Chainlink Price Prediction: Is LINK Crypto a Good Investment?

Chainlink (LINK) is a decentralized oracle network that plays a crucial role in bridging smart contracts with real-world data, enabling blockchain applications to interact with off-chain information securely and reliably. By providing tamper-proof and verifiable data feeds, Chainlink enhances the functionality of DeFi, insurance, gaming, and other blockchain-based industries. How high can LINK go? Discover the Chainlink price prediction in StealthEX’s article.

| Current LINK Coin Price | LINK Prediction 2025 | LINK Price Prediction 2030 |

| $20 | $33 | $155 |

Article contents

- 1 Chainlink (LINK) Overview

- 2 LINK Price History Highlights

- 3 LINK Price Chart

- 4 Chainlink Price Prediction: 2025, 2026, 2030-2040

- 5 Chainlink (LINK) Price Prediction: What Do Experts Say?

- 6 LINK USDT Price Technical Analysis

- 7 What Does the LINK Price Depend On?

- 8 Is Chainlink Crypto Still a Good Investment?

- 9 Will Chainlink Reach $100?

- 10 Can Chainlink Hit $500?

- 11 Will Chainlink Be Worth $1,000?

- 12 Can Chainlink Reach $5,000?

- 13 Can Chainlink Hit $10,000?

- 14 How Much Will Chainlink Be Worth in 2025?

- 15 Does Chainlink Have a Future?

- 16 What Are the Benefits of Chainlink?

- 17 Conclusion

- 18 Where to Buy Chainlink?

- 19 How to Buy LINK Crypto: Quick-Step Guide

Chainlink (LINK) Overview

Chainlink (LINK) is a decentralized oracle network that enables smart contracts to interact securely with real-world data, APIs, and traditional financial systems. Blockchains, by design, are isolated and cannot access external information on their own. Chainlink solves this limitation by providing reliable and tamper-proof data feeds through a network of independent node operators. These nodes fetch, verify, and deliver accurate data to smart contracts, ensuring that dApps can function effectively in industries such as finance, insurance, supply chain management, and gaming. By leveraging multiple sources and a decentralized structure, Chainlink minimizes the risks associated with single points of failure and inaccurate data inputs.

The native cryptocurrency of the network, LINK, plays a key role in maintaining the ecosystem. It is used as an incentive for node operators to provide accurate data and secure the network, as well as a means of payment for services within the Chainlink infrastructure. The network’s architecture includes features like the Verifiable Random Function (VRF) for fair randomness in gaming and NFTs, and Cross-Chain Interoperability Protocol (CCIP) to facilitate seamless communication between different blockchains.

LINK Market Information Data

| Current Price | $20 |

| Market Cap | $12,806,020,052 |

| Volume (24h) | $875,887,324 |

| Market Rank | #11 |

| Circulating Supply | 638,099,970.45 LINK |

| Total Supply | 1,000,000,000 LINK |

| 1 Month High / Low | $27.03 / $16.35 |

| All-Time High | $52.88 May 10, 2021 |

Chainlink was created by Sergey Nazarov and Steve Ellis in 2017. The project was developed by their company, SmartContract, which aimed to bridge the gap between blockchain technology and external data. Sergey Nazarov, a well-known figure in the blockchain space, recognized the need for reliable oracles to connect smart contracts with off-chain data, leading to the development of Chainlink. The initial whitepaper for Chainlink was co-authored by Nazarov and Ellis, along with Cornell University professor Ari Juels, who contributed his expertise on security.

LINK Features

Chainlink offers several features within the crypto space:

- Decentralized oracle network: Chainlink operates a decentralized network of oracles, which reduces the risk of single points of failure. Rather than relying on a single data source, Chainlink aggregates data from multiple independent sources, which enhances the accuracy and reliability of the information being fed to smart contracts.

- Secure data aggregation: The platform’s oracles use data aggregation methods to compile data from multiple sources, reducing reliance on any single source and improving overall data reliability. This aggregation is especially important in use cases where data accuracy is critical, such as in DeFi protocols handling large sums of funds.

- Verifiable randomness function: Chainlink VRF is a unique feature that provides applications with a secure, verifiable source of randomness. This is particularly useful in gaming and NFT applications where fair randomness is essential, such as in loot boxes, randomized minting, and gaming mechanics.

- Cross-chain interoperability protocol: The CCIP allows Chainlink to facilitate communication and transfer of data and assets across different blockchains. This feature is critical for connecting dApps across various chains, enabling interoperability in a multi-chain environment.

- High scalability and reliability: Chainlink is designed to scale and support large-scale data demands from various industries, including finance, supply chain, insurance, and beyond. Its decentralized architecture and ability to scale without compromising on data accuracy or security make it a powerful infrastructure component in the blockchain ecosystem.

- Proof-of-Reserve is a feature that enables Chainlink to audit and verify the reserves of assets held by institutions and financial entities. This is especially relevant for stablecoins and wrapped tokens, helping ensure that these tokens are fully backed and transparent.

LINK Price History Highlights

- 2017-2018: Chainlink held its ICO in September 2017, raising $32 million. LINK’s price initially stayed low, trading below $0.2 for most of 2018 as the overall cryptocurrency market saw a downturn after the late 2017 bull market. It then even hit its all-time low of $0.12.

- 2019: In June 2019, Chainlink saw its first major price spike, rising from around $0.5 to over $4.5. This increase was driven by the launch of Chainlink’s mainnet on Ethereum, as well as growing recognition of its value proposition in the DeFi space. This price surge solidified LINK’s position as one of the top-performing tokens of 2019.

- 2020: In 2020, LINK benefited greatly from the DeFi boom, reaching a peak of approximately $17 in August 2020 as demand for DeFi and Chainlink’s oracles grew. However, LINK’s price fluctuated in the latter part of the year, stabilizing around $10 – $15.

- 2021: Chainlink reached an all-time high of $52.88 in May 2021 as the broader cryptocurrency market surged and the DeFi space continued to expand.

- 2022-2023: Like most cryptocurrencies, LINK’s price faced significant declines after the 2021 bull market. The token dropped from its peak of around $52 to under $10 by mid-2022. In 2023, LINK’s price showed some recovery as Chainlink expanded its offerings with innovations like the CCIP and its continued integration across new DeFi platforms.

- 2024: In March LINK, as the market began to stir, LINK hit $21.75 and later went down to $10. In December of 2024, due to the bullish tendencies, Chainlink again rose to $29.22.

- 2025: At the moment, as the crypto market continues to expand, Chainlink trades between $19 and $21.

LINK Price Chart

CoinMarketCap, February 5, 2025

Chainlink Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $18.4 | $46.6 | $33 | +65% |

| 2026 | $39 | $54.3 | $47 | +135% |

| 2030 | $97 | $213 | $155 | +675% |

| 2040 | $236 | $16,411 | $8,300 | +41,400% |

Chainlink Price Prediction 2025

DigitalCoinPrice experts expect that in 2025 LINK coin’s price might go as high as $45.21 (+125%), while its minimum price can hit $18.42 (-10%).

PricePrediction crypto analysts believe that in 2025 LINK coin will drop in price: it’s expected to cost $27.18 (+35%) at its lowest point, while at its maximum LINK will rise to $33.1 (+65%).

Telegaon crypto experts expect that in 2025 LINK can hit $24.89 (+25%) at its lowest level, while its maximum price will hit $46.56 (+135%).

LINK Price Prediction 2026

DigitalCoinPrice experts think that in 2026, LINK crypto might go as high as $52.7 (+165%) per coin at its maximum. Its minimum price can drop to a minimum of $44.22 (+120%).

PricePrediction analysts think that in 2026 LINK will drop to $39.17 (+95%) at its lowest point. Alternatively, it can reach a maximum of $46.64 (+135%) at its peak.

Telegaon analysts believe that in 2026 Chainlink will hit a minimum of $46.61 (+135%), while at its highest point it can rise to $54.26 (+170%).

Chainlink Price Prediction 2030

DigitalCoinPrice analysts believe that by 2030, LINK coin will rise to a maximum level of $113.15 (+465%), while its minimum price will drop to $97.74 (+390%).

According to PricePrediction, by 2030 LINK will see the lowest price of $176.46 (+780%), while at its peak it might reach $212.65 (+965%).

According to Telegaon expectations, in 2030 LINK might go as low as $97.14 (+385%) or hit $125.32 (+525%) at its peak.

LINK Crypto Price Prediction 2040

According to PricePrediction forecasts, in 2040 LINK is going to hit a minimum of $13,570 (+67,750%) at its low or reach its new all-time high of $16,411 (+82,000%).

According to Telegaon forecasts, in 2040 LINK can reach $235.78 (+1,080%) at its lowest or hit $274.45 (+1,275%) at its highest point.

Chainlink (LINK) Price Prediction: What Do Experts Say?

Chainlink has strong potential as one of the leading decentralized oracle networks, with experts offering a range of price predictions for its future. Many analysts believe LINK could experience steady growth, driven by increasing adoption of blockchain technology and the rising demand for secure, reliable smart contract data. As Chainlink continues to integrate with major DeFi platforms, enterprises, and cross-chain applications, its utility and value proposition are expected to strengthen.

While price forecasts vary, some experts predict LINK could reach new highs in the coming years, depending on market conditions and technological advancements. Bullish scenarios suggest that wider adoption of Chainlink’s oracle services could push LINK significantly higher, while more conservative estimates highlight potential volatility in the crypto space. Based on this, predictions by analysts at CoinLore state that a favorable market environment in 2035 could drive the price of Chainlink up to $176.

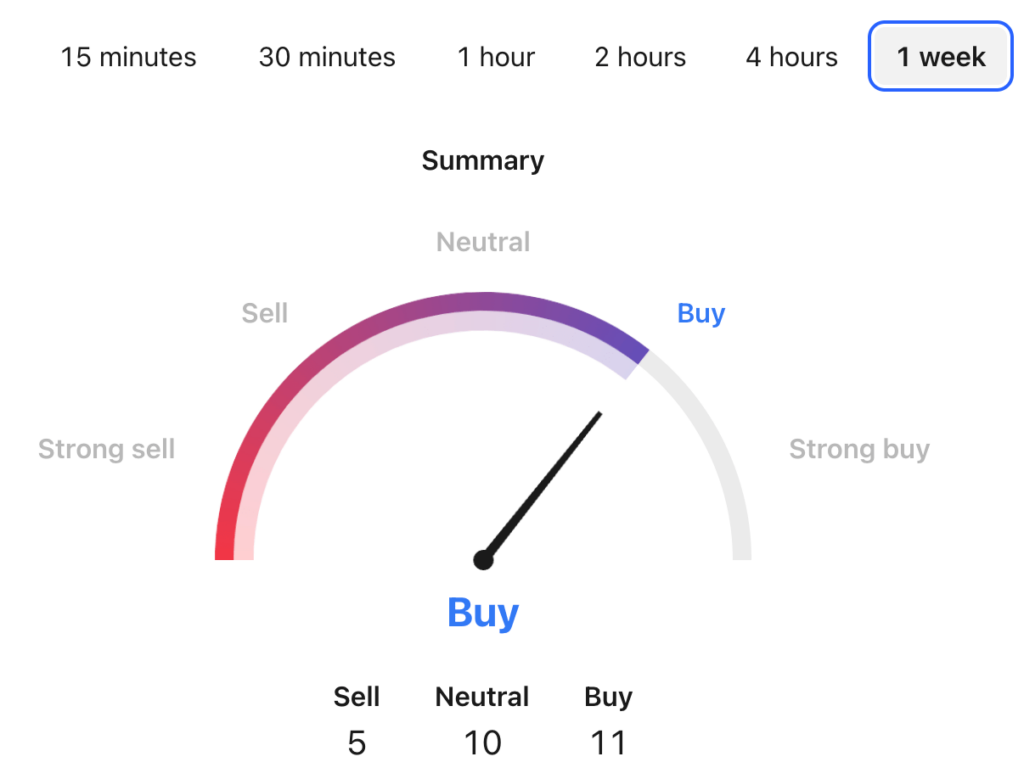

LINK USDT Price Technical Analysis

Tradingview, February 5, 2025

Now that we’ve seen possible price predictions for LINK, let’s find out a bit more about the factors that can influence its price.

What Does the LINK Price Depend On?

The price of LINK depends on several key factors, including market demand, adoption, technological developments, and broader cryptocurrency trends. As a decentralized oracle network, Chainlink’s value is closely tied to its usage within blockchain ecosystems. Increased adoption by DeFi projects, enterprises, and blockchain networks that rely on secure and reliable off-chain data can drive demand for LINK, leading to price appreciation.

Additionally, Chainlink’s price is influenced by overall market sentiment, Bitcoin’s performance, and macroeconomic conditions such as inflation, interest rates, and regulatory developments.

When assessing LINK as an investment, keep the following considerations in mind:

- Supply and demand;

- Demand for Chainlink’s oracle services;

- Growth of the DeFi and Web3 ecosystems;

- Technological improvements and updates;

- Market sentiment;

- Economical factors;

- Partnerships and integrations;

- Market trends;

- Competition;

- Regulatory changes;

- Utility.

Risks and Opportunities

Chainlink presents significant opportunities as one of the most widely adopted decentralized oracle networks, providing secure and reliable off-chain data to smart contracts. Its expanding integration with DeFi, enterprises, and cross-chain applications enhances its long-term utility and demand. As blockchain technology grows, Chainlink’s role in enabling real-world use cases — such as automated insurance payouts, supply chain tracking, and secure financial transactions — positions it as a crucial infrastructure. Additionally, innovations like the CCIP and staking mechanisms could further strengthen its ecosystem, driving adoption and potential price appreciation.

However, Chainlink also faces risks, including competition from other oracle networks and potential scalability challenges as demand increases. Regulatory uncertainty surrounding cryptocurrencies and decentralized services could impact their adoption, particularly if stricter regulations emerge for blockchain-based financial applications. Additionally, market volatility and macroeconomic factors, such as changes in investor sentiment or broader downturns in the crypto market, could lead to price fluctuations.

Is Chainlink Crypto Still a Good Investment?

Chainlink remains a promising investment for those looking at long-term growth in the blockchain sector, given its pivotal role in connecting smart contracts with real-world data. Its strong position as a leading oracle network, coupled with continuous innovation and increasing partnerships, suggests a solid future for the project. However, like all cryptocurrencies, LINK is not without risks: market volatility, regulatory uncertainty, and competition from other oracle solutions could affect its price and adoption. For investors with a high tolerance for risk, Chainlink’s technological foundation and growth potential make it an attractive option.

Will Chainlink Reach $100?

Such a price could become more plausible over a longer horizon, however, reaching $100 for Chainlink would represent a significant challenge. Currently, LINK’s market capitalization would need to increase exponentially to reach that price level, which would require a massive surge in adoption, network usage, and overall market demand. For LINK to get to $100, its total market cap would likely need to exceed trillions of dollars, far surpassing the total value of the entire cryptocurrency market as it stands today. That said, if Chainlink continues to expand its role in the DeFi ecosystem, sees widespread adoption by major enterprises, and capitalizes on emerging trends like cross-chain interoperability and decentralized oracles for real-world data, hitting $100 could become a real-life scenario.

Can Chainlink Hit $500?

It is extremely unlikely that Chainlink will ever hit $500, given its current market structure and tokenomics. For LINK to reach such a price, it would require a market capitalization in the tens of trillions of dollars. While Chainlink has a solid and essential role in the blockchain ecosystem, particularly within DeFi and smart contract applications, reaching $500 would likely necessitate an entire transformation of the broader cryptocurrency and financial industries. Achieving this would require massive adoption and mainstream integration of Chainlink’s technology.

Will Chainlink Be Worth $1,000?

The possibility of Chainlink reaching a price of $1,000 is low, given its current market structure and tokenomics. To reach $1,000, LINK would need to achieve a market capitalization in the hundreds of trillions of dollars. Even in the most bullish scenarios, such as widespread blockchain adoption and the expansion of DeFi, reaching $1,000 for LINK seems a bit unrealistic.

Can Chainlink Reach $5,000?

Given the current tokenomics and broader crypto market structure, it’s pretty unlikely for Chainlink to hit $5,000. However, some analysts, such as those at PricePrediction, believe that reaching that price level is possible closer to 2040.

Can Chainlink Hit $10,000?

Reaching a price of $10,000 for Chainlink is highly improbable based on the current market dynamics and tokenomics. While Chainlink is a critical infrastructure project in the blockchain ecosystem, providing decentralized oracles for smart contracts, the kind of demand required to push its price to $10,000 would necessitate an unprecedented surge in global blockchain adoption, dramatically reducing the token’s circulating supply or fundamentally altering the financial systems that underpin global economies. Even in the most optimistic scenarios, where decentralized technology becomes mainstream and Chainlink’s services are universally utilized, such a price point remains speculative and outside the realm of realistic expectations.

How Much Will Chainlink Be Worth in 2025?

Analysts at DigitalCoinPrice believe that in 2025 LINK will reach a maximum price level of $45.

How Much Will Chainlink Be Worth in 5 Years in 2030?

DigitalCoinPrice experts think that in 2030 Chainlink will hit a maximum of $113.

How High Will Chainlink Go in 2035?

Telegaon experts are of the opinion that in 2035 Chainlink can go as high as $183.

What Is the Price Prediction for Chainlink in 2040?

Experts at Telegaon believe that in 2040 Chainlink will reach a maximum level of $274.

Does Chainlink Have a Future?

Yes, Chainlink certainly has a future, and its prospects remain strong within the growing blockchain and DeFi ecosystems. As a leading decentralized oracle network, Chainlink plays a critical role in enabling smart contracts to securely interact with real-world data, APIs, and external systems, bridging the gap between blockchain networks and the off-chain world.

Is Chainlink Worth Keeping?

Whether Chainlink is worth keeping largely depends on personal investment goals and risk tolerance. From a long-term perspective, Chainlink remains one of the most important and widely adopted decentralized oracle networks in the blockchain ecosystem. Its role in bridging the gap between smart contracts and real-world data positions it as a foundational piece of the growing crypto infrastructure. For investors who believe in the future of decentralized applications and blockchain interoperability and in the future of DeFi, holding LINK could be a valuable addition to a diversified portfolio.

What Are the Benefits of Chainlink?

Chainlink provides crucial benefits by enabling smart contracts to securely access real-world data, making them more functional and reliable. Its decentralized oracle network ensures the integrity and security of off-chain data, reducing the risk of manipulation and single points of failure. With cross-chain interoperability, Chainlink connects multiple blockchain ecosystems, enhancing scalability and connectivity. Moreover, Chainlink continues to innovate and expand its offerings. For instance, the introduction of Chainlink 2.0 brings advancements like staking and the CCIP, which will enable smart contracts to securely interact across different blockchain networks.

Is Chainlink Better than XRP?

This depends on the context and use case. Chainlink serves a specific function as a decentralized oracle network that connects smart contracts to real-world data, making it essential for applications across DeFi, insurance, gaming, and more. Its unique value proposition lies in enabling blockchain interoperability and data security. On the other hand, XRP focuses primarily on facilitating fast, low-cost cross-border payments through its Ripple network, targeting the global financial industry.

Is Chainlink Better than Polkadot?

Chainlink and Polkadot serve different purposes within the blockchain ecosystem, making a direct comparison somewhat challenging. Chainlink is primarily focused on providing decentralized oracles, enabling smart contracts to securely interact with real-world data, which is crucial for applications across DeFi, insurance, and supply chain management. Its strength lies in enhancing the functionality and security of smart contracts. In contrast, Polkadot is a multi-chain platform designed to enable interoperability between different blockchains, allowing them to share information and assets seamlessly.

Will Chainlink Be the Next Bitcoin?

Chainlink’s role is foundational, and while it has tremendous growth potential due to its utility and increasing adoption, it operates within a different niche compared to Bitcoin. Chainlink’s success will depend on continued innovation, adoption within DeFi ecosystems, and integration with other blockchain platforms. While it may achieve significant growth and could become one of the top blockchain projects in terms of market capitalization, surpassing Bitcoin’s status as a store of value or achieving its level of cultural and financial influence seems unlikely.

What Is Better than Chainlink?

While Chainlink is the leader in decentralized oracles, some alternatives offer distinct features or advantages depending on the context. For instance, Band Protocol is another decentralized oracle network that provides similar services but is designed to offer faster and more scalable data feeds, which could be better suited for certain applications. API3 aims to decentralize APIs by enabling direct communication between smart contracts and traditional APIs, offering a more focused approach for integrating off-chain data. In addition, Witnet is a more recent oracle network that uses a novel proof-of-data mechanism to validate data sources, which could potentially offer a more secure and cost-effective solution.

Conclusion

Ultimately, Chainlink stands as a cornerstone of the decentralized ecosystem, offering unmatched utility as the leading decentralized oracle network. Its ability to securely connect smart contracts with real-world data is essential for the continued growth of DeFi, blockchain-based applications, and beyond. With ongoing innovations like staking, CCIP, and a growing network of integrations, Chainlink is positioned to remain a vital infrastructure project for the blockchain space. As adoption continues to expand across industries, Chainlink’s potential for long-term growth and value creation remains strong.

Where to Buy Chainlink?

StealthEX is here to help you buy LINK coin if you’re looking for a way to invest in this cryptocurrency. You can buy LINK privately and without the need to sign up for the service. StealthEX crypto collection has more than 1500 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy LINK Crypto: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to LINK.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Chainlink crypto price prediction LINK coin price analysis price predictionRecent Articles on Cryptocurrency

Toshi Price Prediction: Will TOSHI Coin Reach $1?

Toshi Price Prediction: Will TOSHI Coin Reach $1?  GoPlus Security Price Prediction: Will GPS Coin Reach $1?

GoPlus Security Price Prediction: Will GPS Coin Reach $1?