Yield Farming vs Staking: An Ultimate Guide on Crypto Passive Income

Are you interested in making extra money from your crypto holdings? If so, you’re not alone. Yield farming and staking have become mainstream methods to generate passive income in the crypto space. The question is: what’s the difference between yield farming and staking? And which one is more profitable? Read on to find out. We’ll take an in-depth look at yield farming vs staking and cover everything you need to know to grow your profits and minimize your risks.

Article contents

What Is Yield Farming?

For first timers, yield farming sounds complicated but it is actually quite simple. Its name echoes the analogy of farming as it allows you to grow your crypto. Yield farmers invest their crypto assets into pools for decentralized finance (DeFi) protocols and grow their initial investments.

Yield farming is a popular passive income stream, allowing users to earn a return on their investment with relatively little effort.

Traditional banking institutions use a similar concept, where they take deposits, lend them out to borrowers, and then pay interest to depositors. Comparing yield farming to traditional banking institutions, yield farming incentivizes users for providing liquidity to the protocol based on their liquidity contributions and the underlying protocol’s conditions. Yield farmers can earn rewards from yield farming protocols that are often higher than those offered by traditional banks.

However, yield farming requires a great deal of attention and active management, as you are investing in a complex and extremely volatile market. Therefore, you need to go over everything with a cool head and a fine-tooth comb before jumping into a project.

How to Get Yield Farming Rewards

Yield farming platforms compensate users who benefit the protocol in some way. Several yield farming strategies exist:

- Pool liquidity into a contract to enable market formation

- Add liquidity to become a more influential market maker or to receive a discount

- Pool votes

- Lock up certain assets

Depending on the platform, the yields may take the form of a percentage from transaction fees charged by the platform, interest earned from lenders, or governance tokens. For instance, users pay a yield farming platform transaction fees, and part of them are given to liquidity providers in return for liquidity.

What Is Liquidity Mining?

Liquidity mining involves participants investing their crypto assets into a liquidity pool created by DeFi protocols for crypto trading, not for borrowing or lending crypto assets. In return, they receive tokens issued by the liquidity provider, which is used for the final redeem.

What Is a Crypto Liquidity Pool?

A crypto liquidity pool is an important part of all DeFi platforms. Generally, a liquidity pool consists of crypto assets that are secured under smart contracts. Decentralized exchanges rely on these tokens for liquidity. The term “liquidity” refers to the ease of exchanging crypto tokens for one another. Having this ease is vital for the DeFi ecosystem given that it facilitates financial transactions.

Despite the fact that there are a great number of liquidity pools in the DeFi sector, only a few have established themselves as investors’ top choices.

Listed below are the top 10 pools by TVL according to DeFi data aggregator DeFi Llama.

| Pool | Project | TVL | APY | 30-Day Avg APY |

| STETH |  Lido Lido | $14.777 billion | 3.80% | 3.80% |

| BTC |  JustLend JustLend | $3.015 billion | 0.02% | 0% |

| CBETH |  Coinbase Wrapped Staked ETH Coinbase Wrapped Staked ETH | $2.209 billion | 3.33% | 3.33% |

| RETH |  Rocket Pool Rocket Pool | $1.59 billion | 3.32% | 3.32% |

| WSTETH |  AAVE V3 AAVE V3 | $788.32 million | 0.01% | 0.01% |

| WBTC |  AAVE V2 AAVE V2 | $722.39 million | 0.07% | 0.07% |

| FRAX-USDC |  Curve DEX Curve DEX | $620.65 million | 1.30% | 0.01% |

| ETH-STETH |  Curve DEX Curve DEX | $581.69 million | 2.04% | 2.04% |

| WETH |  AAVE V2 AAVE V2 | $566.63 million | 1.15% | 1.15% |

| FRAX-USDC |  Convex Finance Convex Finance | $549.43 million | 1.96% | 1.96% |

Choose StealthEX for Exchange and Buy Crypto

- User-Friendly — Simple and minimalistic interface for everyone.

- Fast and Private — Instant non-custodial cryptocurrency exchanges.

- Buy crypto with Credit Card.

- 1200+ coins and tokens are available for limitless, quick and easy exchanges.

- NO-KYC crypto exchanges — Buy cryptocurrency up to €700 without KYC!

- StealthEX crypto exchange app — Process crypto swaps at the best rates wherever you are.

- 24/7 Customer Support.

Earn from Each Exchange by Joining StealthEX Affiliate Program.

Become a partner right now and use affiliate tools:

- Public API — Earn from your wallet, aggregator, or exchange terminal.

- Referral Links — Recommend StealthEX to your audience.

- Exchange Widget — Built crypto exchange widget on any page of your website.

- Button — A perfect choice for traffic monetization.

- Banner — Track conversion and stats right in the personal cabinet.

What Is Total Value Locked (TVL)?

To put it simply, Total Value Locked (TVL) measures the total value of crypto assets locked in DeFi protocols. TVL includes all digital assets held in DeFi protocols, including staked coins, lending funds, and liquidity pools.

According to CoinMarketCap data, the total locked value of liquidity pools in yield farming projects as of this writing is $5,231,073,393.02.

What Is APY?

APY stands for Annual Percentage Yield, which refers to the return on an asset when compound interest is applied, or the return on a deposit when accumulated income is reinvested. APY is a universal metric that serves as a way to count expected revenue and compare yields from staking or liquidity pools of token pairs.

APY is usually inversely related to TVL, which means that APY decreases as the number of locked crypto assets increases.

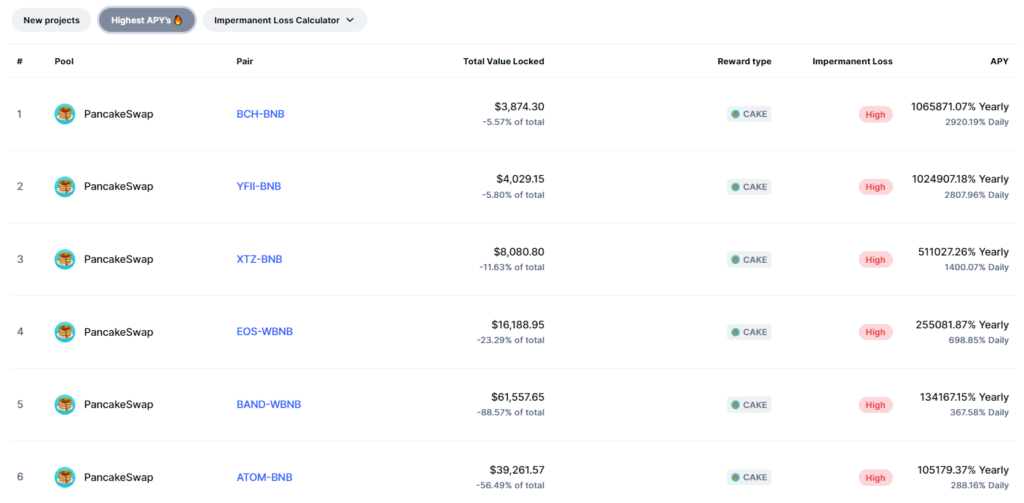

If you want to see which pools offer the highest APYs, sort them by it on the DeFi Llama aggregator mentioned above or CoinMarketCap as shown below.

Source: CoinMarketCap

Remember, though, that juiciest APYs usually come with the greatest level of risk, so always take your own risk tolerance into account when weighing potential rewards against potential losses.

Is Yield Farming Risky?

In yield farming, there is the risk of impermanent loss. Typically, this occurs when the value of a locked crypto asset decreases as a result of unfavorable market conditions. The goal of yield farming is to maintain a balanced proportion between paired assets.

Additionally, smart contracts used to lock assets in yield farming platforms are at risk of being hacked. Furthermore, rug pulls can occur, which are a type of fraud in which scammers launch a project, get investors to deposit funds, but stop the project before it starts and take all of the funds.

Therefore, when it comes to yield farming, it’s important to consider your own risk tolerance and decide whether the potential reward is worth the associated risks.

What Is Staking?

Staking crypto is another way to generate a passive income by locking up your crypto assets in a blockchain network for a fixed period of time. Specifically, this network uses a Proof-of-Stake (PoS) consensus to validate transactions and create new blocks. Staking is similar to an interest-bearing bank account with a predetermined maturity date. The length of the staking period typically depends on the blockchain network but can range from a few days to several months. In general, staking does not require a lot of active management or attention, as opposed to yield farming.

How Does Crypto Staking Work?

Basically, there are three main stages in the staking process.

- A crypto investor stakes their assets in their crypto wallets with stake functionality, or on centralized or decentralized exchanges, allowing the network to use them.

- The information is registered in a new block and validated using the investor’s holdings.

- The network rewards the staker for making their holdings available for validation.

Is Staking Risky?

Unlike yield farming, staking is not subject to impermanent losses. Staking’s main risk is hacking attacks. Next, there is the volatility of crypto asset prices, which means that the value of the user’s coins or tokens can go up and down rapidly, making it difficult to predict the total return on investments.

Where to Buy Crypto for Yield Farming and Staking

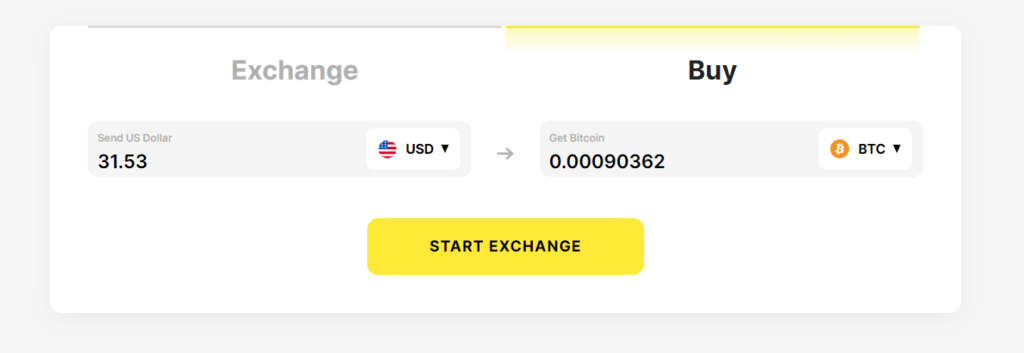

On StealthEX, a wide range of crypto coins and tokens are available for purchase and exchange, including Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDC, which can then be used for yield farming and crypto staking.

You can buy them for fiat by going to the Buy Page, picking the fiat currency and crypto that you want, and entering the amount of fiat that you want to spend. Click the Start Exchange button.

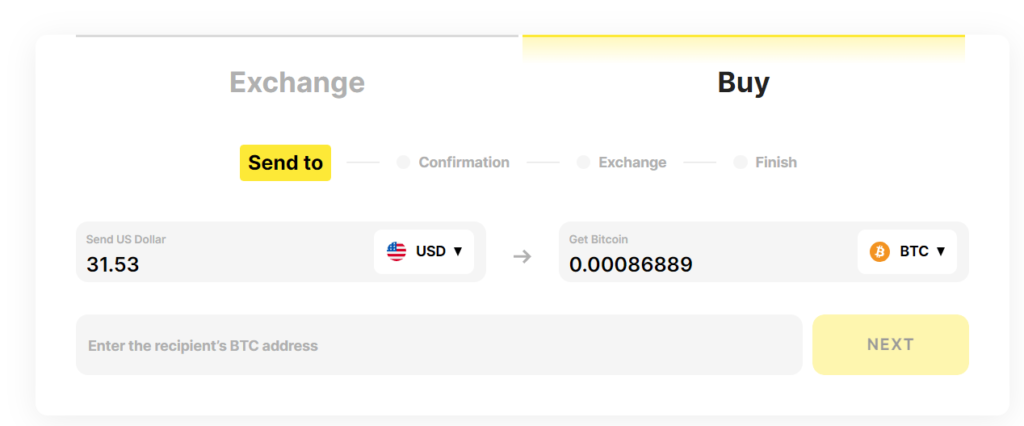

After that, enter your crypto wallet address and click Next.

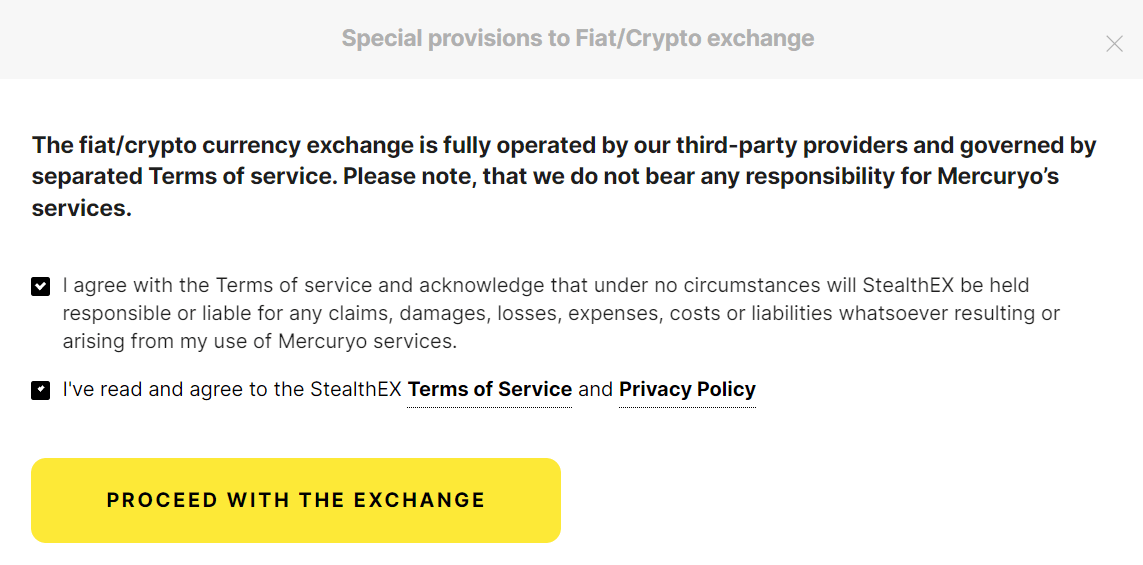

Once you’ve done that, read and accept privacy policies and terms of service of StealthEX’s fiat providers.

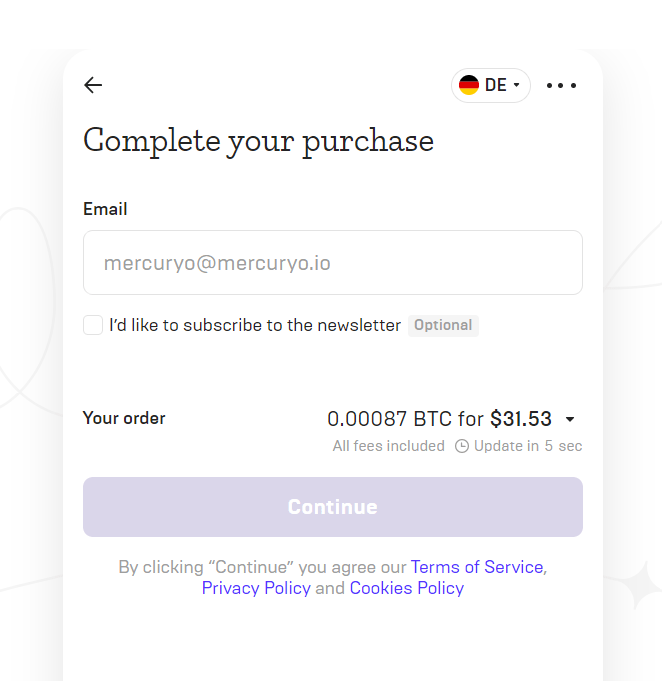

Fill out the email field and click Continue.

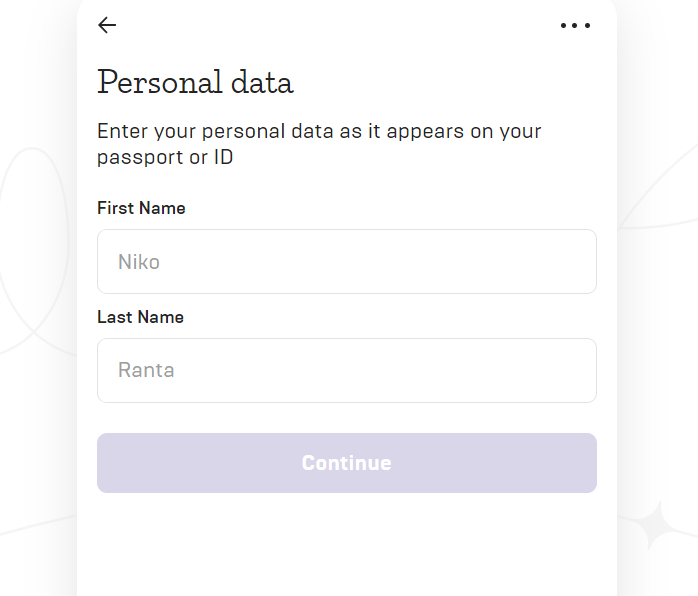

Then, fill out the KYC form, a requirement of all fiat-crypto processors. Уou can purchase an amount of crypto without KYC if it’s less than €700 or the equivalent of this amount in other currencies. As long as your total purchases don’t exceed €700, you don’t have to verify your identity. You can make one big purchase or several small €20, €50 or €100 transactions.

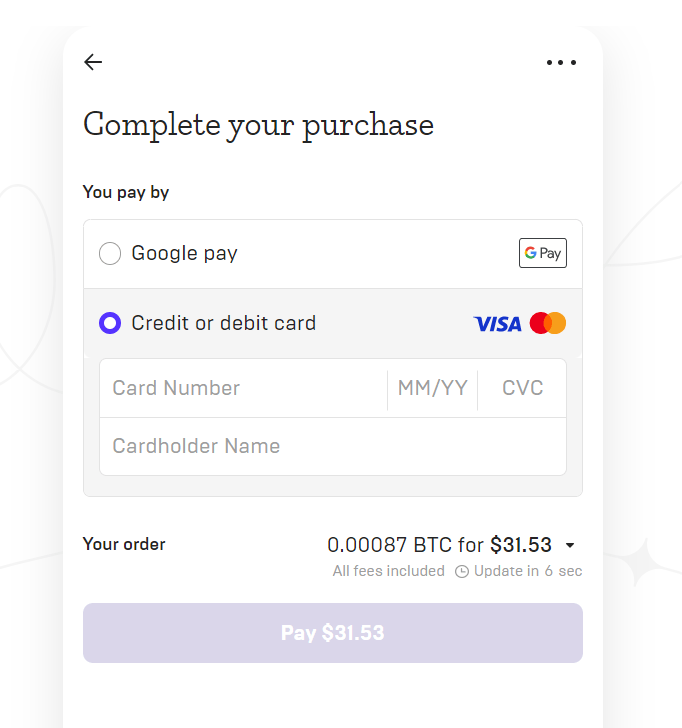

To complete the transaction, enter your payment details and click Pay.

It’s really that simple. Within a few minutes, you’ll have your crypto coins or tokens in your wallet, available for yield farming or staking.

Final Words on Yield Farming vs Staking

Both yield farming and crypto staking are great methods to earn passive income in the crypto world. In both methods, solid returns can be expected, however yield farming offers greater returns at a higher risk. So, yield farming is suitable for investors who are willing to take on the risk and commit the time and effort to understand the complexity of the market. In any case, before deciding which option to go with, make sure you do your research. As with any investment strategy, yield farming and staking should be carefully explored before committing.

crypto passive income cryptocurrency staking staking crypto yield farmingRecent Articles on Cryptocurrency

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?