Why Is Crypto Crashing and Will It Recover?

Understanding the Current Downturn and Pathways to Recovery

The cryptocurrency market experienced significant volatility in early 2025, leaving many investors questioning the future of Bitcoin and other digital assets. This comprehensive analysis examines the factors behind the current crypto crash and explores recovery scenarios based on market fundamentals and historical patterns.

Article contents

- 1 The 2025 Crypto Market Crash: What Happened?

- 2 Current Market Situation: A Snapshot of the Decline

- 3 Why Is Crypto Crashing? Factors Behind

- 4 Historical Context: Crypto Crashes and Recoveries

- 5 Will Crypto Recover? Potential Scenarios

- 6 Strategies for Investors Navigating the Downturn

- 7 Conclusion: Perspective on the Crypto Market Cycle

The 2025 Crypto Market Crash: What Happened?

The cryptocurrency market has once again demonstrated its notorious volatility. After Bitcoin reached an unprecedented all-time high of $109,114 in mid-January 2025, the market took a dramatic turn. As of March 2025, Bitcoin has plummeted to $76,624, representing a 30% decline in just two months. This sharp correction has sent shockwaves through the entire digital asset ecosystem, with most altcoins experiencing even more severe drops.

This market downturn has evaporated approximately $900 billion in total cryptocurrency market capitalization, triggering panic among retail investors and raising serious questions about the sustainability of digital assets.

Crypto Market Cap, CoinMarketCap, March 13, 2025

For newcomers who entered the market during its meteoric rise in late 2024, this first experience with crypto’s extreme volatility has been particularly jarring.

However, seasoned crypto investors recognize a familiar pattern: the cyclical nature of cryptocurrency markets. This article aims to dissect the factors behind the current crash, place it in historical context, and evaluate potential recovery scenarios through expert analysis and market fundamentals.

Current Market Situation: A Snapshot of the Decline

Market Performance in Numbers

The crypto market contraction that began in late January 2025 has affected virtually all digital assets:

- Bitcoin (BTC): Down 30% from January peak of $109,114 to $76,624.

- Ethereum (ETH): Down 60% from peak of $4,100 to $1,760.

- Solana (SOL): Down 65% from peak of $294 to $110.

- Cardano (ADA): Down 55% from peak of $1.3 to $0.6.

The total cryptocurrency market capitalization has declined from $3.6 trillion in January to approximately $2.6 trillion in March 2025, representing a 30% contraction in market value.

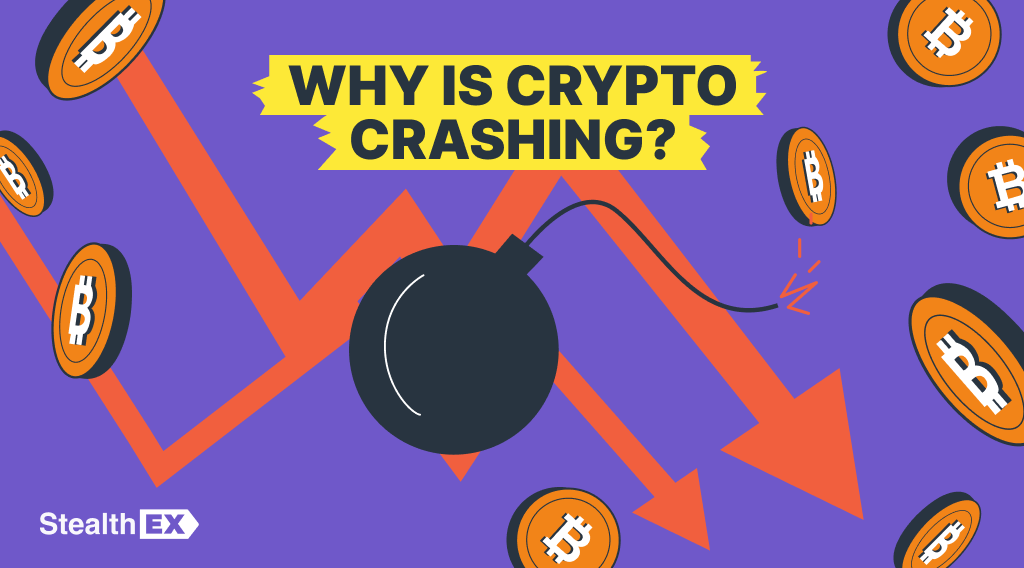

Crypto Fear & Greed Index

According to the Crypto Fear & Greed Index, market sentiment has shifted from “Extreme Greed” (scoring 66/100) in early January to “Extreme Fear” (scoring 15/100) by mid-March, reflecting the psychological impact of the downturn on investors.

Crypto Fear and Greed Index, CoinMarketCap, March 13, 2025

Why Is Crypto Crashing? Factors Behind

Multiple factors have contributed to the current market downturn, ranging from macroeconomic pressures to crypto-specific issues. Understanding these dynamics is crucial for assessing recovery potential.

Government Regulation and Policy Uncertainty

Government regulation represents one of the main factors contributing to cryptocurrency market volatility. The early 2025 crash has been significantly influenced by regulatory developments:

- Regulatory crackdowns in key markets: several major economies have implemented stricter regulations in early 2025. The European Union’s Markets in Crypto-Assets (MiCA) implementation has imposed stricter-than-expected requirements on crypto businesses operating in Europe.

- Political uncertainty: The initial optimism surrounding President Trump’s pro-crypto policies, including the proposal for a strategic Bitcoin reserve, has been tempered by conflicting signals from different branches of government. The Treasury Department’s announcement of enhanced surveillance of cryptocurrency transactions in February 2025 contradicted earlier administration messaging.

- Bitcoin ETFs: Since their grand launch, Bitcoin ETFs have attracted billions of dollars. But inflows have dried up in recent weeks, showing that interest has waned.

- Exchange compliance issues: The largest cryptocurrency exchange Binance has faced increased scrutiny from regulators around the world. In early 2025, Binance was indicted on charges of money laundering and tax fraud, raising market concerns about the stability of the exchange.

Security Breaches and Trust Issues

Several high-profile security incidents have shaken market confidence:

- The Bybit biggest crypto hack: In January 2025, hackers exploited a vulnerability in Bybit’s hot wallet system, stealing approximately $1.5 billion in customer funds. This represents one of the largest crypto heists in history.

- Phemex crypto exchange hack: Attackers exploited a vulnerability in Phemex’s hot wallet system, resulting in the theft of over $85 million in cryptocurrency.

Macroeconomic Pressures

The broader financial environment has created headwinds for cryptocurrency markets:

- Interest rate concerns: The Federal Reserve’s indication of maintaining higher interest rates throughout 2025 has diminished appetite for risk assets, including cryptocurrencies.

- Global economic uncertainty: Tensions between major economies and supply chain disruptions have contributed to market volatility across all asset classes.

- Institutional profit-taking: Many institutional investors who entered the market during the previous cycle have been taking profits after Bitcoin’s rise to new all-time highs, creating significant selling pressure.

Historical Context: Crypto Crashes and Recoveries

To understand the potential recovery trajectory, it’s valuable to examine previous major crypto market corrections.

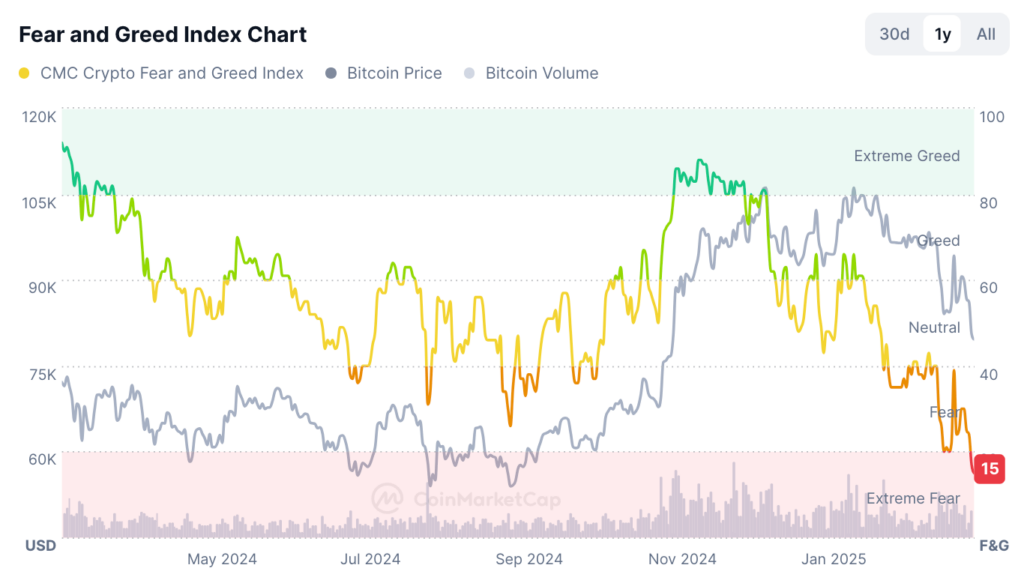

BTC Price Chart, CoinGecko, March 13, 2025

2018 Crypto Winter

Following Bitcoin’s peak near $18,000 in December 2017, the market experienced a prolonged downturn:

- Bitcoin fell approximately 85% to around $3,200 by December 2018.

- The bear market lasted approximately one year.

- Recovery to previous all-time highs took over three years.

- Key recovery catalyst: Institutional adoption beginning with MicroStrategy’s Bitcoin purchases in 2020.

2021-2022 Downturn

After reaching nearly $65,000 in November 2021, Bitcoin entered another significant correction:

- Bitcoin declined approximately 75% to around $15,500 by November 2022.

- The bear market persisted for approximately one year.

- Recovery to previous all-time highs took about two years.

- Key recovery catalysts: Spot Bitcoin ETF approvals and renewed institutional interest.

Comparison with the Current Situation

The 2025 correction shows some notable differences from previous cycles:

- Decline magnitude: The current 30% drop is significantly less severe than previous bear markets (which saw 75-85% declines).

- Institutional involvement: Unlike previous cycles, the market now has substantial institutional participation through Bitcoin ETFs and corporate treasury investments, potentially providing more price stability.

- Market maturity: The cryptocurrency ecosystem has developed more sophisticated infrastructure, regulatory clarity, and real-world utility compared to previous cycles.

- Technical patterns: Chart analysis indicates that Bitcoin has maintained support above its 200-day moving average, unlike in previous major bear markets when this key technical level was decisively broken.

Will Crypto Recover? Potential Scenarios

Based on market fundamentals, technical analysis and historical patterns, crypto experts identify several potential recovery scenarios.

Rapid V-Shaped Recovery

In this scenario, the current correction proves to be a brief pullback in an ongoing bull market:

- Market recovery begins by May 2025, with previous all-time highs retested by Q3 2025.

- Catalysts:

- Successful implementation of Trump’s strategic Bitcoin reserve initiative.

- Regulatory clarity emerging from the anticipated crypto summit in April 2025.

- Inflation concerns driving increased institutional Bitcoin allocation.

- Technical indicators: Bitcoin holds the $70,000 support level and reclaims the 50-day moving average.

Prolonged Consolidation

The most likely scenario involves an extended period of sideways movement:

- Market consolidates between $60,000-$90,000 throughout 2025, with recovery to new all-time highs postponed until 2026.

- Catalysts:

- Gradual improvement in macroeconomic conditions.

- Continued but slower institutional adoption.

- Regulatory frameworks stabilizing across major markets.

- Technical indicators: Bitcoin trades in a defined range with decreasing volatility and volume.

Deeper Bear Market

A more severe downturn cannot be ruled out:

- Further decline to $40,000-$50,000 range by mid-2025, with recovery beginning in late 2026.

- Catalysts:

- Global recession or financial crisis.

- Major regulatory crackdowns in key markets.

- Additional significant security breaches affecting major exchanges.

- Technical indicators: Bitcoin breaks below $70,000, subsequently violating the 200-day moving average and triggering cascading liquidations.

- Education first: Use the market downturn as an opportunity to learn about cryptocurrency fundamentals before committing significant capital.

- Technical level awareness: Pay close attention to key support levels identified by technical analysts.

- Risk management: Reduce position sizes during heightened volatility and maintain strict stop-loss discipline.

- Start small: Begin with modest allocations that you can afford to lose entirely.

- Beware of emotion-driven decisions: FOMO (fear of missing out) and panic selling typically lead to poor investment outcomes.

Conclusion: Perspective on the Crypto Market Cycle

The cryptocurrency market’s dramatic rise and subsequent correction in early 2025 continues a pattern familiar to long-term observers of this asset class. While the specific catalysts change with each cycle, the fundamental dynamic of euphoria followed by fear remains consistent.

What distinguishes the current market environment from previous cycles is the increasing institutionalization of cryptocurrency, particularly Bitcoin. With major financial institutions now offering crypto products and services, the market exhibits greater liquidity and potentially more stability over the long term, despite continued short-term volatility.

For investors navigating this landscape, maintaining perspective is crucial. Bitcoin has experienced six major corrections of greater than 70% throughout its history, yet has ultimately reached new highs following each downturn. However, past performance does not guarantee future results, and the maturing market may display different recovery patterns than previous cycles.

As cryptocurrency continues its evolution from a speculative curiosity to an established asset class, price volatility remains both its most challenging characteristic and its greatest opportunity for patient, disciplined investors.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments involve significant risk, and past performance does not indicate future results. Always conduct your own research and consult with a financial advisor before making investment decisions.

Bitcoin crypto crash crypto market crypto world EthereumRecent Articles on Cryptocurrency

Crypto News: BBVA Backs Bitcoin, Iran Loses $90M, Senate Passes Crypto Bill

Crypto News: BBVA Backs Bitcoin, Iran Loses $90M, Senate Passes Crypto Bill  Quant Price Prediction: How High Can QNT Crypto Go?

Quant Price Prediction: How High Can QNT Crypto Go?