Ethereum ETFs: Will ETH Price Skyrocket Following Their Approval?

With the emergence and growing popularity of Bitcoin ETFs, which were one of the reasons for the current bullish tendencies on the market, the focus shifted to Ethereum ETFs. If Bitcoin’s dominance in the crypto market is undeniable, Ethereum’s unique functionalities and growing ecosystem make it a force to be reckoned with. In the crypto market, Ethereum has established itself as a leader, ranking second only to Bitcoin in terms of market capitalization and user base. At the moment, both the crypto industry and institutional traders are waiting for a number of Ethereum EFTs to be approved by the US Securities and Exchange Commission. How will this change the future of Ethereum and the crypto landscape in general? Can we expect a stronger bullish market following this news? Let’s try and find out.

Article contents

What Is Ethereum ETF?

Ethereum exchange-traded funds (ETFs) are innovative investment vehicles that track Ethereum’s price without the complexities of direct crypto ownership. Just like in the case with Bitcoin EFTs, investors from all around the world are interested in the idea of EFTs based on Ethereum. An Ethereum ETF is traded on conventional stock exchanges, as opposed to direct Ethereum purchases made on cryptocurrency exchanges. This makes it possible for investors to participate in Ethereum’s market movements without having to deal with the hassles of digital asset management, especially for those who are not familiar with the intricacies of cryptocurrencies.

With the possible approval of Ethereum ETFs, investors would have a great chance to profit from the expansion of the Ethereum ecosystem while avoiding the hassles of direct asset ownership. These investment vehicles give investors an easier and more regulated way to gain indirect exposure to fluctuations in Ethereum’s price.

The goals of various Ethereum futures exchange-traded funds vary. The value of the share will fluctuate in tandem with the price of Ether (ETH), as some attempt to precisely replicate its fluctuations. Others attempt to profit on increases in the price of Ethereum.

Why Consider Ethereum ETFs?

There is a number of reasons why Ethereum ETFs can be beneficial for investors, including:

- Accessibility: Ethereum can be easily traded through traditional brokerage accounts on stock exchanges.

- Reduced fees: Compared to purchasing Ethereum futures contracts yourself or hiring a fund manager to invest in Ether for you, an Ethereum futures ETF is very affordable.

- Regulation: Investors will benefit from oversight and regulation within traditional financial markets.

- Diversification: Any portfolio can be diversified by including a cryptocurrency asset class.

- Simplicity: It’s a simple way of gaining exposure to the value of Ethereum without owning and securing actual Ethereum.

- Liquidity: Investors can enjoy the liquidity of ETFs, which makes it easier to buy and sell shares on the stock market.

What Is the Difference Between ETH and an Ethereum ETF?

Differences include the following:

- Ownership: Unlike a typical digital asset investor who holds their crypto in a wallet address, ETF investors own shares in the related fund. That fund may either hold spot digital assets or derivatives tied to that asset.

- Fees: Like other investment funds, an Ethereum ETF will be charged some form of management fee. By contrast, an ETH holder only pays a fee (or ‘gas’) when conducting a transaction on the Ethereum network.

- Trading: Ethereum ETFs are subject to the same trading day restrictions as other investment products. That means Monday through Friday, instead of the traditional 24/7 crypto market cycle.

When Will Ethereum Get an ETF?

Today, there is one type of Ethereum ETF available in the US market. This is the Ethereum futures ETF, which offers financial exposure to ETH futures. All ETFs are carefully regulated by the U.S. Securities and Exchange Commission (SEC), and an ETF can only start trading shares after it gets SEC approval. The SEC started to approve crypto futures ETFs in 2021, and has been very cautious about authorizing new funds. The very first Ethereum futures ETFs were finally released on Oct 2, 2023. Other companies are trying to create and launch spot Ethereum ETFs as part of a broader push for mainstream adoption. These include Grayscale Investments, a US-based asset management firm. Another big player in the field is BlackRock, which has filed paperwork to list an Ethereum ETF.

At the moment, VanEck is the first Ethereum ETF application on the Securities and Exchange Commission’s pile that’s waiting to be approved by the commission. The regulator is due to decide the outcome of the application on May 23. However, not many are so sure that this first ETF will get approved. Moreover, some are hopeful that this won’t happen until the end of the year. For instance, Matt Hougan, CIO at BitwiseInvest, claimed that spot ETFs will gather more assets if they launch in December. Some experts, such as Bloomberg Intelligence analyst James Seyffart, agreed with this.

Most analysts believe that, unlike in the case with Bitcoin ETFs, SEC doesn’t face strong legal pressure this time, and it is still possible that Ethereum ETFs won’t get an approval from the commission.

Why the SEC May Deny Ethereum ETFs

The SEC may reject spot Ethereum ETFs for three primary reasons.

The first is the lack of clarity surrounding Ethereum’s regulatory status. Gary Gensler, SEC chair, has tried hard to avoid talking anything about Ethereum, even though he has said time and time again that Bitcoin is a commodity and should be regulated as such.

Political fallout may be the second reason for a denial from the SEC. The SEC was harshly condemned by Massachusetts Democrat Senator Elizabeth Warren for approving Bitcoin spot ETFs, despite the fact that the agency did so only following a legal setback.

Thirdly, the SEC might think it is less vulnerable to be sued this time around. Although it may be less likely to do so this time, Grayscale Investments sued the agency after it rejected its proposal to turn its Bitcoin Trust into an ETF.

Ethereum Price Prediction After ETF Approval

It is expected that if Ethereum ETFs are approved by the SEC, the price of this digital asset will rise and may even add hype to the bullish crypto market. According to analysts from Standard Chartered, the SEC can approve Ethereum-based ETFs in May. Spot Ethereum ETFs could bring up to $45 billion in inflows in the first 12 months if approved on May 23, according to Standard Chartered. This, in turn, could lead to the price of ETH rising to $8,000 by the end of 2024. In a research note, the bank’s analysts believe that the approval of spot Ethereum exchange-traded funds (ETFs) will be a major catalyst for the cryptocurrency’s price.

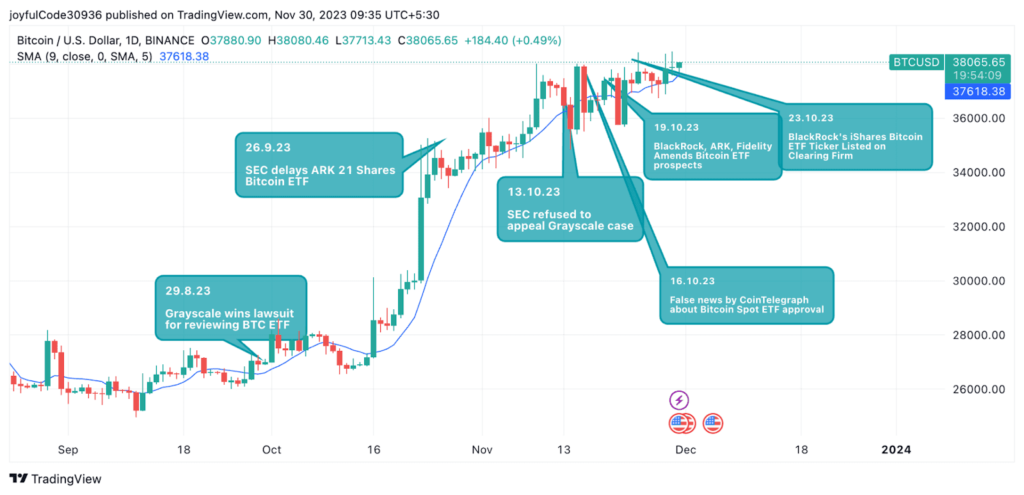

Bitcoin ETF Price Movement as News Emerges. Source: TradingView

Experts believe that the ratio of the price of Ethereum to Bitcoin may return to the values typical for 2021-2022 and reach 7% by the end of 2025. If the price of Bitcoin by the end of 2025 reaches $200,000, the price of ETH can go as high as $14,000.

What Is the Best ETF for Ethereum?

There are a number of ETFs for Ethereum.

- One of the most popular ones is Ethereum Grayscale Trust (ETHE). The fund is backed by Grayscale Investments LLC, a subsidiary of Digital Currency Group. With shares registered under Section 12(g) of the Securities Exchange Act of 1934, the trust is headquartered in the United States. Investors can gain exposure to Ethereum through the Grayscale Ethereum Trust without having to purchase, store, and maintain Ethereum themselves. The trust provides investors with an indirect means of capitalizing on the potential of the Ethereum market because it is fully and passively invested in Ethereum.

- It’s also worth keeping an eye on the ETH ETF applications that are also awaiting approval, for instance, BlackRock Spot Ethereum ETF. A spot Ethereum ETF proposal was formally submitted to Nasdaq by prominent asset management company BlackRock. The SEC has not yet given its regulatory permission to this kind of ETF, which would enable direct investing in Ethereum. Ether’s price has surged, indicating that market enthusiasm over BlackRock’s imminent Ethereum ETF application, which intends to establish an ETF tracking Ether’s spot price, has been generated. After the SEC approved BlackRock’s registration for a spot Bitcoin ETF in January 2024, investor confidence has significantly increased. However, the introduction of such an ETF by a major financial institution could signal a broader acceptance and accessibility of cryptocurrencies for average investors.

- One other potentially attractive Ethereum ETF could be offered by VanEck, the global investment firm whose Bitcoin Trust (HODL) is among the 10 spot Bitcoin ETFs that became available earlier this year. VanEck, which has over 68 ETFs under its umbrella, earlier this week temporarily cut the management fee on its Bitcoin Trust from 0.2% to 0%. The 0% remains in place until March 2025 or the fund gets up to $1.5 billion in AUM.

FAQ

Does Ethereum Have an ETF?

The SEC started to approve crypto futures ETFs in 2021. The ProShares Ether Strategy ETF was the first Ethereum ETF to launch in the U.S., in October 2023. Currently, seven issuers are hoping to launch an Ether fund: BlackRock, Fidelity, Invesco with Galaxy, Grayscale, VanEck, 21Shares with Ark, and Hashdex.

What Is the 3X Ethereum ETF?

A 3X Ethereum ETF is an exchange-traded fund designed to provide investors with leveraged exposure to Ethereum’s price movements. 3x exchange-traded funds (ETFs) are especially risky because they utilize more leverage in an attempt to achieve higher returns. Leveraged ETFs may be useful for short-term trading purposes, but they have significant risks in the long run.

Conclusion

Many traders were ecstatic when the SEC initially decided to approve the first Ethereum futures ETF. However, it’s worth noting that the trading volume for all the new Ethereum futures ETFs was much lower than predicted. This, according to some investors, suggests that the market is oversaturated. So the future of the upcoming Ethereum ETFs is still uncertain.

Nonetheless, for crypto ETFs, the future is still bright despite the excess supply. Compared to standard finance ETF launches, the Ethereum futures ETFs launch had higher-than-average trading volume. This suggests that cryptocurrency products are starting to gain traction in the financial industry, and the potential of Ethereum is undeniable. If approved, the more successful Ethereum futures ETFs are probably going to draw a sizable user base, even if a couple of the less well-liked ones fail.

Regardless of whether you are new to crypto or have been there for a while, it’s essential to stay informed and protected while buying and holding digital assets. To keep updated on the latest news and invest in crypto with no risks, use StealthEX, a platform with over 1400 coins available for secure exchange. Just go to StealthEX, choose the amount of the cryptocurrency you want to swap, for example, ETH to BTC, and click Start Exchange.

Make sure to follow StealthEX on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin ETF crypto ETF ETF Ethereum Ethereum ETFRecent Articles on Cryptocurrency

No KYC for Buying Cryptocurrency on StealthEX

No KYC for Buying Cryptocurrency on StealthEX  XDC Price Prediction: Will XDC Crypto Reach $10?

XDC Price Prediction: Will XDC Crypto Reach $10?