Avalanche Price Prediction: Is AVAX Crypto a Good Investment?

Avalanche (AVAX) is a high-performance blockchain platform designed to support dApps, custom blockchains, and enterprise-scale solutions. Launched in 2020 by Ava Labs, Avalanche aims to solve the scalability, speed, and interoperability challenges that have hindered the growth of blockchain networks like Ethereum and Bitcoin. In the past weeks, the price of AVAX went up to $26.75 (+40%) from the previous low of $19.12 at the beginning of May. What’s driving AVAX’s price movement? This article will explore Avalanche price prediction and uncover the key factors behind its recent spike.

| Current AVAX Price | AVAX Prediction 2025 | AVAX Price Prediction 2030 |

| $22 | $50 | $300 |

Article contents

- 1 Avalanche (AVAX) Overview

- 2 AVAX Price Chart

- 3 AVAX Price History Highlights

- 4 Avalanche Price Prediction: 2025, 2026, 2030-2040

- 5 Avalanche (AVAX) Price Prediction: What Do Experts Say?

- 6 AVAX USDT Price Technical Analysis

- 7 What Does the AVAX Price Depend On?

- 8 Is Avalanche (AVAX) Worth Investing?

- 9 Does AVAX Crypto Have a Future?

- 10 Can AVAX Reach $100?

- 11 How Much Will Avalanche Be Worth in 2025?

- 12 Why Is AVAX So Popular?

- 13 Is AVAX Better Than Solana?

- 14 Is AVAX Better than XRP?

- 15 Is AVAX Better than Cardano?

- 16 Is AVAX Better than Ethereum?

- 17 Is Avalanche Better than Chainlink?

- 18 Is AVAX Better than Bitcoin?

- 19 Conclusion

- 20 Where to Buy Avalanche?

Avalanche (AVAX) Overview

Avalanche is a high-performance blockchain platform designed to support decentralized applications and custom blockchain networks. Its unique consensus mechanism stands out, allowing for rapid transaction finality without compromising decentralization or security. Avalanche supports multiple interoperable blockchains within its ecosystem, enabling developers to create both public and private chains tailored to specific use cases.

One of Avalanche’s key features is its scalability. Unlike many traditional blockchains that struggle under heavy network activity, Avalanche maintains high throughput and low latency even at scale. Its architecture allows for the deployment of complex smart contracts and DeFi applications, offering compatibility with Ethereum tools and assets through the Avalanche C-Chain. This makes it a popular choice for projects seeking speed, flexibility, and a robust infrastructure for blockchain innovation.

AVAX Price Statistics

| Current Price | $22 |

| Market Cap | $9,242,786,238 |

| Volume (24h) | $328,399,736 |

| Market Rank | #13 |

| Circulating Supply | 420,743,645 AVAX |

| Total Supply | 455,746,345 AVAX |

| 1 Month High / Low | $26.75 / $19.12 |

| All-Time High | $146.22 Nov 21, 2021 |

Avalanche was created in 2020 by Ava Labs, a blockchain technology company founded by Emin Gün Sirer, a well-known computer scientist and professor at Cornell University. Sirer is a pioneer in the field of decentralized systems and has contributed extensively to blockchain research. He, along with his team at Ava Labs, developed Avalanche to address some of the major challenges facing existing blockchain networks, such as scalability, transaction speed, and high fees.

Avalanche Features

Avalanche offers several features within the crypto space:

- Energy-efficient: Avalanche is highly energy-efficient compared to Proof-of-Work networks like Bitcoin. Its consensus protocol, which is based on a variation of the Proof-of-Stake model, significantly reduces the amount of energy required for transaction validation, making it a more sustainable option in the blockchain space.

- Decentralization and security: Avalanche’s consensus mechanism is highly decentralized and designed to protect the network against centralization risks. The Avalanche Consensus Protocol allows validators to participate in the network without requiring heavy computational resources, which ensures that no single party can control the network. This makes Avalanche one of the most secure platforms in the blockchain space while maintaining decentralization.

- Interoperability: Avalanche uses a multi-chain architecture that consists of three interoperable blockchains: the X-Chain, C-Chain, and P-Chain. The X-Chain is used for creating and exchanging assets, the C-Chain is optimized for smart contracts, and the P-Chain handles coordination among validators and staking. This modular approach allows developers to create custom blockchains that can interact with one another seamlessly, providing a flexible and scalable ecosystem.

- Low latency and instant finality: One of Avalanche’s standout features is its sub-second transaction finality. Transactions are confirmed within seconds, and once a transaction is finalized, it cannot be reversed or changed. This instant finality makes the platform highly reliable, which is especially important for financial applications where delays or forks can cause major issues.

- Scalability: Avalanche is designed to process thousands of transactions per second without compromising on decentralization or security. Its innovative Avalanche Consensus Protocol enables it to achieve unparalleled scalability compared to older blockchains like Bitcoin and Ethereum, which struggle with bottlenecks during high-demand periods. This scalability makes Avalanche ideal for DeFi, enterprise applications, and other high-performance use cases.

AVAX Price Chart

CoinMarketCap, May 20, 2025

AVAX Price History Highlights

- 2020: Avalanche’s native token, AVAX, was introduced through a private sale in 2020, followed by its public launch in September of that year. The token was priced at around $0.5 during the ICO, and its price initially hovered between $2 to $4 during the early months of trading in late 2020.

- 2021: In early 2021, AVAX began to gain more attention. By February 2021, the price of AVAX had surged past the $10 mark. AVAX reached an all-time high of $146 in November 2021.

- 2022: After hitting its ATH in late 2021, AVAX, like most other cryptocurrencies, experienced a significant correction in 2022. The price of AVAX fell to lows of around $15 to $20 during much of 2022.

- 2023: In 2023, AVAX showed signs of recovery, and by mid-2023, the price had rebounded to the $20 to $30 range.

- 2024: In 2024, Avalanche coin’s price has been fluctuating between the $10 to $25 range. During the bullish market in March, the coin hit $55, and in December it reached nearly $51.

- 2025: In the beginning of 2025, the token went down, hitting $14.7 at its low. At the moment, AVAX coin trades between $21 and $23.

Avalanche Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $20 | $85.89 | $50 | +130% |

| 2026 | $41.14 | $157.34 | $100 | +150% |

| 2030 | $106.03 | $503.36 | $300 | +1,260% |

| 2040 | $917.23 | $18,665 | $10,000 | +45,000% |

AVAX Coin Price Prediction 2025

DigitalCoinPrice crypto experts think that in 2025 AVAX coin’s price can go as high as $49.13 (+120%), while at its minimum it can cost no less than $20 (-10%).

PricePrediction analysts are more optimistic about Avalanche: they believe that in 2025 AVAX crypto will cost $28.43 (+30%) at its minimum, while at its peak AVAX will rise to $32.35 (+45%).

Analysts at Telegaon state that in 2025, Avalanche crypto can rise in price more significantly: it will cost a minimum of $45.19 (+205%), or it can hit $85.89 (+290%).

Avalanche Crypto Price Prediction 2026

DigitalCoinPrice experts think that in 2026, AVAX token will cost as much as $47.93 (+115%) per coin at its highest point. According to them, it will also cost no less than $57.35 (+160%).

PricePrediction analysts state that in 2026 Avalanche token will continue gradually increasing in price: it will hit $41.14 (+85%) at its lowest mark. It can also reach a maximum of $48.75 (+115%) at its peak.

According to Telegaon, in 2026 $AVAX will go even higher: it can cost a minimum of $86.45 (+300%), while at its peak it can reach $157.34 (+610%).

AVAX Crypto Price Prediction 2030

DigitalCoinPrice analysts believe that by 2030, AVAX token will rise to a maximum level of $122.19 (+450%), while it will also cost no less than $106.03 (+380%).

According to PricePrediction, by 2030 AVAX crypto will hit $184.67 (+750%) at its lowest price level, while at its peak it can go to $215.77 (+880%).

Telegaon predictions estimate that in 2030 Avalanche can hit $413.52 (+1,800%) at its peak. At its lowest point, it will cost no more than $503.36 (+2,200%) per coin.

Avalanche Coin Price Prediction 2040

According to PricePrediction forecasts, in 2040 $AVAX is going to peak at staggering price levels: it will hit $15,246 (+68,000%) at its low or reach $18,665 (+84,000%) at its maximum.

According to Telegaon, in 2040 AVAX coin’s price will cost no less than $917.23 (+4,000%), while at its peak it can go over $1,000: its price will reach a maximum of $1,107.56 (+4,900%).

Avalanche (AVAX) Price Prediction: What Do Experts Say?

Avalanche continues to capture attention in the crypto market, with analysts offering a range of predictions about its future price trajectory. While short-term fluctuations remain influenced by broader market sentiment and macroeconomic factors, many experts see potential for long-term growth, citing Avalanche’s strong technology, expanding ecosystem, and increasing adoption in DeFi.

Price forecasts for AVAX vary widely. Some experts anticipate moderate growth, projecting prices in the range of $70 to $75 over the next year or two, while more bullish outlooks suggest it could climb above $100 if market conditions align and developer activity continues to rise. One of the believers in the future of the blockchain is CoinLore: their experts believe that as early as 2030 $AVAX will hit a staggering $345 per coin as its all-time high.

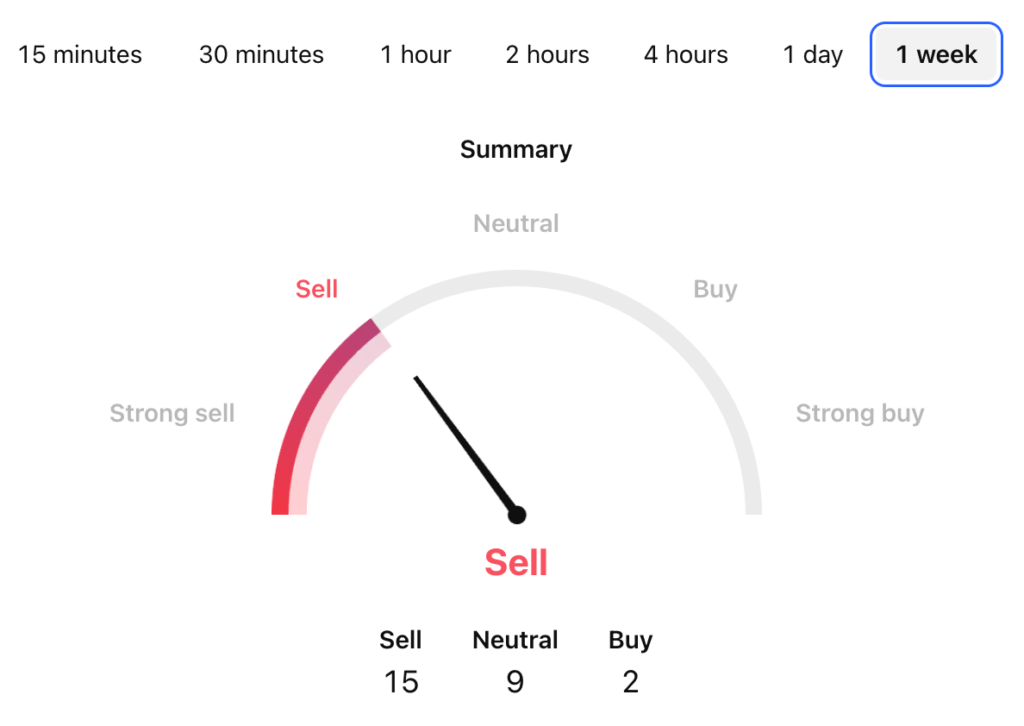

AVAX USDT Price Technical Analysis

Tradingview, May 20, 2025

Now that we’ve seen possible price predictions for the Avalanche coin, let’s find out a bit more about the factors that can influence its price.

What Does the AVAX Price Depend On?

The price of AVAX, like most cryptocurrencies, is influenced by a combination of technical, fundamental, and market-specific factors. One of the primary drivers is network usage: as more dApps, DeFi protocols, and NFTs are built on Avalanche, demand for AVAX increases, supporting its price. AVAX is also used for staking and paying transaction fees, which ties its value directly to ecosystem activity.

In addition to on-chain factors, market sentiment plays a significant role. Macroeconomic conditions, regulatory developments, and investor confidence across the broader crypto market can all impact AVAX’s price. Integration with other blockchains, partnerships, and upgrades to Avalanche’s infrastructure may further boost investor interest. Conversely, competition from other high-performance blockchains or a decline in DeFi activity could place downward pressure on the token. Ultimately, AVAX’s price reflects both the strength of its technology and its positioning within the evolving digital asset landscape.

Risks and Opportunities

Avalanche presents several compelling opportunities for investors. Its high-speed, low-cost network architecture positions it as a strong contender in the layer-1 blockchain race, especially for DeFi, gaming, and NFT applications. The ecosystem continues to grow, attracting developers and users with its compatibility with Ethereum and robust smart contract capabilities. Additionally, AVAX’s use in staking allows holders to earn passive income, making it not just a utility token but also a yield-generating asset. Strategic partnerships, increased adoption, and continued technical innovation could all contribute to long-term price appreciation.

However, investing in AVAX also comes with risks. The cryptocurrency market is highly volatile, and AVAX is not immune to sudden price swings influenced by macroeconomic shifts, regulatory news, or sentiment-driven sell-offs. Competition from other smart contract platforms like Ethereum, Solana, or newer chains could limit Avalanche’s growth if it fails to maintain developer interest or user activity. Furthermore, any technical issues or security vulnerabilities within the network could undermine confidence and lead to sharp declines.

Is Avalanche (AVAX) Worth Investing?

Avalanche (AVAX) is a high-performance blockchain known for its speed, scalability, and unique multi-chain architecture, attracting attention for DeFi and enterprise use. Strategic partnerships, such as the one with Amazon Web Services, have strengthened its ecosystem, and it continues to gain traction in the crypto space. However, like all cryptocurrencies, AVAX remains a volatile and speculative investment. While its technology and adoption trends are promising, it would be best suited for investors with high risk tolerance.

Is AVAX a Risky Investment?

Yes, AVAX is considered a risky investment, like most cryptocurrencies. Despite its strong technology, growing ecosystem, and notable partnerships, it remains highly volatile and susceptible to sharp price swings influenced by market sentiment, regulatory developments, and broader economic factors.

Does AVAX Crypto Have a Future?

Yes, AVAX crypto seems to have a promising future, supported by its strong technological foundation and strategic partnerships. The platform’s unique multi-chain architecture and focus on real-world asset tokenization position it well for growth. Analysts project significant price increases for AVAX in the coming years, with estimates ranging from $110 to $220. These projections are bolstered by growing institutional interest and adoption in sectors like decentralized finance and enterprise applications.

Can AVAX Reach $100?

Yes, reaching $100 is a feasible target for AVAX, though it depends on favorable market conditions and continued ecosystem growth. Analyst forecasts for 2025 vary widely. Factors influencing this potential include increased adoption of DeFi applications, strategic partnerships, and broader cryptocurrency market trends. However, it’s important to note that cryptocurrency investments carry inherent risks due to market volatility and regulatory uncertainties. While some analysts project significant price increases for AVAX in the coming years, these forecasts are speculative and should be approached with caution.

Can Avalanche Reach $200?

Yes, reaching $200 is a plausible target for Avalanche, though it hinges on several factors aligning favorably. Generally, achieving the $200 mark would likely require a combination of factors: significant growth in DeFi adoption, strategic partnerships, and favorable market conditions. While this target is ambitious, it’s not entirely out of reach if AVAX continues to expand its ecosystem and capture investor interest.

Can AVAX Hit $500?

Reaching $500 for Avalanche (AVAX) is an ambitious target, but not entirely out of the question in the distant future. Currently priced at approximately $22, achieving $500 would require a more than 20-fold increase in value. It would necessitate a market capitalization of around $200 billion, placing AVAX among the top cryptocurrencies, and require significant growth in its ecosystem, widespread adoption, and favorable market conditions.

Can Avalanche Reach $1,000?

Reaching $1,000 for Avalanche is an extremely ambitious target, and while not entirely impossible, it remains highly unlikely in the foreseeable future.

Can Avalanche Reach $10,000?

Reaching a $10,000 valuation for Avalanche is highly improbable in the foreseeable future. Achieving this target would require an extraordinary increase in market capitalization. Any optimistic estimates are speculative and depend on numerous variables aligning favorably, and while a $10,000 price point for AVAX is conceivable in a highly bullish, long-term scenario, it would require unprecedented growth and favorable market dynamics for Avalanche to hit that price level.

How Much Will Avalanche Be Worth in 2025?

According to DigitalCoinPrice, in 2025 AVAX can go as high as $49.

What Will AVAX Price Be in 2027?

According to PricePrediction, in 2027 the maximum price level Avalanche coin can reach is going to be $72.

What Is the Price Prediction for Avalanche in 2030?

According to Telegaon, in 2030 AVAX crypto can go as high as $503.

What Will Avalanche Be Worth in 10 Years?

Telegaon experts believe that in 2035 Avalanche coin will hit a maximum of $742.

Why Is AVAX So Popular?

One of the primary reasons for Avalanche’s popularity is its ability to scale effectively without compromising on speed or decentralization. The Avalanche consensus protocol enables the network to process over 4,500 transactions per second, making it one of the fastest blockchains available. Additionally, transaction fees on Avalanche are extremely low compared to Ethereum, which has seen gas fees spike to exorbitant levels during periods of congestion. In addition to these benefits, Avalanche is designed to be highly interoperable, enabling communication between different blockchains.

Is AVAX Better Than Solana?

AVAX and Solana each have strengths, making one better than the other depending on your priorities. Solana offers faster transaction speeds and has strong momentum in NFTs and DeFi but suffers from occasional network outages and centralization concerns. Avalanche is more decentralized, stable, and enterprise-focused, with strong infrastructure for real-world applications. If you value speed and ecosystem hype, Solana may appeal more; if you prefer reliability and decentralization, AVAX could be the better choice.

Can I Bridge Avalanche to Solana?

Yes, you can bridge AVAX to SOL using StealthEX, an instant non-custodial crypto exchange that facilitates cross-chain swaps without requiring registration or KYC.

Is AVAX Better than XRP?

AVAX and XRP serve different purposes, making one better than the other depending on your goals. AVAX is a decentralized smart contract platform built for DeFi, NFTs, and custom blockchain networks, offering high scalability and flexibility. XRP, on the other hand, is focused on fast, low-cost cross-border payments and is widely used in the financial sector, though it has faced centralization concerns and regulatory scrutiny. If you’re looking for Web3 and decentralized application growth, AVAX is likely the better choice; if you’re betting on mainstream financial adoption, XRP may be more appealing.

Is AVAX Better than Cardano?

Both Avalanche and Cardano offer low transaction fees, but Avalanche has the edge in terms of overall cost-effectiveness for high-volume applications. Cardano’s fees are still low, but Avalanche’s scalability makes it more efficient for large-scale decentralized applications. Avalanche is more agile in terms of development and deployment of features. Its approach is more pragmatic, focusing on providing real-world solutions quickly. Cardano takes a more research-driven approach, focusing on long-term sustainability and security. This could be a better fit for projects that require formal verification and enterprise-level security but may take longer to implement.

Is AVAX Better than Ethereum?

AVAX is faster, cheaper, and more flexible than Ethereum, making it appealing for developers and users who prioritize scalability and low fees. However, Ethereum remains the most trusted and widely adopted smart contract platform, with the largest ecosystem, strongest security, and deepest developer community. While AVAX offers innovative features and growing adoption, Ethereum’s maturity and network effects still give it the edge for long-term stability and resilience. Ultimately, AVAX is a strong alternative, but Ethereum remains the dominant force in the smart contract space.

Is Avalanche Built on Ethereum?

No, Avalanche is not built on Ethereum. It is an independent Layer-1 blockchain platform developed by Ava Labs, with its own consensus mechanism and architecture. However, Avalanche is Ethereum-compatible, specifically through its C-Chain (Contract Chain), which supports the Ethereum Virtual Machine (EVM).

Can AVAX Overtake Ethereum?

While AVAX offers faster transactions, lower fees, and higher scalability than Ethereum, it still faces an uphill battle to overtake Ethereum due to Ethereum’s significant lead in adoption, network effects, and developer ecosystem. Ethereum is the dominant platform for DeFi, NFTs, and smart contracts, with a large, established user base. AVAX has the potential to become a major player, especially in DeFi and enterprise adoption, but overtaking Ethereum entirely would require major shifts in the blockchain landscape, and Ethereum’s ongoing upgrades like Ethereum 2.0 and Layer 2 solutions may maintain its dominant position in the long run.

Is Avalanche Better than Chainlink?

Avalanche (AVAX) and Chainlink (LINK) serve different roles in the blockchain ecosystem, making them not directly comparable. AVAX is a Layer 1 blockchain platform focused on building decentralized applications, smart contracts, and custom blockchains, offering high scalability and low fees. Chainlink, on the other hand, is a decentralized oracle network that provides real-world data to smart contracts, enabling them to interact with off-chain data like market prices or weather reports. While AVAX is ideal for developing dApps, Chainlink is essential for enabling decentralized applications to access external data securely. Both are crucial, but they complement each other rather than compete.

Is AVAX Better than Bitcoin?

In a direct comparison, Avalanche (AVAX) and Bitcoin (BTC) are better suited for different purposes, making it difficult to declare one as outright ‘better’ than the other. In short, Bitcoin is better for those looking for a store of value and global adoption as a digital currency, while Avalanche is better suited for developers building decentralized applications and projects requiring high throughput and low fees.

Conclusion

Avalanche stands out as a powerful force in the evolving blockchain landscape, combining speed, scalability, and innovation to meet the growing demands of decentralized applications. With a vibrant ecosystem, strong developer interest, and a clear focus on real-world utility, AVAX has the potential to remain a key player in the next wave of crypto adoption. While challenges persist, the foundations are solid, and for investors and enthusiasts alike, Avalanche offers an exciting glimpse into the future of Web3.

Where to Buy Avalanche?

StealthEX is here to help you swap AVAX coin if you’re looking for a way to invest in this cryptocurrency. You can buy AVAX privately and without the need to sign up for the service. StealthEX crypto collection has more than 1,500 different coins and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy AVAX Crypto: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, ETH to AVAX.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Avalanche AVAX crypto price prediction price analysis price predictionRecent Articles on Cryptocurrency

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?  Hyperliquid Price Prediction: Can HYPE Reach $100?

Hyperliquid Price Prediction: Can HYPE Reach $100?