Bitcoin Halving 2024: Everything You Need to Know

Bitcoin halving is a fundamental mechanism to regulate the amount of new Bitcoin that enters circulation and happens as part of the protocol’s design. Bitcoin operates on a deflationary model, with a capped supply of 21 million coins. To control the rate at which new Bitcoins are introduced into circulation, the protocol undergoes a halving event approximately every four years. During a halving, the reward that miners receive for validating transactions and securing the network is cut in half. In this article, we’ll try to find out what Bitcoin Halving 2024 is and how it’s going to affect BTC price.

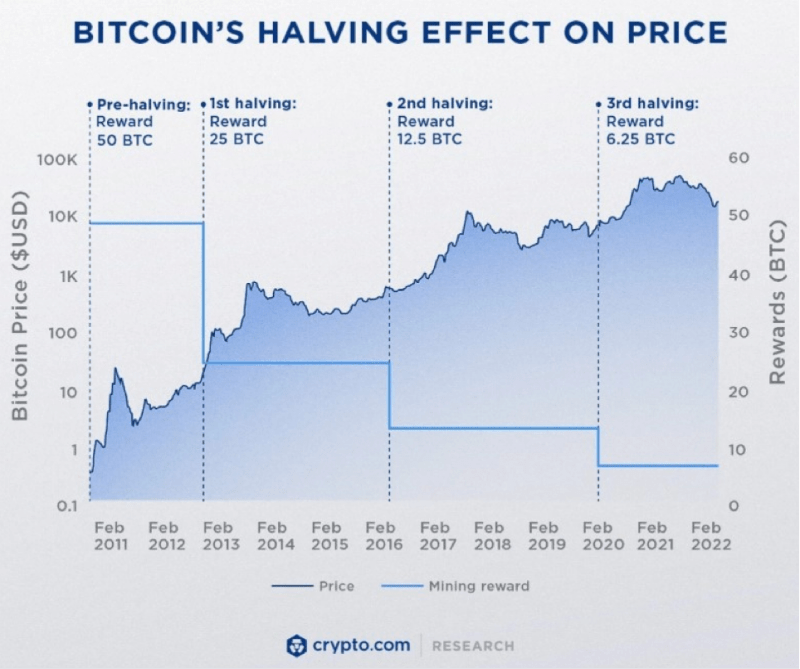

The intended 21 million coin cap will be achieved at some point in 2140, at which point this rewards program will end. At that point, network users will pay miners’ fees in exchange for their processing of transactions. These costs guarantee that miners will continue to be motivated to contribute and maintain the network. As per Bitcoin halving dates history, the last three halvings occurred in 2012, 2016 and 2020. The first Bitcoin halving, or Bitcoin split, occurred in 2012 when the reward for mining a block was reduced from 50 to 25 BTC.

Assuming the network uses Proof-of-Work (PoW), a blockchain protocol incorporates a halving event right from the start of its genesis block. Essentially, just two lines of code define this recurrent event: one indicates when a halving occurs, and the other indicates when the connected blockchain should cease halving. For Bitcoin, this is after 64 times. Halving is important; the halving policy was written into Bitcoin’s mining algorithm to counteract inflation by maintaining scarcity. In theory, the reduction in the pace of Bitcoin issuance means that the price will increase if demand remains the same.

Article contents

- 1 Historical Overview of Bitcoin Halvings

- 2 Bitcoin Halving 2024: What to Expect?

- 2.1 Market Predictions for BTC Price and Expert Opinions

- 2.2 Impact of Bitcoin Halving 2024 on the Crypto Ecosystem

- 2.3 Will Bitcoin Go Up After Halving?

- 2.4 When in 2024 Is the Next Bitcoin Halving?

- 2.5 What Is the Price Prediction for Bitcoin Halving 2024?

- 2.6 Is Bitcoin Halving Good or Bad?

- 2.7 Should I Buy Bitcoin Before or After Halving?

- 3 Conclusion

- 4 Where to Buy Bitcoin (BTC)?

Historical Overview of Bitcoin Halvings

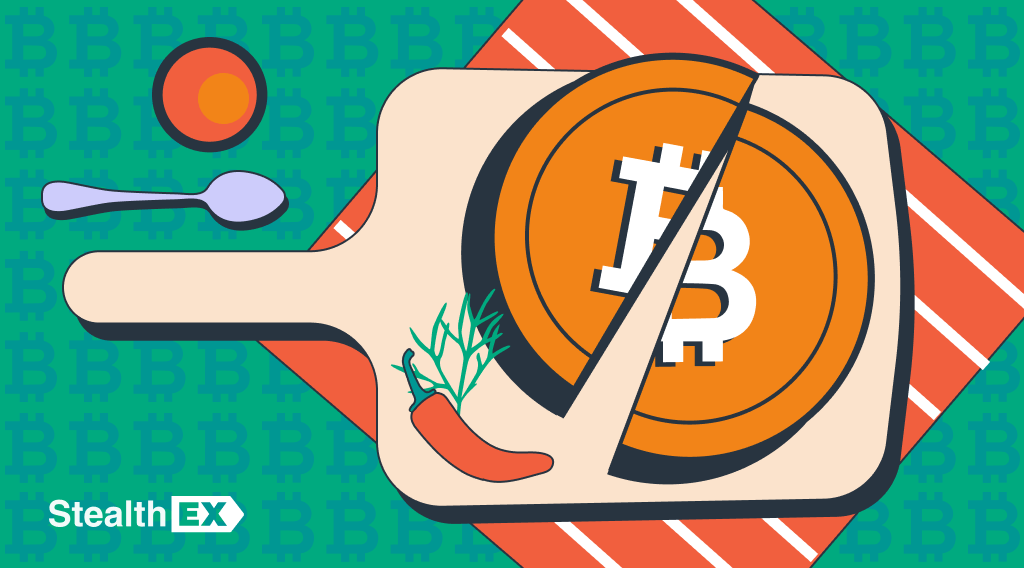

The initial halving of Bitcoin occurred on November 28, 2012, when the price of BTC was approximately $12. A year later, Bitcoin had increased to almost $1,000. When the second halving happened on July 9, 2016, the price of Bitcoin fell to $670, but by July 2017, it had risen to $2,550. In December 2017, Bitcoin also hit its previous all-time high of over $19,700. At the time of the most recent Bitcoin halving in May 2020, the price of BTC was $8,787. By November 2021, it had reached an all-time high of about $69,000.

Bitcoin’s Price Tends to Increase Post-Halving, source: Crypto.com

Bitcoin halvings have historically caused major changes in the cryptocurrency landscape by adjusting the dynamics of Bitcoin’s supply and demand. Because fewer Bitcoins are being created, the value of already-existing Bitcoins may increase due to their increasing scarcity as a result of the drop in block rewards. After the halving, there is typically a spike in Bitcoin volatility and a general optimistic mood on the market. As less Bitcoin is made accessible for mining, the value of the remaining Bitcoin increases and becomes a more alluring asset for investors. When examining the post-halving surges in Bitcoin, one should also take into account other factors:

- Increased media attention to cryptocurrencies and Bitcoin.

- A fascination with the digital asset’s anonymity.

- A gradual increase in real-world use cases for the currency.

Bitcoin Halving History. Source: BitPanda

When Is the Next Bitcoin Halving?

The most recent Bitcoin halving event took place on 12 May 2020. The block reward was promptly slashed in half as soon as the Bitcoin blockchain reached the halving block, and the halving event was carried out practically instantly. Although the exact date is not confirmed, the next Bitcoin halving is scheduled to take place in April 2024.

Bitcoin Halving 2024: What to Expect?

For Bitcoin miners, the halving poses a difficulty. As a result of the reduction in Bitcoin supply from 6.25 to 3.125 BTC per block, the revenue received by miners from block rewards is essentially being slashed in half. Furthermore, costs are rising as well. An important factor in determining miners’ costs is the hash rate, which is a measure of the overall processing power required to mine and process transactions on the Bitcoin network. It also acts as a stand-in for mining difficulty. The most recent spike, which was partially caused by Bitcoin’s price increase in 2023 and businesses purchasing more effective mining gear in response to favorable market conditions, emphasizes the growing difficulties faced by miners. Many miners may find themselves in a precarious situation in the near future as a result of a combination of falling revenue and rising costs.

On the surface, it seems like more investors are paying attention to specific ETF products, which is good for the price of Bitcoin. However, this outlook has been dampened by reducing miner reserves. The quantity of Bitcoin kept in miner treasuries is referred to as miner reserves. The CrptoQuant research claims that after the ETF was approved a few weeks ago, miner outflows have increased dramatically, reaching levels not seen since June 2021.

Miners delivered almost $1 billion in Bitcoin to exchanges on January 12, shortly after ETFs began trading. After a startling rise in Bitcoin prices to a two-year high, miners most likely sold to cash out. The ongoing selling by miners may be related to the recent slowdown in the price of Bitcoin. Following the approval of the ETF, the price of Bitcoin fell by 20%, hitting a yearly low of $39,000.

Market Predictions for BTC Price and Expert Opinions

Examining the price dynamics in the year preceding and following the halving events over the last three cycles reveals significant growth for Bitcoin. During these two-year spans, Bitcoin experienced remarkable increases: approximately 30,000% in 2012, 786% in 2016, and 712% in 2020. If Bitcoin continues to show the same performance this time, its price could reach the $220k mark in 2025. There are, however, a few distinct reasons why the next Bitcoin halving is anticipated to be unlike the others. The rising involvement of institutional investors in the Bitcoin market is one of the main characteristics that sets this halving apart. We’ve noticed an increase in interest in recent years from institutional actors like asset managers, hedge funds, and even conventional banking institutions. There has never been a halving with the degree of capital and experience that these institutional investors offer.

Another factor that sets this halving event apart is the growing popularity of Bitcoin among general users. The interest in and adoption of cryptocurrencies by both individuals and businesses has increased over the last few years. Moreover, because of its decentralized structure and restricted supply, Bitcoin remains an attractive option in uncertain economic times, which may increase demand during this specific halving.

Since the supply of Bitcoin will be drastically reduced in April due to the halving, a rally in price is most likely to occur when demand either rises or stays the same. Experts like Coinpedia believe that in 2024 Bitcoin can even reach an all-time high of $120,000. Predictions from various sources, including Standard Chartered, and Morgan Creek Capital, anticipate Bitcoin exceeding $100,000 and even $300,000 by 2028.

A month ago Skybridge Capital’s managing partner and founder, Anthony Scaramucci, predicted a surge for Bitcoin in the future. His prediction puts the token’s market value at least $170,000, which could increase depending on the current BTC price. He used a minimum value of $35,000, which he called conservative, stating that the BTC could rise to $60,000 before the halving event.

According to Bloomberg Intelligence and Matrixport, the cryptocurrency’s value might rise by at least 81% as a result of the halving. Although the price of Bitcoin is now at about $30,000, analysts think it may rise to $50,000 or even more by April 2024. But obstacles like economic uncertainty and regulatory crackdowns might affect this forecast.

Nasdaq and VettaFi highlight the views of the Twitter account known as BitQuant, which believes that Bitcoin is going to reach a new all-time high before halving. BitQuant predicts that Bitcoin will not reach $160,000 before the halving and could experience pullbacks, with a price forecast of $250,000.

In the cryptocurrency world, there is a lot of discussion and interest in BTC price projections for the 2024 halving. Although there may be differences in opinion among experts, the majority of them think that Bitcoin’s price will rise over time as a result of its growing popularity and limited supply. Some even predict that the 2024 halving will spur more institutional investment in the cryptocurrency, which will raise its price even further.

Impact of Bitcoin Halving 2024 on the Crypto Ecosystem

Over time, the halving serves to further emphasize Bitcoin’s inherent scarcity, which is one of the main draws for many users who view it as ‘digital gold.’ If demand keeps increasing, the slower rate at which new bitcoins are created can push the price higher. But after a halving, this effect takes time to manifest; it happens over the course of months and years.

Furthermore, the need for miners to continue making a profit could encourage advancements in sustainable energy sources and mining technology. The motivation to look for less expensive, more sustainable energy sources increases as mining returns decrease. Regarding the effects of Bitcoin mining on the environment, this trend may be beneficial.

Generally speaking, the halving event also acts as a recurring reminder of the distinctive economic model of Bitcoin, which may stimulate interest and adoption among new users. The halving events of Bitcoin may contribute to its broader adoption as a store of value and investment asset as it develops.

Will Bitcoin Go Up After Halving?

It is anticipated that BTC’s price will rise either before or after the halving event. There is no certainty, but it’s very likely.

When in 2024 Is the Next Bitcoin Halving?

The next Bitcoin halving is expected to take place in April 2024. Since the date is dependent on the block height, it is hard to predict the exact Bitcoin halving dates.

What Is the Price Prediction for Bitcoin Halving 2024?

Experts conclude that Bitcoin can rise in price anywhere from $50,000 to $170,000.

Is Bitcoin Halving Good or Bad?

The Bitcoin halving is considered a good economic model, since it puts disinflationary pressure on the virtual currency and helps it appreciate over time (as long as demand for Bitcoin keeps rising).

Should I Buy Bitcoin Before or After Halving?

It’s best to buy Bitcoin during the crypto winter when the market is at its all-time lows. And don’t forget to do your own research before buying any cryptocurrency.

Conclusion

The Bitcoin halving event remains a highly awaited event in the cryptocurrency world due to its nature and impact on the crypto market. The supply of new Bitcoins entering the market will be cut in half, and it is anticipated that the impending halving will follow the old and tried pattern. However, a number of unique factors set this BTC halving apart from others. First of all, compared to prior years, investors and the general public have a better knowledge and comprehension of Bitcoin. Secondly, with large financial institutions announcing plans to offer cryptocurrency services to their clients, institutional investors have begun to express interest in Bitcoin. This inflow of institutional capital may increase demand for Bitcoin and lead to an increase in its value. Finally, the technology that underpins Bitcoin storage and transactions has had a major upgrade. The development of safe wallets and exchanges has made it easier for individuals to buy, sell, and store cryptocurrency safely.

With so many new investors and the general public awareness of Bitcoin the halving event of 2024 is likely to bring new surprises, perspectives, and outcomes for the crypto market.

Where to Buy Bitcoin (BTC)?

StealthEX is here to help you buy Bitcoin. You can do this privately and without the need to sign up for the service. Our crypto collection has more than 1500 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy BTC Coin?

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange. For instance, ETH to BTC.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin Bitcoin halving crypto world halving price analysisRecent Articles on Cryptocurrency

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight

Bakkt Files $1B BTC Buy, GameStop Raises $2.7B, Ripple-SEC End 5-Year Fight  Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?

Banana For Scale Price Prediction: Can BANANAS31 Coin Hit $1?