What Is Slippage in Crypto Trading – How to Avoid It?

Cryptocurrency or crypto trading refers to the act of speculating on cryptocurrency price fluctuations through a contract for difference (CFD) trading account or buying and selling the underlying coins through an exchange. There are several things one must know before starting trading, and one of them is slippage.

When trading cryptocurrency, you’ve probably noticed that trade orders don’t always execute at the exact price you want. Sometimes the order will execute at a higher price, and other times it will execute at a lower price. This is referred to as price slippage.

Article contents

Slippage in Trading

Traders typically trade with predetermined prices in mind. You will not open a chart setup and trade without a reason or aim in mind. Whether you’re purchasing or selling an asset, you want to do so at a specific price, which isn’t always achievable due to slippage.

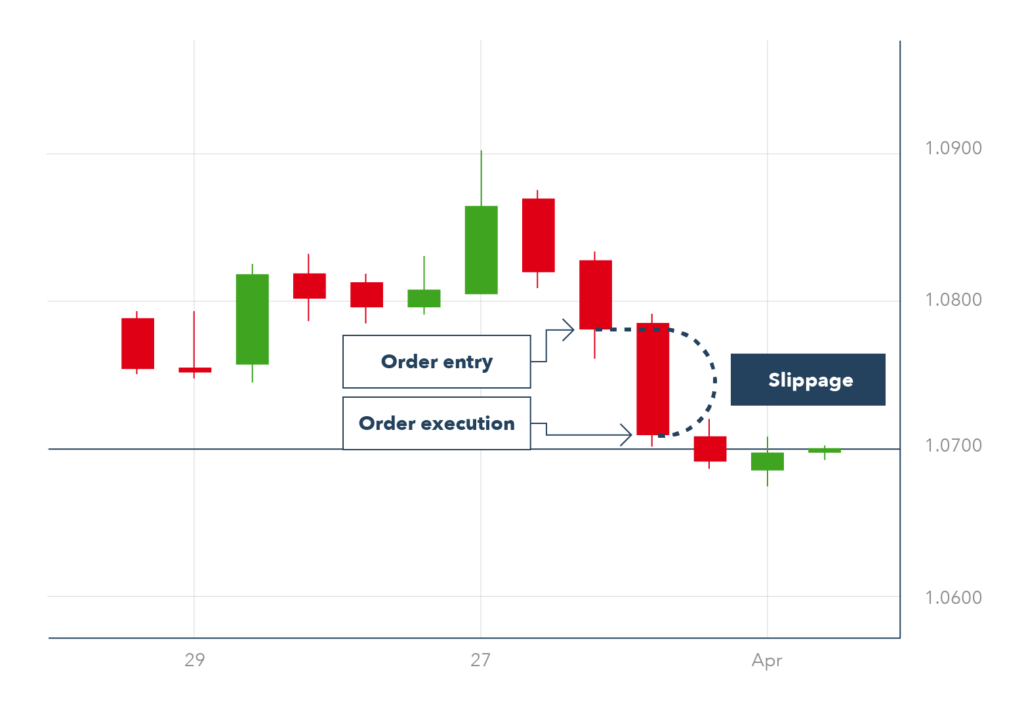

Slippage. Source: IG.com

Simply put, slippage in trading occurs when the price at which your order is performed differs from the price specified. This is especially common in fast-moving, volatile markets that are prone to sudden and unexpected changes in a certain trend.

Depending on the direction of the price movement, whether you are going long or short, and whether you are opening or closing a trade, the price difference might be positive or negative. Sometimes, the slippage can also be neutral.

Slippage is common in all the traditional investment markets: stocks, bonds, equities, etc. The mechanisms by which slippage occurs are largely the same across those markets: it’s caused by the market shifting.

What Is Slippage in Crypto?

Slippage in cryptocurrency refers to the act of someone else’s order having a higher priority in the block than yours, causing their deal to execute first, leading your final price to differ from what you were quoted.

Slippage can be accidental or purposeful. When another trader inadvertently gets ahead of you in the block, this is known as benign slippage. Intentional slippage occurs when arbitrageurs target your trade in order to profit from it.

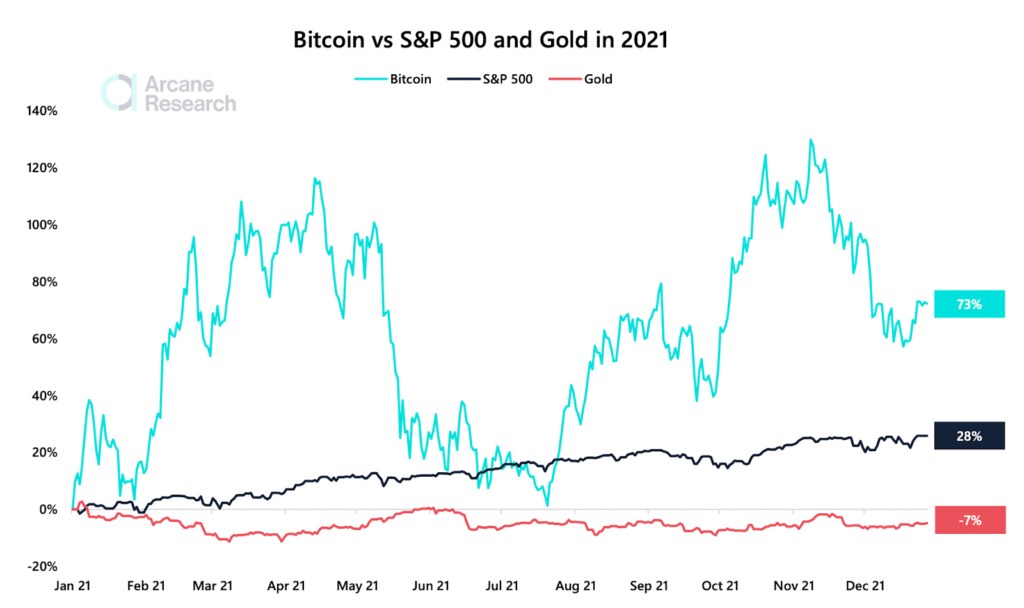

When compared to more established financial markets such as currency and equities, the crypto market is still in its infancy. As a result, minor news updates can significantly enhance the volatility of a crypto asset, causing values to reach astounding highs or lows. The data shows us that the crypto market is unequivocally more volatile than stocks.

Bitcoin vs. S&P 500 vs. gold in 2021. Source: Arcane Research, TradingView

Slippage is also affected by the number of buyers and sellers of a certain crypto asset. Low liquidity occurs when there are insufficient buyers and sellers to fill an order at the specified price, which can result in significant slippage. Slippage can be either beneficial or bad. Many crypto traders always adjust their slippage tolerance while trading crypto assets to avoid negative slippage.

Generally, crypto markets can be more prone to slippage than stocks for three very important reasons:

- Higher volatility.

- Lower liquidity.

- How trades are executed.

Positive vs Neutral vs Negative Slippage

When an order is executed, an asset is bought or sold on an exchange at the most favorable price available. A cryptocurrency’s market price can change quickly and that allows slippage to occur during the delay between when a trade is initiated and when it’s completed.

The final result can be equal to, favorable, or less favorable than the intended execution price. For example, let’s say Solana’s bid/ask price is posted as $28.89/$28.92 on a crypto exchange. You place a market order for 10,000 SOL tokens with the intention that the order gets filled at $28.92. There are three possible outcomes:

- Neutral slippage. You submit the order and it’s filled at the best available price, which is $28.92 per token – the result matches your expectations.

- Positive slippage. You submit the order and the best available price fluctuates and changes to $28.89. Your order is filled at the better price of $28.89 per token – $0.03 below your requested price, saving you $300.

- Negative slippage. You submit the order and the best available price changes to $28.97 before your order is filled. Your final execution price is $28.97 per token, incurring an additional $0.05 per token or $500 in negative slippage.

All in all, slippage is important because it affects every trade, from small to large. And if your trades constantly suffer from negative slippage, it essentially damages the performance of your investments. This impacts investors from all sizes, but even more so investors deploying large amounts of capital. Just a small negative slippage can cost you a large dollar amount in investment performance.

Choose StealthEX for Exchange and Buy Crypto

- User-Friendly — Simple and minimalistic interface for everyone.

- Fast and Private — Instant non-custodial cryptocurrency exchanges.

- Buy crypto with Credit Card.

- 1200+ coins and tokens are available for limitless, quick and easy exchanges.

- NO-KYC crypto exchanges — Buy cryptocurrency up to €700 without KYC!

- StealthEX crypto exchange app — Process crypto swaps at the best rates wherever you are.

- 24/7 Customer Support.

Earn from Each Exchange by Joining StealthEX Affiliate Program.

Become a partner right now and use affiliate tools:

- Public API — Earn from your wallet, aggregator, or exchange terminal.

- Referral Links — Recommend StealthEX to your audience.

- Exchange Widget — Built crypto exchange widget on any page of your website.

- Button — A perfect choice for traffic monetization.

- Banner — Track conversion and stats right in the personal cabinet.

Slippage Tolerance

The gap between the price at which you execute an order and the actual price at which the order will be filled that you are ready to accept is referred to as slippage tolerance. Tolerance is specified as a percentage of the entire exchange value.

Many trading platforms allow customers to set their own slippage tolerance level. Before you execute a market order, they offer a slippage estimate and average price. Most platforms provide a common default rate of 0.10% to 2%, with the opportunity to manually increase it to whatever proportion you choose.

How to Avoid Slippage in Cryptocurrency Trading?

Because of the volatility of the market, slippage can be a severe issue while trading digital assets. When prices move quickly, the chances of a trader receiving a different amount than predicted are considerable. Furthermore, poor liquidity might result in sharp price increases when buyers do not want to pay as much as sellers want to sell for. Slippage should be anticipated by cryptocurrency traders, who should learn how to calculate it and how limit orders might assist them decrease or eliminate slippage. Unfortunately, slippage can’t be completely avoided; even low-cap cryptos suffer from slippage, because the other major source of slippage is liquidity. Slippage can, however, be addressed and minimized. Here are a number of strategies that can help you minimize it whenever you’re trading:

- Trade in peaceful moments. The less volatility there is in the market, the less likely you are to be taken off guard by slippage. If you want to limit slippage, avoid investing near key economic news or important updates about the securities you want to trade, such as earnings reports. These kinds of occurrences can cause major market volatility and price fluctuations.

- Instead, place limit orders instead of market orders. Market orders are transactions that must be completed as soon as feasible, whereas limit orders are orders that must be completed at a specific price or better. You can avoid negative slippage by placing a limit order. However, there is also the possibility that the order will not be implemented. Some crypto exchanges like Coinbase display slippage warnings if you are entering an order with a slippage percentage above a certain amount. Coinbase’s warnings kick in at 2% slippage or higher.

- Only trade during active hours. Unlike global stock markets, which are open from 9:30 a.m. to 4:00 p.m., the crypto market is open 24 hours a day, seven days a week. However, depending on the region, even crypto trading has peak hours. You can reduce your slippage % by trading only during the busiest hours in a certain region. Remember that blockchain transaction fees rise during busy periods due to network congestion. When Ethereum (ETH) has a high transaction volume, the Ethereum network’s gas prices rise to compensate the miners that confirm transactions on the blockchain.

Final Words on Slippage in Cryptocurrency

Timing important events and announcements is easier in the traditional market because they frequently follow a set and scheduled calendar. However, the crypto market is not yet as structured and reliable, as an influencer’s social media activity can quickly shift the price of a coin. As a result, it is difficult to time some of the events that can cause the market to become more volatile.

Many cryptocurrencies have little liquidity, making it difficult to avoid slippage when trading them. Furthermore, if you are a short-term or day trader, it may be tough to trade with limit orders every time.

Market orders are prone to slippages, although if the price discrepancies are small, the slippages may be insignificant. If your approach necessitates quick trade execution, you may begin to see price discrepancies as a variable cost of carrying out transactions that should be kept as low as possible.

The trick is to avoid allowing slippage to spiral out of control. High tolerances and front-running can eat away at your crypto investments, so stay alert at all times.

For more information on how to begin trading crypto, please refer to our earlier articles: Simple and Secure Cryptocurrency Trading Methods for Beginners and Crypto Technical Analysis vs Fundamental Analysis.

This article is not supposed to provide financial advice. Digital assets are risky. Be sure to do your own research and consult your financial advisor before investing.

crypto world cryptocurrency market invest in crypto investing investmentRecent Articles on Cryptocurrency

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?  OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?