The Future of Ethereum: Predictions, Challenges, and Opportunities

Ethereum is the largest dApps hub, the most convenient solution for the vast majority of cryptocurrency projects, and ultimately one of the most promising assets on the market. ETH coin is the second-biggest cryptocurrency by market cap. While Ethereum continues to be a vast and all-encompassing network, many still wonder what the future of Ethereum is and how it will develop.

In its essence, Ethereum is a blockchain-based computing platform that gives programmers the ability to create and deploy decentralized apps; these are not controlled by a single entity. You can design a decentralized application where the decision-making authority resides with the application’s users.

Additionally, Ethereum is an exceptionally important blockchain in the industry due to a number of useful features it provides users with. These include:

- Smart Contracts: Ethereum allows the development and deployment of these types of contracts.

- Ether: The blockchain’s native cryptocurrency ETH.

- Ethereum Virtual Machine: Ethereum provides the underlying technology (the architecture and the software) that understands smart contracts and allows you to interact with it.

- Decentralized autonomous organizations (DAOs): In addition to dApps, Ethereum allows you to create these for democratic decision-making.

Article contents

Ethereum: History and Origins

Despite having multiple founders, Vitalik Buterin was the one who first released a white paper outlining the Ethereum concept in November 2013. After Buterin’s original effort, different minds joined the project in a variety of capacities to assist it succeed. Ethereum is said to have been co-founded by Vitalik Buterin, Gavin Wood, Charles Hoskinson, Amir Chetrit, Anthony Di Iorio, Jeffrey Wilcke, Joseph Lubin, and Mihai Alisie.

At a Bitcoin conference in Miami, Florida, in January 2014, Buterin introduced the world to the idea of the blockchain project, which is how Ethereum came to be known. Later that year, the project raised money through an initial coin offering (ICO), selling millions of dollars worth of ETH in exchange for cash to utilize for project development. The asset sale sold over $18 million worth of ETH, paid for in Bitcoin, between July 22 and September 2, 2014.

Since the initial release of Ethereum, the blockchain has undergone numerous modifications as part of its development, including updates known as Byzantium, Constantinople, and the Beacon Chain. The blockchain has undergone changes as a result of each update.

The Enterprise Ethereum Alliance (EEA), a global community of blockchain leaders, adopters, innovators, developers and businesses, was formed in February 2017 by some notable companies including Microsoft, Intel, and JPMorgan Chase. The purpose of the EEA is to promote the use of Ethereum technology and new business opportunities around the world.

Decentralized finance projects built on Ethereum attracted a lot of attention in 2020 and 2021, which brought Ethereum’s scalability difficulties to the fore as high network fees hampered participants. Although it happens gradually, Ethereum’s migration to PoS and the consensus layer attempts to give the well-known blockchain scalability.

The Future of Ethereum

While Ethereum faced a number of issues, including limited scalability and, occasionally, finality issues, as it did in May 2023, crypto experts remain optimistic about the blockchain’s future.

Expert’s Opinions: What to Expect in the Coming Years?

For instance, Tyler Winklevoss, founder of Winklevoss Capital Management and the crypto platform Gemini, predicted that Ethereum’s global market capitalization could eventually equal gold’s. At the time of Winklevoss’ prediction in 2021, gold’s market cap was over $10 trillion, suggesting an Ethereum price target approaching $80,000.

Another crypto expert, Stani Kulechov, the founder and CEO of Aave, said:

“Most of the DeFi is headquartered on Ethereum, including Aave Protocol. I don’t think Bitcoin will have smart contracts at least for a long time. It would require changes on the protocol itself and the Bitcoin community to have a consensus on such a decision.”

Macroeconomic expert Raoul Paul also remains extremely bullish on Ethereum in 2023, citing that its now deflationary supply combined with staking mechanics sets the stage for a supply shock that will send the price much higher. According to Paul, who sees cryptos, including Ethereum, as economies, Ethereum continues to be the best risk to reward investment in the market and the most vibrant, deepest, broadest ecosystem with the most institutional-style adoption.

Based on recent data, Donald Trump holds a significant amount of Ethereum, with his wallet containing between $250,000 and $500,000. Additionally, he has garnered up to $4.9 million from NFT licensing fees. Interestingly, he had earlier labeled cryptocurrencies as a “scam” impacting the US dollar’s value.

What Will Ethereum Be Worth in 2025?

While it’s exceptionally difficult to predict the rates of cryptocurrencies in a long-term perspective, the overwhelming number of crypto analysts believe in the future of Ethereum. For instance, a popular website called DigitalCoinPrice believes that in 2025, Ethereum’s price will fluctuate in the range from $4,720.27 to $5,791.96.

What Will Ethereum Be Worth in 2030?

Ark Invest CEO Cathie Wood has been quite bullish on Ethereum lately. Her prediction estimates that Ethereum could reach ATHs of between $160K – $180K by 2030, with a market cap of $20 trillion. Cathie Wood said the second largest cryptocurrency could ”displace many traditional financial services” as decentralized finance gains traction, laying the groundwork for Ether to compete as a global currency.

Last Ethereum Technological Developments

Ethereum 2.0 and the Transition to Proof-of-Stake

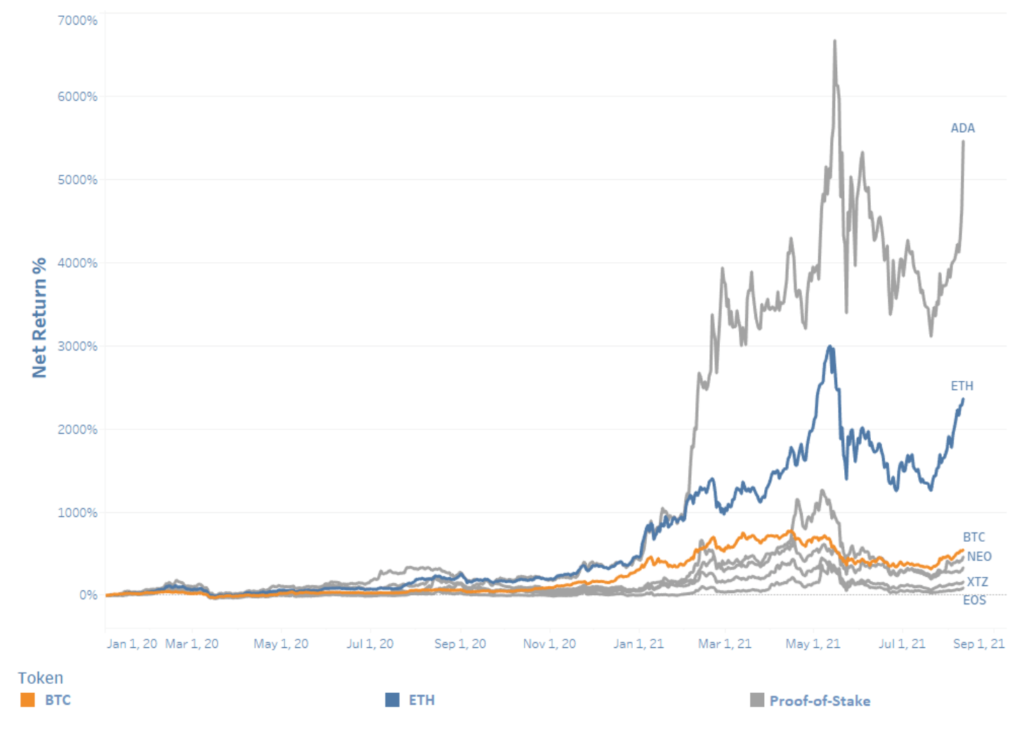

With many advancements and situations that had important positive improvements and setbacks, Ethereum has a long and illustrious history. The Proof-of-Stake (PoS) model replaced the Proof-of-Work (PoW) model in the middle of September 2022 in an event called The Merge, which promised to improve the network’s scalability, cut transaction times, and minimize the network’s energy footprint. Some notable protocols currently using Proof-of-Stake consensus mechanisms include Cardano (ADA), EOS (EOS), Neo (NEO), and Tezos (XTZ).

Sample Proof-of-Stake Price Movement. Source: Digital Asset Research

The modifications that took place in September 2022 were known as ‘Ethereum 2.0,’ a catch-all term that represented Ethereum’s subsequent progress towards a more effective, open network. As the blockchain community considers the update as the next stage in its development and not necessarily something new, the phrase is no longer in use.

Simply put, there were bottlenecks on the Ethereum network due to the volume of activity on the blockchain. For instance, the gas payments made to miners in exchange for their labor occasionally reached extremely high amounts. After the upgrade, the fees decreased as validators started to stake their Ethereum.

To activate a single validation node, validators need to lock in 32 ETH. But by participating in a pool or putting their money in an exchange that will stake it for them, anyone can stake any quantity of ETH.

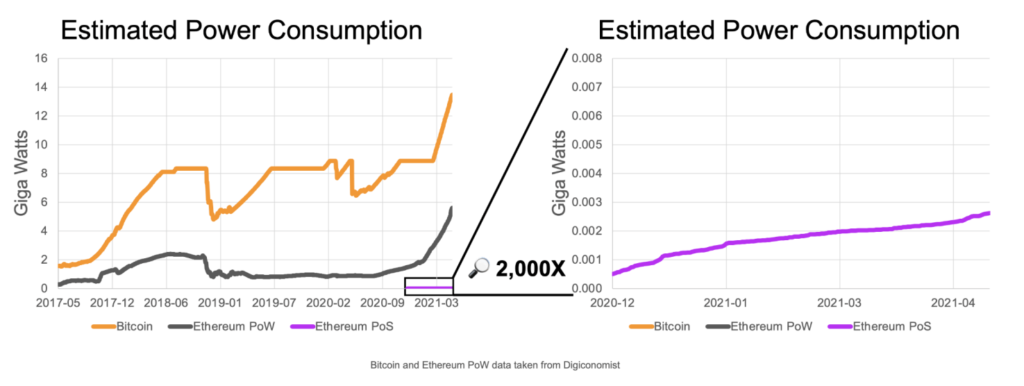

Proof-of-Stake uses significantly less power than Proof-of-Work, making it faster and more environmentally friendly. This is due to the fact that PoS doesn’t pit one miner against another to see who can solve the block hash first, which is what consumes all of the energy. As an alternative, the network protocols choose at random which nodes are allowed to approve transactions and create new blocks.

Proof-of-Work vs Proof-of-Stake ETH Power Consumption. Source: blog.ethereum.org

Layer-2 Solutions and Scalability Improvements

Layer-2 scaling solutions are secondary blockchains or protocols built on top of main blockchains like Ethereum, allowing for increased scalability and improved transaction processing between nodes. Layer 2 scaling solutions offer increased scalability, reduced transaction costs, faster speeds, and enhanced security, which optimizes Ethereum’s capabilities.

Layer-2 scaling enhances decentralized applications by offering high-speed data processing capabilities required for complex operations. It enables developers to build innovative dApps with seamless user experiences without worrying about scalability limitations or exorbitant transaction fees. Layer-2 scaling contributes to the growth and adoption of blockchain technology as it becomes increasingly accessible to mainstream users.

Additionally, Layer-2 scaling solutions for Ethereum offer a significant benefit in terms of reducing transaction costs and fees. By processing transactions off-chain on layer 2 protocols, users can avoid the high gas fees associated with directly interacting with the Ethereum Mainnet.

L2 solutions offer significant improvements in transaction speed and confirmation times. By moving transactions off the Ethereum Mainnet and onto layer 2 protocols, such as Optimistic Rollups or Zero-knowledge rollups, users can enjoy faster processing and quicker confirmations.

Ethereum’s Privacy Features

Ethereum’s inherently transparent nature exposes users’ data, contradicts the principle of minimal disclosure, and may reveal IP addresses. The transparency of transactions and smart contracts, while promoting accountability, compromises privacy by allowing observers to link transactions to individuals. However, Ethereum has ways in which it can evolve. One of them is an attempt to enhance privacy, known as such as Zero-Knowledge Proofs or ZK-SNARKs and Ethereum 2.0’s sharding. This technology, proposed by Buterin, allows parties to confirm the existence of specific information without disclosing the information itself. ZK-SNARKs are employed to safeguard the privacy and security of transactions while maintaining the anonymity of the parties involved in the transfer of digital assets.

In addition, the implementation of stealth addresses enables privacy through the utilization of signature keys and deposit keys, which enables the recipient of the transaction to decrypt and access the digital assets being transferred. As a result, with this technology, any Ethereum wallet can generate a cryptographically obscured public address and receive funds confidentially. Accessing these funds would only require the use of a unique code, known as a spending key. With both of these privacy features yet to be implemented, Ethereum remains an even more promising network.

Ethereum: Technical and Regulatory Challenges

Although Ethereum has advanced technologically since its beginnings, many of the problems it faces now are still the same, according to Vitalik Buterin. He emphasized that the four fundamental issues of privacy, consensus, smart contract security, and scalability continue to be the main obstacles for the blockchain’s future development.

In addition, the rise of alternative platforms, such as Binance Smart Chain and Polkadot, threatens Ethereum’s dominance. These competitors offer advanced technology and lower fees, luring away users and developers. For example, Binance Smart Chain has gained traction due to its compatibility with Ethereum’s smart contracts. And significantly lower transaction fees. Similarly, Polkadot’s interoperability and potential for cross-chain communication appeal to developers seeking to create more connected applications.

Another problem is regulation. The blockchain underwent a successful change to the PoS model, and few were concerned with it being proclaimed a new investment security by the SEC. However, in March 2023, in a lawsuit filed against Seychelles-based crypto-exchange KuCoin on Thursday, New York Attorney General (NYAG) Letitia James alleged the firm broke the law by selling unregistered securities. Among the unregistered securities listed in the suit was Ether. Ether has long been treated as a commodity by state and federal regulators, including the Commodity Futures Trading Commission (CFTC). Designating it as a security would have a massive impact on crypto markets, drastically changing how (and whether) the currency and others like it are traded in the U.S. By addressing its current limitations and adapting to the changing landscape as well as avoiding prosecution by the authorities, Ethereum could maintain its competitive edge and continue to thrive.

Future Ethereum Improvements

As the pioneer of smart contracts on a blockchain network, Ethereum has been at the forefront of groundbreaking trends like Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), GameFi, the Metaverse, and Web3.

Ethereum blockchain is a complex structure with numerous components, but the Ethereum Roadmap is more complicated in nature. With the arrival of the Merge, Ethereum went from Proof-of-Work to Proof-of-Stake, laying the foundation for Ethereum 2.0 and advancing the evolution of cryptocurrency. The Shapella hard fork was an important milestone on the network roadmap. Still, it’s just one step towards a fully scalable Ethereum ecosystem. The Dencun hard fork will implement Proto-Danksharding in the fourth quarter of 2023, allowing rollups to add cheaper data to the blocks and reduce network fees.

Proto-Danksharding Will Change Ethereum

ETH’s blockchain will also experience a number of significant updates in the future, including Full Danksharding, that will offer seamless support for hundreds of individual rollups, making millions of transactions per second (tps) a tangible reality on the Ethereum network. This phase will expand the blobs attached to blocks in Proto-Danksharding from 1 to 64, enabling massive storage space for rollups to effortlessly store their compressed transaction data, and some experts believe Ethereum could gain sharding capabilities by the end of 2023 or early in 2024.

The network will enter a state of progressive improvements, with efforts focused on a certain point: scalability. If Ethereum’s scalability improves, this will open the door for more technological upgrades and a better user experience, transaction times, and dApps deployment. In turn, this will make Ethereum even more sought-after and eventually raise Ether’s price.

Bottom Line

The future of Ethereum is undoubtedly full of innovative updates and advancements aimed at enhancing the network’s scalability, security, and sustainability. Featuring a rich history, the Ethereum network will likely become even more appealing for developers, users, and traders alike as a result of the Ethereum plan and the upcoming Danksharding enhancements. After the blockchain’s smooth transition to PoS during The Merge, improvements in Ethereum’s scalability will most certainly make its price soar even higher and as the network continues to develop, we may see even more technological advancements. It’s expected that the Ethereum Roadmap will change as new information and technology become available.

With the bull market expected to start in 2024, some 2025 Ethereum price predictions estimate a price of $7,630 or even higher. Overall, 2024 could bring a change both to the crypto market, which remains bearish, and the brilliant Ethereum network.

If you’d like to take a first-row seat and watch the future of the second-largest blockchain unveil before you, you can always go to the StealthEX website, choose the coin you want to swap to Ethereum, for example, BTC to ETH, and click Start Exchange.

Follow us on Medium, Twitter, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX.io and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

ETH Ethereum Ethereum blockchain price analysis price predictionRecent Articles on Cryptocurrency

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?

Useless Coin Price Prediction: Is USELESS Crypto a Good Investment?  OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?

OFFICIAL TRUMP Coin Price Prediction: How High Will TRUMP Crypto Go?