Understanding and Avoiding Crypto Scams: A Comprehensive Guide

Cryptocurrency has gained massive popularity, attracting not only investors but also scammers. The decentralised nature of crypto and the lack of regulatory oversight have created opportunities for fraudsters. As more people enter the crypto market, the number of scams continues to rise. This makes it crucial for both new and experienced users to understand how these scams work. Protecting your crypto investments begins with being informed about the tactics scammers use and the ways to avoid them. Let’s dive into some common crypto scams to watch out for.

Article contents

- 1 Common Types of Crypto Scams

- 2 How to Spot and Avoid Scams

- 3 Case Studies of Major Scams

- 4 Security Best Practices

- 5 Legal Recourse and Reporting

- 6 Conclusion

- 7 FAQ

- 7.1 How Do You Know a Crypto Scam?

- 7.2 What to Do if Crypto Is Scammed?

- 7.3 Can I Recover Money from a Crypto Scammer?

- 7.4 Do Banks Refund Scammed Money?

- 7.5 How and Where to Report Crypto Scams?

- 7.6 What Is the Red Flag in Crypto?

- 7.7 Can You Go to Jail for Crypto Scamming?

- 7.8 How to Avoid Crypto Scams?

- 7.9 How to Buy Crypto Instantly?

Common Types of Crypto Scams

There are several types of scams in the crypto world. Understanding how they work will help you stay one step ahead.

- Phishing Scams – Phishing scams involve tricking users into providing sensitive information like private keys or login credentials. Scammers often send fake emails or messages pretending to be legitimate services. Once they gain access to your details, they can steal your funds. Always double-check URLs and never click on suspicious links.

- Ponzi Schemes – Ponzi schemes promise high returns on investments with little to no risk. Scammers pay returns to earlier investors using the capital from new investors. Eventually, the scheme collapses when there are not enough new investors, and everyone loses their money. Be wary of schemes that sound too good to be true.

- Rug Pulls – Rug pulls happen when developers create a cryptocurrency or project, lure in investors, and then abandon the project, disappearing with the funds. These scams usually occur in Decentralised Finance (DeFi) platforms and new crypto projects. Always research the project and the team behind it before investing.

- Fake Exchanges and Wallets – Some scammers create fake exchanges and wallets that look just like legitimate ones. These fake platforms can steal your funds as soon as you deposit them. Always use well-known and trusted platforms, and verify the security features of any service you use.

How to Spot and Avoid Scams

Avoiding crypto scams requires vigilance and knowledge of the red flags. One of the most important steps is learning to identify warning signs. Scammers often use urgency and promises of high returns to lure in victims. If something seems too good to be true, it usually is. Watch out for unsolicited offers and always be cautious of platforms that push you to make quick decisions.

Verifying the legitimacy of sources and platforms is essential. Always conduct thorough research before engaging with any crypto service. Check for reviews, user feedback, and whether the platform has been mentioned in trustworthy media outlets. If a platform or person has little to no online presence, proceed with caution. Always make sure you are using the official website or app for exchanges and wallets. Phishing attacks often mimic the look and feel of genuine platforms, so double-check URLs and sender addresses.

Using secure platforms and wallets significantly reduces your risk of falling victim to scams. Stick to well-known and established crypto exchanges or wallets that have strong security measures in place. Secure your digital assets by choosing wallets that allow two-factor authentication (2FA) and ensure your private keys are stored safely offline whenever possible.

Case Studies of Major Scams

Crypto scams have impacted countless investors over the years, often causing devastating financial losses. While many people enter the crypto world with the hope of making significant profits, the lack of regulation and the anonymity provided by blockchain technology create opportunities for fraudsters. Understanding how these major scams were carried out can give us valuable insight into how scammers operate and how they manipulate their victims.

Let’s take a closer look at some of the biggest scams that have shaken the cryptocurrency world and the lessons they leave behind.

- BitConnect (2016-2018) – BitConnect was one of the most notorious Ponzi schemes in the crypto space. It promised investors high returns through a “trading bot” that would automatically generate profits. For a while, early investors received payouts, which helped build credibility. However, in early 2018, the project collapsed, and investors lost billions. The collapse highlighted the dangers of platforms that promise guaranteed returns without transparency.

- OneCoin (2014-2017) – OneCoin was a global Ponzi scheme disguised as a cryptocurrency. It was marketed as a revolutionary digital currency, but in reality, it had no blockchain or functioning technology behind it. Investors were encouraged to buy packages of tokens, but those tokens had no actual value. The scam generated over $4 billion before it was shut down, leaving investors with nothing. This case serves as a reminder to always verify a project’s technical foundation before investing.

- PlusToken (2019) – PlusToken was a wallet service that offered high returns on deposits. It operated as a Ponzi scheme, paying early users with funds from new users. In 2019, the operators vanished with around $2 billion in cryptocurrency, affecting hundreds of thousands of users. The PlusToken scam demonstrated the risks of trusting unknown wallet services without proper research.

- FTX Collapse (2022) – FTX was one of the largest cryptocurrency exchanges in the world until its sudden collapse in 2022. The platform was involved in lending customer funds to affiliated firms, leading to massive financial mismanagement. When users tried to withdraw their funds, FTX could not honor the requests, leaving billions of dollars in limbo. The collapse of FTX shocked the entire crypto community and highlighted the need for greater transparency and regulation in crypto exchanges.

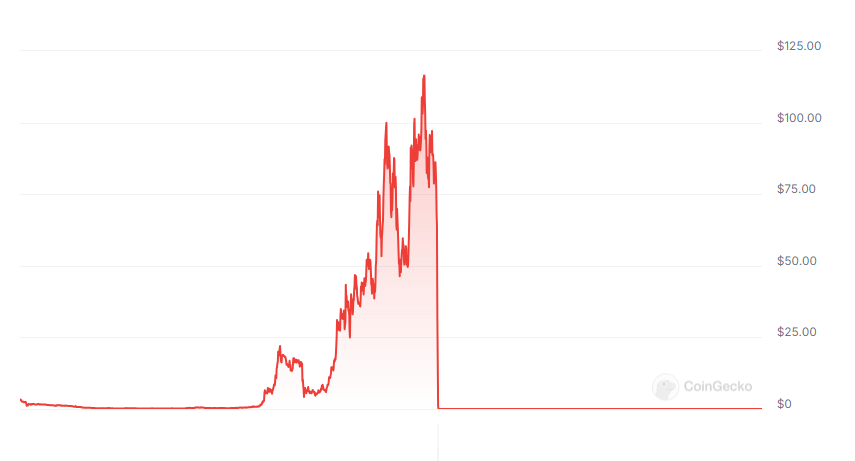

- Terra (LUNA) Collapse (2022) – Terra was a blockchain platform with its native token, LUNA, and a stablecoin called TerraUSD (UST). TerraUSD was pegged to the US dollar, but in May 2022, it lost its peg, causing UST and LUNA to crash dramatically. Investors lost billions of dollars, and the entire ecosystem fell apart. The collapse was due to the flawed algorithm that managed the stablecoin’s value, proving that even seemingly innovative projects can carry hidden risks.

Terra Classic (LUNC) Price Chart, CoinGecko

These examples show how scams and poor management can lead to financial ruin. The common thread in these cases is the promise of unrealistic returns or a lack of transparency, highlighting the importance of being sceptical and cautious in the crypto space.

Security Best Practices

Securing your cryptocurrency investments is crucial in a space where scams and fraud are prevalent. Following a few key security practices can help protect your assets and personal information.

First, securing your crypto wallets is essential. A digital wallet stores your private keys, which grant access to your cryptocurrency. Using hardware wallets (also known as cold wallets) adds an extra layer of security because they store your private keys offline. This makes them less vulnerable to hacks compared to software wallets that are connected to the internet. Make sure to back up your wallet in case it gets lost or damaged.

Hardware Wallets, Photo by rc.xyz NFT gallery on Unsplash

Next, always enable two-factor authentication (2FA) on your exchange accounts and wallets. 2FA adds another layer of security by requiring a second form of authentication, like a code sent to your phone, to access your account. Without this, even if someone obtains your password, they won’t be able to log in. Be sure to use an authentication app instead of SMS, as SIM swapping attacks can bypass SMS-based 2FA.

It’s also very important to protect your personal information online. Scammers often use phishing tactics to steal your credentials. Be cautious when sharing sensitive information and never click on unsolicited links or download unknown attachments. If you receive an email or message claiming to be from a crypto service, always verify the sender by checking the official website or contacting customer support.

Lastly, avoid using public Wi-Fi networks when accessing your crypto accounts or wallets. Public networks are not secure, and hackers can intercept your data. Instead, use a VPN to encrypt your internet connection and shield your activities from prying eyes.

By adopting these security best practices, you can significantly reduce the risk of falling victim to crypto scams and keep your assets safe.

Legal Recourse and Reporting

If you fall victim to a crypto scam, knowing what to do next can make a big difference in recovering your assets or preventing further losses. While the decentralised nature of cryptocurrencies makes it harder to track and recover stolen funds, there are still legal options available.

The first step is to gather as much evidence as possible. Document all transactions, communications with the scammer, and any relevant information about the platform or individual responsible. This evidence can be crucial when reporting the scam to authorities or taking legal action.

Next, report the scam to the relevant authorities. Depending on your location, you can contact organisations like the Financial Conduct Authority (FCA), the Federal Trade Commission (FTC), or your local law enforcement. Many countries have established cybercrime units that specialise in handling cryptocurrency fraud. Reporting the scam not only helps you but also prevents others from falling victim to the same scheme.

In some cases, victims can seek legal recourse through civil lawsuits. This is typically more effective when the scam involves a registered company or identifiable individuals. However, this process can be lengthy and costly, and success is not guaranteed. Consulting a lawyer with experience in cryptocurrency and fraud cases can help you understand your options.

There are also organisations and blockchain analysis firms that specialise in tracking stolen crypto. While recovering funds is difficult, these services may be able to help trace transactions and provide reports that could assist in legal proceedings.

Remember, acting quickly is essential. The longer you wait to report a scam or take legal action, the more difficult it may be to recover your assets.

Conclusion

As the world of cryptocurrency continues to evolve, so do the tactics of scammers. Staying informed and vigilant is your best defence against becoming a victim. By understanding the various types of scams, identifying red flags, and following security best practices, you can protect your investments and avoid falling prey to fraud.

Securing your digital assets requires constant attention, from using reliable platforms to enabling two-factor authentication and safeguarding your personal information. Always take the time to verify the legitimacy of the services and exchanges you use. Remember, if an offer seems too good to be true, it likely is.

When it comes to choosing a trusted exchange, StealthEX stands out as a reliable option. Its non-custodial model ensures that users remain in control of their funds throughout the entire exchange process. With StealthEX, you can exchange cryptocurrency instantly without compromising security or handing over control of your assets to a third party. This makes it an excellent choice for those seeking a safe and trustworthy platform for crypto transactions.

By following these guidelines and staying aware of potential threats, you can navigate the crypto space with confidence and protect your financial future.

FAQ

How Do You Know a Crypto Scam?

Look out for red flags such as promises of guaranteed returns, unsolicited offers, and poorly verified platforms.

What to Do if Crypto Is Scammed?

Gather evidence, report the incident to authorities, and consult with legal experts for possible recovery options.

Can I Recover Money from a Crypto Scammer?

In some cases, it’s possible, but recovery is often difficult due to the anonymous nature of crypto transactions.

Do Banks Refund Scammed Money?

Banks do not refund cryptocurrency transactions as they are not regulated like traditional bank transfers.

How and Where to Report Crypto Scams?

Report scams to cybercrime units, regulatory bodies like the FCA or FTC, and local law enforcement.

What Is the Red Flag in Crypto?

Promises of high returns with little risk, unsolicited investment offers, and pressure to act quickly are major red flags.

Can You Go to Jail for Crypto Scamming?

Yes, engaging in crypto fraud is illegal, and perpetrators can face imprisonment and other severe penalties.

How to Avoid Crypto Scams?

Use secure platforms, verify all sources, enable two-factor authentication, and avoid offers that seem too good to be true.

How to Buy Crypto Instantly?

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, BTC to ETH.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your coins.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

crypto world cryptocurrency phishing phishing attack scamRecent Articles on Cryptocurrency

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?

Artificial Superintelligence Alliance Price Prediction - Is FET Coin a Good Investment?  Hyperliquid Price Prediction: Can HYPE Reach $100?

Hyperliquid Price Prediction: Can HYPE Reach $100?