Review of the Crypto Market: June 30, 2023

Last week, Blackrock applied for a spot Bitcoin ETF. The decision by the world’s largest asset manager resulted in the formation of a huge green candle on the Bitcoin chart. Ultimately, the BTC crypto price broke through the psychological level of $30,000 and even temporarily surpassed $31,000. Since then, it has been in a rather side-trend, trading in a very narrow range – despite a lot of positive news coming out of the market.

We invite you to our weekly review, in which we look at the price charts of BTC and ETH, check investor sentiment, analyze which projects acquired the status of the biggest gainer of the week, and finally, briefly discuss the most important news. So, let’s get started!

Article contents

Bitcoin Price in USD This Week

Although Bitcoin increased its value by more than 20% last week, it has already calmed down. Over the past seven days, the cryptocurrency has traded in a rather narrow range. The highest price of BTC during this time was just over $31,000, and the lowest was just under $30,000.

It is important, however, that the BTC price has not experienced a downward correction. So what is the price of Bitcoin today? BTC is trading around $30,800, noting a 2.7% gain over last week.

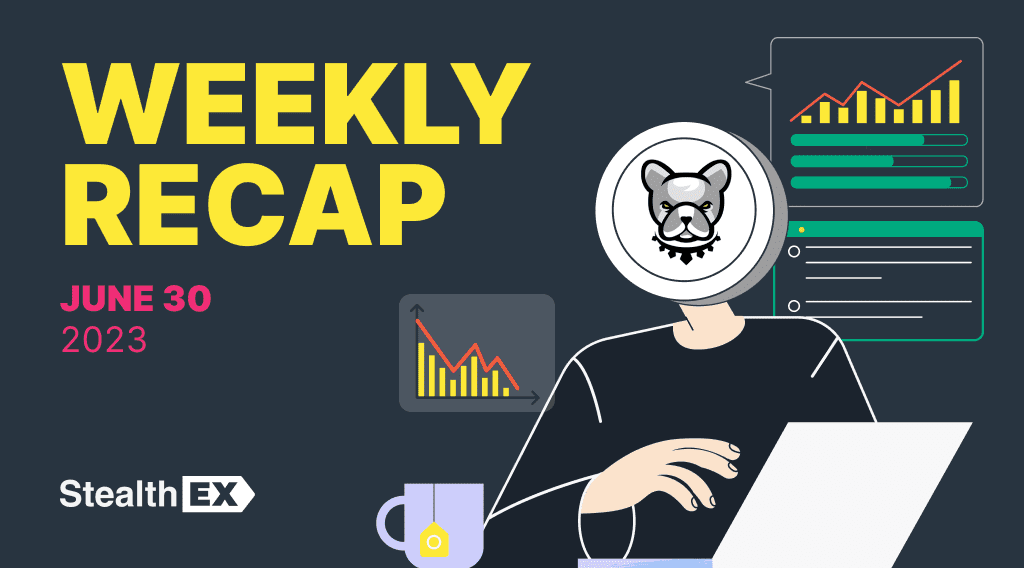

Bitcoin has also increased its dominance. Although CoinMarketCap and Coingecko sites still indicate that it is below 50%, according to the latest Coinshares report, BTC.D has risen to its highest level since April 2021 and is as high as 58%.

As for investor sentiment, it has, unfortunately, begun a gentle decline. Although the Fear and Greed Index still indicates greed, the score fell by 9 points – to 56.

Ethereum Price in USD This Week

We already know how Bitcoin behaved last week. So let’s look at the situation on the chart of the second-largest cryptocurrency. Ethereum behaved similarly to the initial crypto. Although it recorded huge increases last week, it has stagnated. ETH also oscillated in a relatively narrow range from just above $1800 to just above $1900. The price of ETH today is around $1875.

ETH’s dominance fell slightly – from 19.4% to 18.3%, according to Coingecko. Large gains on other altcoins may have influenced this. On the positive side, however, is investor sentiment. According to the Ethereum Fear and Greed Index, they have become much more greedy. CFGI.io currently indicates a level of 69%.

Biggest Crypto Gainers This Week

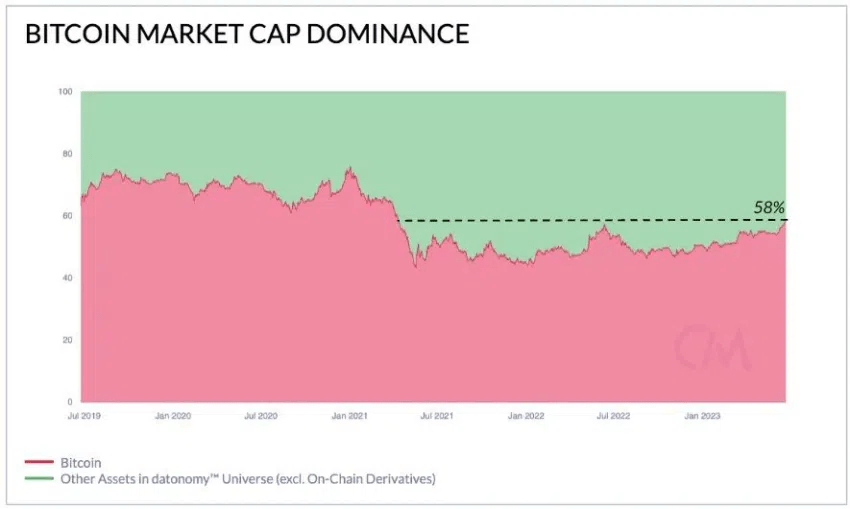

Although Bitcoin and Ethereum have stagnated, and their charts rather breeze with boredom, quite a few altcoins have shown an interesting upward trajectory. Among the TOP 100 projects that can be considered the biggest gainers of this week are:

- Bitcoin Cash (BCH) – an impressive 115% increase.

- Bitcoin SV (BSV) – 39%.

- FLEX Coin (FLEX) – 29%

- Synthetic Network (SNX) – 22%

- Stellar (XLM) – 19%.

Besides the above cryptos, more than 10% growth was also recorded by: eCash (XEC), Aave (AAVE), Ethereum Classic (ETC), Injective (INJ), Monero (XMR), Solana (SOL), VeChain (VET), Dash (DASH) and Litecoin (LTC). Quite a few of these projects are so-called “old-timers” who have survived more than one bull and bull market.

Crypto News of the Week

We already know how the major cryptocurrencies behaved, investor sentiment, the distribution of forces in the crypto market, and who won the title of the biggest gainer this week. So it’s time to move on to the next part of our weekly recap, which summarizes the most important news!

IMF Thinks Banning Cryptocurrencies Is Not a Good Idea

On June 22, the IMF reported on the benefits of CBDCs. It noted that this type of currency could reduce the cost of remittances and improve financial inclusion. The institution added that cryptocurrencies need to be regulated so digital assets can remain part of the current payment system. A total ban would not be the best solution.

The UN’s financial agency, which is working on a global CBDC platform, said governments should “focus on addressing the factors driving demand for cryptocurrencies” instead of banning them.

Horizen (ZEN) Will No Longer Be a Privacy Coin

Privacy coins have been experiencing the effects of intense regulation in recent months. This has resulted in ZEN no longer having the status of a coin of that nature.

The Horizen project has announced that all privacy features will be removed at the consensus level once the ZenIP 42204 update is approved. According to the platform, the withdrawal of the privacy-focused pools of the main Horizen blockchain will be introduced as part of the upcoming mandatory system update carried out in August/September of this year.

The change is to be implemented through a hard fork. On this basis, transactions with transparent inputs at the consensus level will be prevented.

Currently, regulators from various jurisdictions are banning cryptocurrencies that enhance user privacy. For example, Dubai’s Virtual Assets Regulatory Authority (VARA) has banned all activities related to privacy coins, such as Monero (XMR) and Zcash (ZEC) to prevent illegal actions by customers. Binance has followed suit with the SEC and announced plans to remove privacy coins for users in some European countries partially.

Binance Is Losing a Key Partner in Europe

The current times for Binance are extremely complicated. A lawsuit with the SEC, regulatory changes, as well as problems with business partners are forcing the exchange to take some action.

Currently, Binance is in the process of changing its service provider for euro deposits and withdrawals. The platform is closing its partnership with Paysafe Payment Solutions Ltd for the Single Euro Payments Area (SEPA).

This partnership was established a year ago and allowed deposits of, among other things, pounds through Faster Payments – which is the network that oversees payments and bank transfers in the UK. Now the situation is changing. This is because the exchange is exiting several countries, i.e., the Netherlands, Cyprus, and the UK.

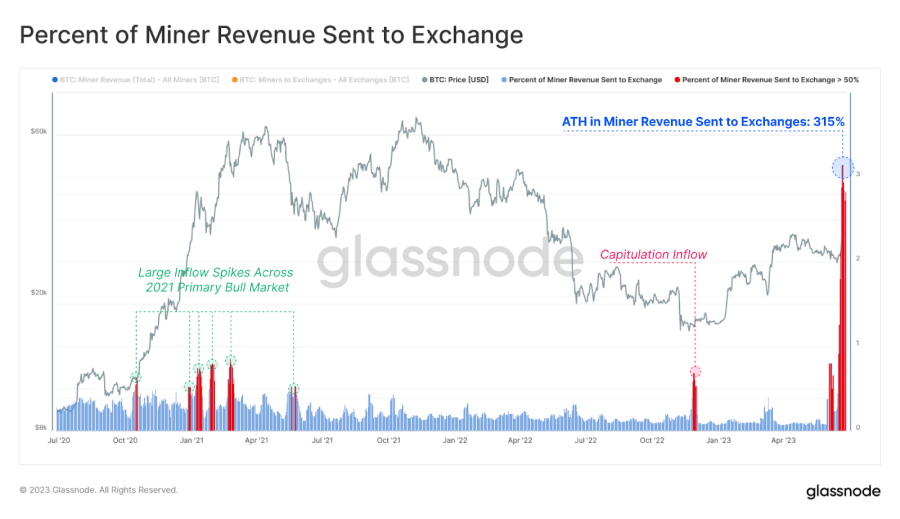

Miners Are Sending a Lot of BTC to Exchanges

Recently, there have been more signs that a new bull market is about to begin. One of them is the fact that miners are sending record amounts of BTC to exchanges. Over the past week, this group’s representatives sent as much as $128 million in Bitcoin to trading platforms.

This corresponds to 315% of their daily revenue, according to Glassnode. Just look at the chart below to understand the scale of this issue.

This is interesting data because it shows that someone is “swallowing” all these coins. On top of that, such a large inflow of BTC to exchanges did not shake the price of the primary cryptocurrency. Bitcoin is still hovering above $30,000.

In all this, however, it is worth asking another question: why are miners selling their BTC at all if the situation on the chart does not look bad?

After all, they have to pay their electricity bills. On top of that, although the price of Bitcoin has risen by more than 88% since the beginning of this year, miners still have some problems.

Miners’ profitability has fallen by more than 30% since last July. Since the bull market’s peak in 2021, by more than 80%. It has risen slightly in less than a week, but we are still far from the mining El Dorado. Even more so as the difficulty of mining is increasing in the background, which is good because of the greater security of the network, but not very favorable for BTC miners.

The rising difficulty, combined with higher energy prices, is putting pressure on miners and driving down the profitability of the mining process. In practice, this means that selling hard-mined Bitcoin is a must. That’s why we’re seeing an inflow of such significant amounts of BTC to exchanges.

However, as we mentioned, the fact that this phenomenon is not collapsing the price of BTC should be considered very bullish.

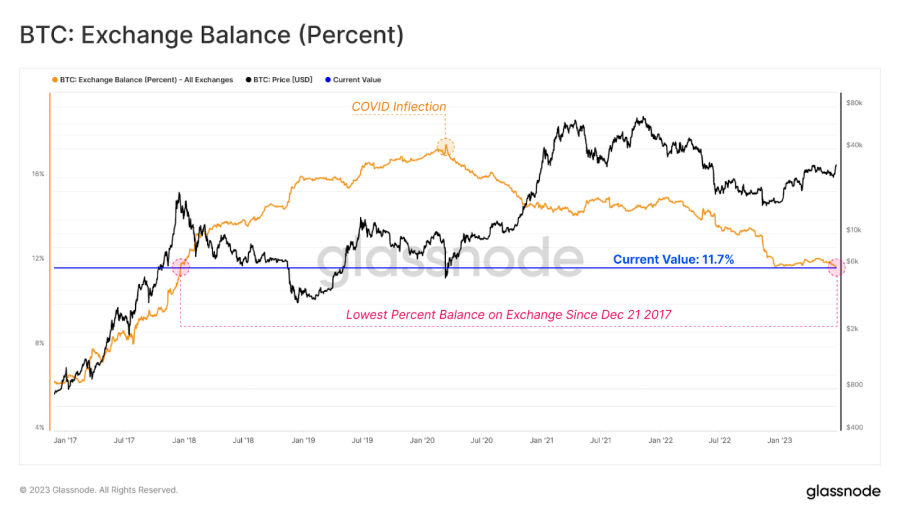

Supply of BTC on Exchanges Lowest Since 2017

Interest in cryptocurrencies is growing. This is due to galloping inflation, the cost of international transactions, and excessive capital controls by governments of various countries. Nevertheless, as interest in Bitcoin grows, so does awareness of it.

When cryptocurrencies were still nascent, and exchanges were not so often victims of hacking attacks, the supply of Bitcoin on them grew steadily.

Unfortunately, the collapse of giants such as FTX, the turmoil associated with the SEC, and the worldwide spectrum of the economic crisis is leading to a decline in confidence in centralized platforms. For this reason, they are only used as a stopover to buying crypto. Then the funds are deposited likely in the investors’ private wallets.

The amount of BTC stored on the exchanges’ addresses has been declining heavily since the COVID-19 crisis. At least, that’s what analysts at Glassnode point out. According to data, we can talk about a crash settling around 11.7% of the market cap and amounting to approximately 2.27 million BTC. This, in turn, marks the lowest level since December 21, 2017.

Pitbull Token (PIT) x StealthEX Giveaway

We would also like to announce that we have organized a giveaway on Twitter together with our partner, the Pitbull (PIT). Four lucky winners can win up to 80 bln PIT tokens. To participate, you must retweet a tweet, tag three friends in the comments, follow our and Pitbull’s Twitter, and post your favorite PIT meme.

Moreover, Pitbull will soon introduce a brand new version of its website. To ensure you get all the latest news on the project, observe its social media!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto world cryptocurrency Ethereum price analysisRecent Articles on Cryptocurrency

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?  FUNToken Price Prediction: Can FUN Coin Reach $1?

FUNToken Price Prediction: Can FUN Coin Reach $1?