Why Is the Crypto Market Down? Top Reasons

The cryptocurrency market is experiencing a significant downturn, causing concern among investors. Many are asking, “Why is crypto down?”. This decline has affected major cryptocurrencies like Bitcoin, Ethereum, and others. Understanding the reasons behind crypto and Bitcoin falling is important for anyone involved in the crypto space. In this article, we will explore the key reasons and specific events causing declines on the crypto market!

Article contents

5 Key Reasons for the Crypto Market Downturn

The downturn in the cryptocurrency market can be attributed to several key factors. Each of these factors plays a significant role in influencing market sentiment and prices.

Regulatory Concerns Impacting Crypto Market

Regulatory actions and announcements from governments and financial authorities often impact the cryptocurrency market. When countries like China or India impose restrictions or bans on cryptocurrency trading or mining, it creates uncertainty among investors.

Additionally, regulations aimed at tightening controls on cryptocurrency exchanges and wallets can lead to a decrease in market activity. For example, the United States Securities and Exchange Commission (SEC) has been scrutinizing various crypto assets and companies, leading to fears of tighter regulations.

This regulatory uncertainty can cause panic selling, driving prices down. Investors tend to be wary of investing in assets that might face legal challenges or operational restrictions, leading to a downturn in the market.

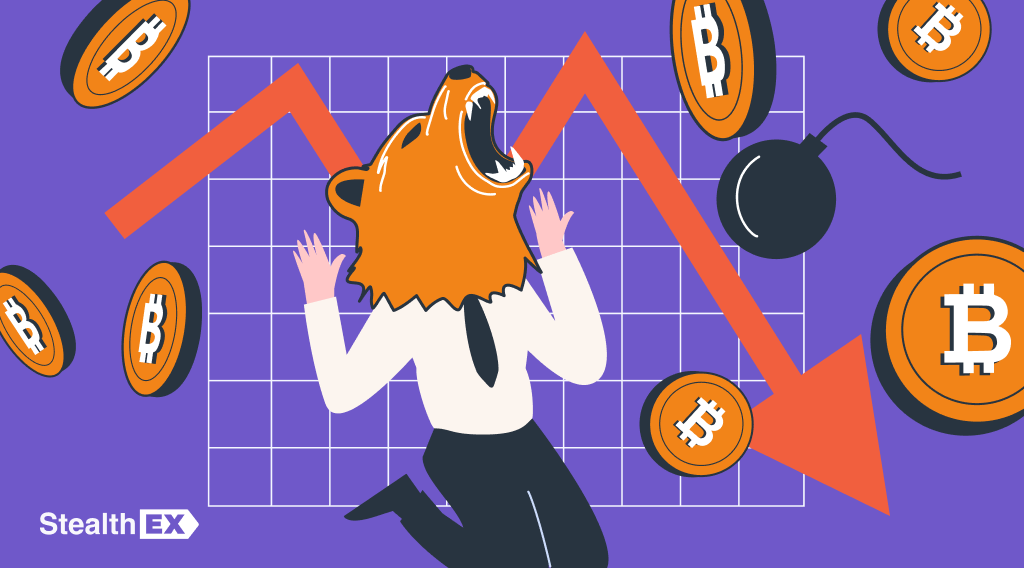

Crypto Market Sentiment

Investor sentiment plays an important role in the crypto market. Negative news can spread quickly through social media and news outlets, leading to widespread panic and sell-offs. Fear, uncertainty, and doubt (FUD) often arise from rumors or misinformation, causing investors to act irrationally.

For instance, when influential figures or analysts predict a market crash, it can trigger a wave of selling. Moreover, fear of missing out (FOMO) can also play a part. When prices start to drop, some investors may sell their holdings to avoid further losses, exacerbating the decline. The overall mood of the market, whether optimistic or pessimistic, significantly influences price movements.

Alternative, July 24, 2024

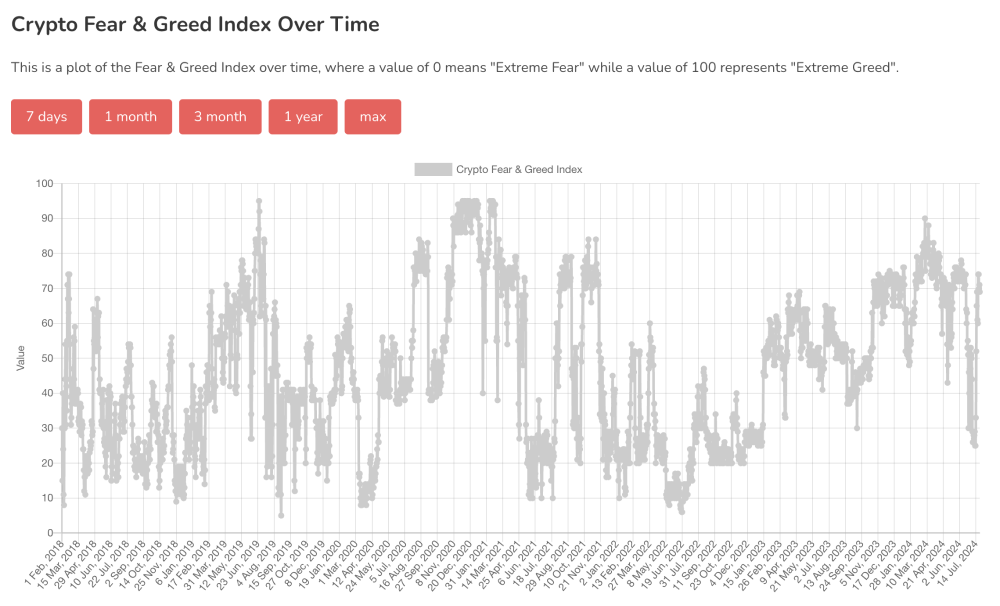

Macroeconomic Factors

Broader economic conditions also impact the cryptocurrency market. Factors such as inflation rates, interest rates, and overall economic growth can influence investor behavior. For example, when inflation is high, investors may move their money into assets perceived as safe havens, such as gold or government bonds, rather than crypto.

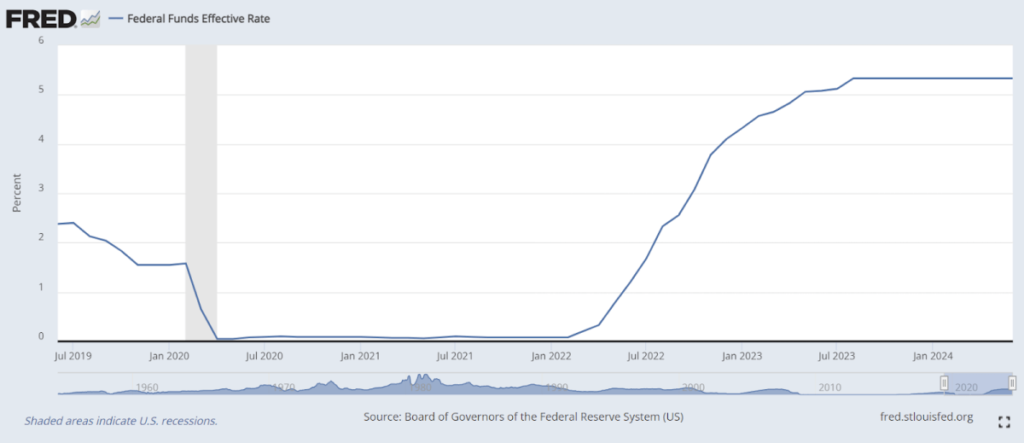

Similarly, rising interest rates can make traditional savings and investments more attractive compared to the volatile crypto market. Economic instability, such as recessions or financial crises, often leads investors to seek safer investments, causing a decline in demand for cryptocurrencies. These macroeconomic factors create a ripple effect, impacting the entire crypto market.

YCharts, July 24, 2024

Technological Issues in Cryptocurrency

Technical problems within the cryptocurrency ecosystem can also lead to market downturns. Issues such as network congestion, security breaches, or technical flaws in blockchain technology can undermine investor confidence. For example, if a major cryptocurrency exchange experiences a hack or significant downtime, it can lead to a loss of funds and trust among users.

Similarly, if a blockchain network faces scalability issues or other technical problems, it can affect the functionality and reliability of the associated cryptocurrency. These technological issues can cause panic and lead to a sell-off, driving prices down. Investors need to feel secure in the technology they are investing in, and any perceived weaknesses can lead to a market decline.

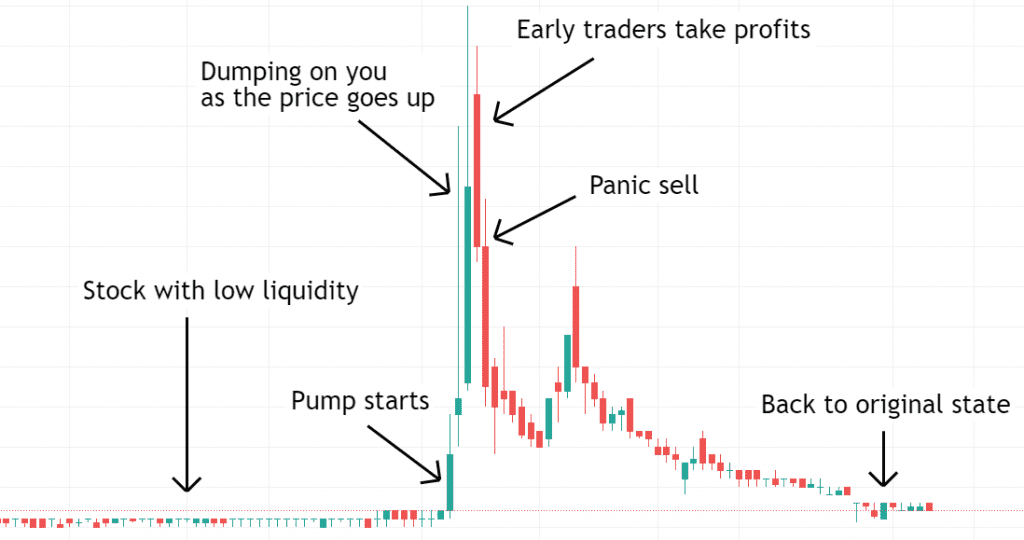

Crypto Market Manipulation

The relatively unregulated nature of the cryptocurrency market makes it susceptible to manipulation. Large traders, often referred to as “whales,” can significantly influence market prices by making substantial trades. For example, coordinated selling or pump-and-dump schemes can create artificial price movements. In a pump-and-dump scheme, manipulators artificially inflate the price of a cryptocurrency through false or misleading information, only to sell off their holdings at the peak, causing the price to crash.

This type of market manipulation creates a volatile and unpredictable market environment. Retail investors, who may not have access to the same information or resources as large traders, are often the most affected by these manipulative practices, leading to further declines in the market.

Why Crypto Is Falling Now?

The recent decline in cryptocurrency prices can be linked to several significant events. These events have created selling pressure and impacted investor confidence, leading to a market downturn.

One of the notable events is Germany’s decision to sell thousands of seized Bitcoins. When governments or institutions decide to liquidate large amounts of cryptocurrency, it can create substantial selling pressure in the market. In this case, Germany sold a significant quantity of Bitcoin, flooding the market with supply. This increase in supply without a corresponding increase in demand led to a decrease in Bitcoin prices. Investors, seeing the potential for further declines, may have panicked and sold their holdings, exacerbating the downward trend.

Another critical event was the decision by Mt. Gox to distribute Bitcoin worth millions of dollars to its creditors. Mt. Gox, a now-defunct cryptocurrency exchange, was once the largest in the world before it collapsed in 2014 due to a massive hack. Recently, the exchange began the process of reimbursing its creditors with Bitcoin. The sudden influx of these reimbursed Bitcoins into the market added to the selling pressure. Creditors, who had been waiting for years to recover their funds, might have sold their received Bitcoin to lock in profits or recoup losses, contributing to the price decline.

Macroeconomic factors have also played a significant role in the recent downturn. Rising inflation rates and increasing interest rates have made traditional investments more attractive compared to volatile cryptocurrencies. For instance, central banks worldwide, including the Federal Reserve, have been raising interest rates to combat inflation. Higher interest rates can lead to a stronger national currency and more attractive bond yields, diverting investments away from riskier assets like cryptocurrencies. Additionally, economic uncertainty due to geopolitical events, such as the ongoing conflicts or trade tensions, can also lead to a shift in investor sentiment, causing them to move away from cryptocurrencies towards safer assets.

Federal Reserve Bank of St. Louis

Cryptocurrency Is Down? Some Case Studies

Analyzing specific incidents that led to sudden drops in cryptocurrency values helps us understand market vulnerabilities. Several key events have had significant impacts on the market.

One such incident was the major exchange hack at Binance in May 2019. Binance, one of the largest cryptocurrency exchanges, reported a security breach where hackers stole over 7,000 Bitcoins. This event shook investor confidence, as it highlighted the security risks associated with even the most reputable exchanges. Following the hack, Bitcoin’s price fell sharply as investors feared similar breaches could happen elsewhere. The immediate response involved a combination of panic selling and market uncertainty, causing a significant drop in cryptocurrency values.

Another influential event was Elon Musk‘s tweet about Bitcoin in May 2021. Musk announced that Tesla would no longer accept Bitcoin as payment due to environmental concerns related to Bitcoin mining. This announcement led to a sharp decline in Bitcoin’s price. Musk’s tweets have historically had a substantial impact on the cryptocurrency market due to his large following and influence. His negative stance on Bitcoin caused widespread panic and selling, contributing to a market-wide downturn.

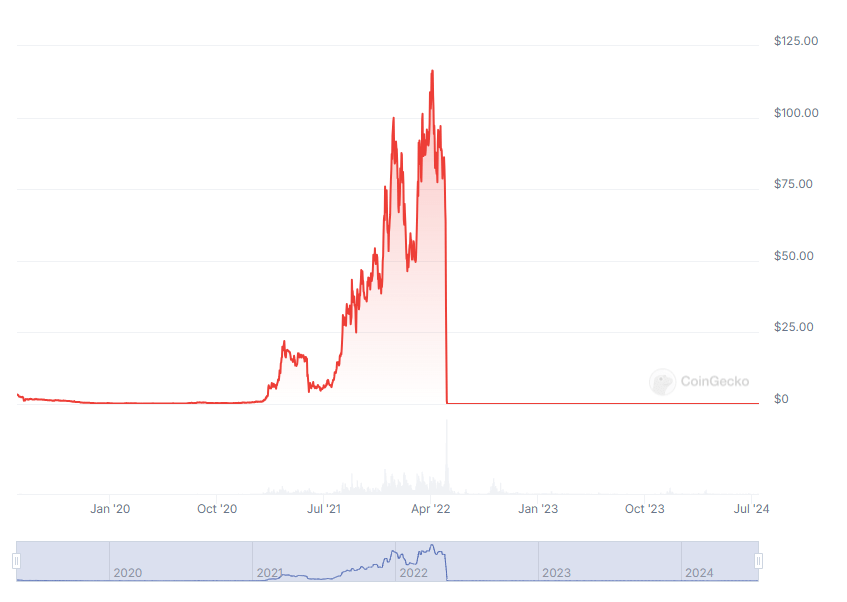

Additionally, the collapse of TerraUSD (UST) and its sister token Luna in May 2022 had a profound impact on the market. TerraUSD, a stablecoin, was designed to maintain a 1:1 peg with the US dollar. However, when the peg broke, it led to a loss of confidence in stablecoins and the broader cryptocurrency market. Luna, which was used to stabilize TerraUSD, also collapsed, leading to significant losses for investors. The fallout from this event caused a ripple effect throughout the market, highlighting the risks associated with algorithmic stablecoins and resulting in a substantial market decline.

How to Survive When Crypto Is Down? Bear Market Tips

Downturn in the cryptocurrency market usually results with varied reactions from investors. Understanding these responses and adopting appropriate strategies can help navigate the bear market effectively.

Many investors reacting to the downturn with panic selling. When prices start to drop, fear of further losses often prompts immediate selling of assets. This panic selling can exacerbate the decline, as more and more investors rush to liquidate their holdings. On the other hand, some experienced investors view downturns as buying opportunities. They adopt a long-term perspective, buying more assets at lower prices to capitalize on future recoveries.

Another common reaction is a shift towards safer investments. In times of market instability, investors often move their funds from cryptocurrencies to more stable assets like gold, bonds, or fiat currencies. This shift is driven by the desire to minimise risk and protect capital from further erosion.

To navigate the bear market, several strategies can be employed:

- Diversification – Diversifying investments across different asset classes can help mitigate risks. By not putting all eggs in one basket, investors can protect themselves from severe losses in any single asset class.

- Hedging – Using hedging strategies such as options and futures contracts can provide a way to manage risk. These financial instruments can help offset potential losses from other investments.

- Staying Informed – Keeping up-to-date with market news, regulatory changes, and economic indicators is very important. Informed investors can make better decisions and anticipate market movements.

- Dollar-Cost Averaging – This strategy involves regularly investing a fixed amount of money regardless of the asset’s price. Over time, this can reduce the impact of volatility and lower the average cost of investments.

- Risk Management – Setting stop-loss orders and establishing clear investment goals can help manage risk. Knowing when to exit a position and having a disciplined approach can protect against significant losses.

Summary

The cryptocurrency market is experiencing a significant downturn due to various factors. Regulatory concerns, market sentiment, macroeconomic factors, technological issues, and market manipulation all contribute to the declines. Specific events, such as Germany selling seized Bitcoins and the collapse of TerraUSD, have played a crucial role this time. Investor reactions vary from panic selling to strategic buying, and employing effective strategies can help navigate at worse times. Staying informed and adopting risk management techniques are essential for investors during turbulence.

And if you want to buy or trade one or more cryptocurrencies, you can always use StealthEX. Just follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, BTC to ETH.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto world cryptocurrency Ethereum price analysisRecent Articles on Cryptocurrency

Ethereum Classic Price Prediction: Will ETC Coin Reach $100?

Ethereum Classic Price Prediction: Will ETC Coin Reach $100?  Kaspa Price Prediction: Can KAS Coin Reach $1?

Kaspa Price Prediction: Can KAS Coin Reach $1?