Review of the Crypto Market: June 22, 2023

In recent weeks, the crypto markets were stagnant initially and then experienced significant declines due to the SEC lawsuit against Binance and Coinbase. However, the situation has begun to change dynamically. Bitcoin’s price surpassed $30,000 today, influenced by news from traditional financial institutions. As every week, we invite you to our regular weekly recap, in which we discuss the price charts of BTC and ETH, check which projects became the biggest gainers of the week, and briefly discuss the most important news from the world of digital assets. So, let’s get started!

Article contents

Bitcoin Price in USD This Week

Bitcoin has done exceedingly well over the past seven days. The king of crypto has increased its value by more than 20% during this period. Although BTC started the week in the area of $25,000, it has recorded almost only green daily candles and today crossed the psychological barrier of $30,000. At one point, the price even hit $38,000, but since then, there has been a gentle pullback. So, what is the price of Bitcoin today? The price of BTC as of today is $30,014.

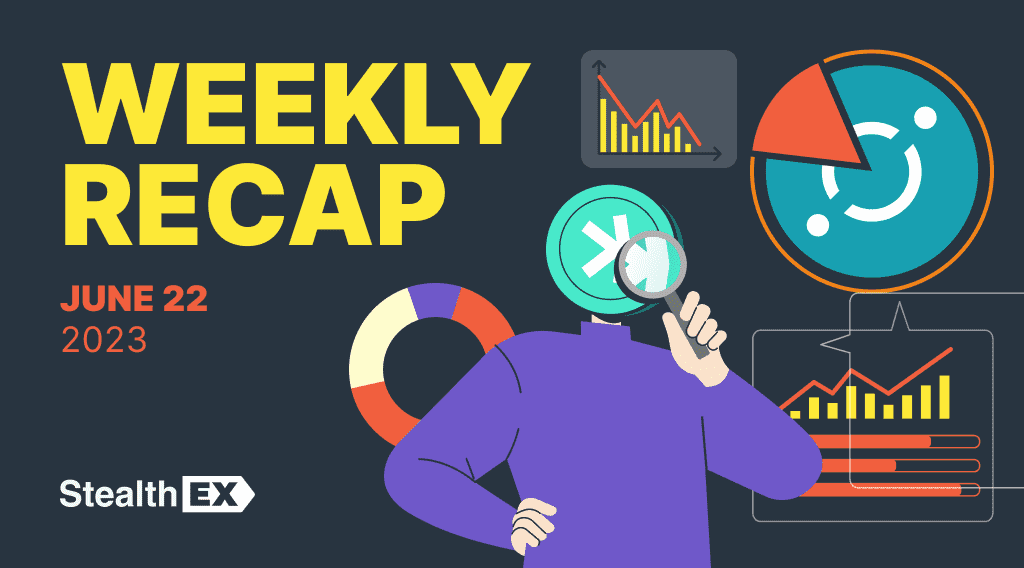

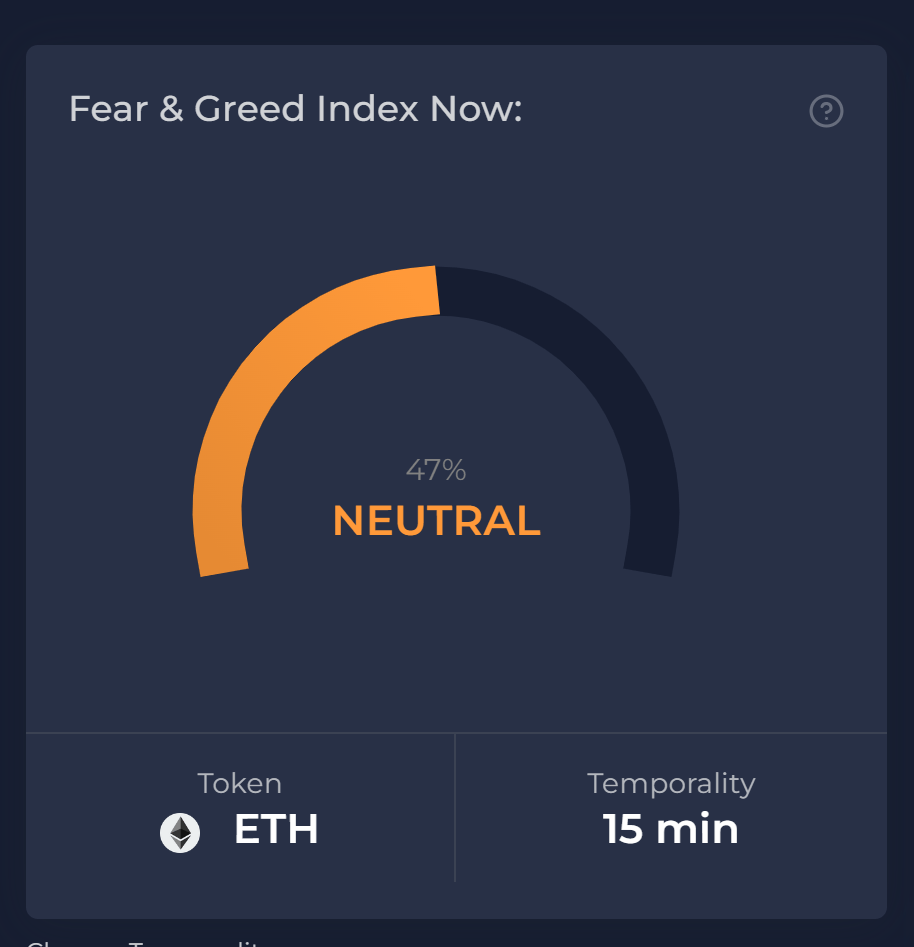

With the rising price, Bitcoin has also begun increasing its market dominance. It currently stands at nearly 50%, according to Coinmarketcap. Investor sentiment has also improved. Last week, traders were in fear, but they have become greedy again. Currently, the Fear and Greed Index shows a level of 65 points.

Ethereum Price in USD This Week

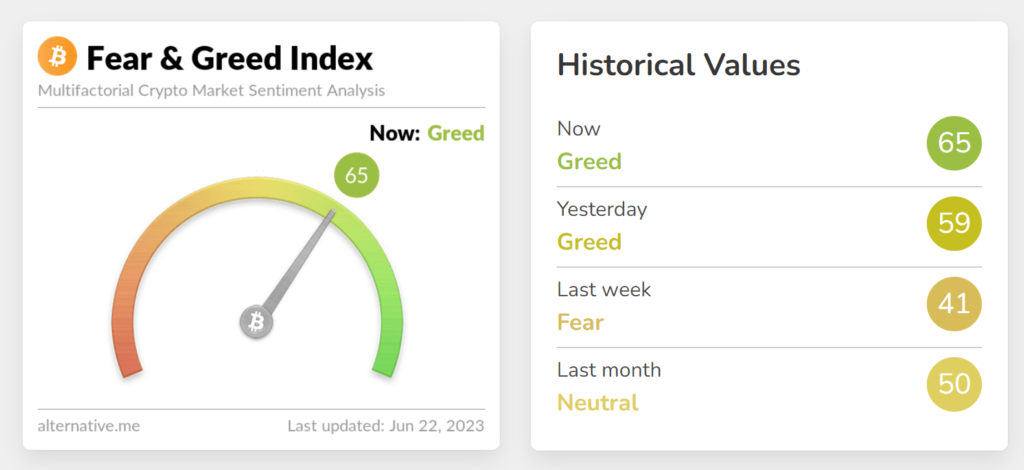

As for the chart of Ethereum, it looks almost identical to that of Bitcoin. The king of smart contracts recorded practically the only green candles over the past week. ETH, until recently, was oscillating around $1,600. Today, however, the price of ETH is $1,900, and at one point, it even exceeded $1,930.

ETH’s dominance relative to the overall crypto market has also increased by almost 1.5% and now stands at 19.4%. This indicates that BTC and ETH are doing better than the rest of the altcoins. However, investor sentiment for the second-largest cryptocurrency regarding market cap has remained unchanged. The Fear and Greed Index for ETH still indicates fear and is lower than seven days ago.

Biggest Crypto Gainers This Week

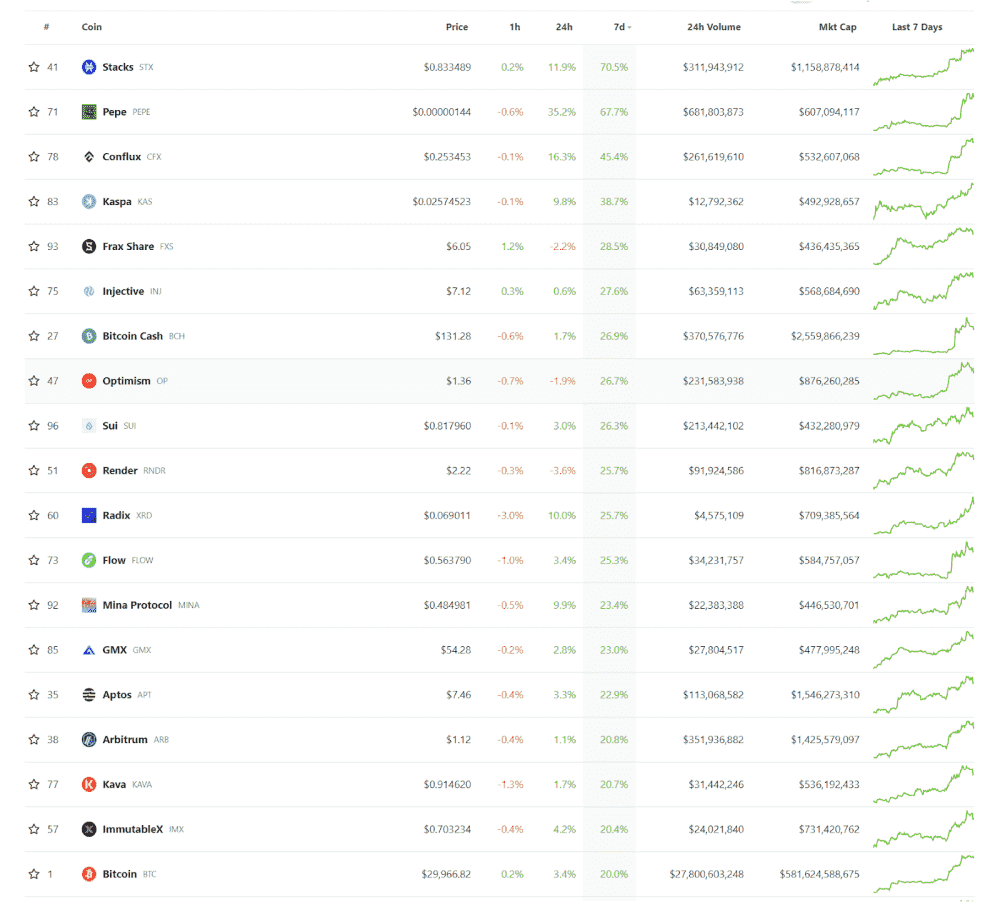

BTC and ETH gained 15% and 20% in value, respectively, during the week. Nevertheless, several altcoins did much better and brought investors really solid gains. Among the biggest crypto gainers of the week, we can include:

- Stacks (STX) – 70%

- Pepe (PEPE) – 67%

- Conflux Network (CFX) – 45%

- Kaspa (KAS) – 38%

- Frax Share (FXS) – 28%

In addition to the above tokens, Injective (INJ), Bitcoin Cash (BCH), Optimism (OP), Sui (SUI), Render (RNDR), Radix (XRD), Flow (FLOW), Mina Protocol (MINA), GMX (GMX), Aptos (APT), Arbitrum (ARB), Kava (KAVA), Immutable X (IMX) it also generated greater gains than Bitcoin.

Crypto News of the Week

Now that we know the market did pretty well last week, it’s time to move on to the most important part of our review. Let’s check out what influenced this situation. What caused the increases? Why is the market rising?

Traditional Institutions Apply for Bitcoin ETFs

This week BlackRock applied to create an exchange-traded fund (ETF) based on Bitcoin. The chances of developing one this time are high, as we are talking about one of the largest investment companies in the world. It will be the first such fund in history if all goes well.

Adding spice is the fact that the ETF would be partly based on the activities of Coinbase Custody Trust Company. The company would be the fund’s Bitcoin custodian. The Bank of New York Mellon would hold the fiat money. The BlackRock iShares Bitcoin Trust would be traded as a commodity-based trust stock. The price of units of the Bitcoin ETF is to undergo an update “at least” every 15 seconds.

It is worth noting, however, that the SEC has not approved any spot ETF based on BTC. And this is despite attempts by several applicants. One of the rejected applications belonged to Grayscale. The company sued the SEC in an appeals court, believing that the Commission wrongly disapproved of the company’s launch of an ETF.

Historically, BlackRock has filed 575 ETF applications, and the SEC approved all but one. Therefore, investors are taking an optimistic approach this time around.

It’s also worth noting that Blackrock is one of many companies that have applied for a Bitcoin ETF. Looking at what is going on, the race regarding this matter has begun. On June 20, Invesco, a US investment manager with $1.4 trillion in assets, filed its application. Similarly, WisdomTree has filed for the WisdomTree Bitcoin Trust. This ETF would be traded on the Chicago Board Options Exchange (Cboe).

Do Kwon Will Remain in Detention for a Minimum of Six More Months

Montenegrin authorities are considering extending Do Kwon’s house arrest in their country for another six months. After that, they will only decide on his possible extradition. The seizure of the former Terra CEO is being sought simultaneously by the U.S. and his native South Korea.

Recall that the Montenegrin police arrested Do Kwon in March this year. Before that, for several months, Terra’s ex-CEO went into hiding from several countries and Interpol authorities. He was only caught at the airport in the mentioned country when he tried to fly to Dubai using a fake document.

Marija Rakovic – public relations advisor to the Supreme Court of Montenegro – confirmed to local media that Kwon will remain under house arrest for a minimum of six more months. During that period, judges decide whether to extradite him to South Korea.

The United States is also seeking Kwon’s takeover. This is because the SEC accuses Terraform Labs of selling unregistered (therefore illegal) securities – those were to be the project’s tokens, according to the Commision. U.S. prosecutors have also filled charges, naming Kwon as the main culprit in Terra’s collapse.

The Key Change for Ethereum Staking. What Are the Validators Proposing?

The main developers of the second-largest cryptocurrency discuss the possibility of increasing the validator’s balance limit. All this is to overcome the operational challenges faced by larger validators.

To run a validation node and become a validator, a minimum of 32 ETH must be placed in an escrow contract. Some members of the Ethereum community would like to raise this threshold to 2,048 ETH.

The current reigning limit of 32 ETH was established to promote the idea of decentralization. However, this has led to an exponential increase in the number of validators.

According to popular researcher and proponent of the recently presented proposal, Michael Neuder, increasing the validator limit would curb the exponential growth of the active set of validators. In addition, it would also accelerate the network’s ability to achieve finality in a single slot.

While the proposal has several advantages, it also has some flawless. Michael Neuder warned of the potential risks associated with the increased node limit. Indeed, it may increase the penalty for failure to make multiple attestations or proposals.

BNB Chain Introduces a New Layer — opBNB

BNB Chain, the network founded by Binance, has introduced a new Layer 2 to increase scalability. The new solution is called opBN. Its operation is based on Optimism OP Stack, which should increase the blockchain’s security and scalability from Binance. It is worth noting that this system is compatible with the Ethereum Virtual Machine (EVM), so it interoperates with smart contracts and ERC-20 token standards.

The developers expect the opBNB testnet to reach speeds of up to 4,000 transactions per second (TPS) at an intended cost of 0.005 cents per transaction. These are speeds comparable to a blockchain such as Arbitrum. The testnet currently underway is simulating blockchains that emulate real customer movements. It allows developers to test applications and complex tools before the product officially hits the market.

Huobi Will Send a Trader to Mars

Cryptocurrency exchange Huobi has announced the launch of a campaign called Mars. One lucky user of the exchange will be eligible to win a trip to Mars.

According to the exchange, the campaign’s winner will be entitled to a seat on a space trip to Mars. If it takes place on the scheduled date, the trip could be the first human expedition to that planet.

The contest will run for a year. It will consist of a series of thematic challenges in 12 rounds.

According to Huobi, a winner will be selected in each round to become the initial candidate for a trip to space. Then, in the second phase of the competition, one of the 12 preliminary candidates will be selected as the final winner. The journey to Mars will take place after July 2024.

The exchange did not disclose which company would make the trip. After all, even NASA has yet to make plans to launch crewed rockets to Mars next year.

The first round of the Huobi Mars program began on June 14 and will last until July 5. During this period, users will have to complete a series of tasks that will allow them to win prizes in the form of space NFTs emitted on the TRON network.

According to Huobi, these space NFTs will be traded on various trading platforms and serve as lottery tickets. The holder of the lucky ticket will be the one who qualifies as a candidate for a trip to the planet Mars.

News and Updates from StealthEX Partners

As you can see, there was really a lot going on in the crypto market last week. A lot also happened with our partners’ projects, such as ICON and Kaspa.

StealthEX x ICON Partnership

StealthEX has formed a partnership with the ICON project – a project connecting all blockchains and communities with the latest interoperability tech. Through this partnership, we have enabled easy ICX token swaps on our platform. ICX can now be swapped for 1000+ other assets – even those on other chains. What’s more, no registration is required and no limits to doing so. To stay updated with ICON, watch the project’s and our social media!

AMA Kaspa x StealthEX

A lot is going on in the cryptocurrency market lately. A lot is also happening with our partners, such as Kaspa. That’s why we are holding an AMA with the project team. If you want to find out what’s new and the plans or have any questions, we invite you to join us on 26 May on Twitter Spaces. Watch our and Kaspa‘s social media to ensure you attend the event.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

Recent Articles on Cryptocurrency

PEPE Coin Price Prediction: When Will PEPE Reach $1?

PEPE Coin Price Prediction: When Will PEPE Reach $1?  Bubblemaps Price Prediction: Is BMT Coin a Good Investment?

Bubblemaps Price Prediction: Is BMT Coin a Good Investment?