Aerodrome Finance Price Prediction: Will AERO Reach $10?

Aerodrome Finance (AERO) is aDeFi platform designed to revolutionize liquidity provisioning and yield generation within the blockchain ecosystem. Built to enhance efficiency and accessibility, Aerodrome Finance offers innovative tools that empower users to optimize their DeFi strategies, whether through staking, liquidity pooling, or governance participation. By leveraging cutting-edge smart contract technology, the platform aims to provide seamless and transparent financial solutions while fostering a strong and engaged community. Will Aerodrome Finance reach $10? Discover the long-term Aerodrome Finance price prediction in StealthEX’s article.

| Current AERO Coin Price | Aerodrome Finance Prediction 2025 | Aerodrome Finance Price Prediction 2030 |

| $0.75 | $3.6 | $25 |

Article contents

- 1 Aerodrome Finance Overview

- 2 Aerodrome Finance Price History Highlights

- 3 AERO Coin Price Chart

- 4 Aerodrome Finance Price Prediction: 2025, 2026, 2030-2040

- 5 Aerodrome Finance (AERO) Price Prediction: What Do Experts Say?

- 6 AERO USDT Price Technical Analysis

- 7 What Does the Aerodrome Finance Price Depend On?

- 8 Is Aerodrome Finance a Good Investment?

- 9 Will Aerodrome Finance Reach $10?

- 10 Will Aerodrome Finance Go Back Up?

- 11 Is Aerodrome Finance a Good Buy in 2025?

- 12 Conclusion

- 13 Where to Buy AERO Coin?

- 14 How to Buy Aerodrome Finance: Quick-Step Guide

Aerodrome Finance Overview

Aerodrome Finance is a DeFi platform designed to enhance liquidity provisioning and optimize yield generation within the crypto ecosystem. By leveraging automated market-making (AMM) mechanisms, it enables users to efficiently trade, stake, and provide liquidity while earning rewards. The platform operates on a model that incentivizes liquidity providers through competitive yield opportunities, making it an attractive option for both individual investors and institutions. Through smart contract automation, Aerodrome Finance ensures transparency, security, and efficiency, reducing reliance on traditional financial intermediaries and fostering a more decentralized financial landscape.

What sets Aerodrome Finance apart is its focus on sustainability and long-term growth. The platform implements innovative reward structures to maintain a healthy balance between liquidity incentives and long-term protocol stability. Governance participation allows the community to have a direct say in protocol upgrades, fee structures, and incentive models, ensuring a more decentralized decision-making process. By integrating with a broader DeFi ecosystem, Aerodrome Finance creates opportunities for seamless interoperability, making it easier for users to navigate and maximize their earnings in the rapidly evolving decentralized finance sector.

AERO Price Statistics

| Current Price | $0.75 |

| Market Cap | $579,486,443 |

| Volume (24h) | $25,135,205 |

| Market Rank | #111 |

| Circulating Supply | 770,135,713 AERO |

| Total Supply | 1,502,602,369 AERO |

| 1 Month High / Low | $1.2 / $0.737 |

| All-Time High | $2.33 Dec 07, 2024 |

Aerodrome Finance was co-founded by Alexander Cutler, who also serves as a core team member at Velodrome Finance, a decentralized exchange on the Optimism network. The platform was launched on August 28, 2023, on the Base network.

Aerodrome Finance Features

AERO crypto offers several features within the crypto space. These are:

- Liquidity provisions and incentives: Aerodrome Finance allows users to provide liquidity to its AMM and earn rewards through incentives such as staking and yield farming. Liquidity providers receive AERO tokens as rewards, encouraging participation and deepening the platform’s liquidity.

- Voting and governance: AERO token holders can participate in governance by voting on protocol changes, liquidity incentives, and fee structures. This ensures that the platform remains decentralized and community-driven, giving stakeholders a direct say in its future development.

- Base Network integration: Aerodrome Finance operates on the Base network, an Ethereum Layer-2 solution, which provides users with faster transactions and lower fees compared to Ethereum’s mainnet. This enhances accessibility and usability for traders and liquidity providers.

- Ve(3,3) tokenomics model: Aerodrome Finance follows the ve(3,3) tokenomics model, where users can lock their AERO tokens to receive veAERO (vote-escrowed AERO). The longer the lock period, the greater the voting power and reward boosts, aligning long-term incentives with the platform’s growth.

- Bribe & gauge system: The platform features a bribe and gauge system, where projects can offer incentives (bribes) to veAERO holders in exchange for directing liquidity rewards toward their pools. This model helps efficiently distribute liquidity across different pools based on demand.

- Yield optimization and staking: Users can stake AERO tokens or participate in liquidity pools to earn passive income through yield farming. The protocol optimizes reward distribution to ensure sustainable growth while maintaining competitive yield rates.

Aerodrome Finance Price History Highlights

- 2024: At its launch in February 2024, Aerodrome Finance (AERO) was priced at approximately $0.091. During the bullish market in January 2024, AERO coin reached $2.02. In December 2024 AERO coin hit its all-time high of $2.33.

- 2025: At the moment, AERO coin’s price hovers just below $0.8.

AERO Coin Price Chart

CoinMarketCap, February 19, 2024

Aerodrome Finance Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.68 | $6.51 | $3.6 | +380% |

| 2026 | $1.6 | $10.2 | $6 | +700% |

| 2030 | $3.6 | $46 | $25 | +3,200% |

| 2040 | $116 | $1117 | $617 | +82,000% |

Aerodrome Finance Price Prediction 2025

DigitalCoinPrice experts expect that in 2025 AERO coin’s price might go as high as $1.63 (+115%), while its minimum price can hit $0.68 (-10%).

PricePrediction crypto analysts believe that in 2025 AERO will cost $1.39 (+85%) at its low, while at its maximum Aerodrome Finance will rise to $1.59 (+110%).

Telegaon crypto experts expect that in 2025 Aerodrome Finance can hit $3.18 (+325%) at its lowest point, while its maximum price will hit $6.51 (+770%).

AERO Price Prediction 2026

DigitalCoinPrice experts think that in 2026, AERO crypto might go as high as $1.9 (+155%) per coin at its maximum. Its minimum price can drop to a minimum of $1.61 (+115%).

PricePrediction analysts think that in 2026 Aerodrome Finance will go as low as $2.12 (+185%) at its lowest point vs $2.41 (+220%) at its peak.

Telegaon analysts believe that in 2026 AERO coin will hit a minimum of $6.55 (+775%), while at its highest point it can rise to $10.19 (+1,260%).

Aerodrome Finance Price Prediction 2030

DigitalCoinPrice analysts believe that by 2030, AERO coin will rise to a maximum level of $4.09 (+445%), while its minimum price will drop to $3.57 (+375%).

According to PricePrediction, by 2030 Aerodrome Finance will see the lowest price of $10.85 (+1,345%), while at its peak it might reach $12.38 (+1,550%).

According to Telegaon expectations, in 2030 AERO might go as low as $30.86 (+4,000%) or hit $45.73 (+6,000%) at its peak.

Aerodrome Finance Crypto Price Prediction 2040

According to PricePrediction forecasts, in 2040 AERO is going to hit a minimum of $930.45 (+123,960%) at its low or reach its new all-time high of $1,117 (+148,850%).

According to Telegaon forecasts, in 2040 AERO can drop to $116.18 (+15,400%) at its lowest point or hit $151.86 (+20,150%) at its highest point.

Aerodrome Finance (AERO) Price Prediction: What Do Experts Say?

Aerodrome Finance distinguishes itself through its innovative approach to decentralized finance. Serving as the central liquidity hub on the Base network, it combines a powerful liquidity incentive engine with a vote-lock mechanism, enhancing both liquidity and governance. The platform employs a dual-token system involving AERO and veAERO tokens, which fuels its self-sustaining liquidity flywheel. Additionally, Aerodrome’s unique blend of yield farming, governance, and cross-chain compatibility sets it apart in the crowded DeFi landscape.

Aerodrome Finance has significant potential as a leading liquidity hub on the Base network, offering innovative solutions for decentralized trading, liquidity provisioning, and governance. Its ve(3,3) tokenomics model, which rewards long-term token holders and liquidity providers, creates a self-sustaining ecosystem that encourages user engagement and growth. As Aerodrome Finance continues to develop, some experts believe that it will continue to expand, while its token AERO will keep rising in price. For instance, predictions by analysts at CCN state that in 2030 the AERO coin could reach a maximum of $10.44.

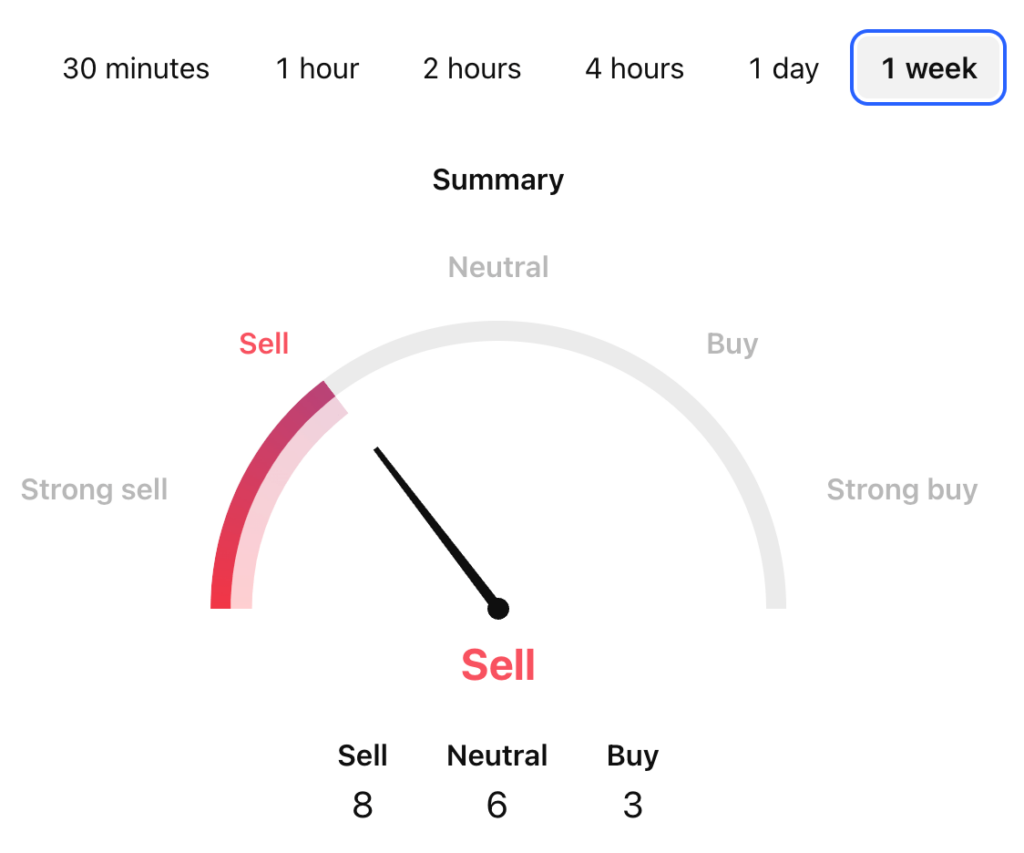

AERO USDT Price Technical Analysis

Tradingview, February 19, 2024

Now that we’ve seen possible price predictions for Aerodrome Finance, let’s find out a bit more about the factors that can influence its price.

What Does the Aerodrome Finance Price Depend On?

The price of Aerodrome Finance depends on several key factors, including market demand, network adoption, token utility, and overall crypto market conditions. As a liquidity hub on the Base network, its success is closely tied to the adoption and growth of Base itself. If more projects and users migrate to Base for its low fees and scalability, demand for AERO could increase, positively impacting its price. Additionally, liquidity incentives and staking mechanisms play a crucial role, as users locking AERO for vote-escrowed AERO (veAERO) reduces circulating supply, potentially driving up its value.

Another major influence on AERO’s price is broader market sentiment and investor speculation. Like most DeFi tokens, AERO is susceptible to overall crypto market trends, including Bitcoin’s performance, macroeconomic conditions, and regulatory developments.

When assessing AERO coin as an investment, keep the following considerations in mind:

- Market conditions;

- Market demand;

- Market sentiment;

- Network adoption;

- Token utility;

- Protocol updates;

- Liquidity incentives;

- Partnerships;

- Exchange listings;

- Growth of the blockchain market;

- Investor speculation;

- Economic factors.

Risks and Opportunities

Aerodrome Finance presents significant opportunities as a leading liquidity hub on the Base network, offering low fees, high-speed transactions, and innovative DeFi solutions. Its ve (3,3) tokenomics model encourages long-term staking and governance participation, helping to create a sustainable ecosystem where liquidity providers and investors can earn rewards. The platform’s bribe and gauge system, which allows protocols to compete for liquidity incentives, further enhances its attractiveness to users and projects seeking efficient yield strategies.

However, despite its potential, Aerodrome Finance also carries risks, primarily due to market volatility and competition. The DeFi space is highly dynamic, with many AMMs and liquidity hubs aiming for dominance. If Base does not achieve widespread adoption or if competing platforms offer more attractive incentives, Aerodrome’s growth could be limited. Additionally, regulatory uncertainty and smart contract vulnerabilities pose risks, as changes in global crypto regulations or security breaches could impact investor confidence and platform stability. Lastly, liquidity fragmentation and dependency on incentives mean that if rewards decrease or fail to attract long-term participation, the ecosystem could struggle to maintain sustainable growth. Investors should weigh these risks carefully while considering Aerodrome’s potential in the evolving DeFi landscape.

Is Aerodrome Finance a Good Investment?

A key factor in Aerodrome’s potential is its integration within the broader DeFi ecosystem. As Base, an Ethereum Layer 2 solution, continues to gain traction, Aerodrome Finance is well-positioned to benefit from increased network activity and adoption. Its governance system, liquidity bribes, and staking mechanisms provide flexibility and efficiency, giving it a competitive edge over traditional AMMs. If the platform continues to evolve, attract users, and expand its partnerships, Aerodrome Finance could become a cornerstone of liquidity on Base and a major player in decentralized finance. However, its long-term success will depend on adoption rates, broader market conditions, and continued innovation in the DeFi space.

What Is Aerodrome Finance Crypto?

Aerodrome Finance is a DeFi platform and liquidity hub built on the Base network, designed to optimize liquidity provisioning and yield generation. It operates using an AMM model with ve(3,3) tokenomics, allowing users to stake, vote, and earn rewards.

Will Aerodrome Finance Reach $10?

Hitting $10 for Aerodrome Finance is a speculative scenario, and while it’s possible, it depends on several key factors. For AERO to reach $10, the platform would need to achieve significant growth in its adoption, liquidity, and user base within the Base network. Strong demand for liquidity, the continued growth of the DeFi ecosystem, and increased institutional interest would be necessary drivers.

Can Aerodrome Finance Hit $100?

Hitting $100 for AERO would be a significant challenge. It would require Aerodrome Finance to not only stand out in the competitive DeFi landscape but also maintain long-term sustainability and community growth. While it’s theoretically possible, the chances of AERO reaching $100 in the near future are relatively slim, and such a price would likely be driven by extraordinary circumstances.

Will Aerodrome Finance Reach $1,000?

Achieving a $1,000 price for Aerodrome Finance would require a massive increase in market capitalization, much larger than what AERO currently commands. This would necessitate exponential growth in the platform’s user base, adoption, and liquidity, which, while possible, would be influenced by a range of unpredictable factors. Many believe this scenario can happen only after 2050.

Will Aerodrome Finance Go Back Up?

If the Base network continues to grow and attract more users and liquidity, Aerodrome, as a key liquidity hub, could see renewed interest and price appreciation. Additionally, new features, partnerships, or incentive programs could drive more demand for AERO, increasing its value over time.

What Is the Aerodrome Finance Price Prediction for 2025?

DigitalCoinPrice experts think that in 2025 the maximum price level for Aero Finance coin will be $1.63.

What Is the Aerodrome Finance Price Prediction for 2030?

Telegaon experts believe that in 2030 Aerodrome Finance will reach a peak price of $46.

Is Aerodrome Finance a Good Buy in 2025?

As a platform built on the Base network, Aerodrome Finance has the potential to benefit from the continued growth of DeFi and Base’s adoption. If the platform continues to innovate and attract liquidity, staking, and governance participation, AERO could see significant value appreciation. However, like all cryptocurrencies, it is subject to market volatility, competition, and regulatory risks. If you’re bullish on Base network’s future and DeFi’s expansion, and you’re comfortable with the inherent risks, Aerodrome Finance could be a worthwhile investment. As always, it’s essential to conduct thorough research and consider the broader market trends before making any investment decisions.

Does Aerodrome Finance Have a Future?

Aerodrome Finance has the potential for a promising future, particularly if it continues to capitalize on its unique positioning within the Base network and the broader DeFi ecosystem. As a liquidity hub with innovative features, Aerodrome Finance is designed to incentivize long-term user participation and efficient liquidity distribution. If Base network adoption grows and the platform attracts more liquidity providers, institutional users, and DeFi projects, Aerodrome Finance could strengthen its position as a key player in the field.

Conclusion

In summary, Aerodrome Finance is positioned at the forefront of decentralized finance innovation, with its unique liquidity hub on the Base network offering exciting opportunities for both users and investors. With its ve(3,3) tokenomics, liquidity incentives, and self-sustaining ecosystem, Aerodrome Finance has the potential to become a cornerstone of the DeFi space, driving long-term value and adoption. As the Base network continues to grow and evolve, Aerodrome’s role in providing efficient liquidity and governance solutions will only become more significant.

Where to Buy AERO Coin?

StealthEX is here to help you buy Aerodrome Finance if you’re looking for a way to invest in this cryptocurrency. You can buy AERO privately and without the need to sign up for the service. StealthEX crypto collection has more than 1500 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy Aerodrome Finance: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to AERO.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

AERO Aerodrome Finance crypto price prediction price analysis price predictionRecent Articles on Cryptocurrency

Kaspa Price Prediction: Can KAS Coin Reach $1?

Kaspa Price Prediction: Can KAS Coin Reach $1?  Pepe Coin Price Prediction: Can PEPE Reach 1 Cent Soon?

Pepe Coin Price Prediction: Can PEPE Reach 1 Cent Soon?