Berachain Price Prediction: Will BERA Coin Go Up?

Berachain (BERA) is a high-performance Layer-1 blockchain that utilizes a Proof-of-Liquidity (PoL) consensus mechanism to align network security with ecosystem liquidity, while maintaining EVM-identical execution for seamless Ethereum compatibility. Berachain is a new addition to the blockchain line and was built with the Cosmos SDK. In this article, we’ll examine several factors influencing the price of its native coin BERA and the platform’s future. Our expert insights will help you make up your mind about investing in Berachain and understand the reasons for its price to go up or down. Discover Berachain crypto price prediction in StealthEX’s latest article.

| Current BERA Price | BERA Price Prediction 2025 | BERA Price Prediction 2030 |

| $6.1 | $17 | $70 |

Article contents

- 1 Berachain (BERA) Overview

- 2 Berachain (BERA) Features

- 3 BERA Price Chart

- 4 Berachain Price Prediction: 2025, 2026, 2030-2040

- 5 Berachain (BERA) Price Prediction: What Do Experts Say?

- 6 BERA USDT Price Technical Analysis

- 7 What Does the BERA Price Depend On?

- 8 Is Berachain a Good Investment?

- 9 Will BERA Coin Go Up?

- 10 How High Can Berachain Go?

- 11 What Is the Prediction for Berachain Coin?

- 12 Is Berachain L1 or L2?

- 13 Conclusion

- 14 Where Can I Buy Berachain Crypto?

- 15 How to Buy Berachain Coin: Quick-Step Guide

Berachain (BERA) Overview

Berachain is a high-performance EVM-Identical blockchain utilizing Proof-of-Liquidity (PoL) as a sybil resistance mechanism that is built on top of a modular EVM-focused consensus client framework named BeaconKit. PoL addresses a critical flaw in traditional Proof-of-Stake (PoS) systems: the misalignment of incentives. PoS validators earn rewards without engaging with protocols or users while projects retain most tokens for themselves, creating a fragmented ecosystem that limits growth. PoL establishes a framework whereby network security and liquidity work together. The system requires validators and liquidity providers to collaborate, with validators distributing rewards to liquidity pools and providers earning governance rights through active participation.

Berchain utilizes BERA, which is used for gas fees, and BGT, which is the blockchain’s soulbound governance token, along with HONEY, the Layer-1’s native stablecoin. Users who lock their assets into the reward vault will receive BGT emissions from the validators, and these emissions can be delegated to validators to earn more rewards. Meanwhile, applications can incentivize user activity with BGT emissions.

Berachain incorporates an advanced sybil protection mechanism to ensure the integrity and security of its network. In the context of blockchain, a sybil attack occurs when a single entity creates multiple fake identities or nodes to gain an unfair advantage over the network, potentially undermining its consensus mechanism and governance. To combat this, Berachain utilizes its unique consensus model, which acts as a robust safeguard against sybil attacks. Unlike traditional Proof-of-Work (PoW) or Proof-of-Stake (PoS) models, where attackers can control a network by amassing large amounts of tokens or computational power, Berachain’s PoL requires validators to provide liquidity instead of merely staking tokens. This liquidity is a more difficult resource to accumulate or fake, as it requires substantial capital and genuine participation in the DeFi ecosystem.

BERA Price Statistics

| Current Price | $6.1 |

| Market Cap | $646,148,557 |

| Volume (24h) | $73,319,427 |

| Market Rank | #91 |

| Circulating Supply | 107,480,000 BERA |

| Total Supply | 500,000,000 BERA |

| 1 Month High / Low | $9.17 / $5.31 |

| All-Time High | $14.99 Feb 06, 2025 |

Berachain initially began as Bong Bears, a community-driven NFT project launched in August 2021 by anonymous developers Papa Bear and Smokey the Bera. What began as a fun experiment with a 0.0694 ETH mint price quickly evolved into something far more innovative.

As the community grew, the team, later joined by Dev Bear, shifted their focus to addressing the core challenges of DeFi, using their NFT success as a foundation. The platform was launched on February 6, 2025.

Berachain (BERA) Features

BERA offers several features within the crypto space:

- Proof-of-Liquidity: Validators provide liquidity instead of simply staking tokens. This mechanism not only enhances liquidity within the network but also ensures greater efficiency and scalability. Validators are incentivized to participate in the network by contributing liquidity, helping maintain a stable and secure environment while simultaneously earning rewards.

- EVM-Compatible: Developers can deploy Ethereum-based smart contracts without modifications. This compatibility bridges the gap between Ethereum and Berachain, enabling developers to leverage the growing Ethereum ecosystem while benefiting from Berachain’s unique features such as its hybrid consensus mechanism.

- DeFi centric: Berachain is built to support liquidity pools, lending platforms, and decentralized exchanges (DEXs). This focus on DeFi makes Berachain an ideal environment for developers and users looking to engage with decentralized financial services.

- Active Community and Governance: Users and liquidity providers play a key role in decision-making. Through decentralized governance, participants can propose and vote on network upgrades, changes to tokenomics, and other vital aspects of the platform’s evolution. This approach fosters a sense of ownership and involvement, aligning the platform’s growth with the interests of its community.

BERA Price Chart

CoinMarketCap, March 19, 2025

Berachain Price History Highlights

Berachain launched on February 6, 2025, and immediately went up to its all-time high of $14.99. However, its price later dropped, and at the moment BERA coin hovers around $6 per coin.

Berachain Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $5.45 | $28.56 | $17 | +180% |

| 2026 | $12.04 | $40.26 | $26 | +325% |

| 2030 | $28.76 | $115.32 | $70 | +1,050% |

| 2040 | $236.78 | $5,941 | $3,100 | +51,000% |

Berachain Price Prediction 2025

DigitalCoinPrice website states that in 2025 Berachain’s price might go as high as $13.25 (+120%), while at its lowest point it can drop to $5.45 (-10%).

PricePrediction analysts believe that in 2025 Berachain can go as low as $8.11 (+35%), while at its maximum it will hit $9.51 (+60%).

Telegaon crypto experts think that at the end of 2025 Berachain can drop to a minimum of $14.89 (+145%) or hit $28.56 (+370%) at its highest point.

BERA Coin Price Prediction 2026

According to DigitalCoinPrice, in 2026 BERA can go as high as $15.71 (+160%) per coin. At its minimum, the coin might drop to $13.01 (+115%).

Based on the experts’ forecasts at PricePrediction, in 2026, Berachain will continue rising in price: $12.04 (+105%) at its lowest point and $14.12 (+135%) at its peak.

Telegaon experts predict that in 2026 Berachain might go as low as $28.61 (+375%), while at its maximum it can reach $40.26 (+565%).

Berachain Price Prediction 2030

Based on the predictions of experts at DigitalCoinPrice, in 2030, BERA might reach $33.09 (+450%) per coin at its highest point. At its lowest point it might drop to $28.76 (+375%).

According to PricePrediction, in 2030 Berachain crypto can hit $67.08 (+1,000%) at its maximum while at its lowest point it can also drop to $59.77 (+900%) per coin.

Telegaon analysts believe that in 2030 Berachain is going to drop to its lowest point of $91.14 (+1,400%), while at its highest point it can rise to $115.32 (+1,800%).

Berachain Token Price Prediction 2040

According to PricePrediction forecasts, in 2040 Berachain will reach higher price levels: its minimum price is expected to be $5,020 (+83,000%), while its maximum price is going to peak at a whopping $5,941 (+98,000%).

When it comes to long-term predictions, Telegaon experts believe that in 2040 BERA coin will cost a minimum of $236.78 (+3,800%) at its lowest point or it can go to an all-time high of $274.45 (+4,450%).

Berachain (BERA) Price Prediction: What Do Experts Say?

As Berachain continues to build momentum within the DeFi space, experts have varied opinions on its future price trajectory. The platform’s innovative features, including a sybil protection mechanism, have attracted attention from investors and developers alike. The growing demand for DeFi solutions and the platform’s focus on liquidity pools, DEXes and lending platforms could position Berachain as a prominent player in the blockchain ecosystem, potentially driving up the value of its native token, BERA.

Crypto experts are optimistic about the future of Berachain, and many believe it can become massively adopted. For instance, CoinCodex experts believe that in 2030 BERA could potentially reach a high of $27.

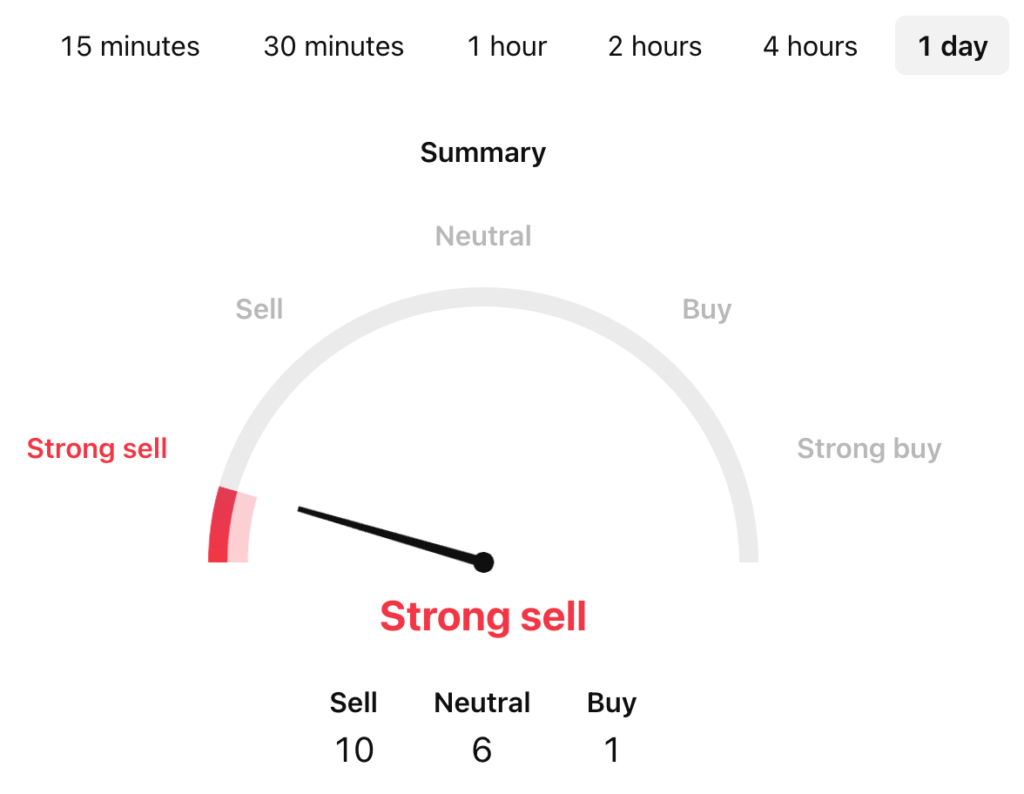

BERA USDT Price Technical Analysis

Tradingview, March 19, 2025

Now that we’ve seen possible price predictions for Berachain, let’s find out a bit more about the factors that can influence its price.

What Does the BERA Price Depend On?

The demand for Berachain coin is closely tied to the adoption of the Berachain platform. As more developers, liquidity providers, and users engage with the network to build dApps, participate in DeFi activities like liquidity pools and lending platforms, and contribute liquidity to the ecosystem, the utility and demand for BERA tokens may increase, potentially driving up its price.

Moreover, the continuous development of Berachain’s technology, including improvements to its PoL consensus mechanism, scalability, and security features, can influence investor confidence and drive demand for the token. Strong updates and new features that enhance the platform’s usability and performance can result in increased interest and investment in BERA. In addition, since Berachain’s PoL model incentivizes validators to provide liquidity rather than just stake tokens, the level of liquidity within the network plays a significant role in the price of BERA. The higher the liquidity and staking rewards, the more attractive the network becomes to participants, potentially boosting the token’s price.

Risks and Opportunities

Berachain presents several exciting opportunities, especially within the DeFi sector. Its innovative PoL consensus mechanism sets it apart from traditional blockchain platforms, offering a more efficient and secure way to validate transactions by requiring liquidity instead of just staking tokens. This feature provides enhanced scalability and reduces the risk of sybil attacks, making Berachain a more attractive option for developers and liquidity providers. As more developers and users embrace DeFi, Berachain’s user-friendly features and EVM-compatibility, which allows for seamless deployment of Ethereum-based smart contracts, position it well for future growth in the DeFi ecosystem.

Despite its promising potential, Berachain faces several risks that could impact its success. The competitive landscape in the blockchain and DeFi space is intense, with many established players like Ethereum, Binance Smart Chain, and Solana already dominating the market. Berachain will need to differentiate itself continuously and attract a large user base to succeed in such a competitive environment. Additionally, the platform’s reliance on liquidity providers and its hybrid consensus mechanism might face challenges in terms of scalability and security as the network grows. Finally, like all cryptocurrencies, Berachain’s price and adoption are subject to the volatility of the broader crypto market, making it a high-risk investment.

Is Berachain a Good Investment?

Berachain could be a promising investment, especially for those interested in the growing DeFi space. Its unique PoL consensus mechanism, combined with its focus on scalability, security, and EVM compatibility, makes it a standout platform for developers and liquidity providers. If Berachain continues to attract adoption and successfully integrates innovative DeFi solutions like decentralized crypto exchanges, lending platforms, and liquidity pools, it could see significant growth. However, as with any cryptocurrency, its success is subject to market volatility, so Berachain would probably make a good investment for someone with high-risk tolerance.

What Is BERA Coin?

BERA coin is the native cryptocurrency of the Berachain blockchain platform, designed to power and secure its decentralized ecosystem. BERA is used for various purposes within the network, including staking, participating in governance decisions, and incentivizing liquidity providers. As part of Berachain’s unique PoL consensus mechanism, validators contribute liquidity instead of just staking tokens, with BERA playing a key role in ensuring the network’s security and functionality. Additionally, Berachain can be used to pay transaction fees, interact with dApps, and participate in activities like lending and liquidity pools, making it an essential asset within the Berachain ecosystem.

How Old Is Berachain?

Berachain was founded in 2020, however, its token was launched in February of 2025.

How Much Is 1 BERA?

At the moment 1 Berachain coin costs around $6.

Will BERA Coin Go Up?

It’s possible, especially during the bull market. The future price of BERA coin depends on a variety of factors, making it difficult to predict with certainty. If Berachain continues to grow and attract more developers, users, and liquidity providers, the demand for BERA could increase, potentially driving its price up. Key elements such as the platform’s ability to successfully scale, its adoption in the DeFi space, and the overall growth of the cryptocurrency and blockchain markets will all influence BERA’s value.

How High Can Berachain Go?

With continued expansion and broader use cases, including partnerships with major DeFi platforms or institutions, BERA could see a more substantial rise to $10 or $20 per coin. This could be further amplified if Berachain successfully differentiates itself with its unique PoL consensus mechanism and achieves significant liquidity and usage on its platform. Realistically, a price of $50 for Berachain would be more achievable in the long term.

What Is the Prediction for Berachain Coin?

The prediction for Berachain Coin is speculative and depends on several key factors, including the platform’s development, market trends, adoption in the DeFi space, and the overall state of the cryptocurrency market. Price predictions for BERA vary greatly, with some analysts, like those at PricePrediction, estimating that in 2050 1 BERA will cost $7,400 per coin at its peak. However, all this is highly uncertain. But what is certain is that if Berachain successfully attracts developers and liquidity providers while expanding its DeFi ecosystem, the demand for BERA could increase, potentially driving its price up.

Is Berachain L1 or L2?

Berachain is a L1 (Layer-1) blockchain. It is a Delegated Proof-of-Stake (DPoS) Layer 1 chain built using the Cosmos SDK and Ethereum Virtual Machine (EVM) compatibility. Unlike Layer 2 solutions that rely on existing L1 blockchains for security, Berachain operates as its own independent blockchain with a unique consensus model called Proof-of-Liquidity (PoL).

What Is the Difference Between Berachain and Solana?

The key difference between Berachain and Solana lies in their underlying consensus mechanisms and focus areas. While both are high-performance blockchain platforms designed to support dApps and DeFi, Berachain utilizes a unique PoL consensus mechanism, where validators provide liquidity rather than simply staking tokens, offering enhanced scalability and security tailored for DeFi applications. In contrast, Solana uses Proof-of-History (PoH) combined with Proof-of-Stake (PoS), allowing for extremely fast transaction processing and low fees, making it highly attractive for a wide range of applications beyond just DeFi. Additionally, Berachain’s focus on providing liquidity-driven solutions specifically targets DeFi markets, while Solana has a broader use case, serving both DeFi and general-purpose decentralized applications.

What Is the Difference Between Berachain and Ethereum?

The main difference between Berachain and Ethereum lies in their consensus mechanisms and approach to scalability. Berachain uses a unique PoL consensus, where validators are required to provide liquidity instead of just staking tokens. This innovative mechanism aims to enhance scalability and security specifically for DeFi applications, offering more efficient liquidity utilization. Ethereum, on the other hand, primarily uses PoS to validate transactions, which requires validators to stake ETH tokens in the network to secure and validate them. Ethereum has a much broader ecosystem and is the leading platform for dApps and smart contracts, whereas Berachain is designed with a specific focus on DeFi use cases. Furthermore, Ethereum is known for its well-established ecosystem, vast developer community, and widespread adoption, while Berachain, although newer, aims to address scalability issues and liquidity optimization. Berachain also focuses on being more efficient for DeFi-related use cases, whereas Ethereum serves a broader range of decentralized applications.

Conclusion

Ultimately, Berachain holds significant promise as a game-changer in the DeFi space. Its innovative PoL consensus model, combined with EVM compatibility, positions it as a powerful platform for developers and users looking for more efficient, secure, and scalable blockchain solutions. With its focus on liquidity pools, decentralized exchanges, and lending platforms, Berachain is well-placed to capitalize on the growing demand for decentralized financial services. As the platform continues to develop, attract partnerships, and foster a vibrant community, Berachain has the potential to become a key player in the blockchain ecosystem.

Where Can I Buy Berachain Crypto?

StealthEX is here to help you buy BERA crypto if you’re looking for a way to invest in this cryptocurrency. You can buy Berachain privately and without the need to sign up for the service. StealthEX crypto collection has more than 1,500 coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy Berachain Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to BERA.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your BERA coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

BERA Berachain crypto meme crypto price prediction price analysisRecent Articles on Cryptocurrency

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?  OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?