be claimed in Exodus wallet. When investing in Algorand, it’s vital to take notice of major investment risks, which include extremely concentrated token distribution in which >60% of the token supply is controlled by founders and private insiders, and centralization.

Polkadot (DOT)

Polkadot is a multi-chain platform that allows for interoperability between several blockchains. Its capacity to provide smooth communication and data transmission over multiple networks makes it an appealing long-term investment, particularly as the blockchain sector expands. Polkadot’s emphasis on scalability, security, and interoperability prepares it for long-term growth.

Polkadot allows developers to launch chains and applications leveraging a shared security model, without having to worry about attracting enough miners or validators to secure their own chains.

DOT is considered to be one of the most underestimated altcoins in the current bull run. To claim rewards on Polkadot, you can stake your tokens via MyContainer with 7% APY. Some of the challenges that may come with investing in DOT are strong competition, code vulnerabilities, resulting in hacker attacks, and a limited number of parachains.

Tezos (XTZ)

Tezos, a self-governing and self-amending blockchain platform for smart contracts and dApps, was introduced in 2018. The project attempts to enhance Ethereum and other smart contract platforms by including on-chain governance, Liquid Proof-of-Stake (LPoS), and formal verification.

Tezos offers a platform to create smart contracts and build decentralized applications that cannot be censored or shut-down by third parties. Furthermore, Tezos facilitates formal verification, a technique used to improve security by mathematically proving properties about programs such as smart contracts. This technique, if used properly, can help avoid costly bugs and the contentious debates that follow.

To claim rewards via staking, you can use Exodus staking with 5.72% APY or Atomic Wallet staking with 6% APY. On the downside, Tezos faces competition from new smart contracting platforms like Cardano, Polkadot, etc. Tezos also suffers from extremely high wealth concentration.

Avalanche (AVAX)

Avalanche is a PoS smart contract blockchain that aspires to outperform Ethereum as a platform for dApps in terms of speed, cost, and performance. Rather of using an existing traditional consensus mechanism, Ava Labs developed a novel consensus family called ‘Avalanche consensus,’ which claims to provide near-infinite scalability and sub-two-second finality. AVAX is used to stake, pay transaction fees, create subnets, and cast governance votes.

Avalanche Consensus has proven to have meaningful benefits compared to alternatives like Nakamoto Consensus (Ethereum) and Classical Consensus (Cosmos), especially in terms of security and time-to-finality.

Staking Avalanche is freely available with 6.54% APY via MyContainer. Some of the challenges that may come with investing in AVAX include scalability, centralization and a large portion of the supply (~33%) being controlled by the team and foundation. Avalanche’s solution to the inevitable scaling issues it’ll face are subnets, separate stand-alone blockchains, which face challenges around security, composability, and interoperability.

How to Buy PoS Coins via StealthEX?

Just follow the guidelines below; these will let you make a quick and efficient exchange via StealthEX. Let’s imagine you would like to exchange Ethereum (ETH) for Tezos (XTZ). To make an exchange through StealthEX, you need to take only a few simple steps.

- First, visit StealthEX and choose Ethereum in the left drop-down list. Then choose XTZ crypto in the list of coins on the right. After setting the pair, enter the amount of ETH you want to exchange. When everything is set, click on Start Exchange, and you will be taken to the next page.

- In the second step, you need to provide your XTZ recipient address. The recipient address must match the crypto you are going to receive. Remember to double-check the information you enter. As soon as you have carefully checked all the details, you can press the Next button and you will be redirected to the Confirmation page.

- Here you can revise the address provided and the amount of XTZ you will receive. Don’t forget to read and check the Terms of Use and Privacy Policy box. Without checking the box you will not be able to continue the exchange.

- When pressing the Next button, you will be redirected to the Exchange page. At first, you will see the address where you need to send your Ethereum to continue the exchange. StealthEX will also provide you with the exchange ID. It is recommended to save your exchange ID or the link to your exchange. As the exchange progresses, statuses will change: from Awaiting deposit to Confirming. This means that StealthEX is confirming the transaction you made. The next status is Exchanging. During this time the exchange is being made. Then the status will be changed to Sending to your wallet.

- Finally, you will be redirected to the Finish page. This shows that the exchange has been successfully made and you will receive crypto to the address provided. To be sure that XTZ crypto was sent to your wallet you can also use the Output hash shown on this page and check it in the blockchain list of transactions.

From here you can either create a new exchange on StealthEX or leave the page and check your XTZ wallet to appreciate how quickly this crypto was sent to your address. Usually, a Tezos coin swap is processed in a matter of minutes.

FAQ

Is Proof-of-Stake Profitable?

Proof-of-Stake can be advantageous for investors since validators can earn staking incentives for securing the network and validating transactions.

What Is the Safest Coin to Stake?

Many people believe that Ethereum is one of the ‘safest’ coins to invest in. As a well-established project with a substantial market capitalization, it’s a popular alternative for investors wishing to get into staking.

What Coins Are Using Proof-of-Stake?

Except for the top-10 listed in this article, popular PoS coins include:

What Tokens Have the Highest Staking Rewards?

Cosmos (ATOM) comes with 14.75% APY, Ontology (ONT) comes with 17.08% APY, and Osmosis (OSMO) comes with 11.75% APY.

What Are the Downsides of Proof-of-Stake?

Security issues, poor scalability, and centralization of power are the most common downsides for the PoS consensus mechanism.

How Is Cryptocurrency Staking Taxed?

If staking rewards are considered income, they are subject to income tax rates ranging from 20% to 45%. If they are regarded as capital gains, they are liable to capital gains tax, which ranges between 10% and 20%.

Conclusion

Proof-of-Stake (PoS) is a consensus mechanism that has various advantages over the older Proof-of-Work. It is more energy-efficient, accessible to the average user, and encourages validators to operate in the best interests of the network. However, it is not without flaws, including concerns about the possibility of centralization and the vulnerability to a ‘nothing at stake’ issue. Despite these difficulties, PoS is becoming a more common consensus mechanism.

Make sure to delve deeper into the topic of investment into PoS coins and explore their use cases and potential. In case you’d like to buy one or several cryptocurrencies that run either on PoW or PoS, you can always use StealthEX.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

best crypto Ethereum proof-of-stake proof-of-work SolanaRecent Articles on Cryptocurrency

Top Monero Faucets to Earn Free XMR: A Comprehensive Guide

Top Monero Faucets to Earn Free XMR: A Comprehensive Guide  Crypto News Roundup: MonoSwap Hack, dYdX Attack, Ethereum ETFs

Crypto News Roundup: MonoSwap Hack, dYdX Attack, Ethereum ETFs