Review of the Crypto Market: June 9, 2023

The crypto market has been stagnant in recent weeks. As it turned out, however, this was only the calm before the storm. In recent days, some very negative news has emerged. The SEC has filed lawsuits against the largest exchange in the world and the largest exchange in America – Binance and Coinbase. The situation has caused quite a bit of turbulence. We invite you to our next weekly recap. As always, we will discuss the charts of the two largest cryptocurrencies – BTC and ETH – and then analyze the news! So, let’s get started!

Article contents

Bitcoin Price in USD This Week

The Bitcoin price has been in a rather narrow range in recent weeks. However, the SEC’s lawsuit against Binance announced on June 2, caused quite a drop. The price of BTC dived from USD 27,000 to almost USD 25,000 in one day. One day later, however, it managed to recover nearly all of its losses. However, we are still below last week’s level. So, what is the price of Bitcoin today? As of today, BTC is oscillating around USD 26 500.

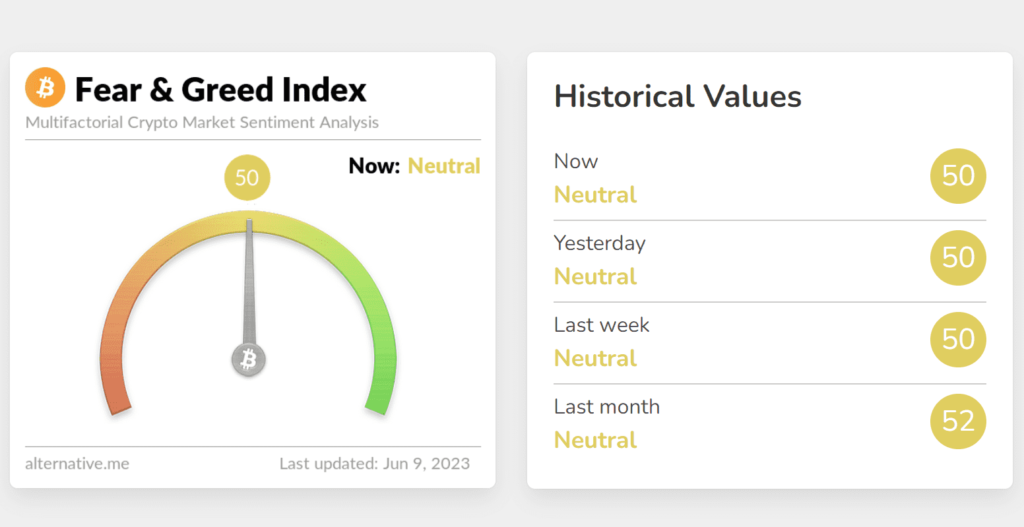

However, all signs indicate that the situation with the SEC has reflected more strongly on altcoins than Bitcoin. And this is because the dominance of BTC has increased by 0.5% and now stands at 44.7%. Interestingly, such strong news has not affected investor sentiment. The Fear and Greed Index indicates the same level as the week before – 50 – and investors’ attitude towards investments is still neutral.

Ethereum Price in USD This Week

Ethereum’s chart looks similar to Bitcoin’s. And this is even though the SEC did not mention ETH in its lawsuit. Ether also recorded a huge red candle, through which it even dived to the USD 1780 level. Today, however, the price of ETH has partially recovered its losses and is oscillating around USD 1850.

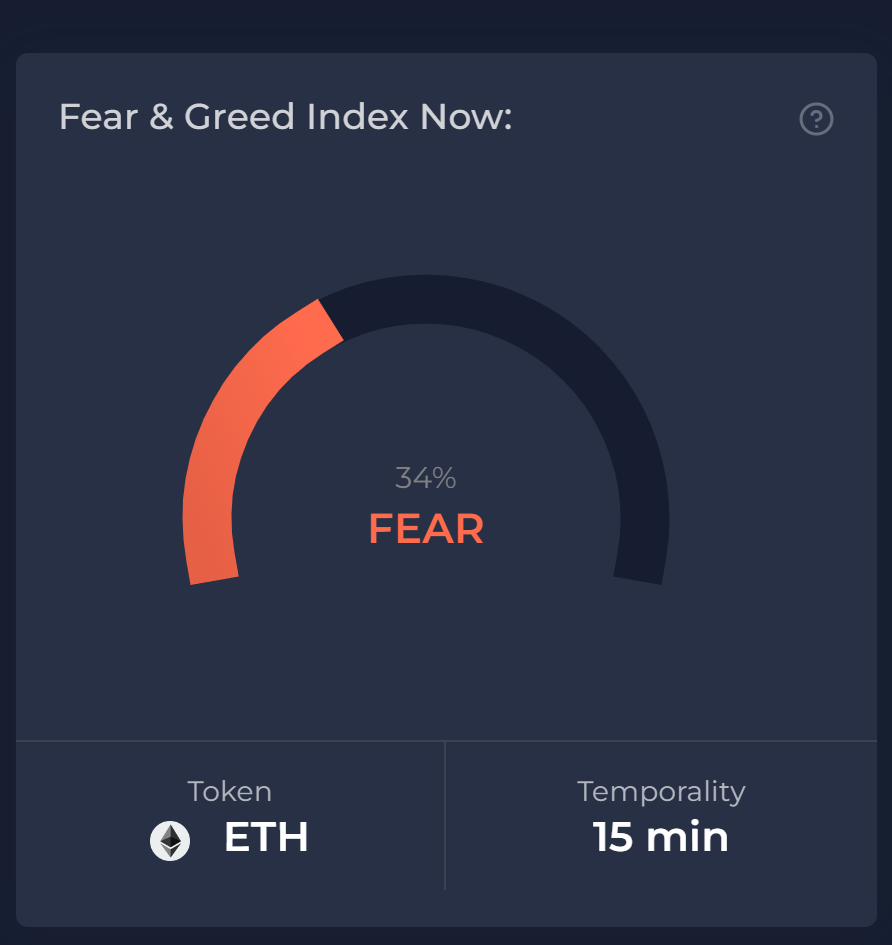

Ethereum’s dominance of the market also increased, although marginally – by 0.2%. Investor sentiment, however, is much worse than a week ago. Ethereum’s Fear and Greed Index indicates fear.

Biggest Crypto Gainers This Week

Although Bitcoin and Ethereum did not do so well this week and saw declines already recovered, several altcoins showed solid gains. BSCEX, for example, has given investors as much as 8,000% return over the past seven days. In terms of other tokens, we can include among the biggest crypto gainers this week:

- Terra Luna Classic (LUNC) – 16.4%

- Stack (STX) – 6.3%

- Bitget Token (BGB) – 4.6%

- Lido DAO (LDO) – 3.9%

- Tron (TRX) – 2.9%

The list of cryptocurrencies that saw any increases last week includes: XRP, EOS, and Cronos. The rest of the altcoins recorded losses.

Crypto News of the Week

Now that we know how BTC and ETH behaved and which alts gained the most, it is time to move on to the most important part of our review. Let’s review last week’s news because a lot was going on.

Ripple May Go Public Via an IPO

According to an expert, Ripple may go public through an IPO. Other rumors and facts also evidence this.

The topic arose during a Digital Perspectives interview with Linda P. Jones, a Wall Street investor. She provided an initial valuation of potential Ripple shares. Based on data from investment firm Linqto, she calculated that the price per Ripple share would be US$35 (with a market cap of US$5.7 billion). The expert added that this valuation could be pessimistic and the price per share could cost more.

But why is the idea of the company going public? Firstly, we have previously seen the successful IPO of the Coinbase exchange. Ripple might want to go in this direction as well. On top of that, the long-running XRP lawsuit filed against the company by the Securities and Exchange Commission (SEC) will soon end. The regulator alleges that Ripple’s token is a de facto security, so the entity broke the law because it issued unregistered stocks.

Above all, however, Ripple had already expressed a desire to go public. In May 2022, its CEO, Brad Garlinghouse, said at a conference in Davos that Ripple was moving the possibility of an initial public offering (IPO). However, he conditioned the IPO on completing the pending legal process mentioned above.

That is not all, however. That these plans are taking shape is evidenced by Fox Business reporting that Ripple held a private ‘roadshow’ – a meeting with potential IPO investors – in April. Several well-known investors reportedly attended the meeting.

Do Kwon Will Be Released

According to an official announcement from the Podgorica High Court, the appeal of the National Prosecutor’s Office against an earlier agreement to release Do Kwon on bail has been dismissed. As a result, the former CEO is being released. Along with him, former CFO Han Chang-Joon was also released from custody. Both will await further court proceedings under house arrest.

Bail was set at as much as €400,000 (US$436,000). On top of this, Kwon and Chang-Joon are subject to strict conditions of release from custody – they are not allowed to leave their temporary residence. Local police will closely monitor the duo. If they leave the accommodation where they will be staying or violate surveillance measures – the bail will be forfeited.

Kwon and Chang-Joon were arrested in Montenegro in March 2023. It all took place at the airport in the country’s capital. They were trying to board a plane they wanted to bring to Dubai. The reason for the arrest was that they were using alleged forged documents. It was not just an attempt to hide their identities, but the South Korean authorities canceled their original passports in October 2022.

The court noted that it would take more time to verify the authenticity of the two Koreans’ Belgian passports and ID cards. Thus, it stressed that the agreed bail amount “is a sufficient guarantee to secure the presence of the defendants” in Montenegro.

SEC Sues Binance and Coinbase

This week, the US Securities and Exchange Commission (SEC) sued Binance and its CEO, CZ. The lawsuit cites cryptocurrencies that the authority considers to be securities.

Let’s start with the SEC suing Binance, its US subsidiary, and CZ itself. It is talking about as many as 13 allegations of, among other things, illegal operations in the US. However, the lawsuit also lists cryptocurrencies that officials consider to be securities. These include BNB, Binance USD, Solana, Cardano, Polygon, Cosmos, The Dandbox, Decentraland, Axie Infinity, and COTI. It is worth mentioning that the SEC also recognizes XRP tokens, LBRY’s LBRY Credits, and Algorand as securities.

A few days later, US exchange Coinbase also received a suit. Authorities claim that the company never registered as a broker, national securities exchange, or clearing agency. On top of that, several tokens offered by the platform, including Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Sandbox (SAND), Axie Infinity (AXS), Chiliz (CHZ), FLOW, ICP, NEAR, VGX, DASH, and NEXO qualify as securities.

The lawsuit specifies that Coinbase has operated as an unregistered broker since 2019. However, this is not the end of the story. It also stated that Coinbase’s staking program is, in legal terms, an investment contract. It also has implications – the exchange should register with the SEC.

With the lawsuits targeting Binance and Coinbase, whether cryptocurrencies are securities is resurfacing. The head of the SEC, Gary Gensler, believes they are. The problem is that he says so in the media, but during a recent congressional hearing, he refused to confirm his controversial claims.

So far, SEC documents show that the Commission considers just over 60 tokens and cryptocurrencies securities. Neither Bitcoin nor Ether is on the list.

Bitcoin Ordinals Will Receive Another Update

The Bitcoin Ordinals protocol will be able to index older inscriptions and thus allow them to be sold and bought.

The new update aims to fix more than 71,000 invalid or faulty inscriptions. These were created due to misuse or deliberate abuse of the operating code. Such behavior ultimately led to their invalidity. An update was, therefore, necessary.

The problem had been analyzed before, with Ordinals creator Casey Rodarmor presenting an initial concept for a solution in April. Casey had an ambitious plan to automate the transformation of faulty inscriptions into correct ones using the creation of special subsets. A block activation pitch was then set, where specific types of previously invalid inscriptions would begin to be indexed as normal, positive ones.

The Atomic Wallet Cryptocurrency Wallet Has Been Hacked

The team behind Atomic Wallet announced on June 3 that it had received reports of the wallet being hacked. It further stressed that it would investigate them. The investigation involves a well-known”detective” who helps track assets transferred on blockchains – ZachBTX.

He has analyzed transactions relating to stolen funds from Atomic Wallet victims and relayed that more than $35 million in cryptocurrencies were stolen due to this breach. The earliest transaction involving stolen Atomic Wallet assets occurred on Friday, June 2, at 21:45 UTC.

The detective relayed that the most severe loss incurred on a single address was US$7.95 million in USDT. The five largest thefts settled at US$17 million.

Atomic Wallet is now collecting information from victims, asking, among other things, what operating system they use, where they downloaded the software from, what they did before their funds were stolen, and where they stored the account recovery phrase.

Crypto News From Our Partners: Bambi is Developing at a Fast Pace

The Bambi project, although relatively new, is developing at an incredibly fast pace. According to a recent tweet, it will soon launch several new products, including a 3D game, an animated series, a THUMP token airdrop, token burning, NFT, and digital comics, to which anyone in the community can contribute. Moreover, the project already has 7,000 HODLers, and the market cap of the BAM token has reached $2 million!

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Bitcoin crypto news crypto world Ethereum price analysisRecent Articles on Cryptocurrency

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?  FUNToken Price Prediction: Can FUN Coin Reach $1?

FUNToken Price Prediction: Can FUN Coin Reach $1?