Top Crypto Life Hacks Every Beginner Should Follow

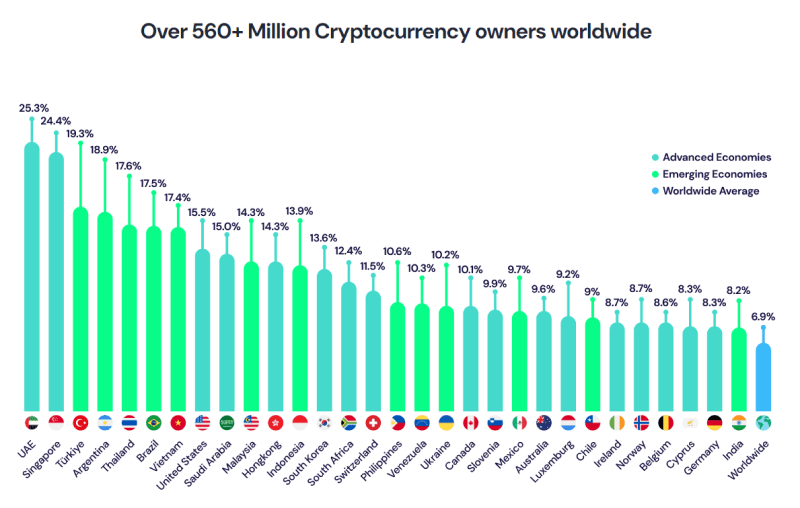

Cryptocurrency is no longer a niche topic. With over 560 million crypto users globally, the market has grown exponentially, offering opportunities to both novice and experienced investors. However, entering the crypto world can be daunting due to its complex nature, rapid developments, and technical jargon. But don’t worry — navigating this space can become easier with the right strategies, crypto life hacks, and insights.

This article will cover practical life hacks tailored for beginners looking to make their mark in the crypto world. These tips will empower you to avoid common pitfalls, secure your investments, and take full advantage of the tools at your disposal. Whether you’re curious about wallets, interested in passive income from staking, or just need guidance on staying informed, this guide provides the essentials you need.

With the right approach, cryptocurrency investing can become an accessible and rewarding journey. Our goal is to simplify the process and make your experience more manageable from day one. Let’s dive into the basics and explore crypto life hacks that will set you on the right path!

Article contents

- 1 Understanding the Basics of Crypto

- 2 Top Crypto Life Hacks for Beginners

- 2.1 1. Start with a Secure Wallet

- 2.2 2. Diversify Your Portfolio

- 2.3 3. Stay Informed with Reliable Sources

- 2.4 4. Use Dollar-Cost Averaging (DCA)

- 2.5 5. Take Advantage of Staking and Yield Farming

- 2.6 6. Leverage Crypto c Tools

- 2.7 7. Secure Your Investments with Two-Factor Authentication (2FA)

- 2.8 8. Participate in Community and Networking

- 2.9 9. Set Clear Investment Goals and Limits

- 2.10 10. Educate Yourself Continuously

- 3 Common Mistakes to Avoid

- 4 Conclusion

Understanding the Basics of Crypto

Before diving into trading or investing, it’s essential to understand the foundation of cryptocurrencies. Knowing the basic terms and concepts will give you the confidence to navigate the crypto landscape effectively. Let’s explore a few key elements every beginner needs to grasp.

Cryptocurrency is a digital currency that uses cryptography to secure transactions. Unlike traditional currencies, cryptocurrencies operate on decentralized networks, typically using blockchain technology. This means that no government or central authority controls them. Bitcoin was the first and remains the most popular cryptocurrency, but thousands of others now exist, like Ethereum, Polkadot, etc.

A blockchain is a distributed ledger that records all transactions across a network. It ensures transparency and security by preventing any tampering with the data. Each block contains a list of transactions, and once added to the chain, it becomes a permanent part of the network.

A crypto wallet stores your private keys, allowing you to access your cryptocurrencies. Wallets come in two main types:

- Hardware wallets (e.g., Ledger, Trezor) – These are physical devices that store keys offline for enhanced security.

- Software wallets (e.g., MetaMask, Trust Wallet) – These are apps or browser extensions that store keys online.

Exchanges are platforms where you can buy, sell, or trade cryptocurrencies. Some popular exchanges include StealthEX, Binance, Bybit etc. Exchanges come in two main types

- CEX: More user-friendly but involves giving custody of your crypto to the exchange.

- DEX: Operates without intermediaries, offering more privacy and control.

On StealthEX blog you can find more detailed educational content about crypto, blockchain, exchanges, and wallets!

Top Crypto Life Hacks for Beginners

Entering the crypto world doesn’t have to be overwhelming. With the right strategies, you can streamline your experience and boost your success from the start. Below are some of the most effective crypto life hacks every beginner should follow.

1. Start with a Secure Wallet

Choosing the right wallet is essential for safeguarding your funds. A hardware wallet offers the highest level of security by keeping your private keys offline, while software wallets are more convenient for frequent use. It’s crucial to keep your private keys safe and never share them with anyone. For additional protection, enabling two-factor authentication (2FA) on your wallet is recommended. Reputable options like Ledger and Trezor provide a great balance between security and usability.

2. Diversify Your Portfolio

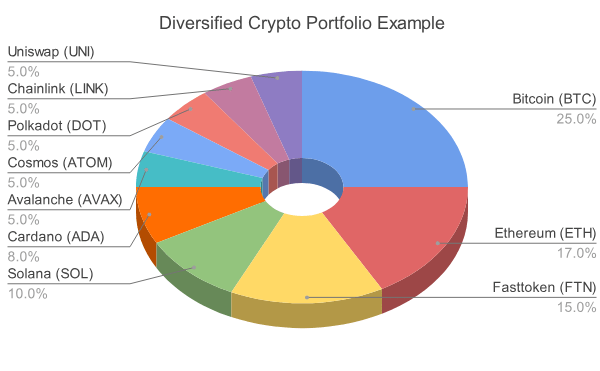

Investing in just one cryptocurrency can be risky due to the market’s volatility. A diversified portfolio reduces the risk and increases your chances of achieving returns. Including established coins like Bitcoin and Ethereum ensures some stability, while adding promising altcoins introduces the potential for higher growth. Balancing your portfolio between safer and riskier assets is a smart approach to protect your investment.

3. Stay Informed with Reliable Sources

In the fast-changing world of crypto, staying informed is very important. Being aware of market developments allows you to make timely decisions and avoid missing out on key trends. Reliable sources provide valuable insights. Engaging with communities on Reddit or joining Telegram groups can also help you stay up-to-date with real-time updates and discussions.

4. Use Dollar-Cost Averaging (DCA)

Trying to time the market perfectly is challenging, even for experienced investors. Using a strategy like dollar-cost averaging (DCA) helps reduce the impact of market volatility. This approach involves investing a fixed amount regularly, regardless of the market’s ups and downs. For instance, setting aside $50 each week to purchase crypto allows you to accumulate assets over time without the pressure of finding the perfect buying opportunity.

5. Take Advantage of Staking and Yield Farming

Earning passive income is one of the many benefits of participating in the crypto ecosystem. Staking involves locking up certain cryptocurrencies to support network operations and earn rewards in return. Yield farming, on the other hand, allows you to provide liquidity to decentralised exchanges and earn interest. Many platforms make it very easy to start staking, even with just one-click options.

6. Leverage Crypto c Tools

Understanding tax obligations is essential to avoid unexpected liabilities. Many countries require crypto investors to report gains and losses for tax purposes, even on small trades. Keeping track of every transaction manually can be overwhelming, especially with frequent trades across multiple platforms. Using crypto tax tools like CoinTracker or Koinly simplifies the process by automatically consolidating your transactions and generating tax reports. Staying compliant with tax regulations not only keeps you out of trouble but also ensures smoother withdrawals and transfers.

7. Secure Your Investments with Two-Factor Authentication (2FA)

Relying solely on passwords leaves your investments vulnerable to hacking attempts. Two-factor authentication (2FA) adds an extra layer of security by requiring a second verification step, such as a code sent to your phone. Many exchanges and wallets offer 2FA as an option, and enabling it is highly recommended for every account. Google Authenticator and Authy are popular 2FA apps that make this process seamless. Always activate 2FA on critical platforms to minimize the risk of unauthorized access.

8. Participate in Community and Networking

Being part of the crypto community helps you stay informed and motivated. Engaging with like-minded individuals provides insights into new trends, projects, and strategies that can enhance your investment journey. Communities on platforms like Reddit, Twitter, and Telegram offer real-time discussions, while attending webinars or meetups helps you connect with industry professionals. Building these connections fosters learning and can open doors to new opportunities in the crypto space.

9. Set Clear Investment Goals and Limits

Setting clear investment goals prevents impulsive decisions and helps you stay on track. Without a plan, it’s easy to fall into emotional trading, leading to losses. Establishing SMART goals—specific, measurable, achievable, relevant, and time-bound—gives your investments direction. For example, defining a profit target or loss limit can protect your capital and keep your strategy disciplined. Regularly reviewing your progress ensures you stay aligned with your financial objectives.

10. Educate Yourself Continuously

The crypto market evolves rapidly, introducing new technologies, projects, and regulations. Continuous learning is essential to stay ahead and make informed decisions. Taking time to educate yourself through courses, books, and online resources ensures you remain adaptable to changes in the market. Staying curious and committed to learning will ultimately enhance your success and confidence in the crypto space.

Common Mistakes to Avoid

Navigating the crypto world can be exciting, but many beginners encounter pitfalls that lead to losses. Knowing what to avoid is as important as following the right strategies. One frequent mistake is investing without understanding the market. This often results in poor decisions and panic-selling when the market fluctuates.

Security is another area where beginners tend to falter. Skipping essential practices like setting up two-factor authentication or choosing the wrong type of wallet can leave your investments vulnerable.

Failing to diversify investments is another common error. Many new investors put all their funds into a single cryptocurrency, which amplifies risk. Spreading investments across multiple assets, including established coins and altcoins, helps manage volatility and improves long-term outcomes.

Chasing quick profits can also lead to losses. Emotional trading often drives beginners to make impulsive decisions based on short-term trends. Strategies like dollar-cost averaging encourage a disciplined approach by reducing the need to time the market. Setting clear goals and limits helps avoid emotional trading and keeps you focused on long-term success.

Conclusion

Starting your journey in the world of cryptocurrency can feel overwhelming, but the right strategies make all the difference. With a secure wallet in place, a diversified portfolio, and a disciplined investment plan, beginners can avoid many common pitfalls.

By following these life hacks, you simplify the process, reduce risks, and position yourself for long-term success. The crypto world offers exciting opportunities, and with continuous learning, you’ll be well-prepared to make the most of them. Remember, the key is to start small, stay disciplined, and adapt to the changing market.

We encourage you to apply these strategies and share your experiences with others. Feel free to subscribe for more tips. Your journey in the crypto space starts now—make the most of it!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto crypto hack crypto world cryptocurrencyRecent Articles on Cryptocurrency

No KYC for Buying Cryptocurrency on StealthEX

No KYC for Buying Cryptocurrency on StealthEX  XDC Price Prediction: Will XDC Crypto Reach $10?

XDC Price Prediction: Will XDC Crypto Reach $10?