Ethereum Price Prediction: Is ETH a Good Long-Term Investment?

Ethereum (ETH) is one of the most influential and widely used blockchain platforms in the world, often referred to as the foundation of the decentralized web. As of today, the price of ETH is hovering around $2,600 level, marking a huge increase from its April low of around $1,472. This upward movement is attributed to factors such as increased institutional interest and ongoing technological developments like the Pectra upgrade. In this article, we’ll look into the key factors influencing ETH’s price. Let’s explore the Ethereum price prediction and analyze what drives the world’s leading smart contract platform.

| Current ETH Price | ETH Prediction 2025 | ETH Price Prediction 2030 |

| $2,620 | $4,200 | $10,000 |

Article contents [hide]

- 1 What Is Ethereum: Technology and Ecosystem?

- 2 ETH Price Statistics

- 3 Overview of Ethereum’s Core Features

- 4 Historical Analysis of Ethereum Price

- 5 Ethereum Price Prediction: 2025, 2026, 2030, 2040, 2050

- 6 Expert and Market Analyst Opinions on Ethereum Price Prediction

- 7 Technical Analysis: Ethereum (ETH) – June 2025

- 8 Fundamental Factors Affecting Ethereum Price

- 9 Questions and Answers: Ethereum Price Prediction

- 9.1 Is Ethereum a Good Investment?

- 9.2 Is Investing in Ethereum Safe?

- 9.3 What Is Ethereum’s All-Time High?

- 9.4 How Much Is 1 ETH Worth Right Now?

- 9.5 How High Can Ethereum Realistically Go?

- 9.6 Can Ethereum Reach $5,000?

- 9.7 Can ETH Reach $10,000?

- 9.8 Can Ethereum Reach $20K?

- 9.9 Will ETH Hit $50,000?

- 9.10 Can Ethereum Reach $100,000?

- 9.11 How Much Will 1 Ethereum Be Worth in 2025?

- 9.12 How Much Ethereum Will Be in 2030?

- 9.13 How Much Will Ethereum Cost in 2035?

- 9.14 What Will ETH Be Worth in 20 Years?

- 9.15 What Will Ethereum Be Worth in 2050?

- 9.16 Should I Buy Ethereum or Bitcoin?

- 9.17 Will Ethereum Overtake Bitcoin?

- 9.18 What Is the Ethereum Pectra Upgrade?

- 9.19 What Does the Pectra Update Allow Users to Do with Their Wallets?

- 9.20 What Is the Next Ethereum Upgrade?

- 9.21 Is It Worth Putting $100 in Ethereum?

- 9.22 How Much Ethereum Should I Buy to Be a Millionaire?

- 9.23 Can Ethereum Crash to Zero?

- 9.24 Is ETH Worth Buying?

- 10 Conclusion and Recommendations

- 11 Where to Buy Ethereum?

- 12 How to Buy ETH Coin: Quick-Step Guide

What Is Ethereum: Technology and Ecosystem?

Ethereum is a decentralized blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Unlike Bitcoin, which primarily serves as a digital currency, Ethereum offers a more versatile infrastructure, allowing for a wide range of applications beyond simple transactions.

Initially, Ethereum operated on a Proof-of-Work (PoW) consensus mechanism, which, while secure, was energy-intensive and limited in scalability. To address these issues, Ethereum transitioned to Ethereum 2.0, introducing a Proof-of-Stake (PoS) system. This shift reduced energy consumption by over 99% and laid the groundwork for enhanced scalability and security.

The Pectra upgrade, implemented on May 7, 2025, was another milestone in Ethereum’s evolution. Combining the Prague and Electra updates, Pectra introduced several enhancements:

- Account Abstraction (EIP-7702): Allows crypto wallets to function like smart contracts, enabling features like transaction batching and gas fee sponsorship.

- Increased Staking Limits (EIP-7251): Raised the maximum stake per validator from 32 ETH to 2048 ETH, improving network security and efficiency.

- Enhanced Scalability: Optimizations in data availability and transaction processing to support growing network demands.

ETH Price Statistics

| Current Price | $2,620 |

| Market Cap | $317,113,521,621 |

| Volume (24h) | $17,195,310,800 |

| Market Rank | #2 |

| Circulating Supply | 120,722,573 ETH |

| Total Supply | 120,722,947 ETH |

| 1 Month High / Low | $2,729 / $1,764 |

| All-Time High | $4,891.7 Nov 16, 2021 |

Ethereum is not just a digital currency—it’s a global computing platform. While ETH is the fuel for transactions, the real value lies in Ethereum’s ability to host smart contracts and decentralized applications (dApps). This makes it a foundation for innovations in finance, gaming, identity, and governance. Unlike coins used solely for payments, Ethereum powers a programmable ecosystem where developers can build complex systems that run without intermediaries. It’s this versatility that sets Ethereum apart from other cryptocurrencies.

Overview of Ethereum’s Core Features

Ethereum is far more than a digital coin. It’s a full-featured decentralized platform that enables developers to build and run applications that operate without central control. This makes Ethereum a foundation for a wide range of blockchain innovations. Below are the main features that set Ethereum apart:

Smart Contracts

Smart contracts are at the heart of Ethereum. These are self-executing agreements written in code. Once certain conditions are met, they run automatically—no banks, lawyers, or third parties required. This automation reduces cost, speeds up execution, and removes the need for trust.

Ethereum Virtual Machine (EVM)

The EVM is a decentralized computing engine that runs smart contracts on every Ethereum node. It ensures that all Ethereum applications operate in a predictable and secure way, regardless of where in the world they are used. Developers can write code in programming languages like Solidity and deploy it across the network.

Decentralized Applications (dApps)

Ethereum allows anyone to build dApps—applications that are open-source, censorship-resistant, and operate on the blockchain. Popular dApps include games, decentralized exchanges (DEXs), social media platforms, and more. Unlike traditional apps, they don’t rely on central servers.

Decentralized Finance (DeFi)

Ethereum powers the entire DeFi ecosystem. DeFi apps let users borrow, lend, earn interest, and trade tokens—without using banks or financial institutions. Protocols like Uniswap, Aave, and Compound are all built on Ethereum and use smart contracts to handle billions in volume.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets that represent ownership of specific items like digital art, music, or game items. Ethereum was the first blockchain to support NFTs through standards like ERC-721 and ERC-1155. This feature has revolutionized digital ownership and creator monetization.

Other Applications

Ethereum’s flexibility makes it useful in many industries. Businesses use it for:

- Supply chain management (verifying product authenticity)

- Identity verification and digital credentials

- Blockchain-based voting systems

- Crowdfunding and tokenized ownership

Historical Analysis of Ethereum Price

Ethereum was launched in 2015 with a starting price of around $0.75. It quickly caught the attention of developers due to its unique smart contract functionality. By 2016, Ethereum reached $20, driven by interest in the DAO project—one of the first major decentralized autonomous organizations. However, a major hack resulted in a hard fork, splitting the network into Ethereum (ETH) and Ethereum Classic (ETC).

In 2017, Ethereum experienced its first major bull run. Fueled by the initial coin offering (ICO) boom, ETH surged to nearly $800. Thousands of projects launched tokens on the Ethereum blockchain using the ERC-20 standard. But in 2018, the market crashed. Ethereum dropped below $100 as investor confidence collapsed, though development on the network quietly continued.

A major turning point came in 2020 with the rise of decentralized finance (DeFi). Ethereum’s utility surged, and ETH closed the year above $700. In 2021, Ethereum hit an all-time high of $4,878 in November.

In 2022, the crypto market faced a severe downturn. ETH plunged to $880 amid macroeconomic uncertainty and events like the Terra/Luna collapse. However, in September of that year, Ethereum completed “The Merge,” shifting from proof-of-work to proof-of-stake. This move reduced energy usage by over 99% and helped rebuild long-term investor confidence.

Throughout 2023 and 2024, Ethereum slowly recovered and stabilized above the $1,600–$2,000 range. As of June 2025, it trades at approximately $2,600.

CoinMarketCap, June 5, 2025

Ethereum’s price often moves in correlation with Bitcoin, but its own developments—like DeFi, NFTs, and protocol upgrades—make it stand out during bullish cycles.

Ethereum Price Prediction: 2025, 2026, 2030, 2040, 2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change* |

| 2025 | $2,896.17 | $6,589.17 | $4,200 | +60% |

| 2026 | $1,704.61 | $7,812.48 | $5,700 | +120% |

| 2030 | $3,117.43 | $15,131.42 | $10,200 | +290% |

| 2040 | $5,429.87 | $48,241.81 | $33,300 | +1,170% |

| 2050 | $8,844.69 | $75,156.47 | $47,700 | +1,720% |

*Price change based on current ETH price: ~$2,620 (June 2025)

Ethereum Price Prediction 2025

The Ethereum price prediction for 2025 varies significantly depending on the source. According to Telegaon, ETH could reach a minimum of $2,896.17, representing an 11% increase from the current price of $2,608. In a more optimistic scenario, Ethereum may surge to $6,589.17, marking a 150% gain.

On the other hand, Gate.io analysts offer a more conservative Ethereum price prediction for 2025, suggesting a potential low of $2,298.41 (a −12% drop) and a possible high of $3,369.26 (+30%).

Ethereum Price Prediction 2026

Looking ahead, the Ethereum price prediction for 2026 remains bullish among some analysts. Telegaon expects Ethereum to trade between $6,624.98 and $7,812.48, indicating gains of 155% and 200% respectively from today’s value.

In contrast, Gate.io predicts a more modest range, with ETH possibly dropping to $1,704.61 (−35%) or climbing to $3,110.16 (+20%).

Meanwhile, MEXC offers a conservative Ethereum price prediction for 2026, forecasting a small increase to $2,742.45, which represents a +5% rise.

Ethereum Price Prediction 2030

The long-term Ethereum price prediction for 2030 becomes notably more optimistic. Telegaon foresees a dramatic rise, with ETH potentially hitting $12,296.76 on the low end (+370%) and $15,131.42 on the high end (+480%).

Gate.io’s Ethereum price forecast for 2030 is less aggressive, projecting a price range between $3,117.43 (+20%) and $5,737.89 (+120%).

MEXC joins in with a moderate outlook, estimating ETH to reach $3,333.47, a 27.5% increase from its current level.

Ethereum Price Prediction 2040

When it comes to the Ethereum price prediction for 2040, expectations skyrocket. Telegaon predicts ETH could soar to $41,513.45 in a bearish market (+1,490%) or even up to $48,241.81 in a bullish case (+1,750%).

In contrast, MEXC maintains a cautious stance, projecting Ethereum could reach $5,429.87 by 2040, which still represents a 108% gain from current prices.

Ethereum Price Prediction 2050

Looking even further into the future, the Ethereum price prediction for 2050 highlights the potential for exponential growth. Telegaon suggests ETH could trade between $61,213.29 and $75,156.47, representing staggering increases of +2,250% and +2,780% respectively.

MEXC, while still optimistic, offers a more restrained estimate of $8,844.69, which would be a +240% rise over today’s price.

Expert and Market Analyst Opinions on Ethereum Price Prediction

Ethereum continues to attract strong opinions from financial analysts, economists, and crypto market strategists. While forecasts vary, most experts agree on one key point: Ethereum remains an important infrastructure layer in the broader digital economy and has long-term growth potential.

Geoff Kendrick, head of digital assets research at Standard Chartered Bank, has publicly stated that Ethereum could reach $8,000 by the end of 2024 and possibly $14,000 in 2025. His analysis is based on expected inflows into spot ETH ETFs and Ethereum’s growing role as a settlement layer for tokenized assets.

Raoul Pal, founder of Real Vision and former Goldman Sachs executive, remains highly bullish on Ethereum. He has previously compared Ethereum to a high-growth tech stock and projected that ETH could reach $20,000–$40,000 in the next market cycle, especially if network usage and institutional investment continue to grow.

Brian Kelly, CNBC contributor and founder of BKCM, considers Ethereum one of the most fundamentally sound assets in the crypto space. He believes Ethereum could outperform Bitcoin in the long run due to its programmability and use in DeFi, NFTs, and real-world asset tokenization. While he avoids fixed targets, Kelly has said ETH reaching five figures is “entirely plausible.”

Kevin O’Leary, investor and entrepreneur, views Ethereum as the foundation for future financial infrastructure. He has publicly supported the long-term growth of Ethereum, especially after the network’s transition to Proof-of-Stake, which aligns better with ESG investment principles.

Matt Hougan, Chief Investment Officer at Bitwise, has expressed confidence in Ethereum’s ETF-driven future. In his view, ETH is undervalued compared to Bitcoin and could see significant revaluation if Ethereum-based ETFs attract institutional capital at scale.

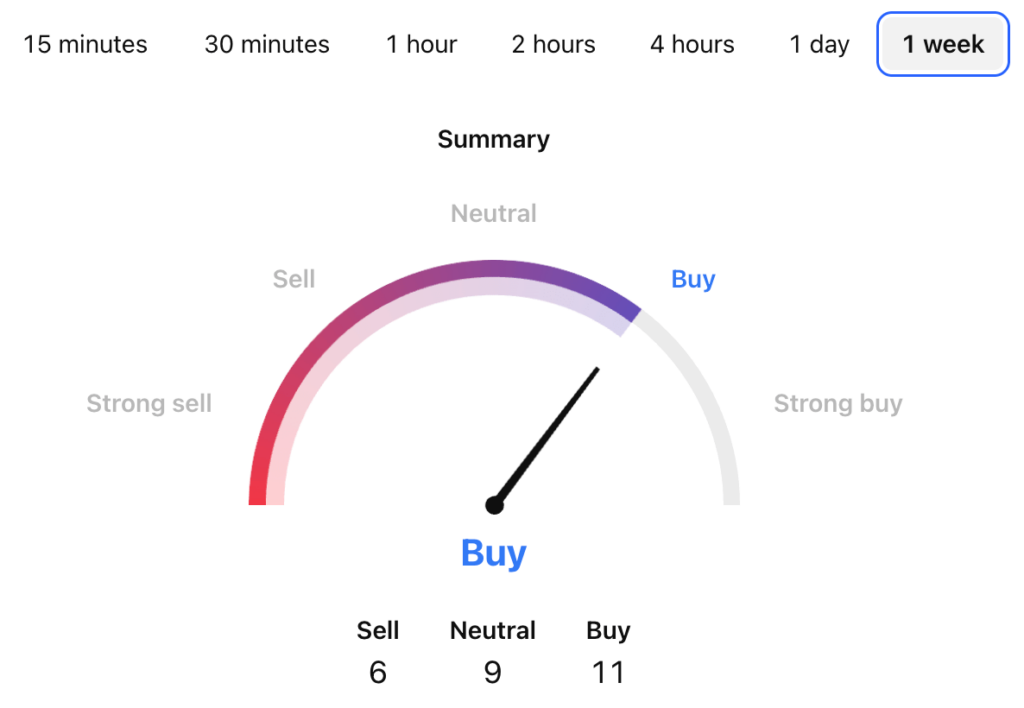

Technical Analysis: Ethereum (ETH) – June 2025

As of early June 2025, Ethereum (ETH) is trading around $2,620, reflecting a slight increase of 0.5% from the previous close. The price has fluctuated between $2,606 and $2,667 during the day.

Tradingview, June 5, 2025

Momentum Indicators

- Relative Strength Index (RSI): The RSI stands at 53.9, indicating a neutral momentum. This suggests that ETH is neither overbought nor oversold, pointing to a potential consolidation phase.

- Moving Average Convergence Divergence (MACD): The MACD shows a value of -1.9, signaling a bearish trend. This negative value indicates that the short-term momentum is weaker than the long-term momentum, which could lead to further price declines if the trend continues.

Trend Indicators

- Moving Averages: The 50-day Simple Moving Average (SMA) is at $2,620.03, while the 100-day SMA is at $2,575.45. The current price is slightly below the 50-day SMA but above the 100-day SMA, suggesting a mixed trend.

- Average Directional Index (ADX): With a value of 38.495, the ADX indicates a strong trend. However, since the trend direction is not specified, traders should use other indicators to determine whether the trend is bullish or bearish.

Support and Resistance Levels

- Support: The immediate support level is around $2,575, which aligns with the 50% Fibonacci retracement level of the recent upward move from $2,476 to $2,677.

- Resistance: The key resistance level is at $2,665. A break above this level could signal a bullish trend continuation, while a failure to break through may lead to a price decline.

Tradingview, June 5, 2025

Fundamental Factors Affecting Ethereum Price

Ethereum’s price is driven by a mix of internal network developments and external market forces. Below are the key factors that impact its valuation in 2025 and beyond:

Technological Development

Ethereum continues to evolve. The recent Pectra upgrade improved performance, security, and user wallet flexibility. Earlier, the Merge shifted the network to Proof-of-Stake, cutting energy use by over 99%. Layer 2 scaling solutions like Arbitrum and Optimism are also growing fast, helping Ethereum handle more transactions at lower costs. These innovations support long-term demand for ETH.

Adoption and Real-World Use

Ethereum is the backbone of DeFi, NFTs, and many Web3 applications. But now, it’s also gaining traction in traditional finance. Large institutions are testing Ethereum to tokenize assets, issue bonds, or build infrastructure. This includes major players like BlackRock and JPMorgan. More use means more demand for ETH.

Competition from Other Blockchains

Ethereum is no longer the only smart contract platform. Solana, Avalanche, Cardano, and newer ecosystems offer faster or cheaper transactions. Some developers and users are moving to these platforms. Still, Ethereum holds the biggest market share and developer base. Its strong network effect gives it an advantage—but the competition puts pressure on ETH to keep innovating.

Regulatory Landscape

Regulation is becoming clearer. In 2024, Ethereum ETFs launched in the U.S., which boosted trust and access for big investors. However, regulators still debate how to classify Ethereum, especially when it comes to staking rewards. Unfavorable rules in large markets could limit adoption or price growth.

Macroeconomic and Market Sentiment

Global interest rates, inflation, and overall risk appetite play a role. In uncertain times, crypto demand may rise as people look for alternatives. On the other hand, rising rates or stricter monetary policy can pull money out of risk assets like ETH. Market cycles—both in crypto and stocks—also affect Ethereum prices.

Questions and Answers: Ethereum Price Prediction

This section addresses the most common beginner-friendly questions about Ethereum’s future price and potential.

Is Ethereum a Good Investment?

Ethereum is considered a strong long-term project due to its wide use in smart contracts, DeFi, and tokenization. However, like all crypto assets, it’s volatile and carries risk.

Is Investing in Ethereum Safe?

Ethereum is one of the most secure and decentralized blockchains. Still, investing in ETH involves market risk. Always do your own research and invest only what you can afford to lose.

What Is Ethereum’s All-Time High?

ETH’s all-time high was $4,878, reached in November 2021.

How Much Is 1 ETH Worth Right Now?

As of June 2025, Ethereum trades at approximately $2,608.

How High Can Ethereum Realistically Go?

Estimates vary. Analysts suggest ETH could reach between $10,000 and $20,000 over the next few years if adoption and ETF demand grow.

Can Ethereum Reach $5,000?

ETH has already come close in 2021. A new market cycle or mass adoption could push it past this level again.

Can ETH Reach $10,000?

Many analysts believe this is possible long term, especially if Ethereum dominates real-world applications like tokenized finance and gaming.

Can Ethereum Reach $20K?

It’s an ambitious target. It may require global adoption, strong institutional inflows, and positive regulation.

Will ETH Hit $50,000?

This would need Ethereum to become the core layer of global digital infrastructure. It’s not impossible, but it’s highly speculative.

Can Ethereum Reach $100,000?

Very unlikely in the near term. This would require massive global adoption and likely decades of growth.

How Much Will 1 Ethereum Be Worth in 2025?

Analyst predictions suggest a range between $2,300 and $6,500, depending on the source.

How Much Ethereum Will Be in 2030?

Estimates vary from $3,000 to $15,000. It depends on adoption and macroeconomic trends.

How Much Will Ethereum Cost in 2035?

Long-term forecasts predict $24,000 to $30,000 in a bullish scenario.

What Will ETH Be Worth in 20 Years?

Impossible to know. Some models suggest six-figure valuations. Others say crypto may be replaced by newer tech. Always treat long-term predictions cautiously.

What Will Ethereum Be Worth in 2050?

Some optimistic forecasts suggest $60,000 to $75,000, assuming steady growth and wide adoption.

Should I Buy Ethereum or Bitcoin?

Bitcoin is seen as digital gold. Ethereum is a programmable platform. ETH has more utility, but BTC is more conservative. Many investors hold both.

Will Ethereum Overtake Bitcoin?

This is called the “Flippening.” ETH might surpass BTC in market cap, but it hasn’t happened yet. It depends on future use cases and investor confidence.

What Is the Ethereum Pectra Upgrade?

Pectra is an upgrade combining Prague and Electra proposals. It improves smart contract performance, wallet features, and validator operations.

What Does the Pectra Update Allow Users to Do with Their Wallets?

With EIP-7702, users can turn wallets into smart contracts. They can batch transactions, reduce fees, and sponsor gas costs.

What Is the Next Ethereum Upgrade?

After Pectra, Ethereum developers plan upgrades focused on statelessness, execution layer improvements, and account abstraction.

Is It Worth Putting $100 in Ethereum?

Yes—if you’re learning and want exposure to crypto. Ethereum has long-term potential. But $100 won’t make you rich—treat it as an educational investment.

How Much Ethereum Should I Buy to Be a Millionaire?

At $2,600, you’d need roughly 385 ETH. That’s over $1 million today. It’s more realistic to aim for steady gains over time.

Can Ethereum Crash to Zero?

Highly unlikely. Ethereum is too widely used. But price crashes of 80% or more have happened before.

Is ETH Worth Buying?

Many investors think so—especially for long-term holding. But the price is volatile. Only invest if you understand the risks.

Conclusion and Recommendations

Ethereum remains one of the most important assets in the cryptocurrency space. It powers the largest ecosystem of decentralized applications, smart contracts, and digital assets. With the successful transition to Proof-of-Stake and upgrades like Pectra, Ethereum has become faster, more energy-efficient, and developer-friendly.

Price predictions for Ethereum vary widely—from modest growth to extremely bullish long-term forecasts. Most expert analysts agree that Ethereum’s potential depends on four key areas: increased real-world adoption, strong institutional interest (especially through ETFs), healthy competition and innovation, and a supportive regulatory environment.

In the short term, ETH may remain volatile. However, if Ethereum continues to lead in decentralized finance, NFTs, and blockchain infrastructure, its value could rise significantly over the next decade.

For investors:

- Ethereum can be a valuable part of a long-term crypto portfolio.

Start with small amounts if you’re new and always diversify. - Focus on use cases and fundamentals, not hype.

- Stay updated on upgrades, regulations, and market conditions.

ETH is not a guaranteed win—but it’s one of the most proven and widely adopted blockchain assets in existence today.

Where to Buy Ethereum?

StealthEX is here to help you buy ETH coin if you’re looking for a way to invest in this cryptocurrency. You can buy ETH privately and without the need to sign up for the service. StealthEX crypto collection has more than 1500 different coins, and you can do wallet-to-wallet transfers instantly and problem-free.

How to Buy ETH Coin: Quick-Step Guide

Just go to StealthEX and follow these easy steps:

- Choose the pair and the amount you want to exchange — for instance, BTC to ETH.

- Press the “Start exchange” button.

- Provide the recipient address to transfer your crypto to.

- Process the transaction.

- Receive your crypto coins.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

This material is presented for informational purposes only and is not investment advice. Ethereum price predictions are based on analysis of historical data and expert opinions, but do not guarantee future returns. The cryptocurrency market is highly volatile and subject to various risks. Before making investment decisions, it is recommended to conduct your own research and consult with a financial advisor.

ETH ETH price prediction Ethereum Ethereum price prediction price predictionRecent Articles on Cryptocurrency

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?

Pudgy Penguins Price Prediction: Is PENGU Coin a Good Investment?  XLM Price Prediction: Can Stellar Lumens Reach $10?

XLM Price Prediction: Can Stellar Lumens Reach $10?