Top 15 Best Altcoins to Buy Now: The Comprehensive Guide

What are altcoins? In short, these are alternative cryptocurrencies to Bitcoin (BTC), the first and oldest crypto. The term ‘altcoin’ is short for ‘alternative coin’. All cryptocurrencies that were launched after Bitcoin are considered altcoins. Some of them are not particularly old. This also implies that a number of altcoins that were in the top ten in terms of market capitalization in the early days of cryptocurrency are no longer present or are not as popular as they once were. As alternatives to Bitcoin, altcoins can act as more than mere digital mediums of payment; they may offer different features or benefits, such as faster transaction speeds, lower fees, improved privacy, or enabling smart contracts.

Altcoin season is a period when the prices of altcoins climb dramatically and outperform Bitcoin (BTC). Bitcoin, the largest cryptocurrency by market capitalization, accounts for the lion’s share of trading volume in the cryptocurrency market. The BTC/non-BTC (or altcoin) ratio is an important measure in market analysis. It’s appropriately titled ‘Bitcoin dominance.’ Bitcoin’s dominance was nearly 100% in the early days of cryptocurrency, but as altcoins gained popularity, that dominance waned. Nowadays, when altcoins collectively increase market capitalization and surpass BTC’s, it can signify the commencement of an altcoin season. But what altcoins can bring the most significant gains during the quickly approaching altseason? In this article, we’ll list the top 15 altcoins to buy based on their market cap.

Article contents

- 1 Altcoin Season

- 2 Best Altcoins to Buy Now

- 3 Altcoins FAQ

- 3.1 What Are the Best Altcoins to Invest in Now?

- 3.2 Which Crypto Can Give 1000x Soon?

- 3.3 Which Crypto Will Boom?

- 3.4 Which Altcoin Will Explode in 2025?

- 3.5 Which Coin is Best to Invest Now?

- 3.6 What Are the Top 5 Altcoins?

- 3.7 What Are the Top 10 Altcoins to Buy?

- 3.8 Which Altcoins Are the Future?

- 3.9 Which Altcoins Are Most Promising?

- 4 Is It a Good Time to Buy Altcoins?

- 5 Conclusion

Altcoin Season

Before we move to particular altcoins, let’s take a look at what may await us in the new altcoin season. According to renowned analyst Rekt Fencer, altcoin season might be around the corner. This optimistic outlook suggests it is now the time to select the right low-cap cryptocurrencies, aiming for the elusive 100x returns that many dream of.

Bitcoin’s entire share of the crypto market in terms of total value has been dropping since March, and altcoins have witnessed increasing interest in recent weeks. Cryptocurrencies with lesser market capitalization are less widely traded, making them more vulnerable to price fluctuations.

Altcoin valuations are mostly benchmarked against Bitcoin, which is why they tend to follow the price of the first cryptocurrency. This strong position gives Bitcoin significant influence over the broader market. Bitcoin is also frequently used to transfer fiat payments to cryptocurrencies. As a result, when Bitcoin is bullish, it can accelerate the flow of fiat money into the crypto market as a whole, potentially benefiting altcoins.

Moreover, a possible bull run can generate enthusiasm that spreads to the entire altcoin market. This is due in part to new or casual investors joining the market with Bitcoin and subsequently diversifying into altcoins, as well as an overall increase in market liquidity and trading volume. In addition, during the future altcoin season, it’s crucial to take into account market trends, technological advancements, regulatory changes, and global economic factors. All of this will greatly contribute to the crypto landscape and determine the prices for the upcoming bull run.

Best Altcoins to Buy Now

Here are the top 15 altcoins with high potential to explode in the next altcoin season:

Ethereum (ETH)

Ethereum is a decentralized, open-source, and distributed computing platform that allows you to create smart contracts. This ‘next-generation web’ allows for decentralized apps (dApps), decentralized financing (DeFi), and decentralized exchanges (DEXs). Ethereum is also the second largest cryptocurrency after Bitcoin, so it remains an attractive investment for many.

Its strong infrastructure, expanding usage, and planned improvements, such as Ethereum 2.0, which saw the transition from a Proof-of-Work to a Proof-of-Stake consensus algorithm, make it one of the leading altcoins. Ethereum’s capacity to ease the development of a wide range of applications, as well as its thriving ecosystem, make it popular among developers. Ethereum has firmly established itself as a formidable presence within the cryptocurrency space, indicating its resilience.

However, like any financial investment, it has its imperfections. To ensure you make an informed decision, here are some of the potential challenges you might face when investing in ETH:

- High volatility;

- Scaling issues;

- Security threats;

- High gas fees;

- Regulatory concerns;

- Competition from other blockchains;

- Liquidity risk.

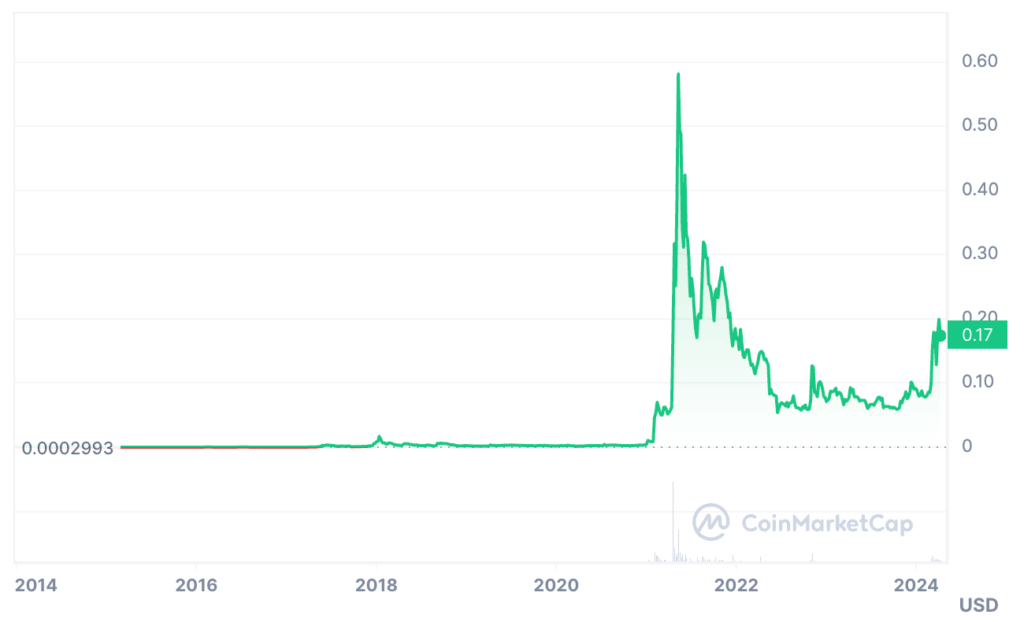

ETH Price Chart, Source: CoinMarketCap

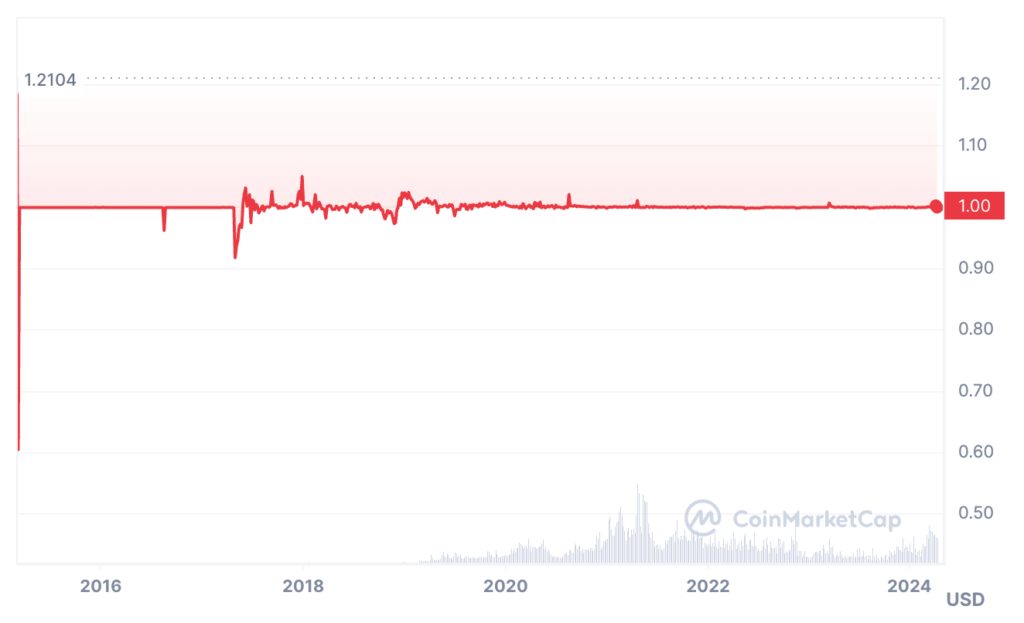

Tether (USDT)

Tether is a well-known brand in the stablecoin space, it is also the third largest crypto-asset in the crypto space behind Bitcoin and Ethereum. As the name implies, its price is fixed to the US dollar. In other words, one USDT always equals one American dollar. Tether provides rapid and smooth transfers between the US dollar and any cryptocurrency.

Theoretically, Tether should retain a value of around $1 at all times. This theoretical stability may facilitate transferring value between exchanges since Tether holdings are perceived as potentially more likely to retain a stable value when compared against other, more volatile, coins. However, stablecoins are not without risk. In May 2022 another stablecoin, Terra USD (UST) crashed. The price dropped from $1 to a low of just $0.3. Consequently, investors cashed out millions of dollars they had put into other stablecoins, including Tether. For a complete overview, here are the potential challenges you might face when investing in USDT:

- Security risk;

- Banking risk;

- Regulatory risk.

USDT Price Chart, Source: CoinMarketCap

Binance Coin (BNB)

The native token of the well-known Binance crypto exchange serves two purposes. First, as a means of exchange. Secondly, holding BNB gives a variety of benefits at Binance, like lower trading fees. The BNB currency is used as ‘gas,’ similar to Ethereum, to pay transaction costs.

BNB was initially launched as an ERC-20 compliant Ethereum token in mid-2017 through an Initial Coin Offering (ICO). With the launch of Binance Chain, a decentralized exchange was constructed on top of the network, allowing consumers to retain custody of their assets. However, BNB does not come without its own risks. For instance, if the platform becomes less popular and traders move to platforms such as Kraken and Coinbase then BNB may be less in demand. Other potential challenges you might face when investing in Binance Coin (BNB) are:

- Hacks;

- Centralization;

- Unsustainable scalability.

BNB Price Chart, Source: CoinMarketCap

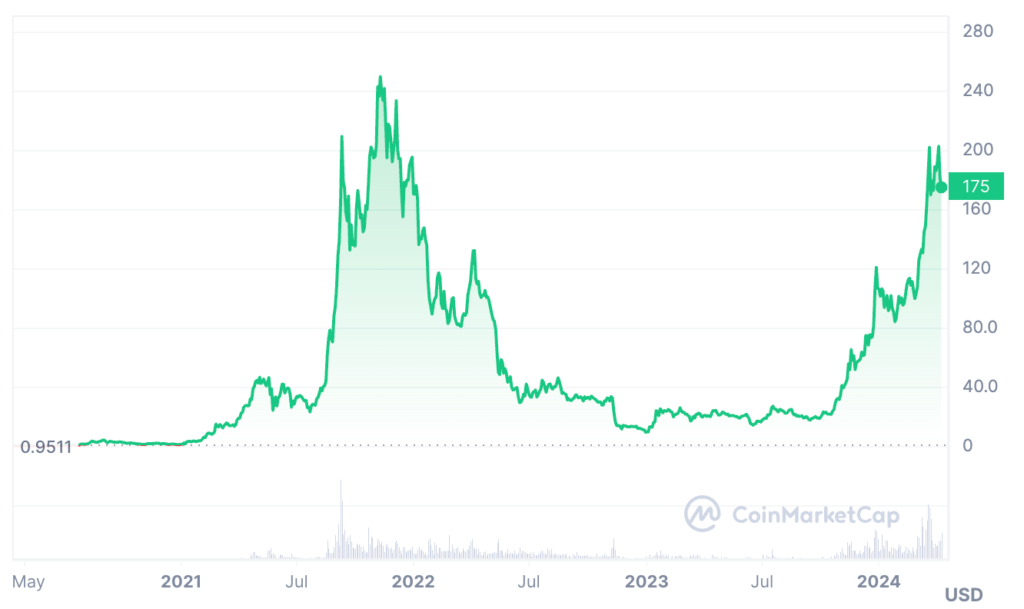

Solana (SOL)

Solana is a high-performance blockchain noted for its quick transaction times and scalability. Its thriving ecosystem, developer-friendly architecture, and increasing usage make it a viable long-term investment alternative. Solana originated as a blockchain designed for decentralized banking, applications, and smart contracts. Its core architecture is based on a unique combination of hybrid Proof-of-Stake and Proof-of-History technologies that enable fast and secure transaction processing.

Solana stands out from other blockchains in terms of efficiency. However, investing in it carries some risks. Among them, here are the challenges you might face when investing in SOL:

- Monolithic construction (leading to centralization);

- Problems with overall security.

SOL Price Chart, Source: CoinMarketCap

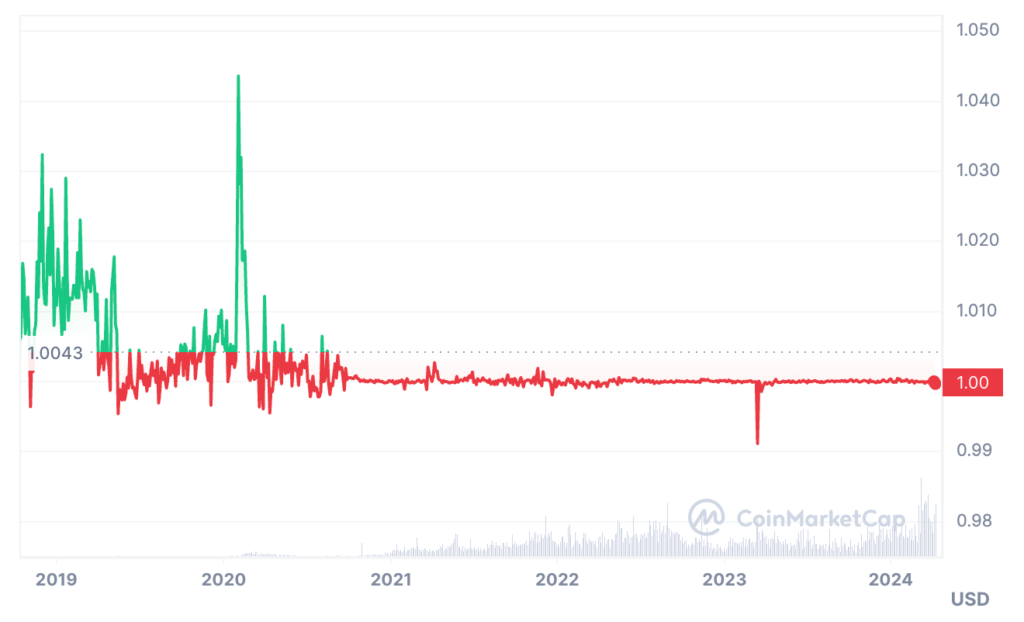

USD Coin (USDC)

USD Coin (USDC) is another asset-backed stablecoin. Its value is tied to the US dollar (USD). Every USDC token in circulation is backed by one US dollar in cash or cash equivalents, such as short-term US Treasury bonds held by regulated US financial institutions. USDC has accepted the ERC-20 token standard, which makes it compatible with all Ethereum-based apps.

USDC’s price predictability has helped it to act as a safe haven for cryptocurrency traders during times of market instability. USDC also allows for more efficient value transfers across borders in a stable digital currency than has been the standard in traditional finance. Some of the potential challenges of investing in USDC include:

- Centralization;

- Custody;

- Banking risks.

USDC Price Chart, Source: CoinMarketCap

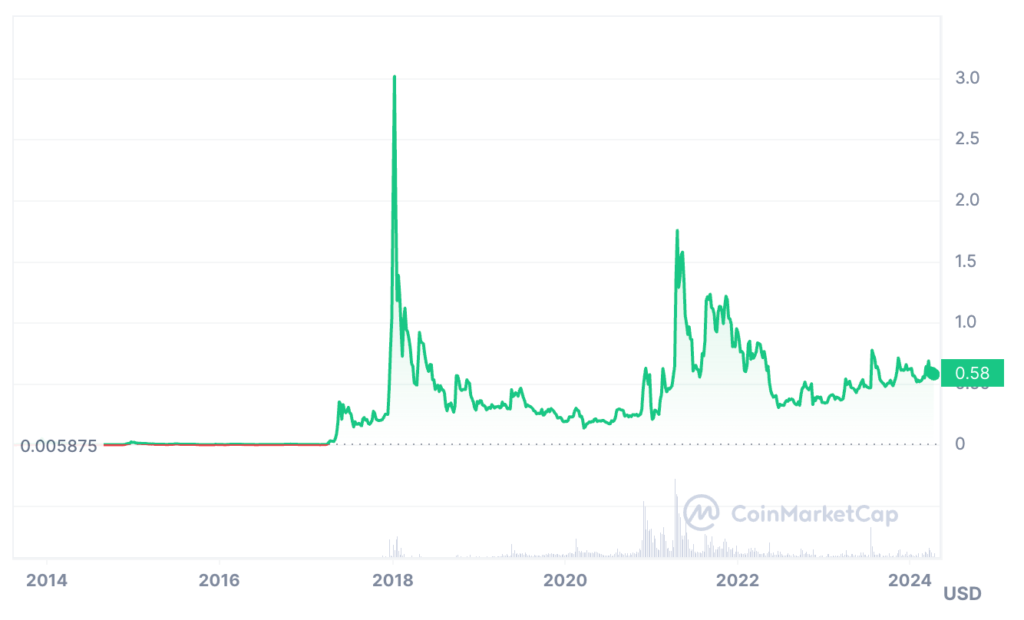

XRP (XRP)

Ripple (XRP) has been operating for more than a decade and is the oldest digital money on our list. It uses a proprietary consensus protocol. The ledger servers accept and transmit transactions. They compare data transfers and determine if the ledger should accept them. The server sends the data transfer candidates to validators, who record the ledger version if there are no errors in the transfer.

Both this asset and several of its executives had previously faced legal troubles, but they appear to be addressing them. XRP has cheap transaction fees and simplifies the trading of many currency kinds. Here are also some of the potential challenges you might face when investing in XRP:

- Lack of mining;

- Unfavorable government regulations;

- Banking risk;

- Not censorship-resistant;

- Increased competition.

XRP Price Chart, Source: CoinMarketCap

Dogecoin (DOGE)

Dogecoin has earned cult status in the worldwide crypto community as a result of its quick rise to prominence and endorsements from Elon Musk. It is the first cryptocurrency to emerge from an Internet meme, but it has since gained a reputation as a ‘tipping’ currency. Users began tipping video creators on Twitch and YouTube immediately with Dogecoins rather than worthless upvotes, likes, and retweets.

The power of this coin lies in its user base. It will likely remain popular for as long as people find it funny and convenient. However, like all cryptocurrencies and meme coins, DOGE comes with its own risks. For a more informed decision, here are some of the potential challenges you might face when investing in DOGE:

- Extreme wealth centralization;

- Less reliable;

- Higher volatility;

- Lack of development.

DOGE Price Chart, Source: CoinMarketCap

Cardano (ADA)

Cardano has emerged as an early proponent of the Proof-of-Stake consensus method. Unlike Bitcoin, which uses competitive and energy-intensive problem-solving methodologies, Cardano’s Proof-of-Stake mechanism speeds up transaction processing.

Cardano is a major figure in the sector, functioning as a thought leader in establishing Proof-of-Stake consensus processes. ADA, Cardano’s native coin, provides a blockchain solution with lower fees and higher security than many of its competitors. The team behind Cardano revealed their future plans, and these include delivering solutions for legal contract tracing, voter fraud, and chain interoperability as well as an ecosystem of DeFi products. Whenever investing in ADA, take into consideration the following risks:

- Extreme wealth centralization;

- Competition;

- Too general-purpose.

ADA Price Chart, Source: CoinMarketCap

Toncoin (TON)

Toncoin is the native cryptocurrency used on the Open Network blockchain. Open Network is a Layer-1 blockchain that uses the Proof-of-Stake (PoS) consensus process. Toncoin was created to meet the needs of millions of users while also allowing them to conduct transactions conveniently.

TON cryptocurrency is mostly used by investors, as it focuses on giving a comfortable manner for everyone to connect with the coin, as well as simple integration via an easy application. Ton has a block time of 5 seconds, with a time-to-finality of under 6 seconds. The cross-shard communication is near-instantaneous. To ensure you make an informed decision, here are some of the potential challenges you might face when investing in TON:

- Legal concerns;

- Coin’s manipulability.

TON Price Chart, Source: CoinMarketCap

Avalanche (AVAX)

Avalanche is a blockchain platform that uses a novel Proof of Stake (PoS) mechanism to handle the blockchain’s trilemma of scalability, security, and decentralization. Avalanche is an open-source decentralized system that is based on smart contract operations This blockchain is said to be the first smart contract platform that can finalize transactions in less than a second. The network has the potential to process over 4,500 transactions per second, making it one of the fastest blockchains on the market.

Avalanche provides a high-fidelity, high-security network that balances transaction speed and cost-effectiveness while remaining user-friendly and reliably decentralized. A number of challenges you might face when investing in AVAX include:

- Scaling issues similar to Ethereum;

- Large portion of the supply (33%) is controlled by the team and foundation.

AVAX Price Chart, Source: CoinMarketCap

Shiba Inu (SHIB)

Shiba Inu is yet another meme coin that appeared on the market in August 2020. It gained prominence after its founder handed part of the token supply to Ethereum co-founder Vitalik Buterin. Buterin destroyed 90% of these coins, generating huge interest and major growth for SHIB. The initiative is still focused on improving the network.

For example, it is working on Shibarium, a Layer-2 network designed for Ethereum. Shibarium aims to create a safe and scalable network for SHIB token holders to send and receive SHIB. Some potential challenges you might face when investing in SHIB:

- High volatility;

- Speculative nature;

- Slow adoption.

SHIB Price Chart, Source: CoinMarketCap

Polkadot (DOT)

Polkadot is a multi-chain platform that allows for interoperability between several blockchains. Its capacity to provide smooth communication and data transmission over multiple networks makes it an appealing long-term investment, particularly as the blockchain sector expands. Polkadot’s emphasis on scalability, security, and interoperability prepares it for long-term growth.

Polkadot allows developers to launch chains and applications leveraging a shared security model, without having to worry about attracting enough miners or validators to secure their own chains. To ensure you make an informed decision, here are some of the potential challenges you might face when investing in DOT:

- Strong competition;

- Code vulnerabilities, resulting in hacker attacks;

- Limited number of parachains.

DOT Price Chart, Source: CoinMarketCap

Tron (TRX)

Tron enables developers to create dApps and provides digital content providers with maximum ownership rights through tokenization and dApps. This project purchased BitTorrent and integrated it into its system.

Tron has a robust developer community and supports smart contracts. Its network is easily scalable, and data transfers are economical. The TRX coin serves two functions: creating and validating blocks in the network, as well as trading and investing. For a better understanding, here are some of the potential challenges you might face when investing in TRX:

- High volatility;

- A ‘copy and paste’ of Ethereum code.

TRX Price Chart, Source: CoinMarketCap

Chainlink (LINK)

Chainlink is a decentralized oracle network that connects smart contracts to real-world data and external APIs. Its novel approach to bridging the gap between blockchain and real-world applications has piqued the interest of major corporations, establishing it as a viable long-term investment choice. As development on Layer-1 and Layer-2 blockchains progresses, developers increasingly rely on Chainlink to retrieve data from the outside world.

In addition to refining its staking mechanism, Chainlink has released a suite of new features and services. As smart contract technology penetrates legacy systems, Chainlink may benefit from increased adoption and the potential growth of the crypto industry and DeFi usage as a whole. Here are some of the potential challenges you might face when investing in LINK:

- Limited network;

- Overall complexity of the project.

LINK Price Chart, Source: CoinMarketCap

Polygon (MATIC)

Polygon emerged as a Layer-2 scaling solution, or sidechain, to overcome this issue, resulting in speedier transactions and lower costs. Polygon serves as a parallel blockchain to Ethereum, allowing users to connect their crypto assets and access a variety of popular crypto apps.

Polygon allows developers to build dApps, smart contracts, and other solutions. In essence, it’s a cheaper, faster, but Ethereum-aligned EVM-compatible chain. To ensure you make an informed decision, here are some of the potential challenges you might face when investing in MATIC:

- Strong competition;

- Security tradeoffs.

MATIC Price Chart, Source: CoinMarketCap

Altcoins FAQ

What Are the Best Altcoins to Invest in Now?

According to Coinpedia, it might be a good idea to take a look at Solana, Polygon, EtherLite, yPredict, and 5thScape.

Which Crypto Can Give 1000x Soon?

Binance has come up with a few ideas, including Pepe, Arbitrum, and Litecoin.

Which Crypto Will Boom?

Economic Times lists Dogecoin, Filecoin, and SEI among the best alternatives to look out for.

Which Altcoin Will Explode in 2025?

Ethereum may continue to thrive and rise in price as it is one of the crypto hubs with a well-developed ecosystem and a myriad of projects under its roof.

Which Coin is Best to Invest Now?

It is impossible to predict which coin would make the best investment choice, however, analyzing top 10 cryptocurrencies by their market cap can help you make a sound investment decision.

What Are the Top 5 Altcoins?

Binance lists Solana, Sui, Siacoin, ApeMax, and Celestia as alternative coins that can rise in price in the coming months.

What Are the Top 10 Altcoins to Buy?

According to Benzinga, these are Ethereum, Solana, Dogecoin, Binance Coin, Avalanche, Chainlink, Uniswap, Render, NEAR Protocol, and Optimism.

Which Altcoins Are the Future?

According to Forbes Advisor, some of the most promising ones are Ethereum, Solana, Cosmos, Kaspar, and Stellar.

Which Altcoins Are Most Promising?

According to Binance, these are Litecoin, XRP, Dogecoin, Shiba Inu, and Wolrdcoin.

Is It a Good Time to Buy Altcoins?

The altcoin season has not yet started, so it may be a good moment to add some new assets to your portfolio. If you have a strong conviction to buy, buy and hold. If you don’t have strong conviction, don’t buy or, if you are holding, then you should sell, else you may be more likely to panic sell, which is always a bad thing.

Conclusion

Despite their distinct use cases, altcoins’ prices frequently correlate with Bitcoin’s movements due to its widespread existence. Bitcoin serves as a valuation benchmark, reserve asset, and fiat onramp, therefore its price signals have an impact on investor sentiment, liquidity, and altcoin pricing.

Nonetheless, in the future altcoin season altcoins might deviate from Bitcoin’s trajectory when they provide compelling utility or shift market favorability, highlighting the crypto ecosystem’s multifaceted and fluid character. It’s up to the savvy investor to decide which of them are going to make up their portfolio. In case you’d like to buy one or several of the best altcoins, you can always use StealthEX.

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, BTC to DOT.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

altcoin altcoin season altcoins Ethereum investmentRecent Articles on Cryptocurrency

GoPlus Security Price Prediction: Will GPS Coin Reach $1?

GoPlus Security Price Prediction: Will GPS Coin Reach $1?  OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?