Review of the Crypto Market: July 14, 2023

The last few weeks have been good for the crypto market. However, things have been dull over the past seven days, with digital assets falling into a strong stagnation – until yesterday. Bitcoin and Ethereum traded in a very narrow range, but everything changed on Thursday evening. Indeed, we got an insight into the result of the Ripple vs. SEC case. As every week, we invite you to our crypto recap. First, we will analyze the charts of BTC and ETH and then look at the most important news. So, let’s get started!

Article contents

- 1 Bitcoin Price in USD This Week

- 2 Ethereum Price in USD This Week

- 3 Biggest Crypto Gainers This Week

- 4 Crypto News of the Week

- 4.1 U.S. Presidential Candidate Robert F. Kennedy Jr. Owns Bitcoins

- 4.2 Halving in Less Than 240 Days!

- 4.3 Meta Sets Up Competition for Twitter – Threads

- 4.4 BNB Beacon Chain Will Undergo a Hard Fork

- 4.5 Latest U.S. Inflation Data Released

- 4.6 Bitcoin Has Reached ATH In Turkey and Argentina

- 4.7 Ripple vs. SEC – A Historic Verdict in Court Has Been Reached!

- 4.8 AMA StealthEX x Hive

Bitcoin Price in USD This Week

Bitcoin’s price was overly stable this week – until the SEC vs. Ripple case news when a large green candle appeared on the chart. We also got to know a lot of macroeconomic data this week. The world’s largest cryptocurrency is currently trading at around $31,350. The 7d low for BTC was just under $30,000. We still have to wait to see if the resistance breakthrough will be long-lasting.

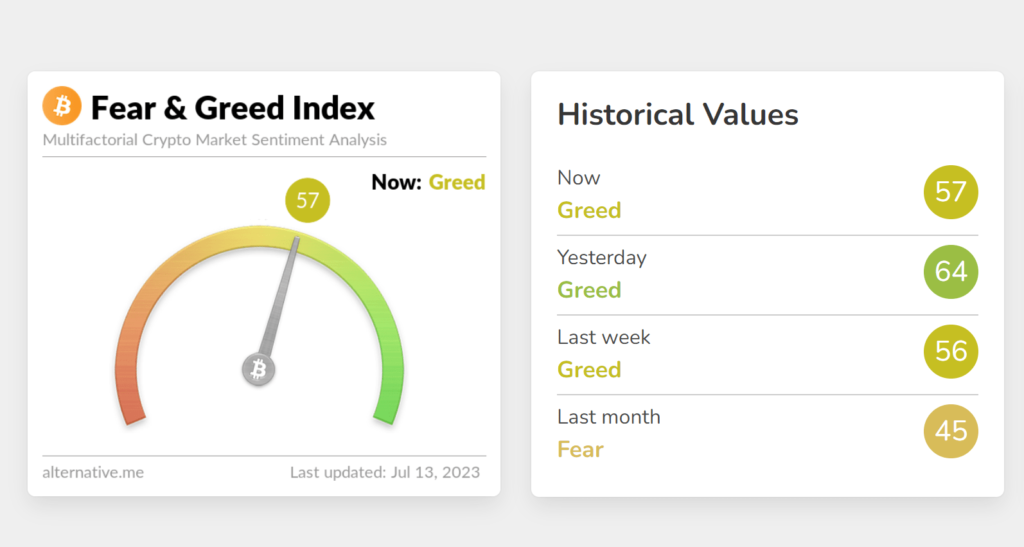

Bitcoin’s dominance remains similar to the week before – 48%. Investor sentiment has gently improved. The Fear and Greed Index indicates 1 point more than a week ago – 57.

Ethereum Price in USD This Week

The situation for Ethereum looks similar to that of Bitcoin. ETH has oscillated in a narrow range over the past seven days but experienced a breakout after the Ripple court ruling. The 7d low was $1870, and the 7d high we are observing now – almost $2000.

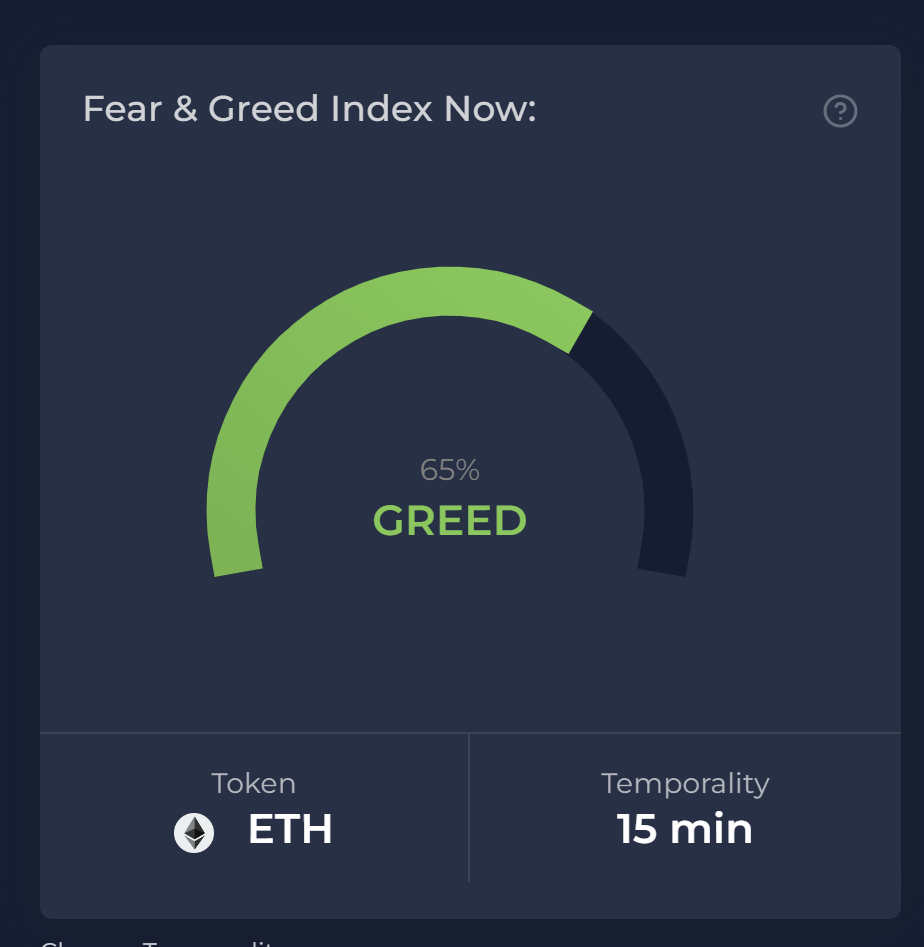

Like Bitcoin, ETH’s dominance remains at the same level as seven days ago – just over 18%. So is investor sentiment – according to CFGI.io, they are still greedy.

Biggest Crypto Gainers This Week

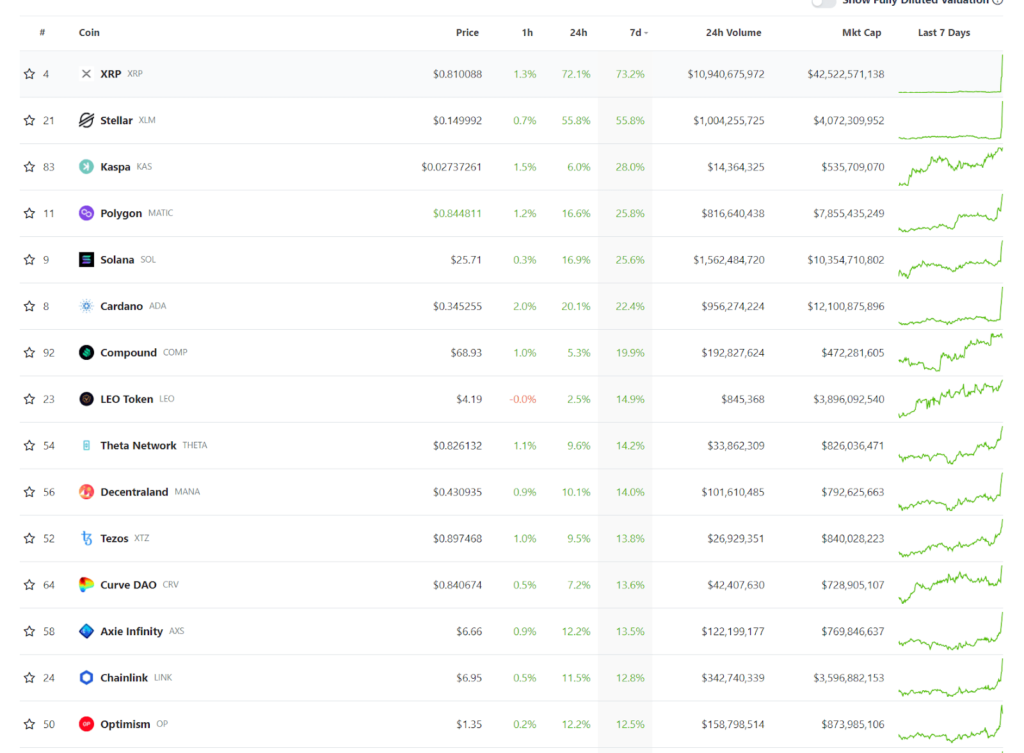

Bitcoin and Ethereum experienced relatively modest gains over the past seven days – up 3.5% and 6.5%, respectively. However, many altcoins provided investors with really impressive returns on their investments. The king this week turned out to be Ripple, for obvious reasons, but Stellar did well too. The biggest gainers of the week among the top 100 projects by market cap were:

- Ripple (XRP) – 73%.

- Stellar (XLM) – 55%

- Kaspa (KAS) – 28%

- Polygon (MATIC) – 25%

- Solana (SOL) – 25%

Apart from the above cryptos, Cardano (ADA), Compound (COMP), and LEO Token (LEO) also provided investors with returns of more than 15% over the past seven days.

Crypto News of the Week

Although the crypto market was stagnant for most of the week, this does not mean that nothing happened. There was indeed a lot of interesting news last week, either from the macroeconomy or the projects themselves. Moreover, there was a precedent yesterday, as a court ruled that XRP is not a security. So let’s recap the latest news!

U.S. Presidential Candidate Robert F. Kennedy Jr. Owns Bitcoins

As it turns out, U.S. presidential candidate Robert F. Kennedy Jr. is not only publicly defending cryptocurrencies but has also invested in Bitcoin. He holds between $100,000 and $250,000 in BTC. CNBC reported the news.

Interestingly, he previously denied being an investor. During the Bitcoin 2023 conference in Miami, Kennedy Jr. suggested that he does not own any cryptocurrencies. He also previously announced that he would accept donations in BTC as part of his election campaign.

Kennedy, however, cannot be accused of lying. After the CNBC article was published, Dennis Kucinich, his chief of election staff, reported that the politician had bought BTC after the Miami conference.

Choose StealthEX for Exchange and Buy Crypto

- User-Friendly — Simple and minimalistic interface for everyone.

- Fast and Private — Instant non-custodial cryptocurrency exchanges.

- Buy crypto with Credit Card.

- 1200+ coins and tokens are available for limitless, quick and easy exchanges.

- NO-KYC crypto exchanges — Buy cryptocurrency up to €700 without KYC!

- StealthEX crypto exchange app — Process crypto swaps at the best rates wherever you are.

- 24/7 Customer Support.

Earn from Each Exchange by Joining StealthEX Affiliate Program.

Become a partner right now and use affiliate tools:

- Public API — Earn from your wallet, aggregator, or exchange terminal.

- Referral Links — Recommend StealthEX to your audience.

- Exchange Widget — Built crypto exchange widget on any page of your website.

- Button — A perfect choice for traffic monetization.

- Banner — Track conversion and stats right in the personal cabinet.

Halving in Less Than 240 Days!

Every four years, halving occurs in the BTC network, naturally reducing the supply of new Bitcoin that enters the market. This phase is expected to occur in less than 240 days, on March 6, 2024. So far, we are again going through the same thing in the market.

The fact that Bitcoin’s price increases after each halving is obvious. It results from the law of supply and demand. Therefore, each of the last three halving has been followed by strong price jumps. The previous miners’ reward halving took place in mid-May 2020. The bull market for BTC lasted a year and a half, resulting in an ATH of $69,000. The situation was similar after the halving in 2016. (ATH at $20,000).

Looking at the chart of BTC, you can see a consistent pattern. Everything starts with a 1.5-2 year bull market, followed by a slump and a sideways trend. According to these statistics, BTC has already reached the bottom after a nearly 400-day bull market, culminating in last year’s drop below $16,000.

There are many indications that we are currently following the same scenario again, which leads us to conclude that stronger increases will begin in about 240 days, and we will see a new ATH in 2025 (of course, this is not investment advice!).

Meta Sets Up Competition for Twitter – Threads

One of the main communication channels of the crypto community until now was Twitter. All news regarding new projects, airdrops etc. were published on this social media platform. Unfortunately, the recent actions of Twitter’s leadership have badly battered the crypto community.

Audiences have fallen by up to 60%, so crypto Twitter has begun to look around for another platform on which the community could communicate effectively. All this is due to the need for concrete information about the end of Twitter’s restrictions.

An alternative to Twitter has appeared on the horizon, namely Threads from Meta – and just at the time of the biggest problems of the Elon Musk-managed platform. It is worth noting that Threads shows a lot of potential for cryptocurrency marketing because of its algorithm. It is similar to the mechanism of TikTok.

It is possible to create targeted ads that increase their reach by tailoring messages to the audience. In other words, people interested in cryptocurrencies will get more referrals to channels and projects that deal with this topic.

The speed at which Threads is growing is also significant. Zuckerberg’s platform broke the record for the fastest time to get one million active users. Twitter took two years to do it, the last leader – ChatGPT – only five days, while Threads reached that level in just one hour.

BNB Beacon Chain Will Undergo a Hard Fork

BNB Beacon is set to undergo an update called “ZhangHeng” which will significantly change blockchain performance. The hard fork is expected to take place at block height 328,088,888. The scheduled date for the update has been set for July 19, 2023, at 6:00 UTC.

The Beacon BNB network update introduces two important changes. The first is the addition of BEP-255. This new element allows tracking of how the state of users’ accounts – how much money they have on them – changes every time a new block is created in the network. If something goes wrong, the production of new blocks will be stopped, increasing security for the accumulated capital.

The second change is a fix for a bug that could cause problems with quick approval of transactions. It’s called Rogue Key Attack. To fix this, all addresses used for voting will be removed during the update, and then the validators – the people who approve the transaction – must add them again.

Latest U.S. Inflation Data Released

The latest economic data from the United States show mixed inflation trends. The Consumer Price Index (CPI), a key inflation indicator, rose 3.0% year-on-year in June. This is a significant decline from previous months – 4.0% in May, 4.9% in April, 5.0% in March, and a peak of 6.0% in February.

The data shows that the average consumer’s cost of goods and services has grown more slowly over the past 12 months. However, the CPI rose by 0.2% compared to the previous month, indicating a further slight price increase.

Moreover, core inflation figures, which exclude volatile food and energy prices, show an annual increase of 4.8% and a monthly increase of 0.2%. This suggests that the costs of other goods and services, besides food and energy, rose faster than the overall CPI.

The data paint a mixed picture of inflation trends in the United States. Although overall inflation appears to be slowing, core inflation remains relatively high.

Bitcoin Has Reached ATH In Turkey and Argentina

In recent weeks, the national currencies of Argentina, Turkey, and Egypt have experienced a series of significant declines, reflected by long red candles.

Various factors, such as the consequences of the coronavirus pandemic, soaring inflation, political challenges, and general macroeconomic instability, have contributed to the decline in the value of these fiats.

In the context of accelerated devaluation, Bitcoin’s price rose sharply against the Argentine peso, Turkish lira, and Egyptian pound. It has already reached an all-time high in the first two. Currently, one Bitcoin is valued at about 8,080 ARS and 803,000 TRY, respectively. In Egypt, the price is on track to exceed the previous ATH.

Ripple vs. SEC – A Historic Verdict in Court Has Been Reached!

Ripple Labs has won, as it were, its battle with the U.S. Securities and Exchange Commission (SEC) in the U.S. District Court of the Southern District of New York. Judge Analisa Torres ruled more in favor of the accused company.

Although the U.S. regulator had been trying since late 2020 to force Ripple Labs to stop offering allegedly unregistered securities in the form of the XRP token, the court ultimately took the side of the digital asset company on some issues.

According to the court documents, Ripple Labs’ programmatic sale of XRP was not illegal. The judge said that the XRP token “is not necessarily a security” – except when it was sold to raise funds from institutions.

According to Analisa Torres, programmatic sales of XRP to public buyers and distribution to Ripple Labs employees do not constitute sales of non-registered securities.

It should be noted that the court’s opinion does not apply to the sale of this virtual currency on the secondary market – such as crypto exchanges.

It is worth mentioning that Ripple Labs did not win on all issues. After all, to the company’s detriment, Judge Torres ruled that the institutional sale of XRP worth $728 million represented an unregistered offering of securities. Moreover, she noted that institutional investors bought the virtual currency in anticipation of the profits the Ripple project would bring them.

The cryptocurrency community reacted highly optimistically to the opinion issued by the U.S. court. In the last 24 hours, XRP price rose by more than 80%.

AMA StealthEX x Hive

In addition to the broader crypto market, a lot is happening in our partner’s projects. A great example is Hive. We will hold an AMA with the team on the Twitter Spaces platform next week. Take advantage of this unique opportunity to ask questions or learn about the project’s plans. The date of the AMA will be announced soon, so keep a close eye on our social media!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto cryptocurrency Ethereum price analysisRecent Articles on Cryptocurrency

GoPlus Security Price Prediction: Will GPS Coin Reach $1?

GoPlus Security Price Prediction: Will GPS Coin Reach $1?  OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?