Future of Crypto in the Next 5 Years: Trends, Challenges, and Predictions

Today, cryptocurrencies are finally recovering from the fall of the previous years. The next 5 years promise to be a breakthrough for the industry. But which factors will affect the growth of digital assets? And what do experts say about trends in the cryptocurrency market? Let’s try to predict what the future of crypto may be.

Article contents

Current Market Analysis

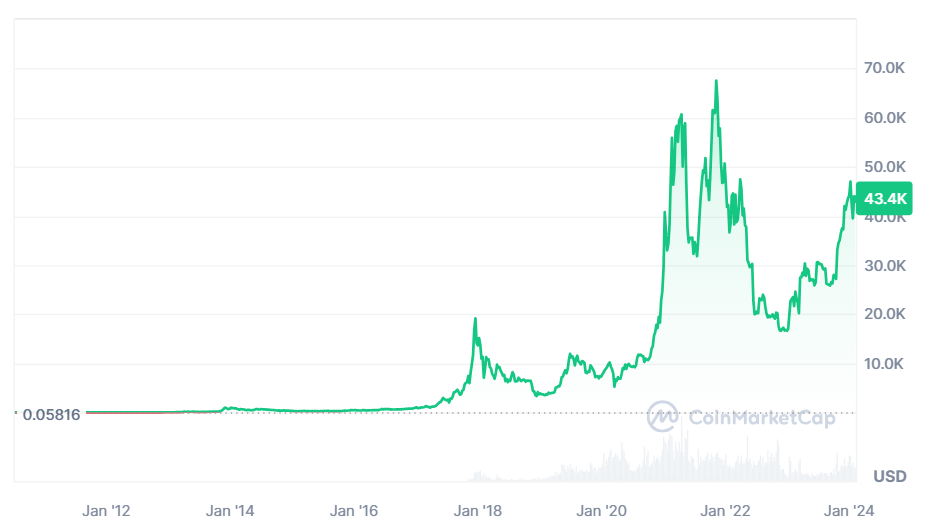

The cryptocurrency market is recovering from the fall that occurred in 2022. Bitcoin’s price was at $16,000 at the beginning of 2023, and now it has risen to $43,500. The total crypto market capitalization has also more than doubled, from $800 billion to $1.67 trillion.

Source: CoinMarketCap, January 30, 2024

This behavior of the cryptocurrency market was influenced by a number of factors, including a pause in the US Federal Reserve rate hike and the traditional market pullback after a fall. Additionally, the demand for cryptocurrencies is spurred by high inflation. In countries that are significant for the market, like Turkey and Argentina, it reaches 100% per year, and in some countries, it’s even higher.

Interestingly, the market’s recovery came at a time when key cryptocurrency companies were having really big problems with regulators in the US. The main events were SEC lawsuits against Coinbase and Ripple, the Sam Bankman Fried scandal trial, a $4.3 billion fine for Binance, and the resignation of Changpeng Zhao.

Recently, cryptocurrency prices have been influenced by another factor that has already helped investors make money on crypto: the approval of a new exchange-traded tool, the Bitcoin ETF. This event is associated with the arrival of liquidity to the market from institutional investors.

Despite the individual disadvantages of cryptocurrencies, their advantages as investment assets and means of international settlements. make more people use digital assets.

Future of Crypto in the Next 5 Years

Technological Developments

JPMorgan Chase, Goldman Sachs, BlackRock, and Fidelity recognize the transformative potential of blockchain technology. Exploring the possibilities of asset tokenization and digital transactions, these institutions are pioneering notable developments in the financial industry. Clear regulatory frameworks and partnerships with trusted financial institutions are their optimal tools for leveraging blockchain expertise to improve transaction efficiency.

Blockchain technology is at the forefront of enabling the tokenization of real assets through smart contracts for more efficient transactions. According to experts, tokenization has the potential to encompass private sector securities, funds, central bank digital currencies, and stablecoins, reaching a staggering $10 trillion by 2030.

Despite challenges such as differing views on tokenization and the choice between public and private blockchains, Wall Street clients are showing increasing engagement, signaling a shift in sentiment. For example, JPMorgan’s Onyx digital asset platform eases the creation of tokenized representations of traditional assets, increasing efficiency and decreasing costs.

JPMorgan Chase’s expansion of its blockchain-based payment platform for euro transactions and its venture into asset tokenization epitomize the untapped potential of the industry. Citigroup forecasts $5 trillion in tokenization of private sector securities and funds by 2030, including a variety of assets such as corporate debt and real estate. An extra $5 trillion could move into fast-growing digital currencies.

The merging of traditional financial institutions with blockchain technology is shaping a new financial landscape, opening up new market opportunities, and making transactions more efficient.

Another development that will potentially affect cryptocurrency development is Lightning Network implementation. It’s a second-tier solution for Bitcoin, a source code software that is a kind of network of payment channels between users. The goal is to scale BTC for faster transactions. The fee for a transfer via LN is 1 satoshi (0.00000001 BTC).

Implementing Lightning Network into the BTC network can improve scalability and transaction speed, which will also increase efficiency.

Moreover, as DeFi expands its influence in the fintech scene, it facilitates the emergence of:

- GameFi (financial management tools for blockchain games that provide transparency and prevent fraud).

- IndFi (Industrial apps that improve efficiency by eliminating middlemen).

- MediaFi (decentralized technologies for media production, improving financial management).

- SciFi (Financial support for researchers, guaranteeing transparency and fair funding).

Most of these platforms owe their existence to the powerful capabilities of Ethereum smart contracts. DeFi aims to replace intermediaries with faster, superior, and more cost-effective systems, although we shouldn’t forget about the challenges related to liquidity protocols and user vulnerabilities.

The value of DeFi is particularly clear for SMEs and emerging markets. DeFi’s programmability brings to life customized financial tools and smart contracts for streamlining transactions and reducing costs. Trust in financial transactions stems from the transparency and immutability of DeFi, supported by blockchain.

There is one more trend: Regenerative Finance (ReFi). It allows users to generate income from their crypto assets by providing new financial instruments. The benefits of ReFi include:

- Rethinking classic liquidity.

- Deductions when selling NFTs.

- Creating innovative financial instruments that help users maximize the potential of the assets they hold.

- Building a more sustainable economy by bringing shareholders together.

ReFi may play an important role in the future of the financial industry. But like any new trend, it has its risks and challenges related to security and regulation.

Choose StealthEX for Exchange and Buy Crypto

- User-Friendly — Simple and minimalistic interface for everyone.

- Fast and Private — Instant non-custodial cryptocurrency exchanges.

- Buy crypto with Credit Card.

- 1400+ coins and tokens are available for limitless, quick and easy exchanges.

- NO-KYC crypto exchanges — Buy cryptocurrency up to $700 without KYC!

- StealthEX crypto exchange app — Process crypto swaps at the best rates wherever you are.

- 24/7 Customer Support.

Earn from Each Exchange by Joining StealthEX Affiliate Program.

Become a partner right now and use affiliate tools:

- Public API — Earn from your wallet, aggregator, or exchange terminal.

- Referral Links — Recommend StealthEX to your audience.

- Exchange Widget — Built crypto exchange widget on any page of your website.

- Button — A perfect choice for traffic monetization.

- Banner — Track conversion and stats right in the personal cabinet.

Regulatory Evolution

As blockchain technology becomes more widespread, experts expect to see increased regulation. Governments around the world are beginning to establish rules for its use, aimed at ensuring the responsible and secure use of blockchain. This trend of regulatory oversight will continue beyond 2024, shaping the future trajectory of blockchain technology.

In 2024, different countries around the world will continue to introduce legislative regulation for the crypto market. The transfer of the crypto industry into the legal field will intensify the involvement of large investors in this type of asset. This scenario may provide additional liquidity and stability to the market, as well as increase its legitimacy.

One of the main events of the beginning of 2024 was the fact that the Securities and Exchange Commission (SEC) on the evening of January 10, for the first time in 10 years, approved exchange-traded funds that invest directly in Bitcoin, that is, made a positive decision on the launch of Bitcoin ETFs from BlackRock and other companies.

However, SEC head Harry Gensler mentioned that, despite approving the listing and trading of certain ETP bitcoin spot shares, the SEC still disapproves of Bitcoin. He believes that investors should be cautious about the many risks associated with bitcoin and products whose value is linked to the cryptocurrency.

The launch of the Bitcoin ETF entails a new influx of funds into decentralized assets. As a result, DeFi tools, such as Liquid Staked Derivatives (LSD), will develop.

Adoption and Integration Trends

The introduction of new technologies will significantly contribute to the growth and adoption of cryptocurrencies in 2024. We can expect to see continued growth in interest in Ordinals, which are now available not only on the Bitcoin network but also on other blockchains. This gaining popularity, which was born On the Bitcoin blockchain, is now spreading to other networks as well.

The interest in the new standard also facilitates the flow of capital into the crypto market and contributes to its growth. Above all, the positive impact stimulates interest in Bitcoin, whose blockchain was the progenitor of Ordinals.

2024 can also be a watershed for the NFT market, long dominated by Ethereum and Solana. In November 2023, NFT trading volume on the Bitcoin network surpassed that of Ethereum, and this was made possible by the emergence of Ordinals. This may be one of the major trends for the NFT market in 2024: the flow of capital and users to the Bitcoin network.

Another trend for 2024 will be a boom in Layer 2 ecosystems and applications focused on infrastructure and blockchain tokenization. It’s worth considering the DePIN concept. The emergence of new concepts and applications like these can help stimulate adoption and demand for cryptocurrency from a wide range of users.

The influx of capital into decentralized financial protocols will serve as another trigger for the growth of the entire crypto market. But unlike the previous bull cycle in DeFi, this time growth should be expected in the niche of regulated decentralized solutions such as tokenization of real-world assets (RWAs) and structured onchain products.

Risk Management in a Growing Market

Although improving daily and being implemented in more industries, the cryptocurrency market is still extremely volatile, currency exchange rates are unstable, and ups are followed by sharp drops. These difficult conditions will keep affecting traders in the near future. That’s why it’s worth using risk-management strategies to avoid capital losses. The main ones are:

- Holding. It’s a choice for long-term investors. It’s the purchase of cryptocurrency with the expectation that its value will increase in the future. The strategy is based on a fundamental analysis of the market, individual projects, and the prospects of a particular cryptocurrency. Stamina and patience are required, as investments can be unprofitable at the initial stage.

- Scalping. It’s a process of making a large number of trades in one day to get a small but quick profit. During scalping, a trader analyzes charts to identify short-term trends and patterns. They must recognize signals of a possible trend break and close positions in time to minimize losses.

- Arbitrage. This strategy involves the simultaneous buying and selling of one cryptocurrency on different exchanges to make a profit on the difference in rates.

For proper risk management, it’s important not only to pick the right strategy but also to use a trusted exchange. Since most cryptocurrency risks are still associated with fraud, it’s better to use only platforms like StealthEX. It provides access to anonymous transactions and encrypts data so that hackers will never break open accounts.

Challenges and Risks

In November 2023, a sum of $363 million fell into the hands of criminals. As a result of a series of episodes of exit fraud, crypto market participants lost $1.1 million.

The three biggest events in November were the KyberSwap flash loan, the HTX/Heco bridge incident, and the Poloniex attack. The combined losses suffered by Poloniex and HTX/Heco Bridge totaled $131.4 million and $113.3 million, respectively. The attack on KyberSwap was the largest flash-credit offense that month.

In November 2023, DeFi Kronos Research was victimized by hackers. Attackers compromised the private key of one of the platform’s administrators and stole about $26 million.

Experts believe that such a problem could continue into 2024. The rise in hacking cases may be due to inadequate security procedures for most protocols. Recent studies have shown that the main target of most hacker attacks is cryptocurrency exchanges.

Hackers use sophisticated tactics to attack these platforms, including using fake websites, sending emails on behalf of legitimate entities, and using phishing schemes.

The solution to the problems should be to improve security protocols. On an individual level, each user must learn how to protect their assets.

Common security practices include protecting private keys, using multi-factor authentication, and securing hardware wallets.

One of the main challenges for crypto platforms in 2024 is becoming more serious about security. Experts hope that eradicating fraud and cybersecurity crimes is a matter of time.

Another issue discussed is the problem of blockchain interoperability. Most blockchains are incapable of interoperability and data exchange, which limits their use and benefits. The number of industries that are ready to adopt blockchain technology is growing, so the issue of interoperability is increasingly coming to the forefront.

Achieving blockchain interoperability is critical to the growth and development of this technology; it will help overcome current limitations and realize the true potential of decentralized networks.

Interoperability is critical for seamless communication and the transfer of data and assets between different blockchain networks. Interoperability will enable seamless information exchange, simplified execution of smart contracts, a convenient user experience, and the ability to develop partnerships and share solutions.

More interoperability projects are coming onto the scene, trying to bridge the gap between different blockchains, and this trend will continue in the coming years. Each has its own features and benefits. Their goal is to facilitate interoperability between networks and ensure that the concept of decentralization is fully realized. The leading cross-network projects are Chainlink, Cosmos, Polkadot, Wanchain, and more recently, Canton Network.

Economic Impact

Compared to traditional finance, cryptocurrencies offer easy transfers between users in different countries. Conventional funds move slowly and often need additional bureaucracy. Despite all the regulatory changes, digital assets are still faster and more transparent, and the fees are smaller in size.

It affects the global economy in the following ways:

- Trade becomes more profitable due to lower costs.

- Financial accessibility increases in countries where banking services are problematic.

However, many debates revolve around the interaction between cryptocurrency and monetary policy. The government implements these policies to stabilize the economy and manage inflation. Cryptocurrencies don’t obey these tools, so they could potentially break the entire monetary policy.

However, some experts have a different opinion, saying that crypto only complements monetary policy. For example, the stablecoin is pegged to the US dollar exchange rate. In 2024, these assets will keep interacting normally and won’t threaten the world economy.

The world economy was slowing down until recently. But when it entered the stage of slow movements, the emergence of cryptocurrency seemed to become its catalyst. The growth of the economy in recent years is hard to ignore.

It’s the insane pace of economic development in most countries that has been the main advantage of the crypto industry’s development. Furthermore, blockchain technologies themselves do not even think of stopping yet. Thanks to this, it can be predicted that the economy will further develop as well.

Cryptocurrency has proven its stability and reliability. For example, Binance even has its own charity fund to help refugees and victims of natural disasters.

Despite all the benefits, the risks and challenges should be considered. For example, these include:

- Insubordination to regulators. The world is still debating how this relatively new technology should be perceived and managed.

- Government prohibition. In some countries, cryptocurrencies are considered untrustworthy because of the potential threat to their own financial systems.

- Volatility. Cryptocurrency actively fluctuates and can change several times a day. This makes it difficult to choose digital assets as a means of payment and storage of value. It also negatively affects investing and budget planning for companies.

Fraud risks are common here as well. While many such cases are also found in traditional finance.

Expert Opinions and Predictions

Experts see positive trends in the crypto market. According to Matthew Sigel, head of digital assets research at VanEck, Bitcoin ETFs will make the BTC price keep rising.

As PanteraCapital analysts consider, BTC will reach $147,843 already this year.

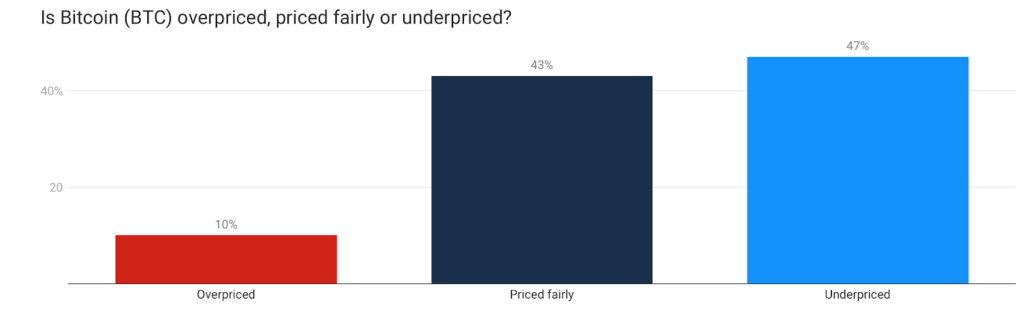

Most Finder panelists consider that now BTC is underpriced.

Source: Finder, Bitcoin (BTC) price prediction

Michaël van de Poppe believes in ETH. In December 2023, he posted on X:

“Ethereum is also in the race for a Spot ETF, which is ultimately even more beneficial for a bullish continuation on the markets.”

Other cryptocurrencies will also skyrocket. Emily George says that the main digital assets will be Solana (SOL), Chainlink (LINK), and ZetaChain (ZETA).

Conclusion

All in all, the potential of cryptocurrencies is unprecedented. Looking at the current advancements and projects that are underway in the crypto ecosystem and blockchain, we will witness disruptions and changes in many industries. Even the current statistics, analysis, and numbers demonstrate that blockchain will be one of the greatest innovations of this century.

Regardless of whether you are new to crypto or have been there for a while, it’s essential to stay informed and protected while buying and holding digital assets. To keep updated on the latest news and invest in crypto with no risks, use StealthEX, a platform with over 1,400 coins available for secure exchange. Just go to StealthEX, choose the amount of the cryptocurrency you want to swap, for example, ETH to BTC, and click Start Exchange.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto world Ethereum future of crypto future of cryptocurrencyRecent Articles on Cryptocurrency

Crypto News: BBVA Backs Bitcoin, Iran Loses $90M, Senate Passes Crypto Bill

Crypto News: BBVA Backs Bitcoin, Iran Loses $90M, Senate Passes Crypto Bill  Quant Price Prediction: How High Can QNT Crypto Go?

Quant Price Prediction: How High Can QNT Crypto Go?